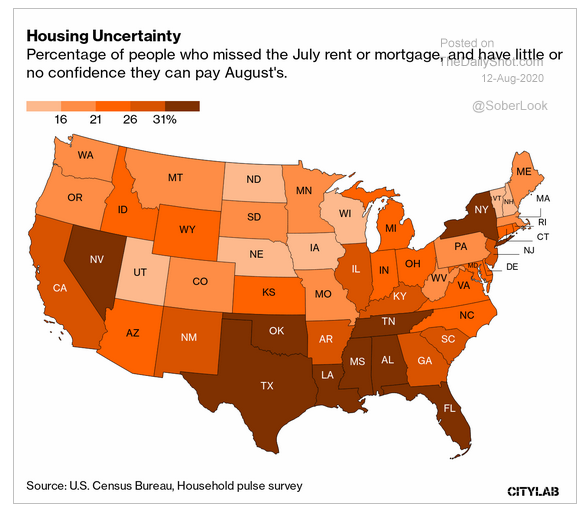

There's a lot going on in D.C these days, but an effective response on housing—or a cross-party compromise on the next round of stimulus funding—doesn't appear to be one of them. Stimulus talks have reached a stalemate as the share of the population unable to meet housing costs soars. Meanwhile, the S&P 500® Index may have come close to a new all-time high today, but cumulative U.S. equity fund flows have continued their downward trajectory. Are the mega-caps safe from this trend or is being "too big to fail" worth about as much as it was back in 2008? And as the USD grows weaker, we're keeping an eye on some emerging patterns from the Euro, Asian currencies, and EM as a whole. Could the sphere be poised for some revitalization after years of relative weakness?

1. Washington dickers while main street suffers. Up to 40 million Americans face eviction notices. How will up to 40 million new homeless people help the current situation? And once evicted, who is going to be able to afford rent?

Source: WSJ Daily Shot, from 8/12/20

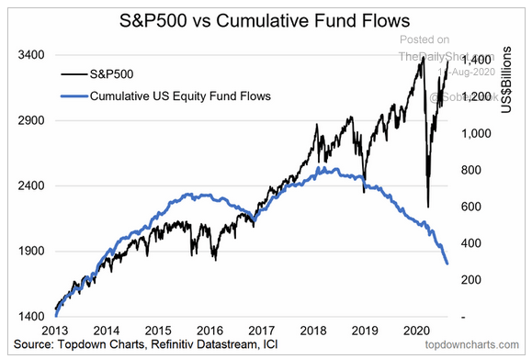

2. Will the asset 'drain" catch up to the U.S. equity markets?

Source: WSJ Daily Shot, from 8/11/20

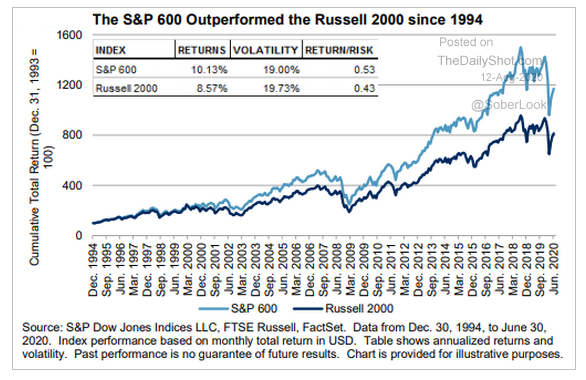

3. A great example of why knowing & understanding each ETFs underlying index construct is so important. Here are two small cap indices:

Source: S&P Global Market Intelligence, as of 6/30/20

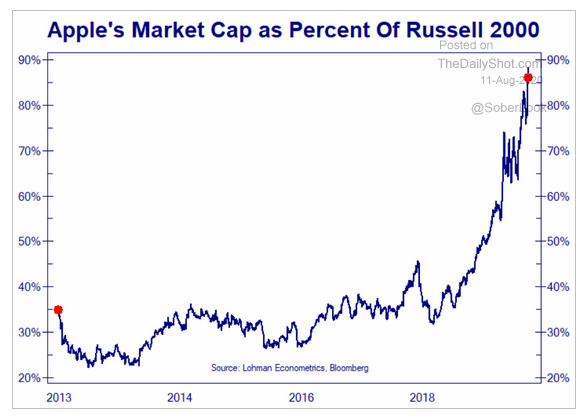

4. Is there such a thing as too big?

Source: WSJ Daily Shot, from 8/12/20

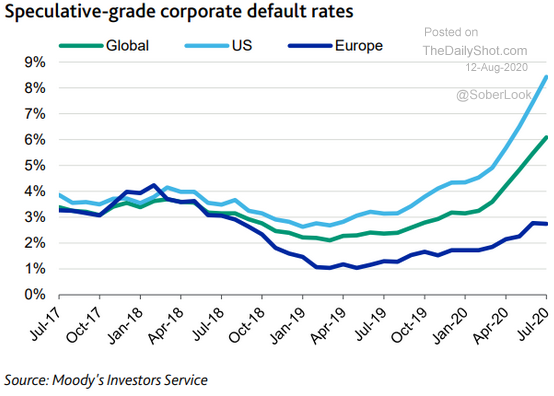

5. For those using high yield bonds, there is a storm brewing!

Source: WSJ Daily Shot, from 8/12/20

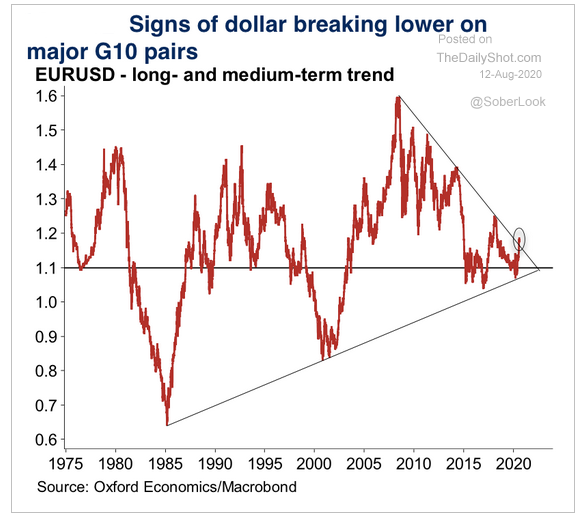

6. Is the Euro finally breaking out as the USD struggles or is this a head-fake?

Source: WSJ Daily Shot, from 8/12/20

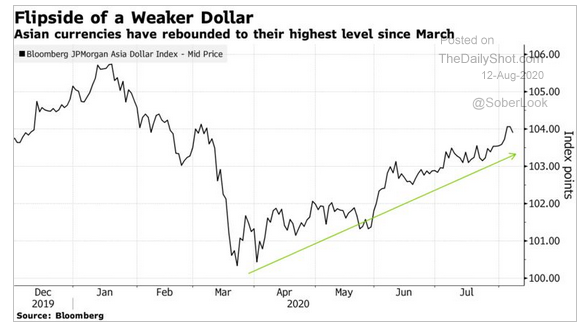

7. ...And it is not just the Euro that is strengthening...

Source: WSJ Daily Shot, from 8/12/20

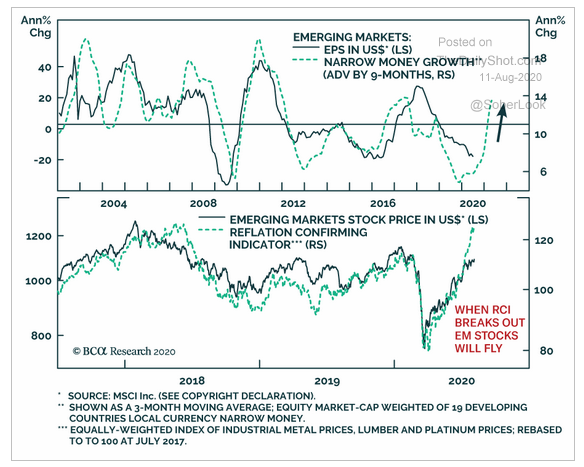

8. Is a weaker USD, strong money supply growth and years of underperformance setting up EM for a run?

Source: WSJ Daily Shot, from 8/11/20

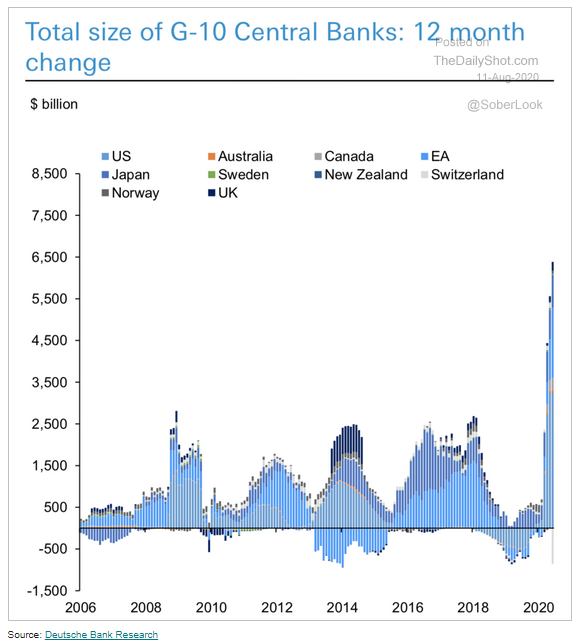

9. Putting "don't fight the Fed" (and friends) in perspective...

Source: WSJ Daily Shot, from 8/11/20

With the announcement of Kamala Harris as Joe Biden's running mate, the election is heating up. For a look at how markets have historically performed during election years—and our thoughts on what investors should be looking out for—read "How Should Investors Think About the Upcoming Election’s Impact on the Stock Market?" by BCM Portfolio Manager Brendan Ryan.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.