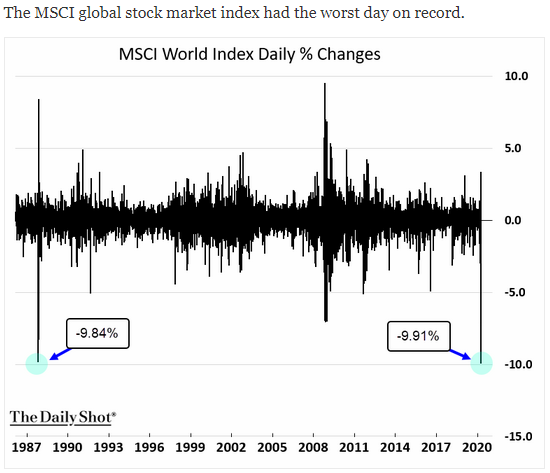

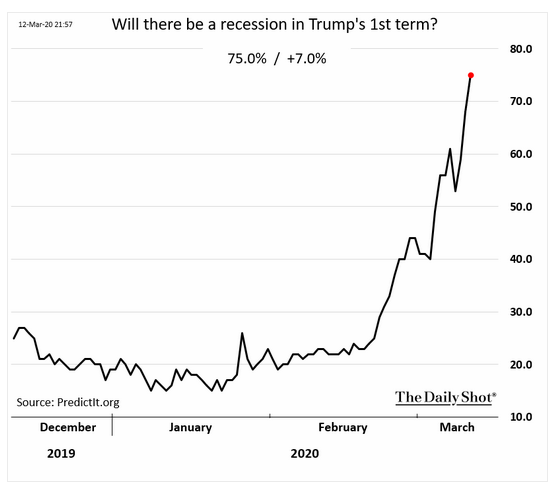

And the hits just keep on coming... The Dow saw its worst single-day loss since the 1987 rash yesterday, the circuit breaker kicked in again, the MSCI world Index saw it's worst day on record (even worse than 1987...), and the S&P 500 Index joined the Dow in a bear market—not to mention Italy's 17% one-day loss! The Fed has stepped up its game since last week's emergency rate cut amounted to barely a blip on the market's radar, and is massively increasing both its bond purchases and repo market intervention. If you thought post-financial crisis QE was dramatic, you ain't seen nothing yet... And as panicked as investors are, even the diversifiers are taking a hit this week—gold, silver, and bonds have all suffered dramatic losses despite their typical "safe haven" status. Investors seem to be seeing the writing on the wall as the betting markets now peg the likelihood of a recession hitting by inauguration 2021 at 75%—almost a 20% jump since Wednesday! Are you prepared to ride out the market downturn?

1. Bear markets usually take months or years to unfold. This one has taken just a few weeks, the speed and volatility are unprecedented...

Source: WSJ Daily Shot, from 3/13/20

2. It is about the fear of the COVID-19...

Source: WSJ Daily Shot, from 3/13/20

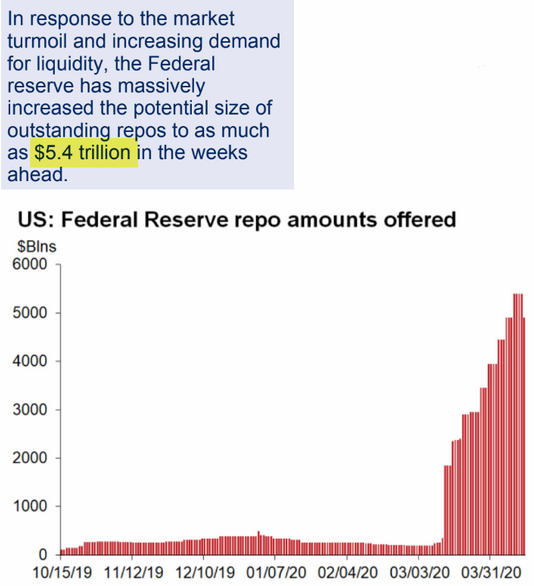

3. In addition to the 1/2 trillion of bond purchases announced yesterday across the curve, look at the highlighted number below. This is twice the entire QE from the financial crisis!

Source: WSJ Daily Shot, from 3/13/20

4. As was the case in 2008, even the supposed diversifiers or other "safe havens" get hit when margin calls force selling across the board...

Source: WSJ Daily Shot, from 3/13/20

5. The carnage is not just in equities... bonds, both duration and credit, have been hit hard. Even high-yield munis are down over 25%.

Source: WSJ Daily Shot, from 3/13/20

6. And AAA muni bonds are under pressure too as doubts on future revenue begin to creep into the picture.

Source: WSJ Daily Shot, from 3/12/20

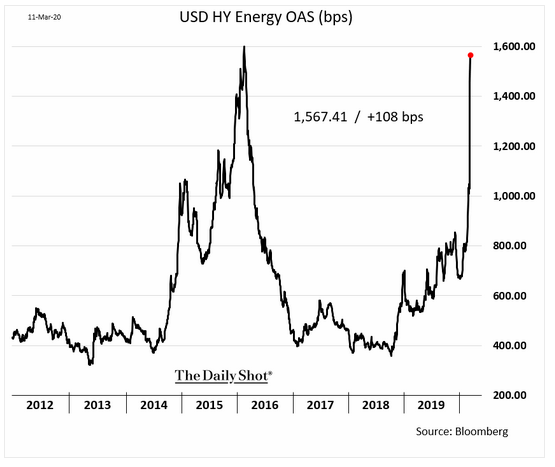

7. Junk bonds are also getting clobbered, led by oil and gas credit.

Source: WSJ Daily Shot, from 3/12/20

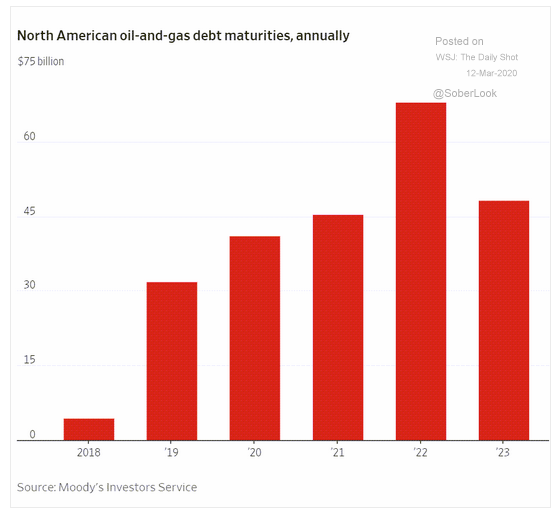

8. And most of this debt will need to be paid off or refinanced in the next three years.

Source: WSJ Daily Shot, from 3/12/20

9. Yield curve inversions have been a solid predictor of recessions in the past albeit with some timing variability. This cycle, the yield curve has inverted not once but three times...

Source: WSJ Daily Shot, from 3/13/20

10. Cryptocurrencies have fared even worse than equities... If these were truly viable currencies, they would not fall 60% in a month...

Source: WSJ Daily Shot, from 3/13/20

Are you wondering what lies ahead now that we're settling into bearish territory? For a look at previous bear markets and how they've unfolded, read "Anatomy of a Bear Market" by BCM Portfolio Manager and Managing Partner, Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.