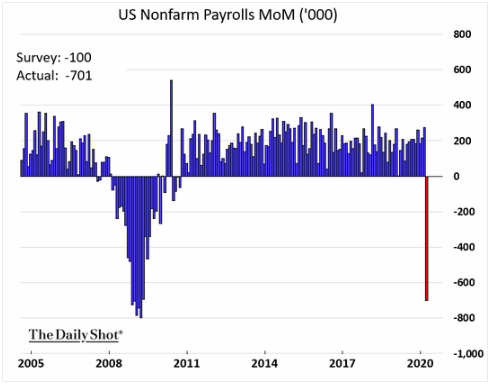

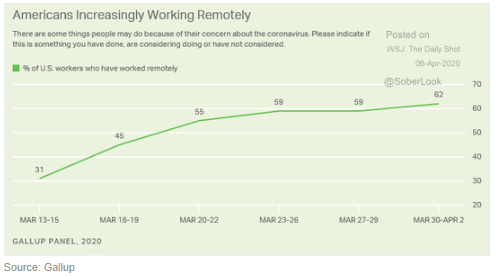

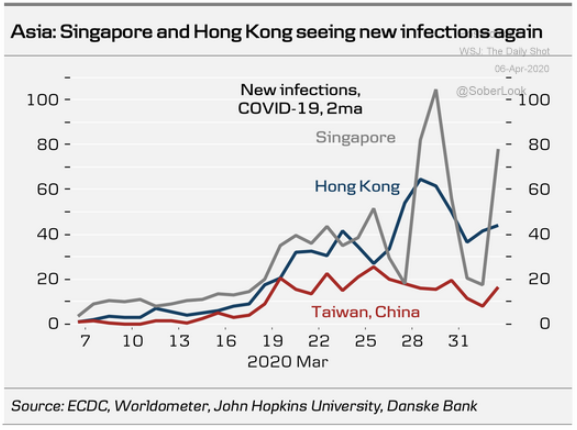

The U.S. lost about 700,000 jobs in March—7x the expected figure and a grim way to cap off the first quarter. Still, given the staggering number of unemployment claims continuing to roll in, this may be just the beginning; the unemployment rate is expected to hit a multi-decade high over the next few months. Thankfully, many have been able to make the switch to working from home in an effort to slow the spread of COVID-19—the percentage of Americans working remotely has doubled to 62% in just the past few weeks. Meanwhile, debt downgrades have taken hold as ratings firms take a critical eye at corporations' financial health, and the number of fallen angels has spiked. Cash flow may be part of the issue, and many firms are slashing dividends to compensate. Can you guess which industry leads the pack? Finally, while restrictions have begun to lift in China, a second wave of infections looks to be unfolding in Singapore and Hong Kong... is the U.S. in for the same if we relax social distancing measures too quickly?

1. With projections reaching into the tens of millions, this is just the tip of the iceberg...

Source: WSJ Daily Shot 4/6/20

2. In addition to those who remain on the front lines, to all those staying home: Thank you!

Source: WSJ Daily Shot, from 4/6/20

3. The amount of U.S. debt downgrades is stunning...

Source: WSJ Daily Shot, from 4/6/20

4. European firms are slashing dividends to preserve cash...

Source: WSJ Daily Shot, from 4/6/20

5. A possible glimpse into our future if we relax our diligence and social distancing too early:

Source: WSJ Daily Shot, 4/6/20

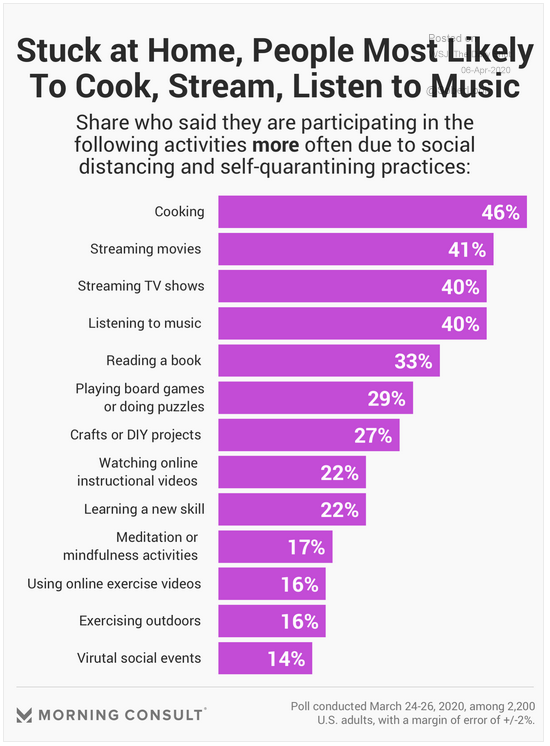

6. We wonder how this might change over time...

Source: WSJ Daily Shot, from 4/6/20

Are your clients aware that they could incur capital gains tax on a mutual fund even if they're still invested and have suffered a loss? And that the chances are higher during a high-redemption period like 2020? For a refresher on mutual funds and how they're taxed, read "Mutual Funds in Taxable Accounts: Despite Losses, You May Incur a Sizable Capital Gains Tax" by BCM Portfolio Manager and Managing Partner, Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.