Another 2.2 million Americans filed for unemployment assistance last week as the pandemic continues to wreak havoc on the labor market. Claims have now been falling for 11 straight weeks and the trend is likely to continue as re-openings roll on—New York City will begin phase two of its reopening plan on Monday—but claims are still topping double the previous record high and unemployment remains above 20% in Nevada, Hawaii, and Michigan. The New York Fed's National Economic Activity Index has ticked up again though and manufacturing activity looks to have surged back into growth territory, so things are headed in the right direction. But as demand for gasoline is slowly coming back to life thanks to easing social distancing restrictions, energy is still suffering under the weight of the COVID-19 crisis and is projected to be one of the hardest hit sectors. The world grinding to a halt and the oil price war—Q1's other black swan event—have already had a significant impact, and US crude oil production is down 19% year-over-year. Meanwhile, correlation among risk assets has soared since the start of the crisis, and even some historical "safe haven" assets are showing correlation to equities. Where will investors look for shelter in the next downturn?

1. Initial unemployment remains stubbornly high...

Source: WSJ Daily Shot, from 6/19/20

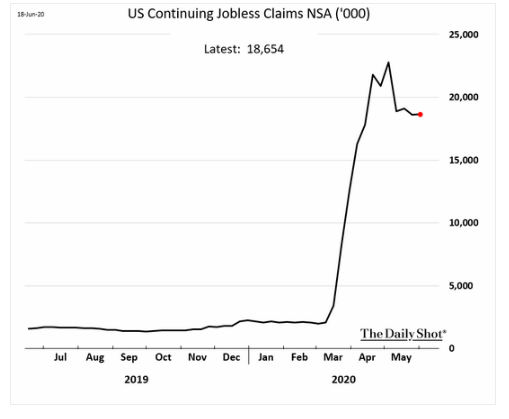

2. ...As do continuing claims. Yet as states reopen, these numbers should improve.

Source: WSJ Daily Shot, from 6/19/20

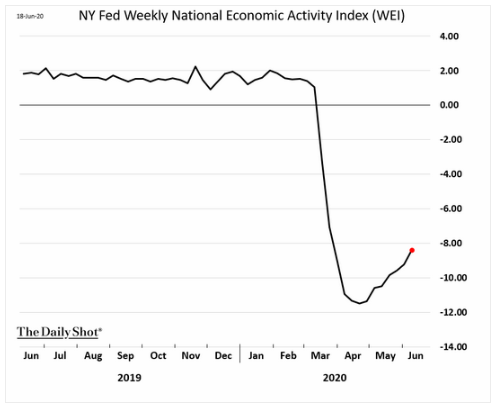

3. The recovery has started...

Source: WSJ Daily Shot, from 6/19/20

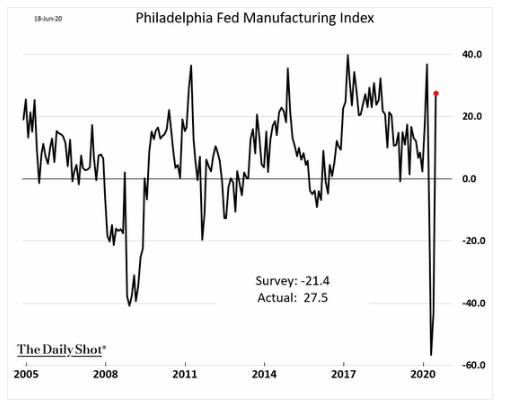

4. Another snap-back...

Source: WSJ Daily Shot, from 6/19/20

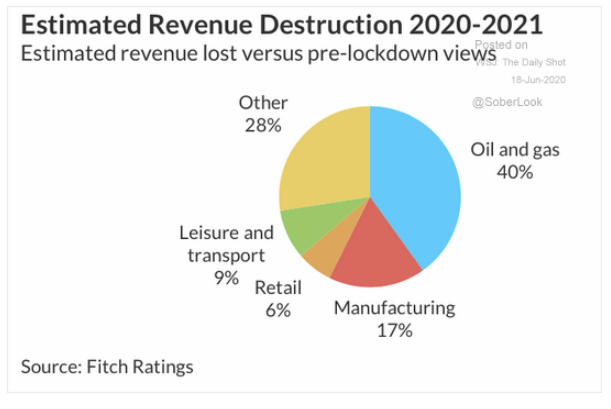

5. The pandemic is also weighing heavily on the energy sector...

Source: WSJ Daily Shot, from 6/18/20

6. When the Saudis and Russians got into their oil "spat" a few months back, is this what they were really after?

Source: WSJ Daily Shot, from 6/18/20

7. 2020 has seen many asset classes increase their correlations. Here are some examples:

Source: WSJ Daily Shot, from 6/18/20

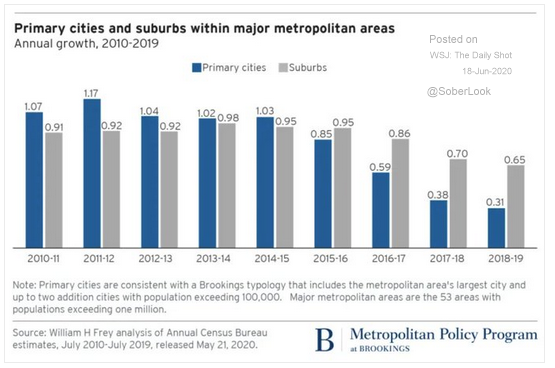

8. Will Covid and work from home cause a suburban surge?

Source: WSJ Daily Shot, from 6/18/20

Tax season may have been delayed this year, but July 15th is approaching. Are your clients aware that they could incur capital gains tax on a mutual fund even if they're still invested and have suffered a loss? And that the chances are higher during a high-redemption period like 2020? For a refresher on mutual funds and how they're taxed, read "Mutual Funds in Taxable Accounts: Despite Losses, You May Incur a Sizable Capital Gains Tax" by BCM Portfolio Manager and Managing Partner, Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.