Brendan Ryan

Brendan’s primary responsibility is as an Analyst for Beaumont. Additionally, Brendan is a member of the Beaumont and BCM investment committees and is responsible for assisting with BCM trading and special projects as necessary. He currently holds the Series 65 securities license and is a CFA® Charterholder.

Prior to joining the firm, Brendan had spent time working for Brown Brothers Harriman & Co. after receiving his B.A. in Economics from Boston College.

Recent Posts

Mutual Funds in Taxable Accounts: Despite Losses, You May Incur Sizable Capital Gains Tax

April 2, 2020As investors and advisors alike look to realign/re-balance their portfolios this year, we wanted to provide a reminder about how mutual funds are taxed. Like any investment, if you buy a mutual fund, own it for more than one year, and sell it at a profit, you must pay federal (and for most states) capital gains tax on your gain. If you own the position for less than one year, you will have to pay ordinary income tax on your gain. Yet many do not realize that if you keep owning a mutual fund (you don’t sell it), there may be short- and long-term capital ...

A Word of Caution on Fixed Income in the Current Market Environment

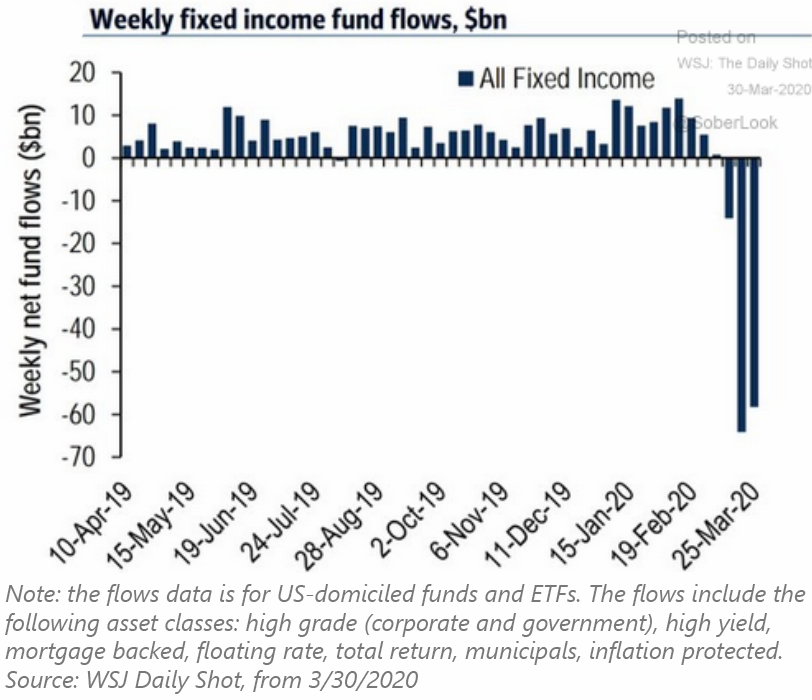

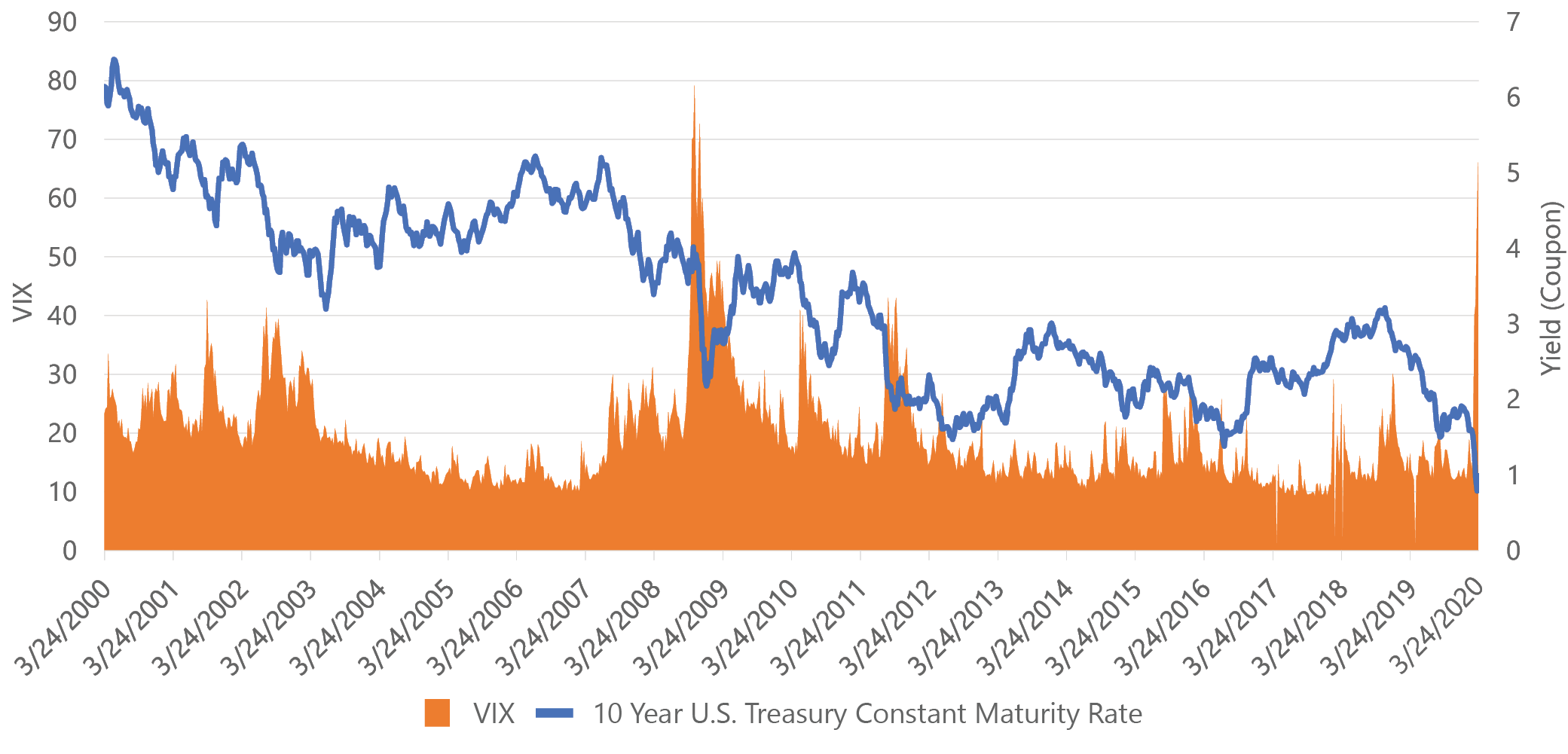

March 26, 2020Investors of balanced strategic portfolios as well as effective tactical portfolios are now well aware of the benefits of reduced risk during times of market duress. While volatile markets may encourage investors to seek the historical “safe havens” of fixed income and lower risk investments, an unfortunately timed rebalance or re-allocation towards fixed income can be particularly risky in today’s environment.

Technology Sector in the “Work from Home” Economy

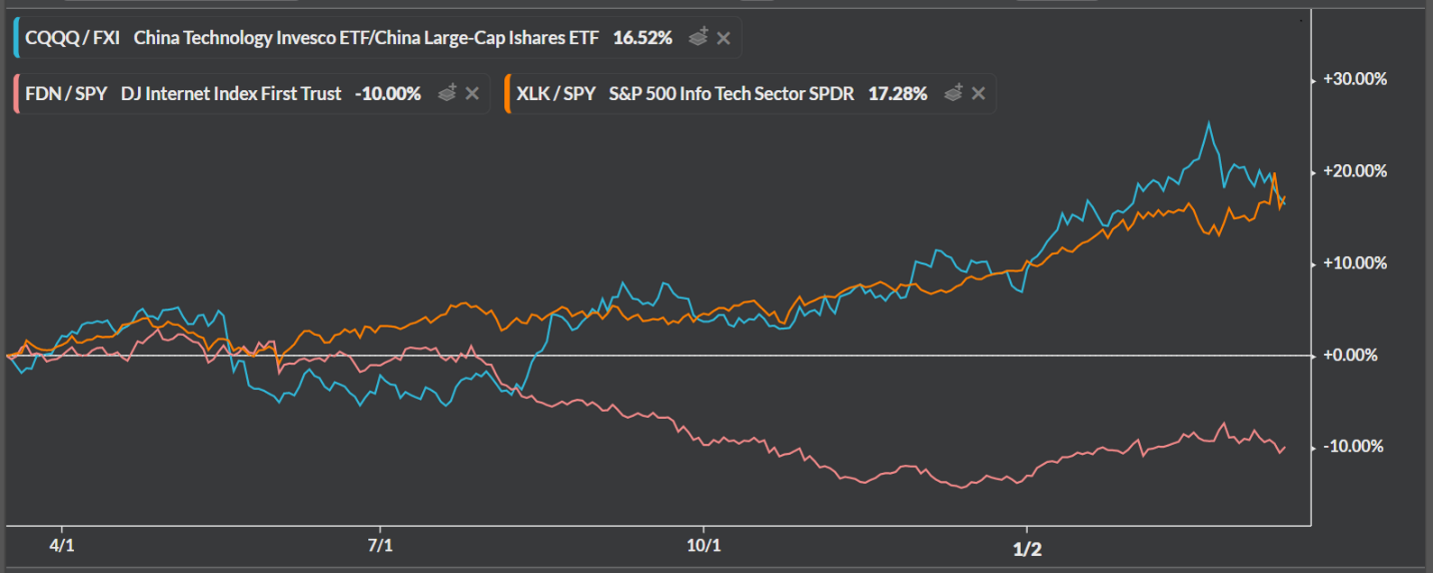

March 17, 2020Although none of our investment systems directly incorporate fundamental data, we enjoy contemplating the fundamental narratives reflected in the price trends our systems ultimately find attractive. Our systems are currently quite leery of equity or other risk assets, as we now sit firmly in a bear market induced by the widespread economic halt caused by COVID-19. However, our Decathlon system continues to favor technology-sector equities more than its other investment opportunities. In addition, our Weekly Sector Rotation strategies have held on to the technology sector, due to its ...

Can Active Investing Make a Comeback?

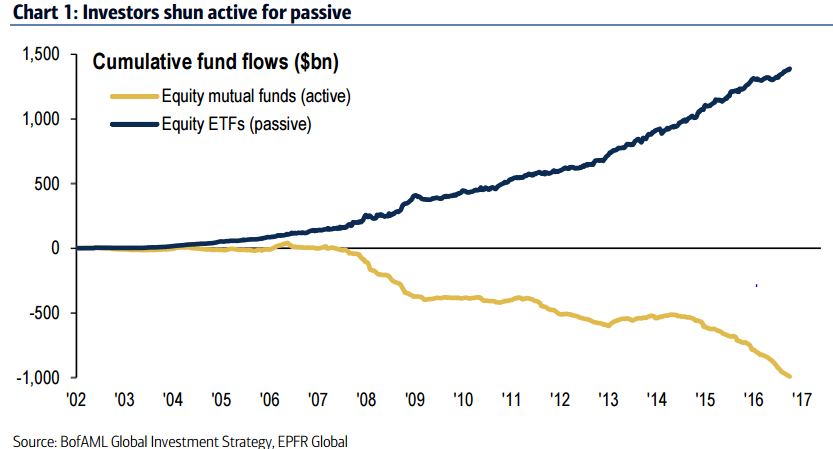

September 15, 2017Much has been made on the “death of active investing” due to the investor’s increasing preference for low-cost index funds, made more accessible through the proliferation of ETFs. As the charts below show, there is no denying this trend. Historically, the high costs of active ...