The S&P closed at another all-time high on Friday (that's three new records set in a single week, by the way), thanks in large part to last week's surprise GDP and jobs reports. Today, we take a closer look at the details:

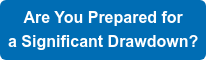

- Consumer spending is still the primary driver of the current expansion, and surpassed expectations despite a >1% decline from Q2.

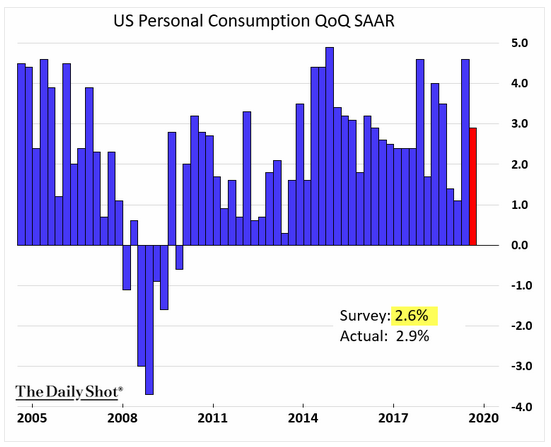

- Business investment's contribution has been on the decline since 2018, and has been a negative contributor to GDP since 1Q19.

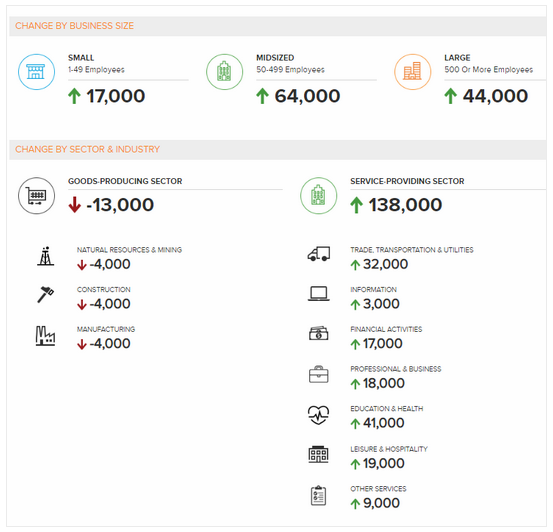

- Despite encouraging gross job gains, the goods-producing sector is struggling, and suffered a decline of 13,000 jobs in Q3.

- The service-producing sector, however, enjoyed gains across all business sizes and industries, including trade, transportation, and utilities.

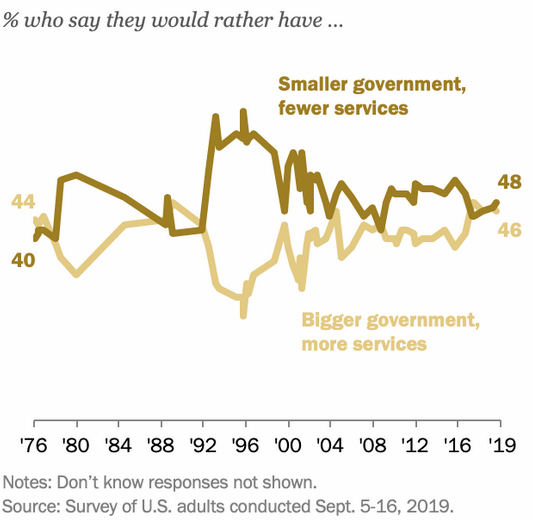

Despite these record-high market closes, broad job gains, and historically low interest rates that would typically send people flocking to the housing market, banks remain more stringent on lending today than they were before the financial crisis. Could that be a major factor in the sector's sluggish recovery? And finally, with one year to go until the general U.S. election, we see just how split the public remains on their preferences on the role of government...

1. While consumer spending declined in Q3, it surpassed expectations by 0.3% and remains a primary driver of the current expansion.

Source: WSJ Daily Shot, as of 10/31/19

2. Business investment, however, has continued on its downward trajectory.

Source: WSJ Daily Shot, as of 10/31/19

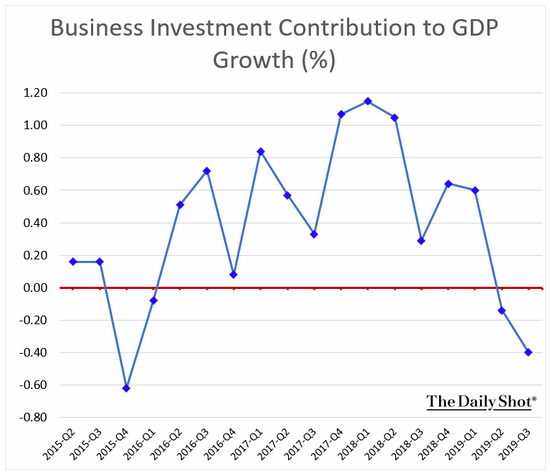

3. A more detailed look at GDP breakdown:

Source: WSJ Daily Shot, as of 10/31/19

4. And a breakdown of the ADP jobs report:

Source: WSJ Daily Shot, as of 10/30/19

5. While lending standards have loosened slightly in the past few years, they are still tighter than before the housing bubble.

Source: The Urban Institute, as of 10/28/19

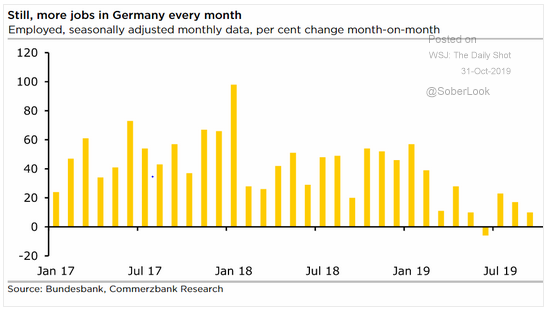

6. Job growth is slowing in Germany.

Source: WSJ Daily Shot, as of 10/30/19

7. Yesterday marks 1 year until the U.S. general election, and the population appears almost equally split over their preferences for the size and scope of government. The next year will be interesting!

Source: Pew Research Center, as of 9/16/19

Pleasant earnings surprises have helped prop up the markets and sustain the current expansion, but—statistically speaking—the longer the expansion goes, the worse the drawdown is likely to be when it finally turns. Read our piece "Are You Prepared" to take a moment to start thinking about your portfolio for 2020.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.