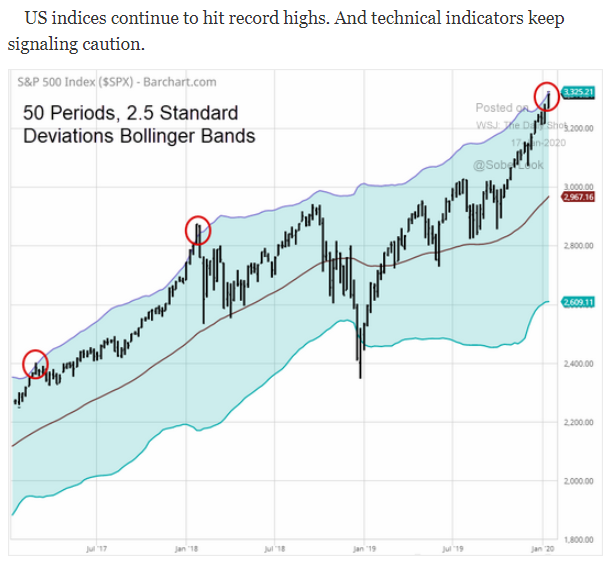

The S&P 500 sailed through the 3,300 mark for the first time yesterday to clinch yet another record, thanks in large part to solid December retail numbers, a strong start to earnings season, and tech stocks (congratulations Alphabet!). But similarly outsized performance back in 2018 was followed quickly by a significant correction—should we brace for history to repeat itself? The technical indicators seem to think so, but some economic reports are doing their best to sustain sentiment; more than one East Coast manufacturing print look to have (finally) established some upward momentum after a long period of contraction. The Producer Price Index (PPI) hasn't quite gotten the memo yet, but will hopefully benefit from the news on its next print. And while Wednesday saw the long-awaited signing of the phase one trade deal between the U.S. and China, the trade war isn't the only economic sword hanging over China's head at the moment...

1. Are we in the parabolic "blow-off" stage of the market?

Source: WSJ Daily Shot, from 1/17/20

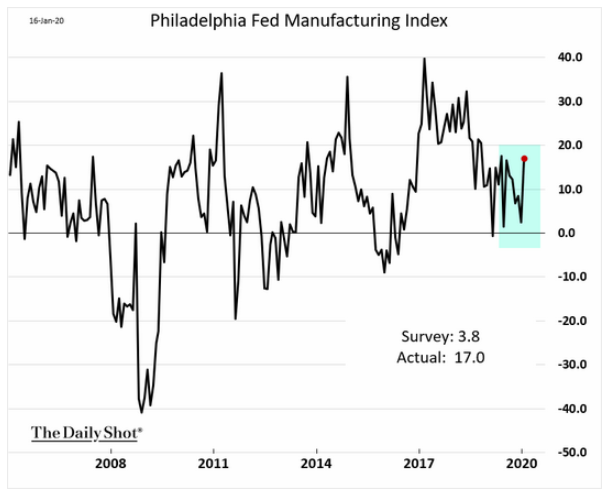

2. The NY Fed has shown positive manufacturing growth for several months now. Let's see if the country's manufacturing belt can follow suit!

Source: WSJ Daily Shot, from 1/16/20

3. Together with the NY Fed survey, it looks like the East Coast is rebounding!

Source: WSJ Daily Shot, from 1/17/20

4. Unlike the CPI which is establishing an up trend, the Producer Price Index is likely suffering from the manufacturing recession...

Source: WSJ Daily Shot, from 1/16/20

5. A ray of hope for Germany and the European economy?

Source: WSJ Daily Shot, from 1/17/20

6. While China's economic activity came in as expected, there may be some issues under the hood...

Source: Bloomberg, from 1/16/20

We'll still be enjoying the long weekend this Monday, so now's a good time to load up on BCM content if you'll be missing Fireside Charts. Our Q4 market commentary released this week and it's chock full of our investment team's thoughts on the past quarter, the past decade, and the one before that. See how the past 10 years stack up against the 90's and the aughts in "BCM 4Q19 Market Commentary: Will the Next Decade Look Anything Like the Last Two?"

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.