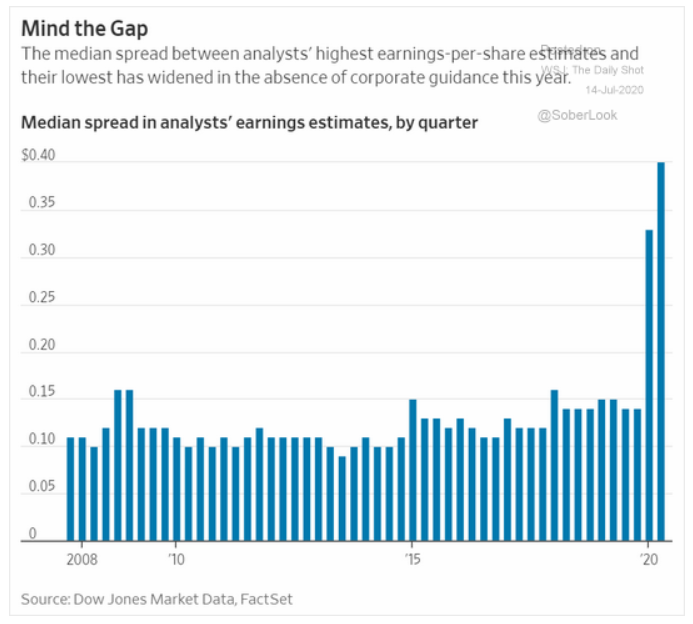

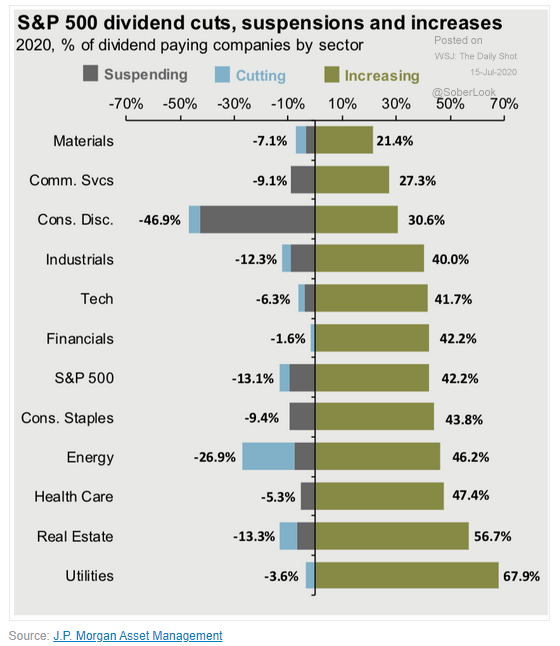

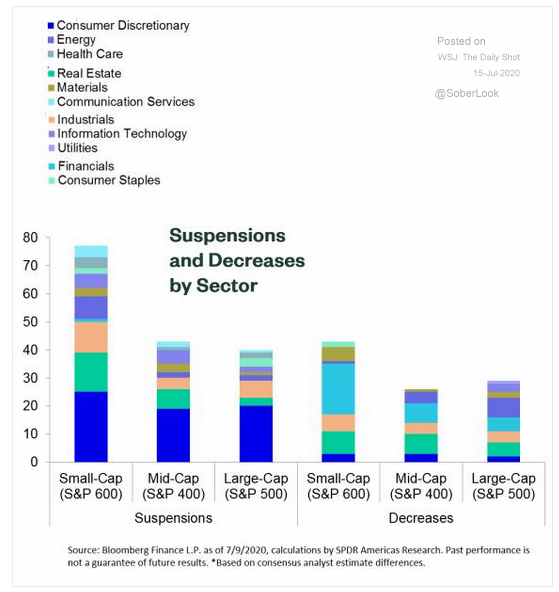

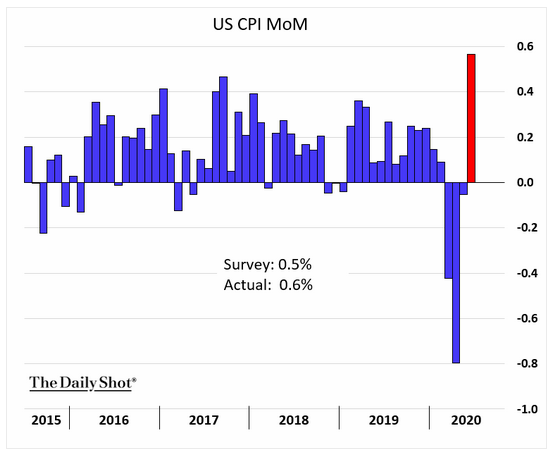

Earnings season is upon us and no one is quite sure what we're in for. Discord between analysts over earnings-per-share (EPS) estimates have soared, thanks in large part to a swath of companies pulling corporate guidance as economic uncertainty swelled in the face of the Covid-19 crisis. Already weak dividends are likely to suffer—particularly at smaller, more cash-strapped companies—but are also climbing in more than 40% of S&P 500® Index companies. Inflation is also ticking up and grew slightly more than expected in Q2, boosted by soaring energy and food prices. But is an unprecedented federal deficit too high a price to pay? And our government isn't the only one bracing to deal with massive debt; major lenders stockpiled more than $28 billion last quarter to prepare for an enormous wave of loan defaults. A significant portion of the pandemic's economic impact has thus far been blunted by the CARES Act and the boost to unemployment benefits, but with the $600 addition set to expire next week and unemployment still near record highs, could the worst still be ahead?

1. Covid-driven uncertainty has companies and analysts alike struggling to predict earnings...

Source: WSJ Daily Shot, from 7/14/20

2. We note that dividends have been falling since the early 1980's just like interest rates. Will Covid-19 reverse this trend?

Source: WSJ Daily Shot, from 7/15/20

3. Smaller companies, needing to preserve cash to deal with the pandemic, have seen many more dividend suspensions and cuts...

Source: WSJ Daily Shot, from 7/15/20

4. Energy prices soared in Q2 after plunging ~80% in Q1, which—together with rising food prices—has led to a recovery in inflation.

Source: WSJ Daily Shot, from 7/15/20

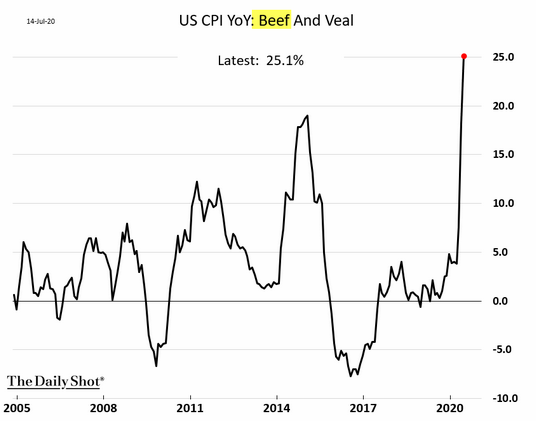

5. Here is an example of food inflation:

Source: WSJ Daily Shot, from 7/15/20

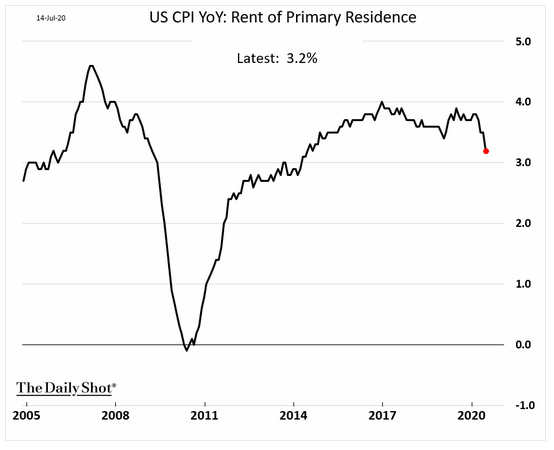

6. Equivalent rent is the large housing component in the CPI. College and other young adults staying home and other Covid effects has moderated this component...

Source: WSJ Daily Shot, from 7/15/20

7. Is the deficit (and thus debt) driving inflation expectations?

%20driving%20inflation%20expectation-1.png)

Source: WSJ Daily Shot, from 7/14/20

8. Banks are preparing for the inevitable...

Source: Statista, from 7/14/20

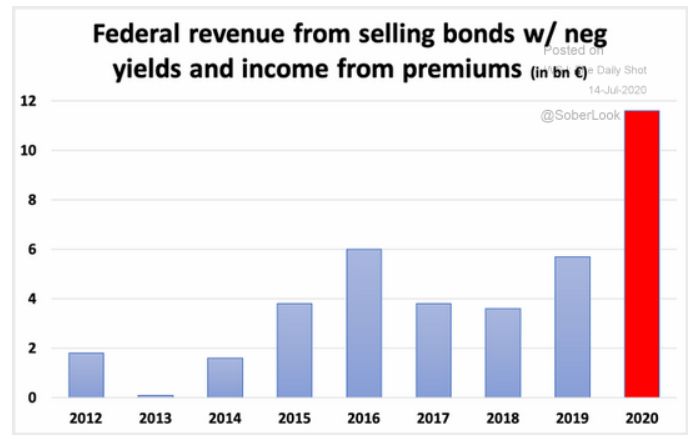

9. An unintended consequence of negative interest rates...

Source: WSJ Daily Shot, from 7/14/20

10. This is not about politics...it is about helping each other stop a pandemic. Until we have more data and a deeper understanding of this disease and how it spreads, we should take extra precautions.

Source: Nicole Foreman, from 7/14/20

As we head into Q3—which many analysts see poised to bear significant ongoing fallout from the Covid-19 crisis—watch BCM Portfolio Manager Dave Haviland join Jenna Dagenhart of AssetTV to discuss strategies for taking risk opportunistically, managing loss avoidance, and meeting clients' return and income needs in this new decade's distinct investment climate.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.