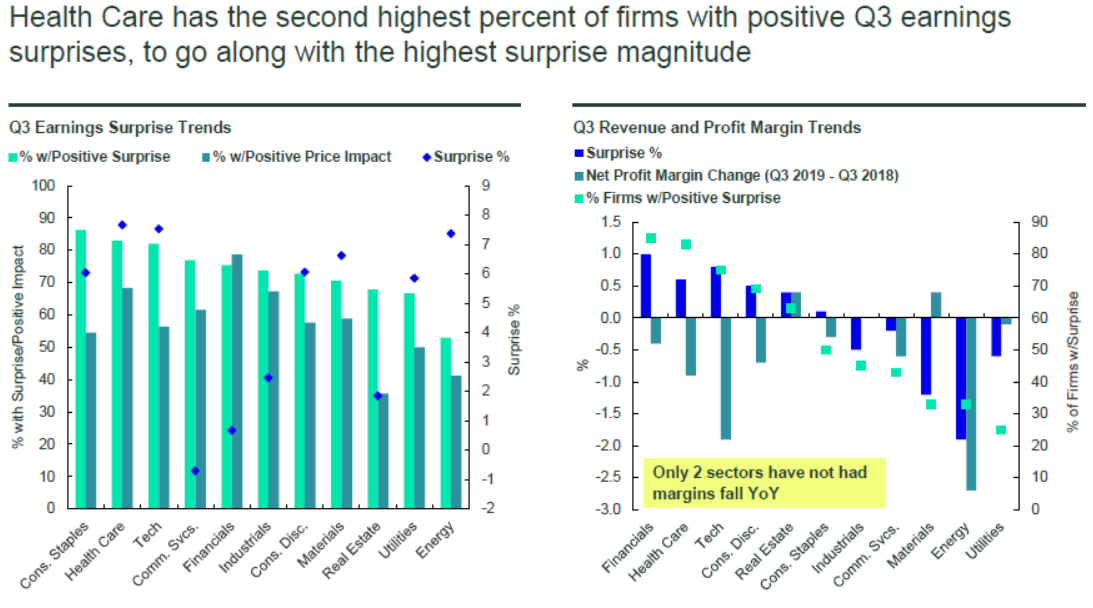

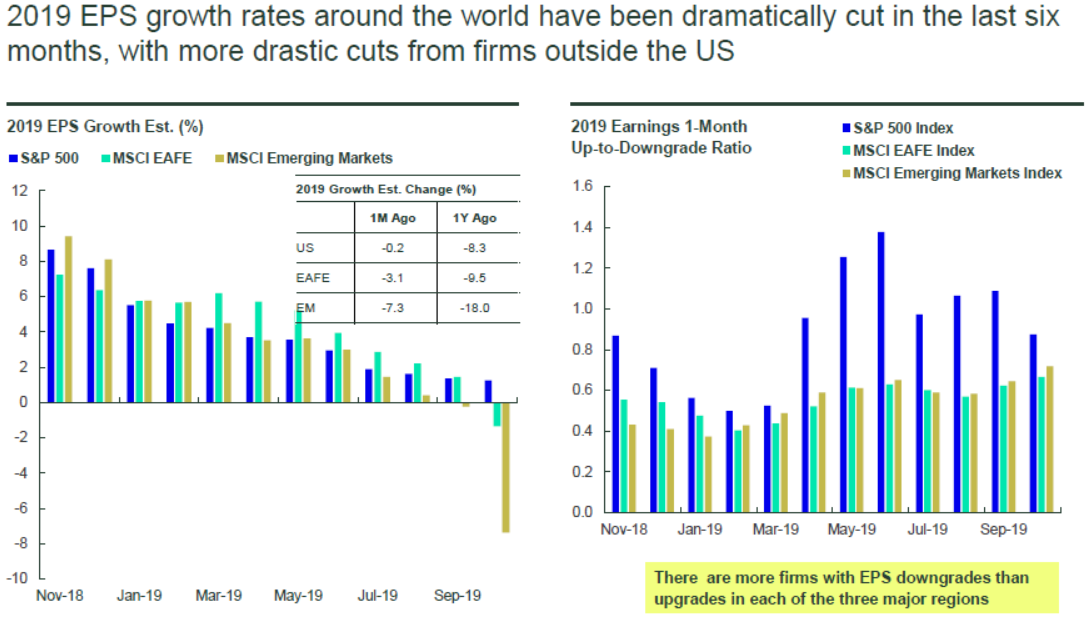

“Fed officials should go to the doctor if they think there is no inflation in the economy,” say Chris Rupkey, chief economist at MUFG in New York. Medical care, education, and housing costs are soaring—and significantly outpacing the rest of the market. Healthcare earnings surprised in more than one way in Q3 (see the details in the charts below)... could such aggressive pricing increases be to thank? Meanwhile, despite 70%+ of companies beating earnings estimates as of last week, EPS growth rates have established some downward momentum in the last year. While record performance from the S&P 500 has offered some insulation to the U.S., how much of that strength is owed to the mega-caps, and can their dominance go on forever? U.S. crude oil production hit a record high last week, and in 2020 we're expected to become a net energy exporter for the first time since the 1953. Are there any other trends you'd like to see come back from the '50s?

1. This topic came up last week in San Francisco...

Source: Deutsche Bank Research, from 11/14/19

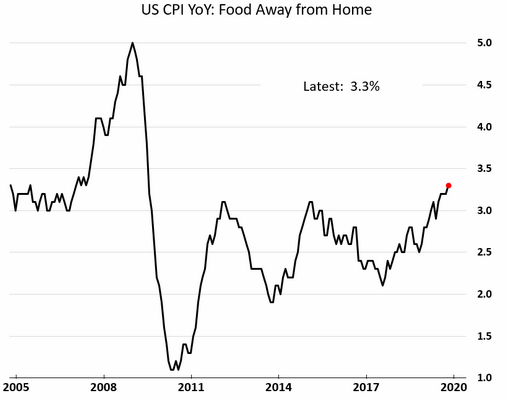

2. Inflation for eating out is almost double the U.S. CPI

Source: WSJ Daily Shot, from 11/14/19

3. Healthcare earnings surprised in Q3; are rising costs trickling through to earnings?

Source: State Street Global Advisors, as of 10/31/19

4. But overall, earnings growth has established a downward trend.

Source: State Street Global Advisors, as of 10/31/19

5. As the mega-caps get bigger, the GAP between the market cap weight of the S&P 500 and the equal weight S&P 500 continues to widen.

Source: WSJ Daily Shot, from 11/14/19

6. Another record high:

Source: WSJ Daily Shot, from 11/14/19

7. It took a decade, but the excesses of the Great Recession have finally been absorbed by our financial system. Better times for banks ahead?

Source: WSJ Daily Shot, from 11/14/19

8. What's in your... index? The BBAB has significantly increased duration and risk; are your clients aware?

Source: WSJ Daily Shot, from 11/15/19

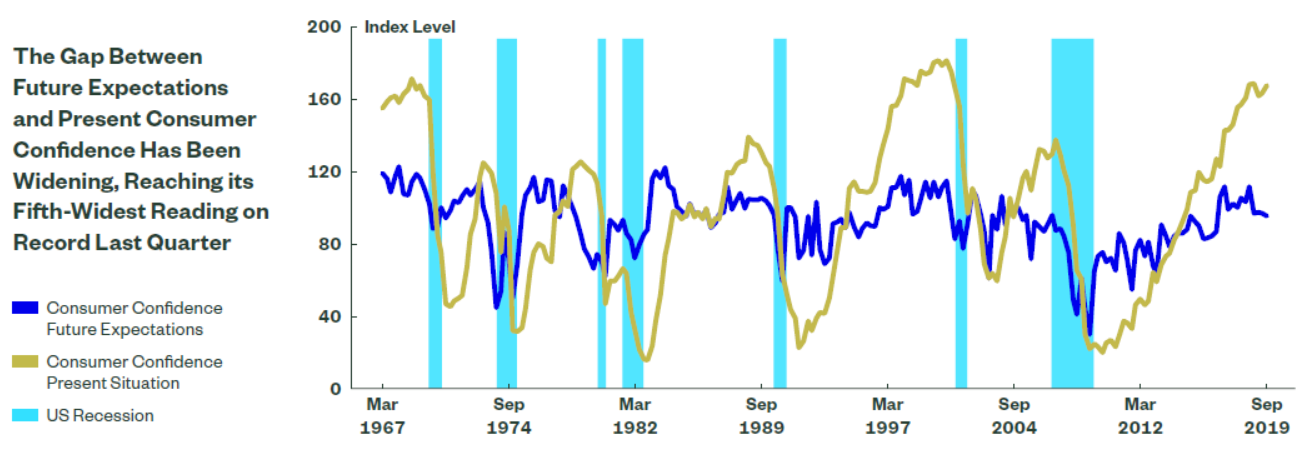

9. Consumer confidence has soared to ~10 year highs, but it looks like they can feel a turn coming...

Source: State Street Global Advisors, as of 9/30/19

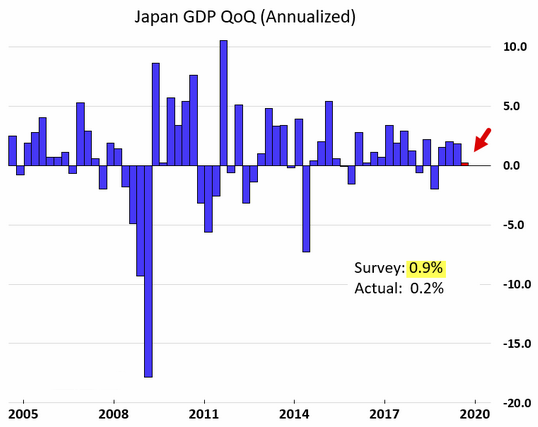

10. A disappointing GDP print from Japan:

Source: WSJ Daily Shot, from 11/14/19

11. The U.S. is not the only country to lose its manufacturing base to china and other countries...

Source: Desjardins Capital Markets, from 11/14/19

12. There is a negative trend forming...

Source: WSJ Daily Shot, from 11/14/19

Consumer debt in the U.S. hit a record ~$14 trillion earlier this year and is higher in 2019 than it was during the financial crisis. With 2020 presidential campaigns kicking into high gear, debt—particularly of the student variety—has become a hot topic. But all debt is not created equal. Click below for more detail from BCM Portfolio Manager & Managing Partner Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.