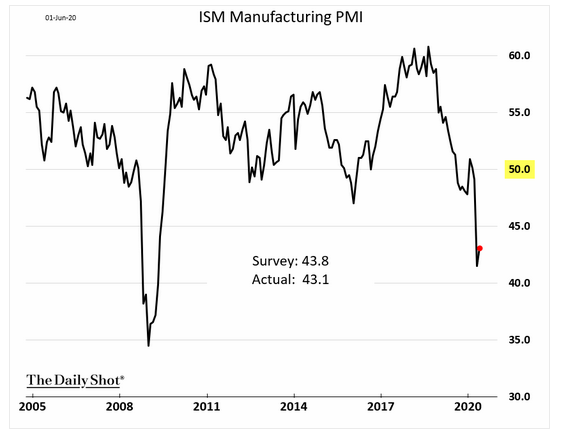

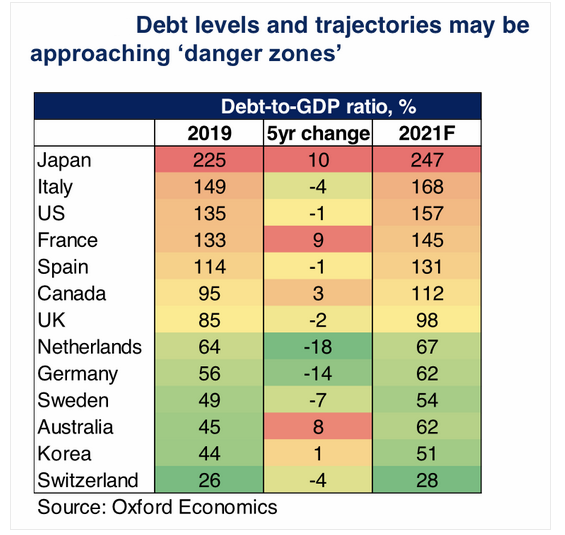

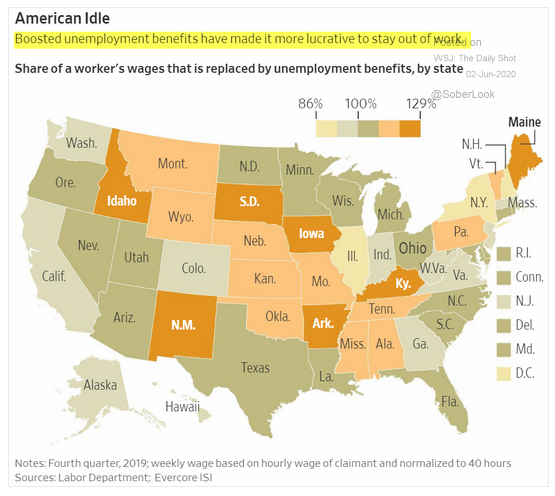

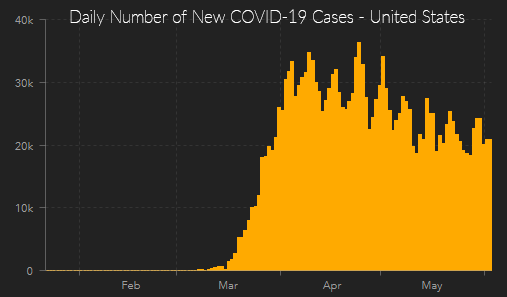

The ISM Manufacturing PMI report showed a modest improvement last month, narrowly beating analyst expectations and (hopefully) establishing some upward momentum. The sector has been struggling since mid-2019 and it's fledgling recovery earlier this year was cut short by the COVID-19 outbreak—let's hope these gains have more staying power. Government stimulus has proved a useful weapon in cushioning some of the economic effects of the virus, but the massive wave of debt being incurred could spark its own eventual crisis; the U.S. is projected to see a 157% debt-to-GDP ratio by 2021. Increased unemployment payouts—while essential to many's survival in the current environment—are certainly a factor in the growing debt and may also cause issues down the line, given how many low-income workers are taking home more from unemployment than they were in their paychecks. The system certainly isn't perfect, as highlighted by a new report from Bloomberg claiming that nearly 33% of benefits owed to those who lost their jobs in the pandemic have yet to be paid out. Meanwhile, infection rates are not slowing as much as hoped in the U.S., and are spiking in many parts of the Middle East—in some cases for a second time. Is the U.S. prepared for our own second wave?

1. OK, if we have seen the bottom, we'll be fine...

Source: WSJ Daily Shot, from 6/2/20

2. Countries have now infused ~$9 trillion into their economies. What effect will all this debt have post-crisis?

Source: WSJ Daily Shot, from 6/2/20

3. The Law of Unintended Consequence? Yet these Americans need this support!

Source: WSJ Daily Shot, from 6/2/20

4. A 50-year super-cycle?

Source: WSJ Daily Shot, from 6/2/20

5. The concern here in the U.S. is that the slowing of new infections is not accelerating and is flattening around 20,000 new cases /day...

Source: JHU CSSE, from 6/3/20

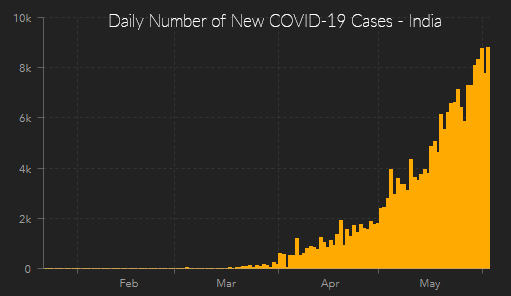

6. Covid is now rampant in India while Pakistan and Afghanistan have similar Covid Curves.

Source: JHU CSSE, from 6/3/20

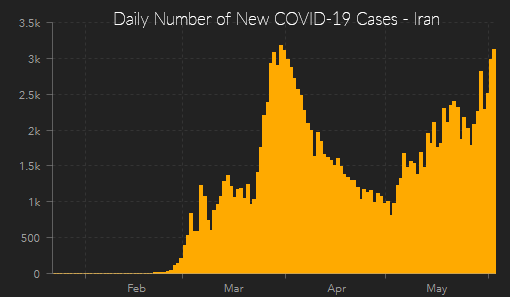

7. Religious pressure to allow large gatherings for public prayer seems to have contributed to a second wave in Iran.

Source: JHU CSSE, from 6/3/20

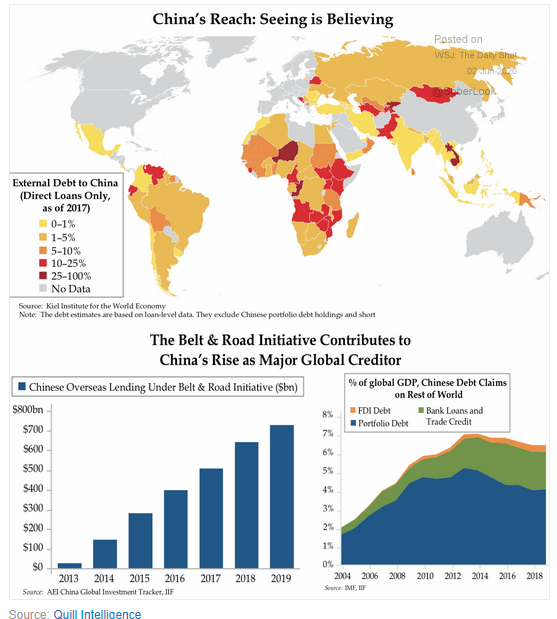

8. China's growing global influence can be observed by who they have lent money to...

Source: WSJ Daily Shot, from 6/2/20

Markets have staged an impressive rally since their unprecedented downturn in March, but does that mean we're out of the woods and safe from the bear market? Maybe not, if past bears have anything to say about it. Read “The Anatomy of a Bear Market” by BCM Portfolio Manager Dave Haviland to see how past bear markets have played out and why this one may just be getting started.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.