While Q3 GDP growth surprised at 1.9%, the New York and Atlanta Feds' projections for Q4 see levels dropping to 1%. Slowing growth, the inverted yield curve, and ongoing trade woes have many worrying about an approaching recession, but a look at the charts shows that select advanced economies have historically been able to withstand global downturns. While wage inflation has finally ticked up and overall inflation—though slowing—is relatively in-line with expectations, the ongoing domestic (and global) manufacturing contraction continues to weigh on the U.S.'s efforts to sustain this period of economic expansion. And is China still a part of the manufacturing-contraction club, or have they turned things around? While the nation claims their manufacturing activity declined for the sixth straight month in October and remains in contraction, the Caixin/Market Manufacturing PMI report paints a different picture, coming in above expectations at 51.7. Check out the charts below, and we'll leave the interpretation up to you!

1. Both the Atlanta and NY Fed regional banks are predicting 1% GDP growth in 4Q19. Will the near bear market of -19.7% afford us a near recession?

Source: NY Fed, as of 11/5/19

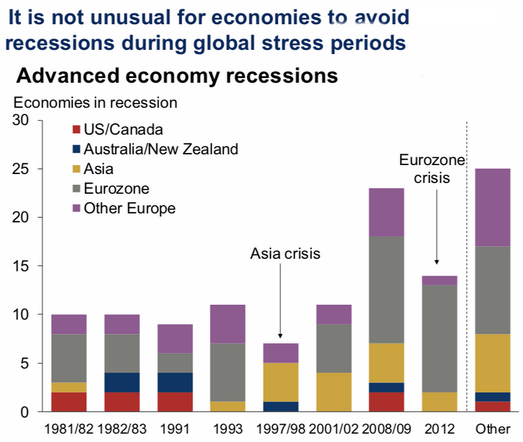

2. Despite the inverted yield curve, a U.S. recession is not a forgone conclusion!

Source: Oxford Economics, as of 11/5/19

3. Wage inflation is trying to reestablish its positive trend...

Source: FRED, as of 11/5/19

4. However, overall inflation is trending lower...

Source: WSJ Daily Shot, as of 11/5/19

5. The October U.S. manufacturing PMI remains in contraction.

Source: WSJ Daily Shot, as of 11/5/19

6. European manufacturing also remains in contraction (less than 50)...

Source: WSJ Daily Shot, as of 11/5/19

7. Recent gains in the Chinese currency is likely a result of the up front goodwill from the first round of a trade deal.

Source: WSJ Daily Shot, as of 11/5/19

8. China is bucking the global trend and is solidly back in growth mode.

Source: WSJ Daily Shot, as of 11/5/19

9. Mexico rejoined Canada with modest manufacturing growth in October.

Source: IHS Markit, as of 11/1/19

10. Does the Fed's Sahm rule apply to other countries?

Source: WSJ Daily Shot, as of 11/5/19

11. Another false breakout or is this (finally) for real?

Source: WSJ Daily Shot, as of 11/6/19

You're following the BCM blog, so we know you like to keep up to date on the market—shouldn't your investment strategies do the same? The buy-and-hold approach has dominated in recent years, but check out our piece "Trend Following, an Alternative to Buy and Hold" for a look at how a more active approach could benefit both you and your clients.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.