Stocks soared Monday on hopes that COVID-19 had reached its peak in epicenters like New York and Italy, but such rallies aren't uncommon in bear markets, and the euphoria was short lived. Such swings may be the norm for a while now given that many companies have withdrawn their earnings guidance, leaving investment decisions more subject to headlines and sentiment. Was that a factor behind the S&P 500 Index's forward P/E ratio creeping back up to record highs in the midst of such sweeping—and devastating—changes to the economic landscape? Meanwhile, companies are reacting swiftly to these changes with slashes to dividends, halted buybacks, and other tactics. Massive unemployment has been perhaps the most visible change following a staggeringly quick 180 from record lows earlier this year, and according to the St. Louis Fed, it may soon outpace numbers from the Great Depression. States are already seeing massive losses to GDP, so lets hope we'll soon see some palliative effect from the recent unprecedented stimulus efforts. Now for some good news: confirmed cases of COVID-19 look to be growing more slowly than previously projected. Does that mean the economic fallout might fall short of some of the more dire projections too?

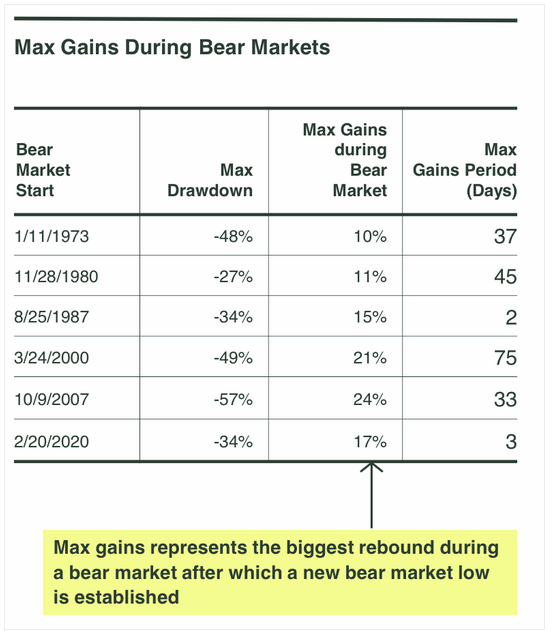

1. A reminder that rallies like Monday's are common in bear markets. Will this time be different?

Source: WSJ Daily Shot 4/7/20

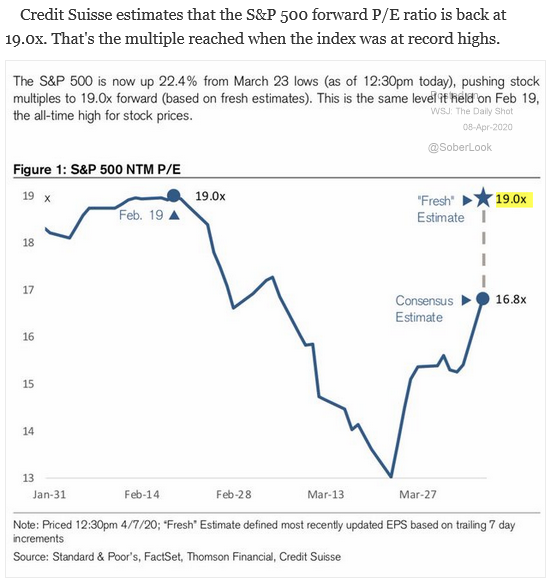

2. This is where the guestimating gets serious...with most U.S. companies withdrawing their earnings guidance, the market will be faced with a long string of good and bad news for a long time, stringing out uncertainty and volatility...

Source: WSJ Daily Shot, from 4/6/20

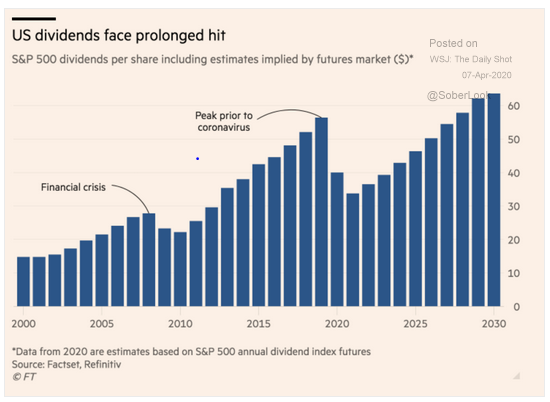

3. Stock dividends may also be significantly reduced...

Source: WSJ Daily Shot, from 4/7/20

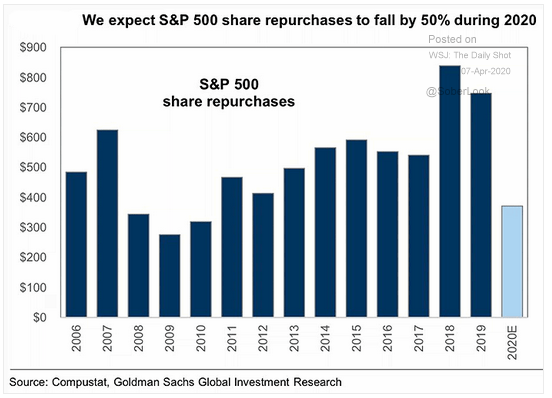

4. What was a major tailwind for the last bull market will likely be significantly curtailed as many companies will need the cash to meet other needs...

Source: WSJ Daily Shot, from 4/7/20

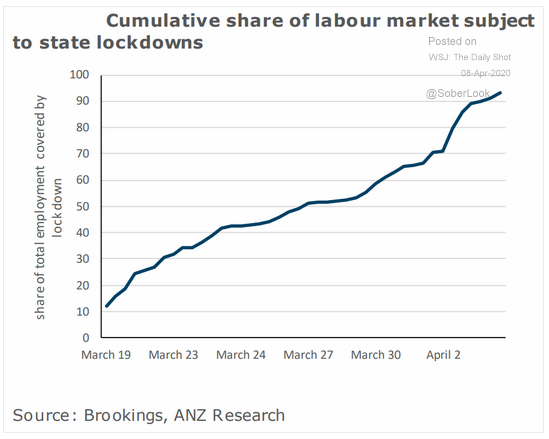

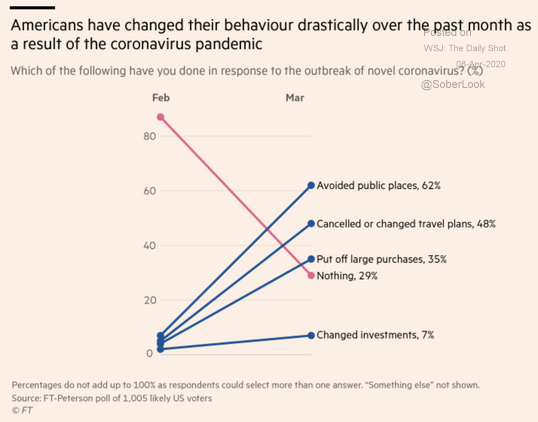

6. As the pandemic fully establishes itself across the country, we all now know we're in this together...

Source: WSJ Daily Shot, from 4/9/20

7. The speed of the shutdown has been matched by the speed of unemployment....roughly six months reduced to two weeks...

Source: WSJ Daily Shot, from 4/8/20

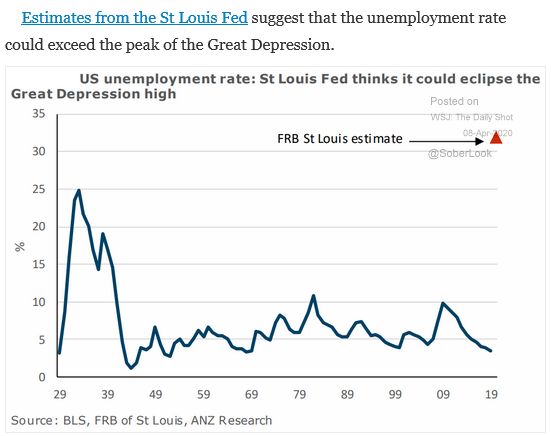

8. While estimates vary wildly, this Fed estimate of total Covid-19 induced unemployment is staggering...

Source: WSJ Daily Shot, from 4/8/20

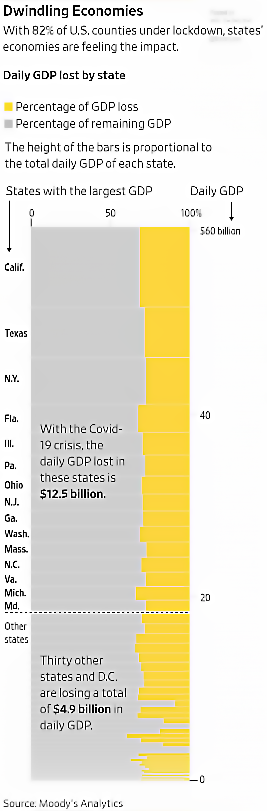

5. If Moody's Analytics is even remotely close, that would mean the U.S. economy is "giving up" ~$17.4 billion/day, $522 billion /month and $1.567 trillion per quarter. Let's make it count and stay home!

Source: WSJ Daily Shot, 4/6/20

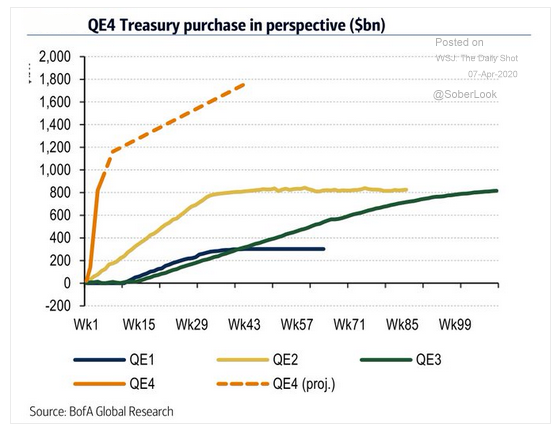

9. The unprecedented speed of this bear market is being matched by the unprecedented speed (and quantity) of the Fed's new QE program...

Source: WSJ Daily Shot, from 4/7/20

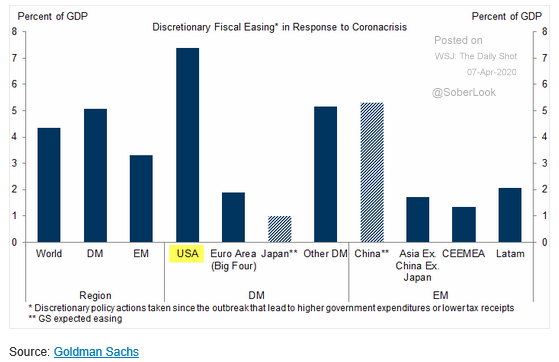

10. Yesterday it was reported that Japan is adding ~$900 billion to their relief efforts...

Source: WSJ Daily Shot, from 4/7/20

11. If 38% of us still gather in public, this will not end anytime soon! Please stay home...

Source: WSJ Daily Shot, from 4/7/20

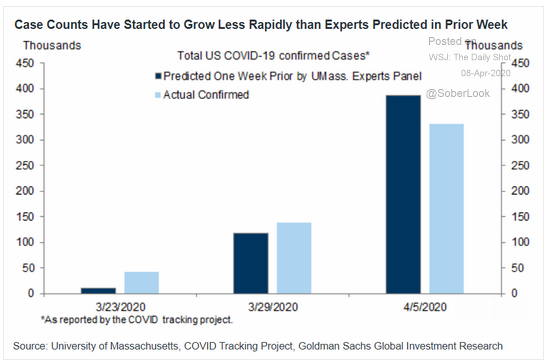

12. Staying home, covering your face and keeping 6 feet apart...IS WORKING!

Source: WSJ Daily Shot, from 4/8/20

It's been a wild few months for the U.S. economy, so we certainly weren’t short on material for our Q1 Market Commentary. For BCM’s analysis of Q1 events and where we go from here, read “To V or Not to V” by the BCM Investment Team.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.