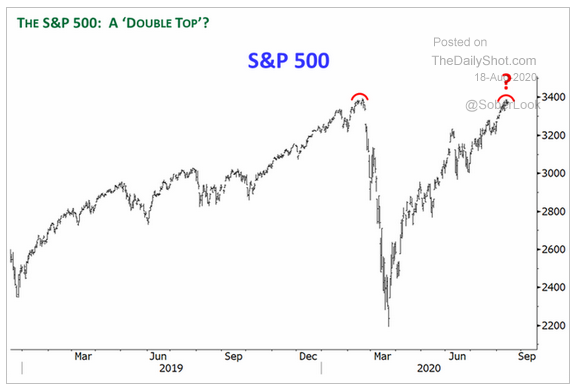

The NY Fed's Manufacturing Index backed up a bit in August after a near perfect v-shaped comeback while recovery in other advanced economies of the world also seems to have plateaued. Large-caps continue to outperform mid- and small-caps although that outperformance can almost entirely be attributed to select subset of companies and sectors. Looking closer at the current shape of the S&P 500 is making some wonder if we are seeing a double top? And if it falters again, what does that mean for high yield bonds? Investors need to be judicious about where they take risk. And remember the trade war? The weakness in the USD is helping strengthen China's currency and the contribution of trade with the U.S to China's GDP has plummeted. Are they charging on without us? Covid surely amplified the dependence of the U.S. on China as well...as global cases rise once again, even in children, how will this effect the two largest economies and their codependency?

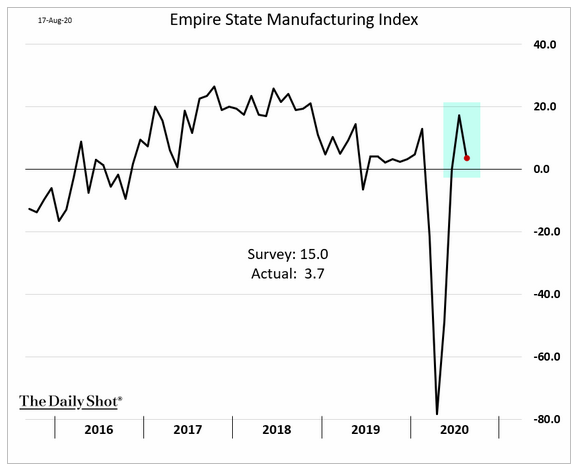

1. The NY Fed's regional rebound backed off in August, at least partly due to pent up demand being fulfilled...

Source: The Daily Shot, from 8/17/20

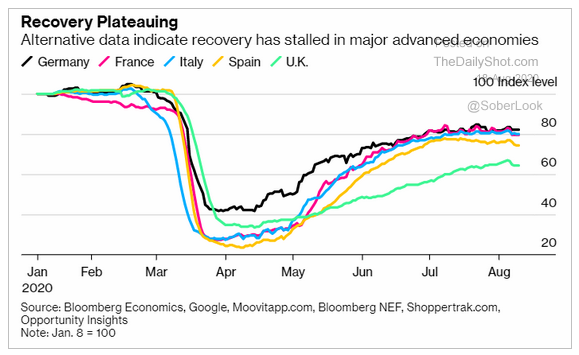

2. Certain segments of the economy, including travel, leisure and restaurants, cannot fully recover until a vaccine/cure is found...

Source: The Daily Shot, from 8/18/20

3. While the S&P 500 tagged a new all-time high, small- and mid-caps are still lagging meaningfully...

Source: thechartstore.com, from 8/14/20

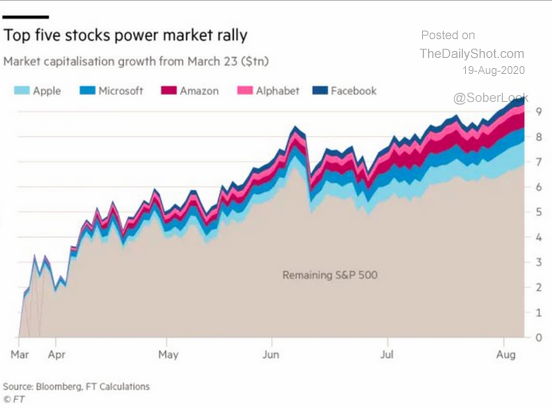

4. Has the S&P 500 really become the S&P 5?

Source: The Daily Shot, from 8/19/20

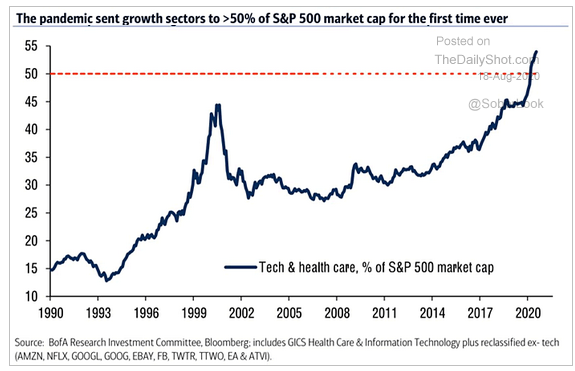

5. Tech and healthcare now make up ~53% of the S&P 500's valuation...

Source: The Daily Shot, from 8/18/20

6. An interesting question...

Source: The Daily Shot, from 8/18/20

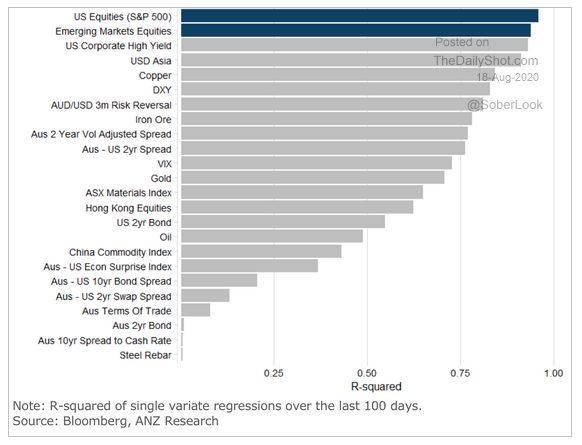

7. Note that high yield bonds are highly correlated to equities; when equities falter, junk bonds follow suit...

Source: The Daily Shot, from 8/18/20

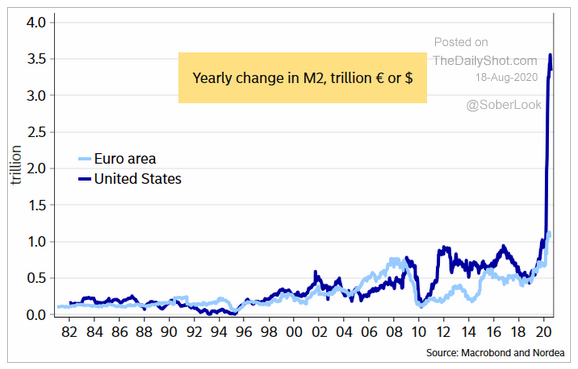

8. The Fed injected trillions to help stimulate the economy, but the over-supply of dollars is helping many currencies appreciate against the USD.

Source: The Daily Shot, from 8/18/20

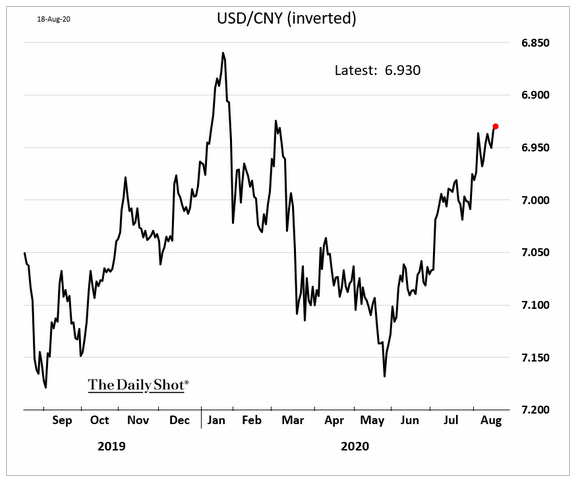

9. USD weakness is helping China's currency strengthen as well...

Source: The Daily Shot, from 8/18/20

10. Remember the trade war? Are the Chinese adapting and leaving us behind?

Source: The Daily Shot, from 8/19/20

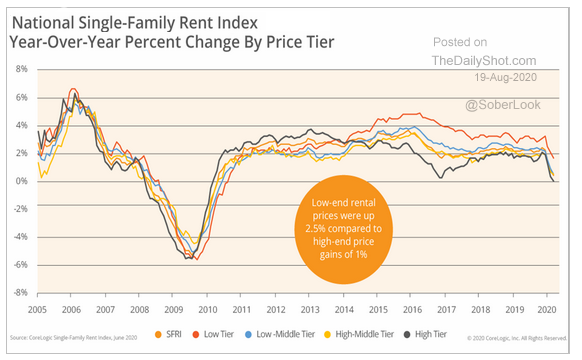

11. Covid induced trends are showing up in housing: Rents are down as people flee large co-habitation buildings and students endure remote learning...

Source: The Daily Shot, from 8/19/20

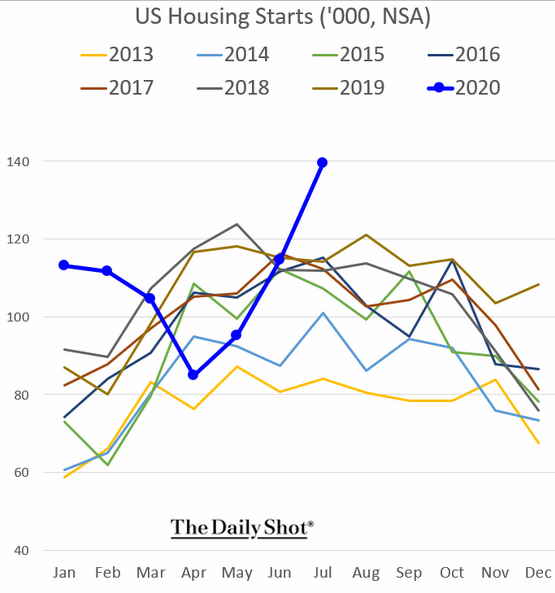

12...And demand for new starter homes is soaring...

Source: The Daily Shot, from 8/19/20

13. If people let their guard down, Covid will take advantage...

Source: John Hopkins University, As of 8/17/20

14. We can send kids back to school, travel on a bus or airplane, but not go to an outdoor baseball game in every third seat wearing a mask?

Source: The Daily Shot, from 8/19/20

Want to stay up to date with BCM's latest news, insights, events and thought leadership? Subscribing to the blog is a good start, but follow us on LinkedIn for additional timely updates!

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.