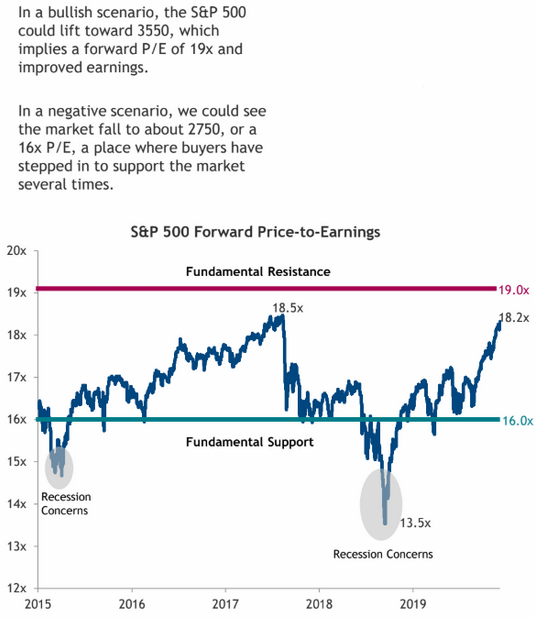

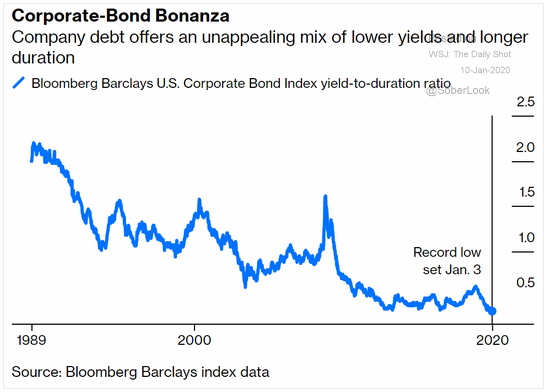

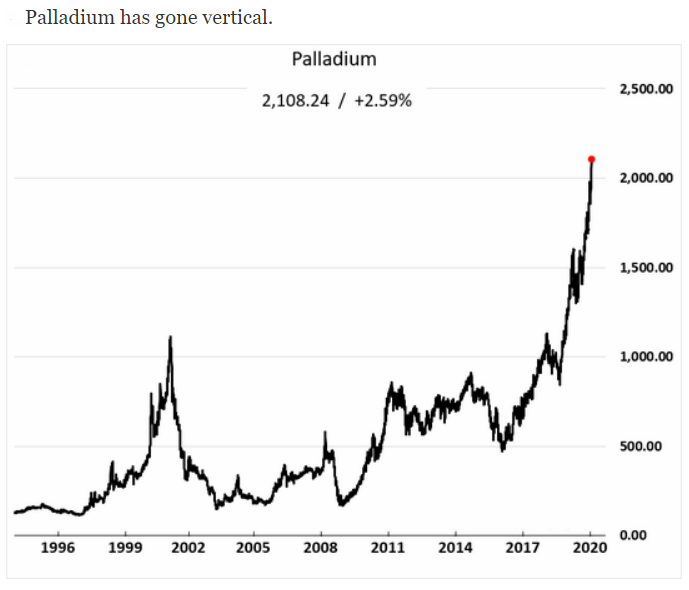

What are your hopes and expectations for 2020? Corporate earnings markets are certainly feeling optimistic, as demonstrated by the historic highs of the forward P/E ratio, but earnings season will have to deliver if we hope to keep the good times rolling. Meanwhile, the bond market looks to already be experiencing some hardship, with the Barclays U.S. Corporate Bond (BBCB) Index yield-to-duration ratio kicking off 2020 by sinking to a record low. How do your clients feel about taking on greater duration-risk in exchange for lower returns? What goes up must come down though, and vice versa, so we'll be keeping an eye on Palladium prices while we're getting our (hopefully discounted) morning coffees. And the renminbi looks to be abiding by the same principal and gaining some traction against the dollar after falling to historic lows in the second half of 2019. Is anticipation of the phase one trade deal, or perhaps the deal itself, driving the recovery?

1. Will the first quarter's earnings season be a time of reckoning or rejoicing?

Source: WSJ Daily Shot, from 1/10/20

2. What's going on in your bond index?

Source: Bloomberg, from 1/9/20

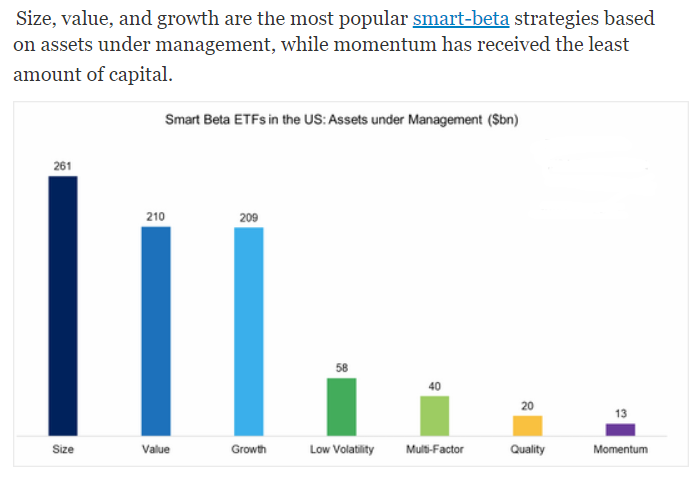

3. AUM growth and performance don't always go hand in hand...

Source: Factor Research, from 1/9/20

4. Parabola up, parabola down...

Source: WSJ Daily Shot, from 1/9/20

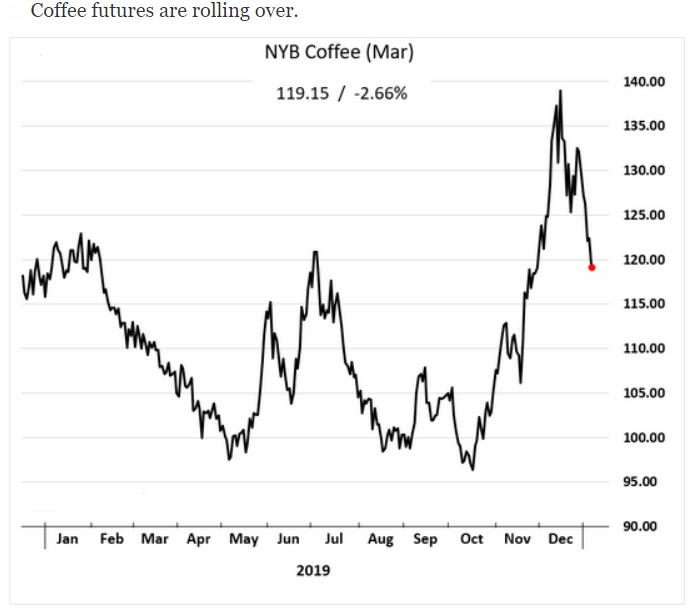

5. Case in point...

Source: WSJ Daily Shot, from 1/9/20

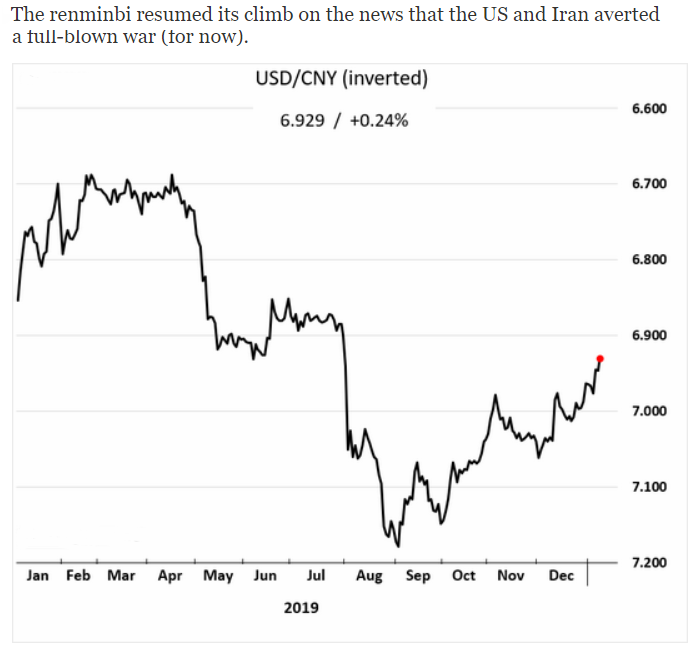

6. Currency appears to be part of the stage one trade deal...

Source: WSJ Daily Shot, from 1/9/20

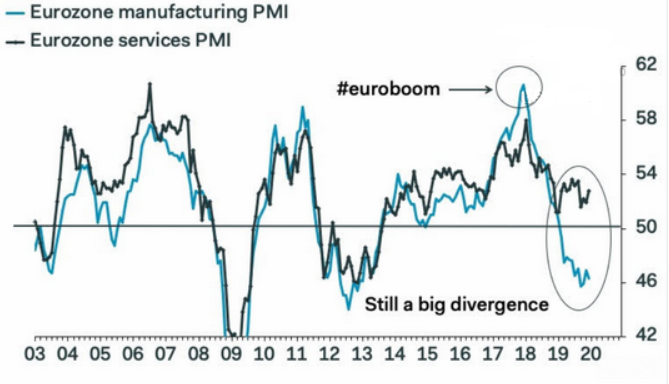

7. European manufacturing is still struggling...

Source: Pantheon Macroeconomics, from 1/9/20

8. And which U.S. companies are racking up the biggest ad spends?

Source: How Much, from 12/16/19

It's a new quarter, a new year, and a new decade—that means the release of BCM's 4Q19 commentary is right around the corner (keep an eye out for this early next week)! In the meantime, it may be helpful to review our 3Q commentary to reflect on where we stood just three months ago. Click here for a refresher on Q3.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.