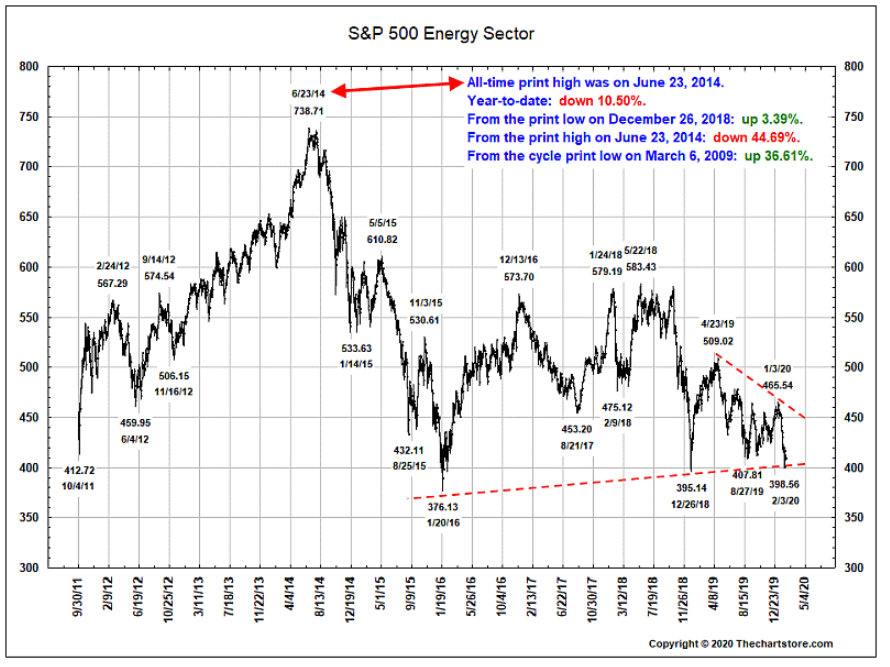

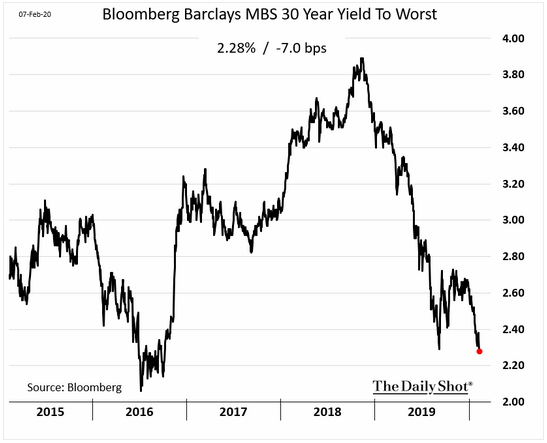

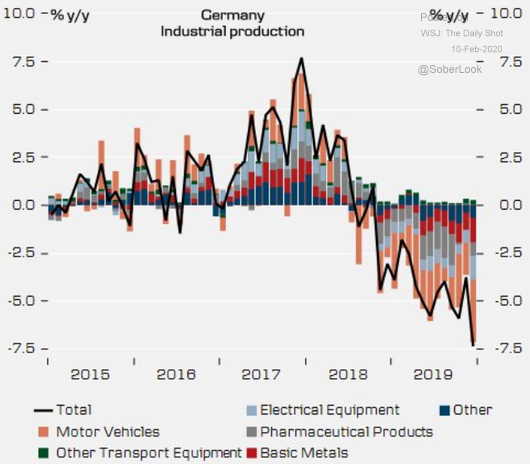

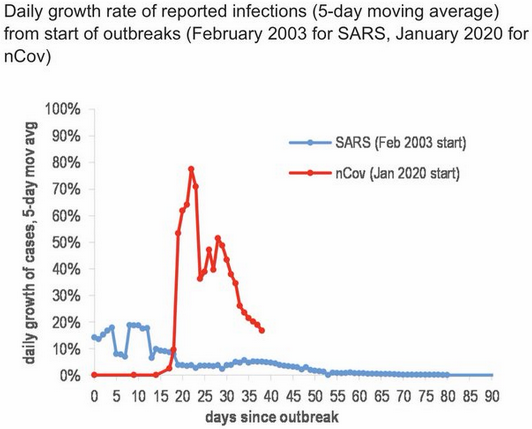

While the S&P 500 is as "energized" as ever, the energy sector itself has been struggling; it was the worst performer in 2019 and declined 11% in the past month, making it the only negative S&P 500 sector in that period. Will the bad times keep rolling or could the sector be poised for revitalization? We're seeing another low from mortgage backed security yields this morning, which just hit their lowest point since 2016. Have you called up your loan officer to talk refinancing yet? Meanwhile, strong December numbers had us feeling hopeful for a manufacturing recovery in Germany and France, but the feeling was short lived and January's decline has put the possibility of a European recession back on our radar. The coronavirus isn't helping matters; China's plummeting demand for copper means "the doctor" is out. But while the virus's death toll just passed that of the SARS epidemic at 910, the daily growth rate of new cases is slowing and experts believe the transmission rate has peaked. Let's hope the same holds true for the economic fallout!

1. The energy sector has not reached its all-time high since June of 2014. Is it ready to bounce or breakdown further?

Source: The Chart Store, as of 2/7/20

2. If you missed the last refinance "window," now may be the time to strike!

Source: WSJ Daily Shot, from 2/10/20

3. After a December bounce, Both Germany and France posted weak manufacturing numbers in January. Is Europe heading into a recession?

Source: WSJ Daily Shot, from 2/10/20

4. The coronavirus has spiked Chinese food prices and thus their CPI surged to 5.4% in January.

Source: WSJ Daily Shot, from 2/10/20

5. Is copper over-sold? Here is what has happened to Chinese demand since the coronavirus outbreak...

Source: JP Morgan, from 2/10/20

6. There is real hope that the spread of the coronavirus is being contained...

Source: JP Morgan, from 2/10/20

Our PM team is always researching various markets and topics. Is there a particular topic you want to know more about? Let us know!

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.