The S&P 500 hit another all-time high on Thursday and while the S&P 600 has risen over 460% since its financial-crisis lows, it—like many other markets—has yet to recapture its summer '18 magic and continues to trade below previous peaks. In comparison, its large-cap counterpart—the S&P 500—has continued setting records into 2020, leaving many wondering... could it be overheated? Mounting tensions in the Middle East could have something to say about the matter; brent crude futures shot past $70/bbl following Friday's killing of an Iranian commander and energy price volatility can quickly metastasize to other sectors. The question is whether the impact will be short-lived like other recent headline events or if we're in for a longer haul. Meanwhile, our manufacturing woes continue. ISM PMI came in at its worst levels in ten years, and manufacturing activity is down across the board year-over-year. Chinese officials are set to arrive on January 13 to sign the phase one trade deal, and their plane can't arrive soon enough!

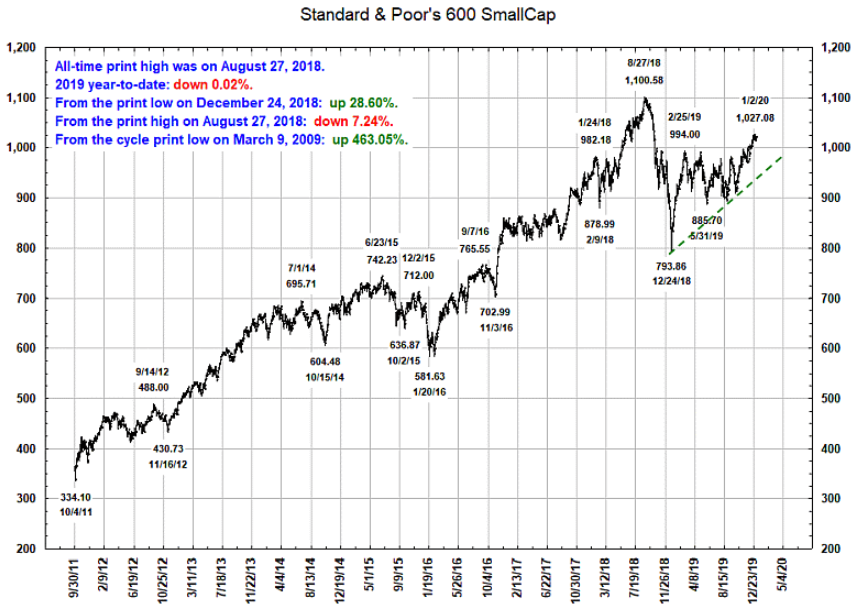

1. While the S&P 500 continues it's historic run, many markets, including U.S. Small Cap, have not returned to their 2018 highs...

Source: The Chart Store, as of 1/3/20

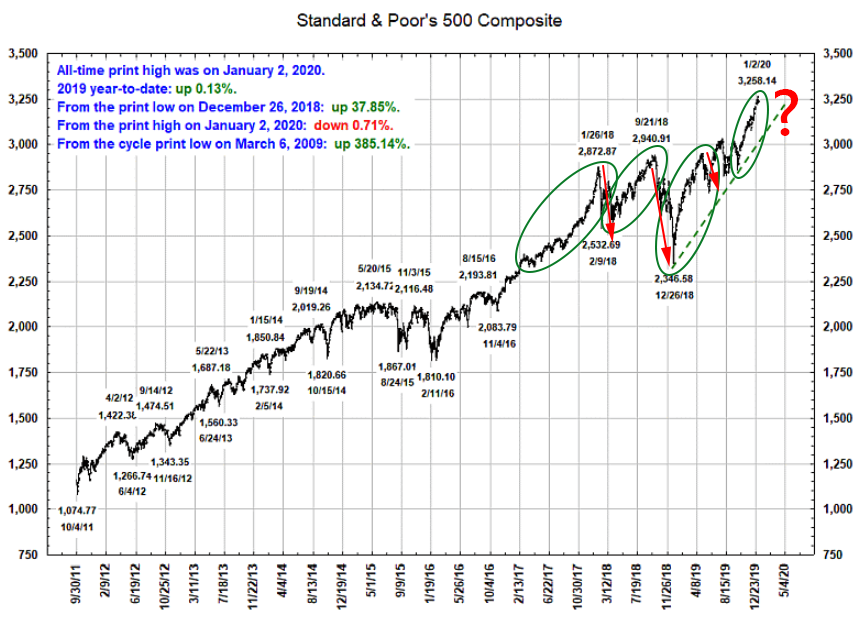

2. Trading at 19x 2020 estimated earnings, has the market gotten ahead of itself?

Source: The Chart Store, as of 1/3/20

3. The question is will the current situation be transient like the last attack on the Saudi oil facilities or will this escalate into a shooting war?

Source: WSJ Daily Shot, from 1/6/20

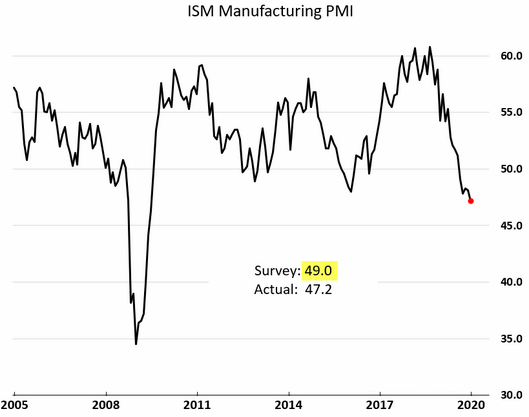

4. The trade truce cannot get here fast enough and needs to be meaningful. Readings below 50 indicate contraction.

Source: WSJ Daily Shot, from 1/6/20

5. To put this into perspective, U.S. manufacturing has not contracted like this since the Great Recession...

Source: WSJ Daily Shot, from 1/6/20

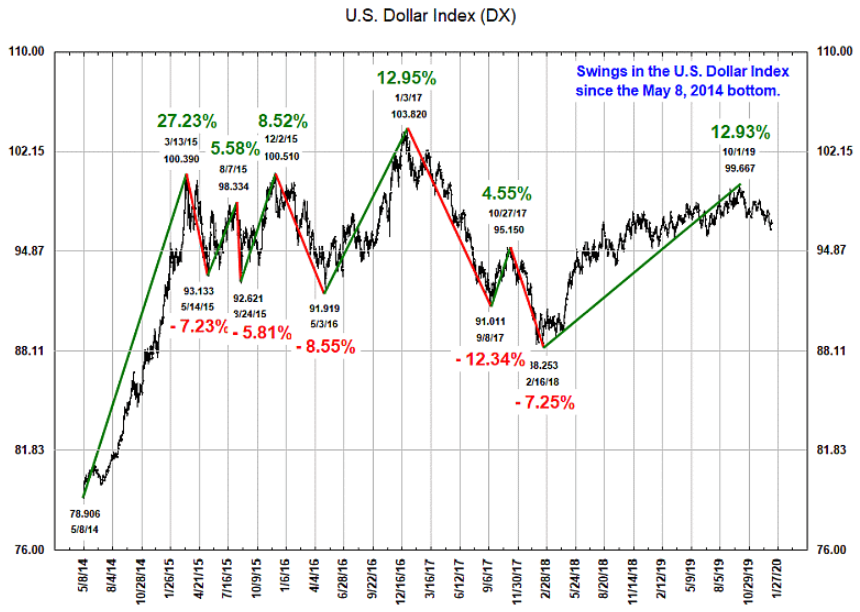

6. The dollar looks tired. Any sustained weakness will help give a bid to commodities and International markets...

Source: The Chart Store, as of 1/3/20

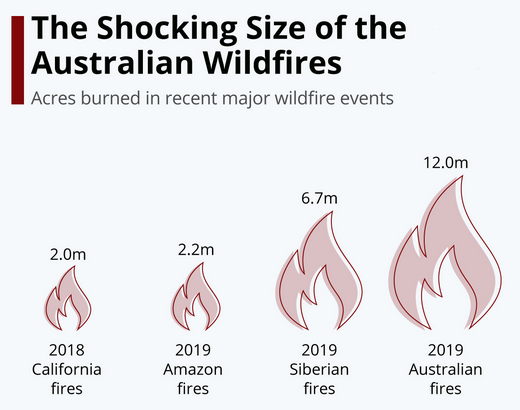

7. Our thoughts and prayers are down under...

Source: Statista, from 1/2/20

New years bring new resolutions—do yours involve pursing asset growth without sacrificing downside protection? If so, check out the BCM strategy guide for insights on which of our rules-based systems may be right for your clients. Click below to tell us what you're looking for and receive customized information on the systems best designed to fit your needs!

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.