Denis Rezendes

Denis’ primary responsibilitiesinclude beingan analyst for BCM and serving on the BCM investment committee. Additionally, he is responsible for assisting with trading of the BCM strategies, operational support and special projects as needed.

He currently holds the Series 65 securities license; and passed all three levels of the CFA Program and may be awarded the charter upon completion of the required work experience.

Prior to joining Beaumont, Denis worked for P-Solve and Boston Trust and Investment Management Company. He is a graduate of Babson College with a B.S. in Business Administration, with a concentration in Finance.

Recent Posts

Bond ETF’s Price Divergence From NAV: How Do We Tell Which Was “Right”?

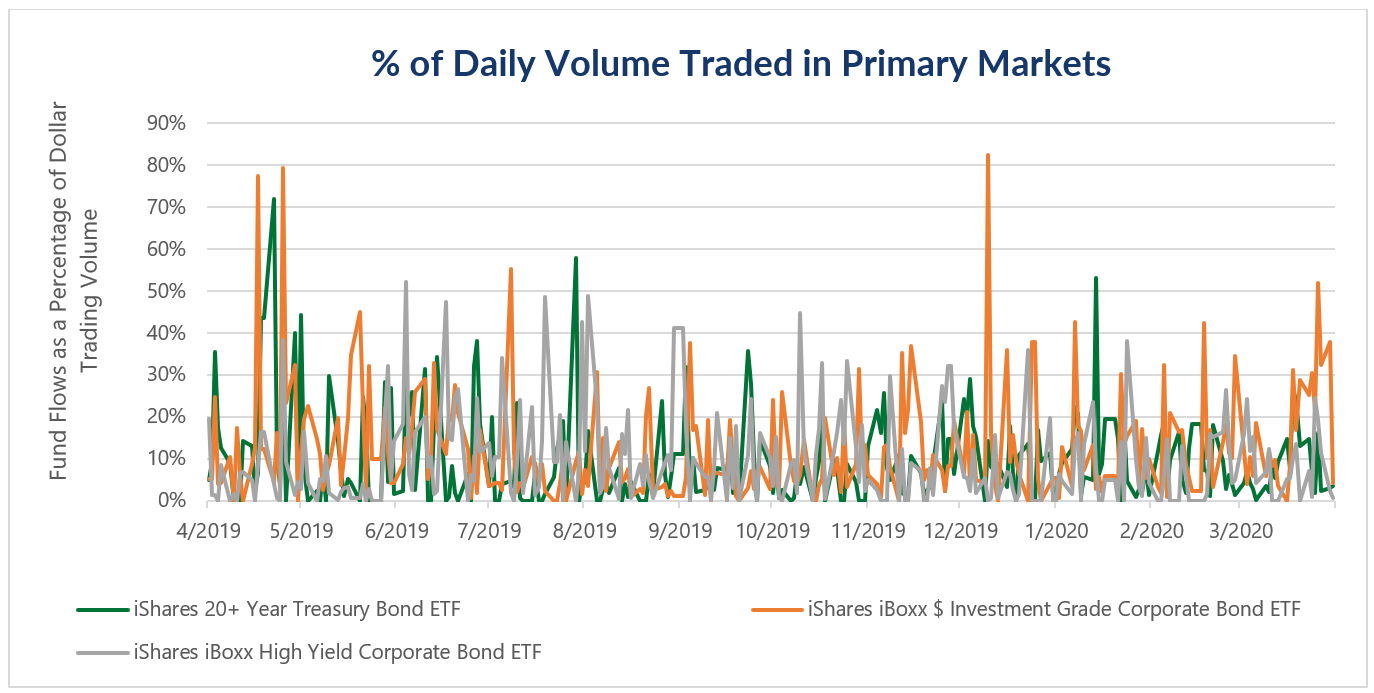

April 30, 2020“What happened to fixed income ETFs in the March sell-off?" So far, we’ve kept quiet on the subject. Not due to a lack of opinions, but because we felt we didn’t have much to add to the discussion. Our many fund sponsor and trading partners (SSGA, iShares, Invesco, and Jane Street to name a few) have done a fantastic job of providing detailed analyses on the subject. Anything we could have produced over the past month would have been nothing more than a regurgitation of work produced by others. So, what’s changed? Why have we decided, after the fact, to throw our hat ...

Caveat Emptor (Buyer Beware)

August 16, 2018As a Tactical ETF Strategist, we consider ourselves fairly qualified to navigate the exchange traded product (ETP) universe. That being said, there’s one place even we won’t go. To pull a quote directly from our presentation: no margin, leverage, or shorting. We believe that this subset of the ETF universe is far more trouble than it’s worth for investors, experienced and unexperienced alike.

Setting Return Expectations

August 9, 2018For the past two years I’ve attended the Berkshire Hathaway shareholder meeting in Omaha, Nebraska, known by many as the “Woodstock of Capitalism.” During the 2017 meeting’s question and answer section, a shareholder asked a seemingly simple question: at what rate can Berkshire Hathaway compound its book value per share over the long term? For those who are unaware, Warren Buffett has long maintained that this measure, growth in book value per share, will equate to the stock’s long term performance. The old sage took a second to think and then responded, if my memory serves, ...

Isn't the Consumer Staples Sector Defensive?

February 20, 2018In the past, the Consumer Staples sector has had a reputation for providing investors with the best of both worlds: market-like returns and defensive characteristics. This reputation is well deserved—during the 10 years starting 12/31/2007 and ending 12/31/2017 the Consumer Staples sector outperformed the S&P 500® Index by roughly 1.5% annualized with a maximum drawdown of 27.4%, compared to 48.4% for the ...

Is Slow Growth Saving for the Future?

March 9, 2017Slow growth in the U.S. economy has been one of the most consistent topics of conversation since the end of the Great Recession (2007-2009). In fact, the U.S. economy has realized real GDP growth of less than 3% for a record eleven straight years! One of the flaws that we find with many slow growth discussions is that they make the implicit assumption that this recovery should be “normal”. We doubt that any American would ...