Some interesting charts today... Have a great weekend!

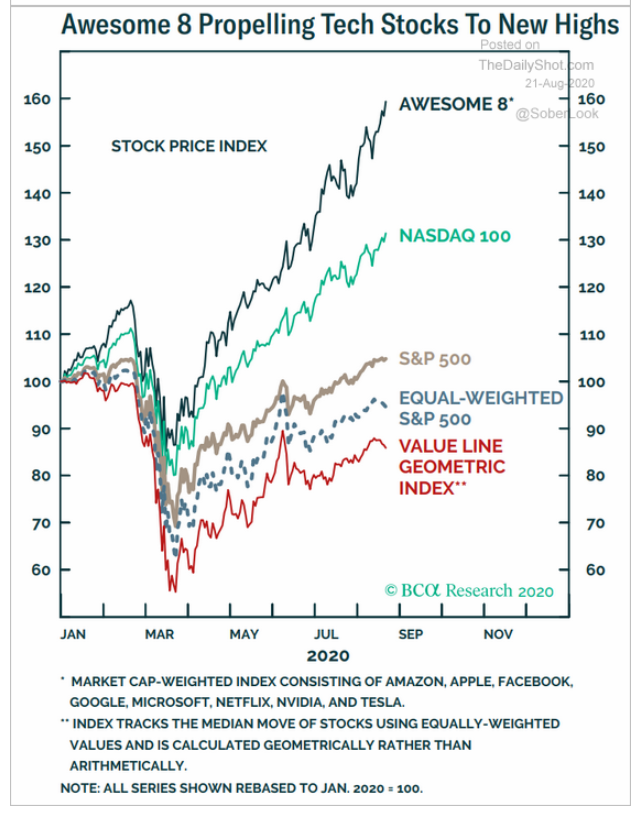

1. Does anyone else feel that this market looks and feels a lot like 1999?

Source: The Daily Shot, from 8/21/20

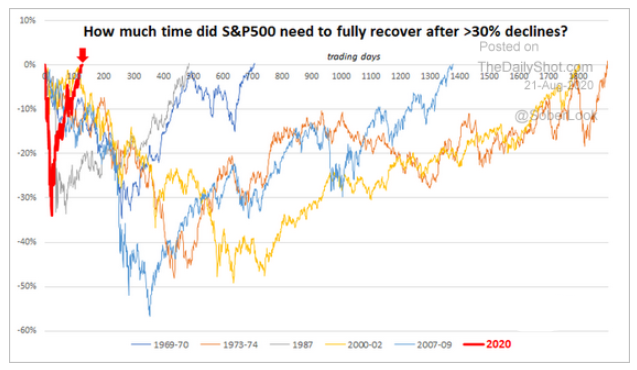

2. The main difference has been the speed...the faster pace down and the fastest recovery...ever....

Source: The Daily Shot, from 8/21/20

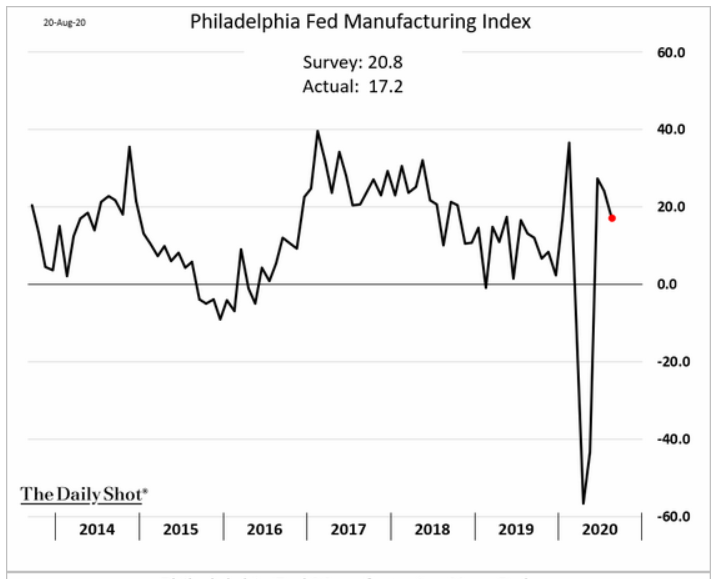

3. Despite slight moderation last month, the Philly Fed is still showing manufacturing ahead of pre-pandemic activity levels…

Source: The Daily Shot, from 8/21/20

4. As the markets digest recent gains a bit, what does the historic picture look like in election years?

Source: The Daily Shot, from 8/20/20

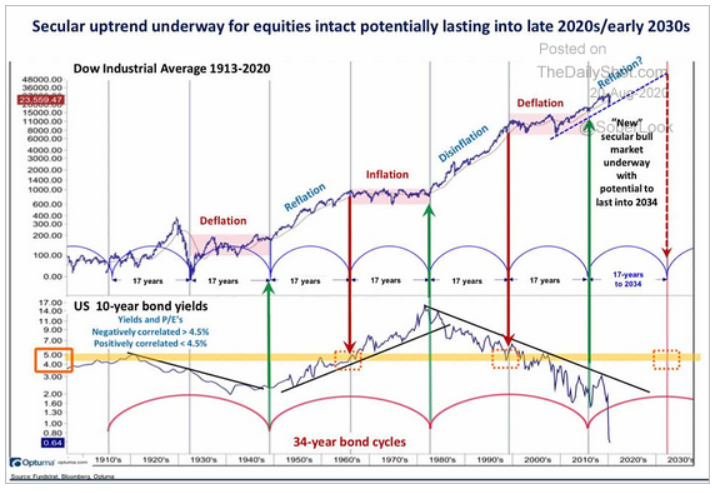

5...And an even longer viewpoint. In particular, will bond yields come back to the 4-5% historic inflection point?

Source: The Daily Shot, from 8/20/20

6. Understandably, the Covid shutdowns are causing bond downgrades across the credit spectrum. Despite the surge in fallen angels (BBB to junk status), BBB is still growing...

Source: The Daily Shot, from 8/20/20

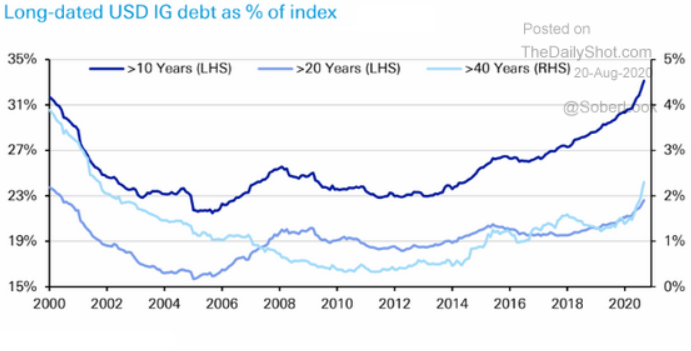

7. Duration has also been increasing. Extremely low rates, increased credit and duration risk, and investors are still pouring money into bonds. What could possibly go wrong?

Source: The Daily Shot, from 8/20/20

8. If yields follow the ISM (old PMI), then bonds are in for a serious correction. Yet the Fed, with trillions of buying capability, has stated they want rates at these levels through 2022. Who will win?

-1.png?width=683&name=8.21%20If%20yields%20follow%20the%20ISM%20(old%20PMI)-1.png)

Source: The Daily Shot, from 8/20/20

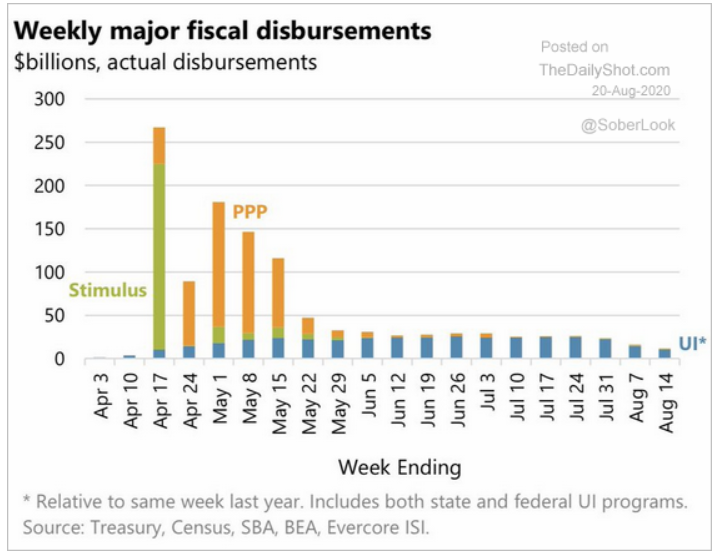

9. Is one round of stimulus all we are going to get?

Source: The Daily Shot, from 8/20/20

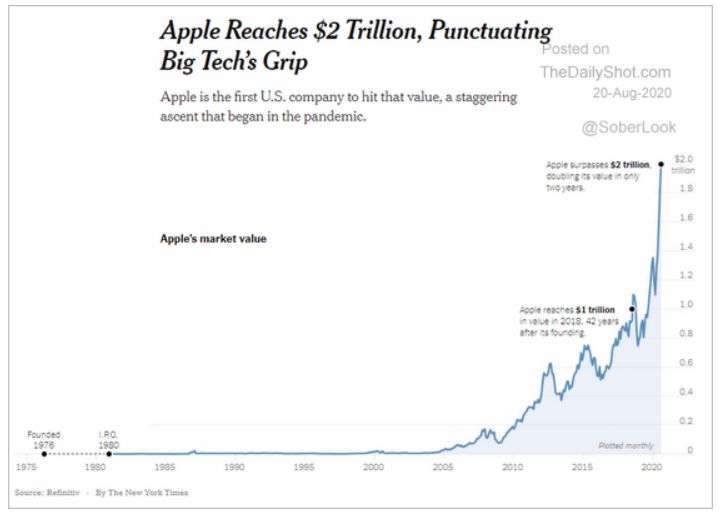

10. Apple has gone parabolic. Historically, parabola up, parabola down. We shall see...

Source: The Daily Shot, from 8/20/20

Want to stay up to date with BCM's latest news, insights, events and thought leadership? Subscribing to the blog is a good start, but follow us on LinkedIn for additional timely updates!

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.