Equities and Treasuries are sending different signals these days, with treasury yields painting a grimmer picture than the ever-surging S&P 500. The often synchronous measures started to diverge in early 2019 and the gap between them has continued to grow since. Which do you think is more indicative of our current economic state? Many may say treasuries, given that the Conference Board Leading Economic Index (LEI) just turned negative for the first time this cycle, but other indicators have us feeling confident the loss will be fairly short lived. Economic measures will have to persevere through the Coronavirus outbreak though. While there have been some holdouts and even some that have gotten a boost (gold just hit multi-year highs), many measures including bond yields and commodities are clearly suffering under the weight of the pandemic. Could these worsening economic conditions in China, and the renminbi's drop in particular, threaten the still-drying ink on the U.S./China phase one trade deal? Check out the charts to draw your own conclusions!

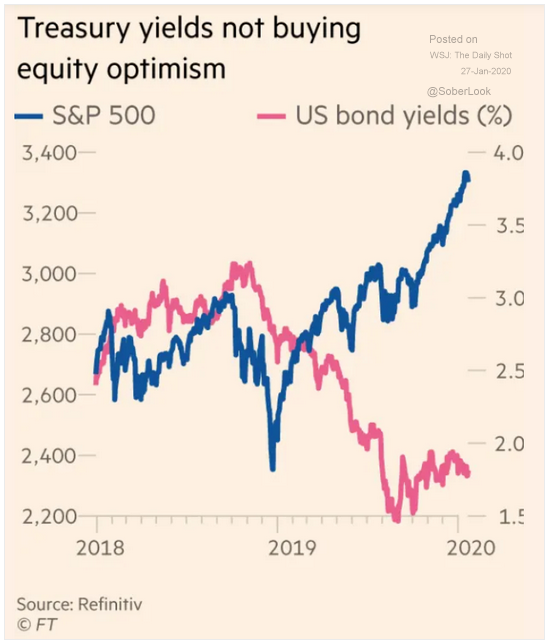

1. Which market is calling it correctly?

Source: Financial Times, from 1/23/20

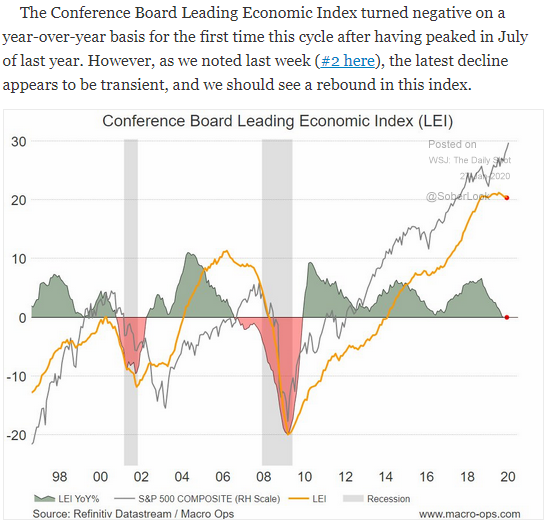

2. A trend worth keeping an eye on...

Source: WSJ Daily Shot, from 1/27/20

3. The U.S. yield curve is flattening again...

Source: The Chart Store, as of 1/24/20

4. With bond yields declining and a quick risk-off shift due to the Coronavirus, Utilities have surged...

Source: The Chart Store, as of 1/24/20

5. With the exception of Gold, the Coronavirus fears are hitting commodities hard:

Source: The Chart Store, as of 1/24/20

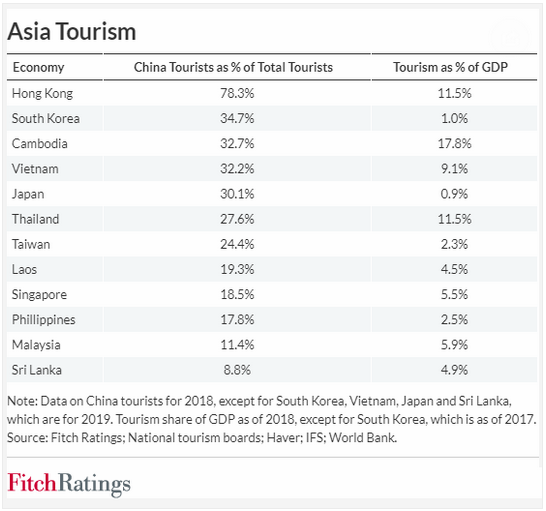

6. Why all of Asia is worried about the Coronavirus...

Source: WSJ Daily Shot, from 1/27/20

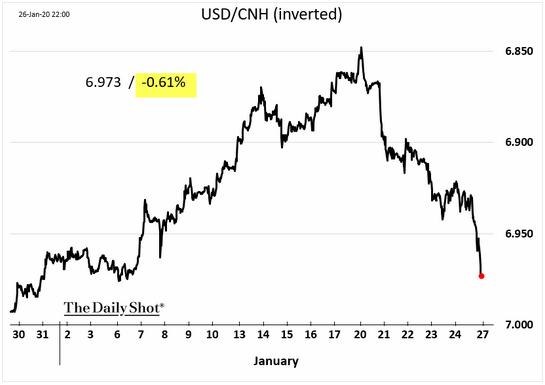

7. The Chinese currency has surrendered almost all of the gains from the trade truce. Will this cause the deal to unravel?

Source: WSJ Daily Shot, from 1/27/20

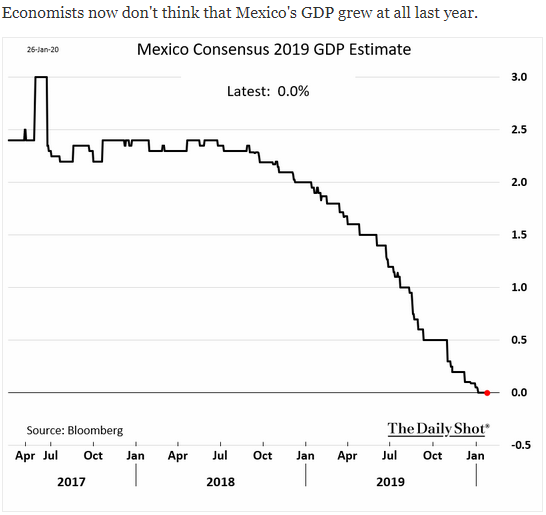

8. All is not well economically south of the border...

Source: WSJ Daily Shot, from 1/27/20

With stocks coming off their first losing week of the year, many have turned their attention to the Fed meeting this week, hoping to hear that interest rates will remain low and perhaps offer some relief (i.e. stimulus) to the market. But what about investors in or approaching retirement who rely on fixed income returns? Read more about BCM Portfolio Manager and Managing Partner Dave Haviland's preferred method for meeting withdrawal needs in historically low interest rate environments in "Finding Total Return."

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.