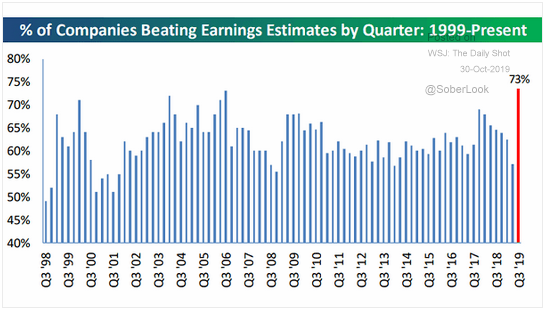

It's Fed day! Whether the third consecutive interest rate cut happens this afternoon or not, the announcement will likely be sharing column inches with today's other big release: Q3 GDP growth. 1.9% ain't too shabby! Check back in on Friday for more post-game analysis. In the meantime... 73% of companies came in above earnings estimates this quarter (the highest percentage since 2006), but this rising tide didn't lift all boats—many regions of the economy suffered significant earnings contraction YoY. And a closer look at the quality of earnings gives a different perspective. The recent yield curve inversion also may deserve another look... Could its unusual depth and short duration have bearing on its economic implications? The implications of soft small business job growth are fairly straightforward though, just ask Fed economist Claudia Sahm. Finally, China looks to be stocking up on crude oil—are they arming themselves for more trade war maneuvers, or maybe planning a yard sale to finance their approaching >2 trillion yuan debt repayment?

1. After all, it is about company earnings...

Source: Bespoke Investment Group, as of 10/30/19

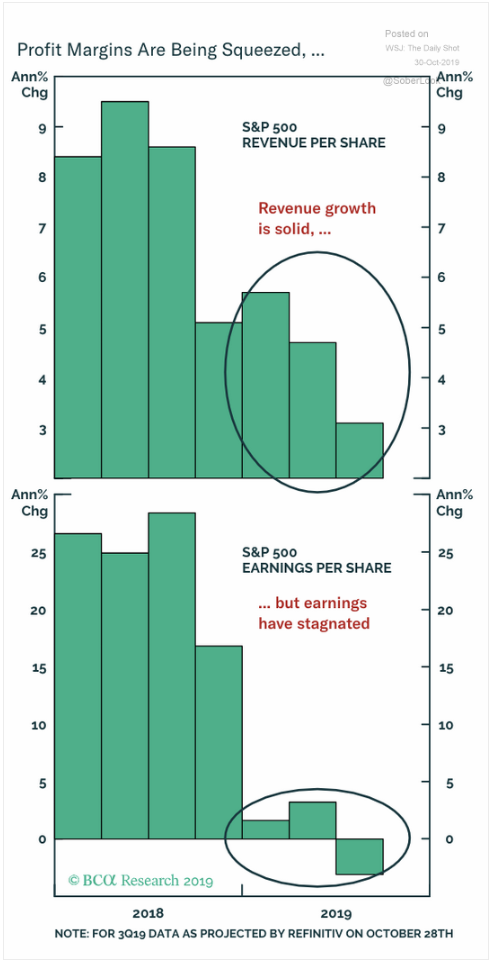

2. However the quality of the earnings also matters as does "beating" significantly lowered earnings estimates...

Source: BCM Research, as of 10/29/19

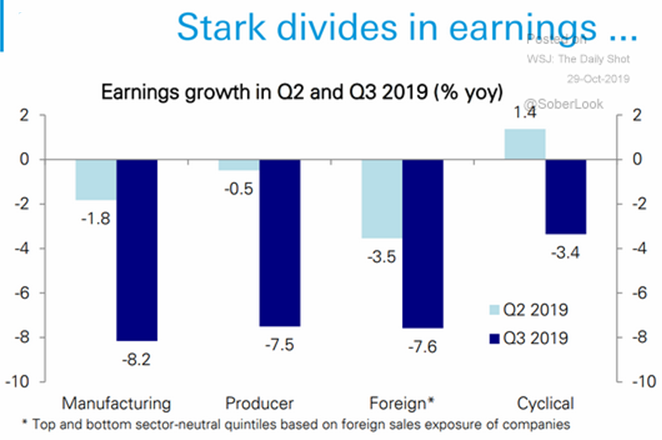

3. Yesterday's highs, however pleasing, are not reflective of every segment of the economy.

Source: Deutsche Bank Research, as of 10/29/19

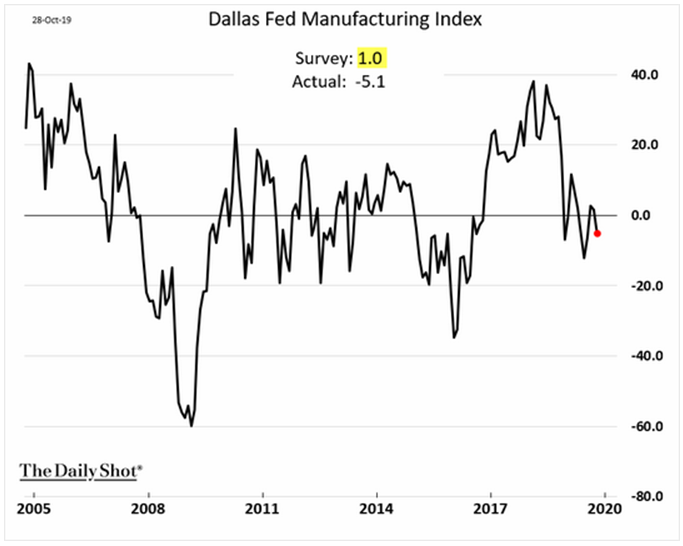

4. The Chicago Fed also showed National manufacturing to be contracting.

Source: WSJ Daily Shot, as of 10/29/19

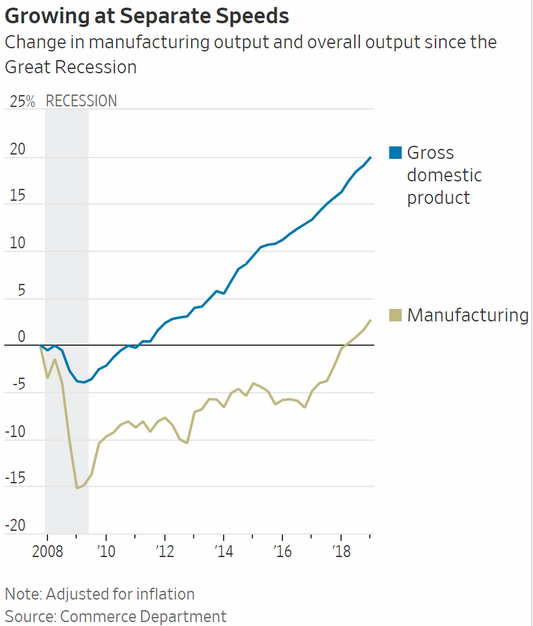

5. It has been 10 years since the Great Recession and our manufacturing base is just barely ahead...

Source: WSJ Daily Shot, as of 10/30/19

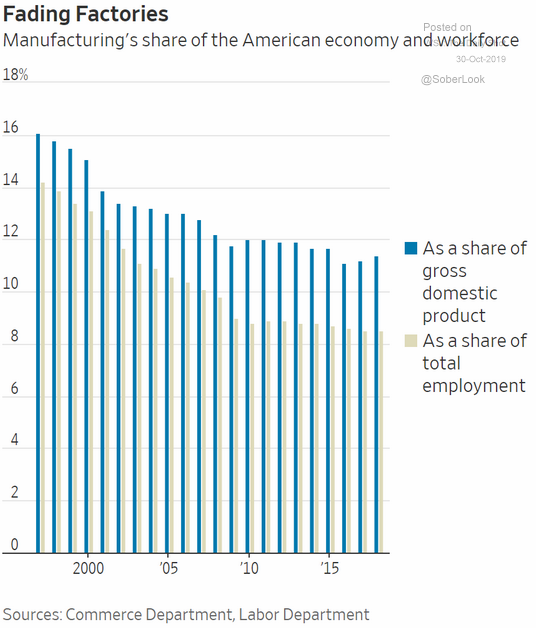

6. This is why our manufacturing slowdown is having, at least so far, a muted effect on our economy.

Source: WSJ Daily Shot, as of 10/29/19

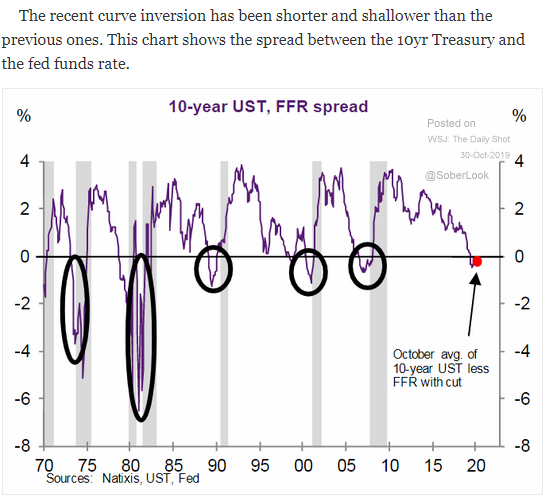

7. Does this mean it was a false signal or perhaps the recession will be short and mild?

Source: Natixis, as of 10/30/19

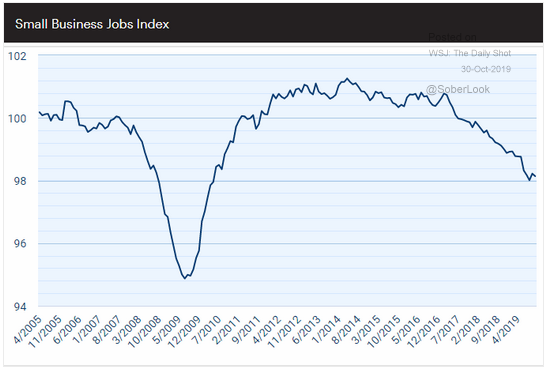

8. Don't forget the Sahm Rule... and the fact that small businesses drive most employment in the U.S.

Source: The Chart Store, as of 10/25/19

9. Is China preparing for another round of the trade war?

Source: Fitch Solutions, as of 10/29/19

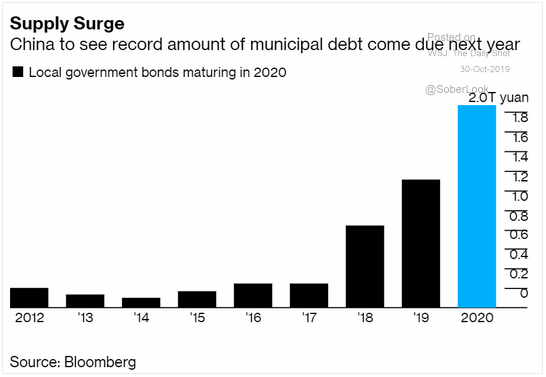

10. By itself this may not be an issue...

Source: Bloomberg, as of 10/28/19

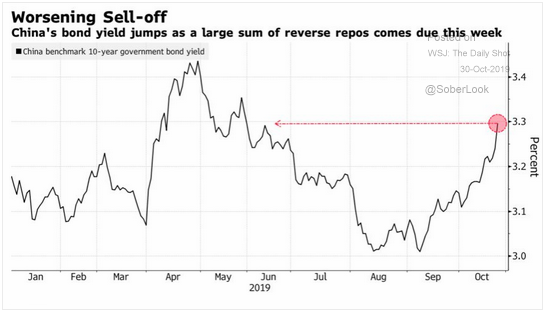

11. ...but combined with significantly higher rates poses a potential problem!

Source: Bloomberg, as of 10/28/19

Tomorrow's Halloween and then we're moving full steam ahead into November, but are you still trying to catch up on the October headlines? Why not let us do it for you? Sign up for BCM's monthly newsletter for a quick digest of the major stories we've been following and our leading blog posts from the month!

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.