The S&P 500® Index closed at a new record high on Friday, boosted by stronger-than-expected manufacturing and housing data. The mega-cap outliers are still running the show though as small- and mid-caps—and even ~60% of S&P 500 companies—post losses. Over in the bond market, the yield curve is slowly normalizing, but credit risk remains significantly elevated as corporate bankruptcies approach a 10-year high. And as the PMI recovery pauses in Europe, U.S. manufacturing activity hit a 19-month high, and services a 17-month high, in August as the economic reopenings march on and demand reignites. Here’s hoping the trend continues…

1. Fewer than a dozen stocks were responsible for the lion share of S&P 500's gains while small- and mid- caps retreated.

Source: The Daily Shot, from 8/24/20

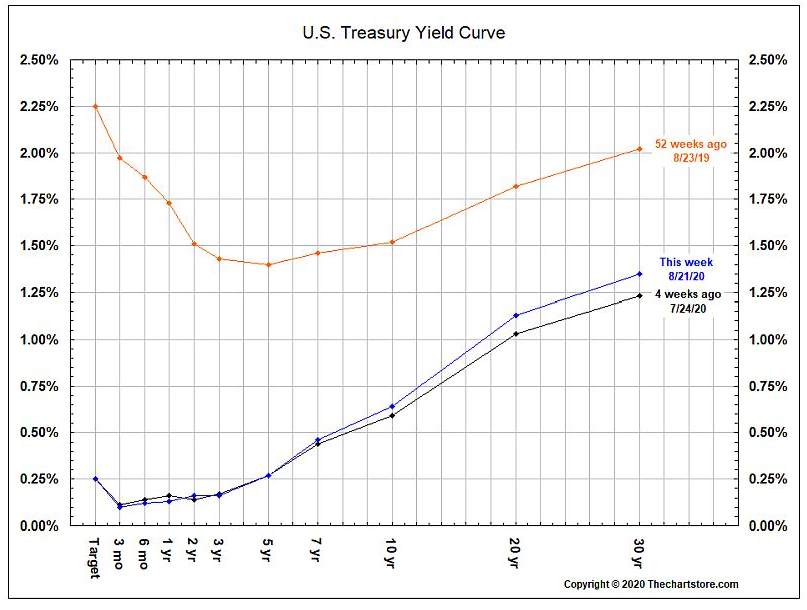

2. The U.S. yield curve continues to "normalize" as the long end slowly widens out...

Source: The Daily Shot, from 8/24/20

3. The speeds of the 2020 bear and recovery are being matched by another, more ominous trend...

Source: The Daily Shot, from 8/24/20

4. After a 10.5% decline, is the U.S. dollar breaking down out of its long-term trading channel?

Source: The Daily Shot, from 8/24/20

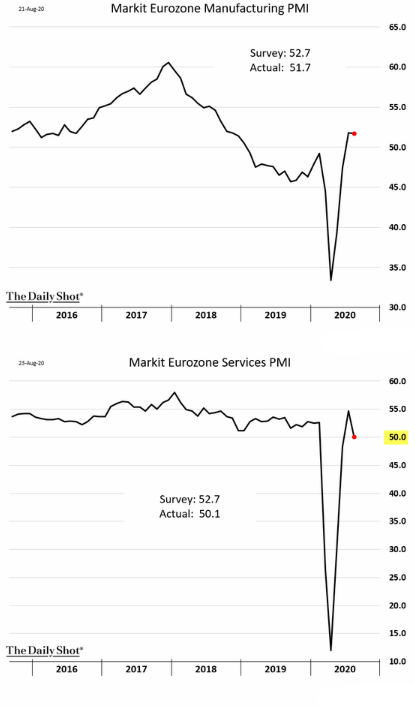

5. In Europe, the recovery is resting as Germany was strong, but France retreated a bit...

Source: The Daily Shot, from 8/23/20

6. Here at home it is "steady as she goes"... at least for now...

Source: The Daily Shot, from 8/23/20

7. Maybe the USPS should prohibit marketing mail in the 10 days before the election...

Source: The Daily Shot, from 8/24/20

For more insights from BCM and a look at the stories & trends we're following closely, sign up for our monthly newsletter releasing next week

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.