David M. Haviland

Dave is the Portfolio Manager of Beaumont Capital Management’s (BCM) Investment Strategies as well as a Managing Partner of BCM. He chairs the BCM Investment Committee and serves on the Beaumont Financial Partners (BFP) Asset Allocation and Investment Committees. His overall responsibilities include portfolio management, product creation, and ongoing business development.

With three decades of experience, Dave has worked in the financial industry since 1986 and has spent most of his career as an investment advisor. His advisory background has provided him with a unique perspective on managing the BCM Strategies. In 1993, Dave joined his father at H & Co. Financial Services and in October 2000, under his management, Dave merged H & Co. into Beaumont Financial partners (BFP). In 2009, Dave created the BCM division and has been the steward of BCM’s rapid yet purposeful growth.

Outside of the office, Dave has always been active in his community. He has served as Treasurer for several organizations, volunteered six years on the Dover School Committee, including multiple chairmanships, and currently serves as Dover’s Assistant Town Moderator. Dave enjoyed coaching his three boys in just about every sport; he and his wife Kate, along with their sons, are active trap and skeet enthusiasts and registered Therapy Dog handlers. Dave is a graduate of Deerfield Academy and an honors graduate of the University of Vermont.

Dave is supported by our team of research analysts who also serve on the Beaumont Investment Committees. The team employs a discretionary and quantitative investment process to provide upside participation while minimizing losses.

Recent Posts

Do you know the Total Debt in the U.S.?

January 25, 2017The charts below from 2016 show total debt in two ways. The first show total debt as a percent in Gross Domestic Product (GDP) and the second show total debt in dollars. Today the United States’ debt, as a percent GDP, is close to that of the 1940s. Yet in WWII, we fought and won against three fascist dictators, rebuilt the world (Marshall Plan, talk about Tobin’s Q!), funded the Manhattan project, invented more new technology, built more highways, ships, trucks and factories, etc. and created more infrastructure than ever before. What ...

Don't Fear the Fed

December 2, 2016Equity markets, absent the extremes brought on by irrational emotion-based investing, spend most of the time going up. So it often works out for the best, even with emotion driving decisions...until the markets “crash” due to over-exuberance. Are you investing based on hope and desire or with an emotionless approach? We are currently enjoying the second longest bull market in history. Times are good! Now is the time to ask: Is your portfolio ready?

Bonds have bear markets too... Is your bond manager ready?

November 23, 2016For those who are unknowing of the potential for large losses in the bond market, please see below. About half of this loss is post-election market movement. Assuming the markets are flat to the end of the month, long maturity bond funds will likely see losses around 10%.

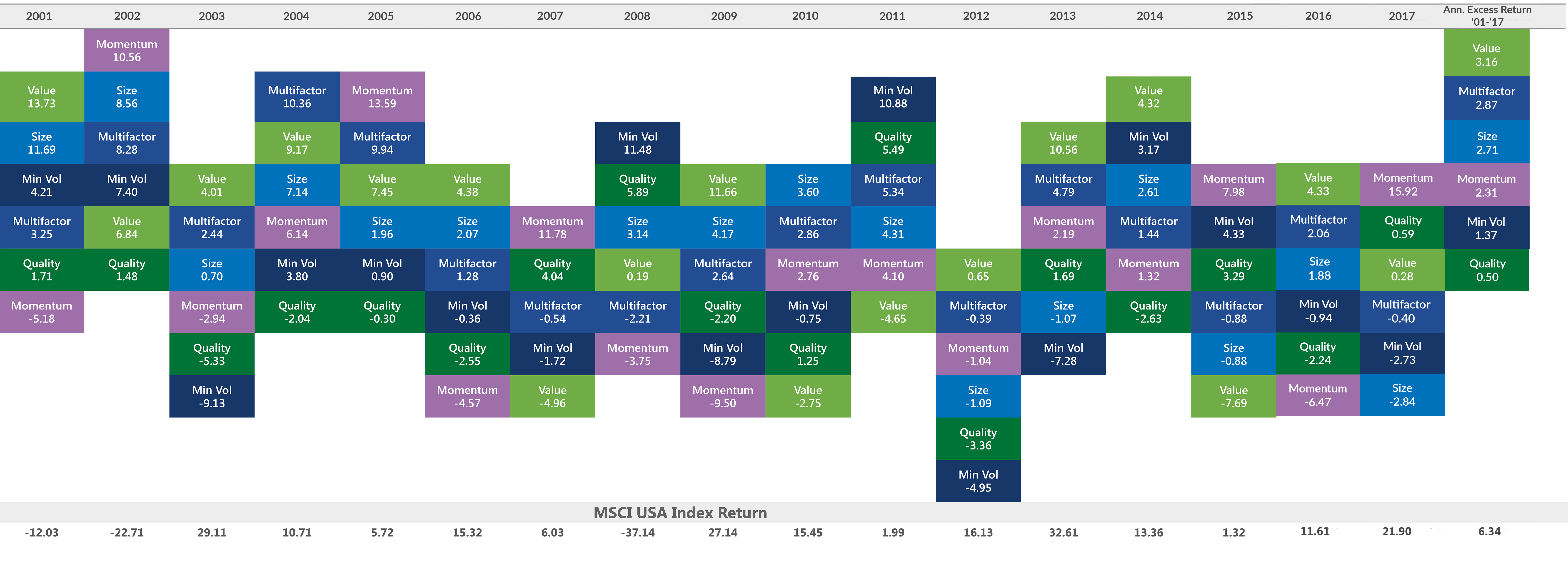

Factor Investing: Smart Beta Pursuing Alpha

September 28, 2016In the spectrum of investing from passive (index based) to active management there are no shortage of considerations. Passive tends to be cheaper and should deliver returns very close to the index it tracks, which is great in up markets, less so in down markets. Active tends to be more expensive and relies on the skill of the portfolio manager(s) to deliver desirable results. Factor investing is a blended approach which may be best characterized by the popularly used phrase ‘smart beta’.