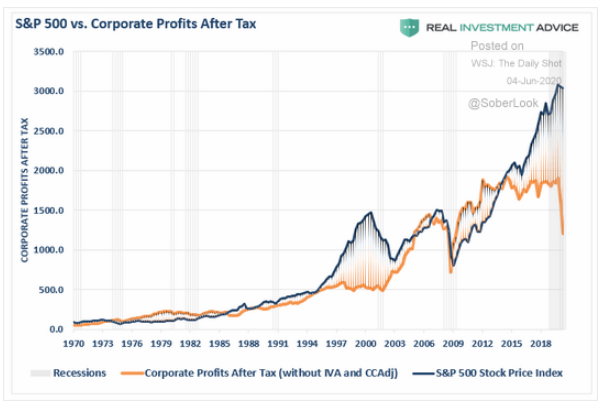

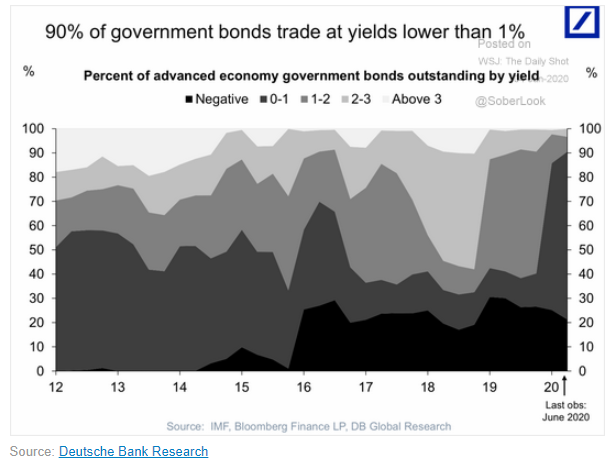

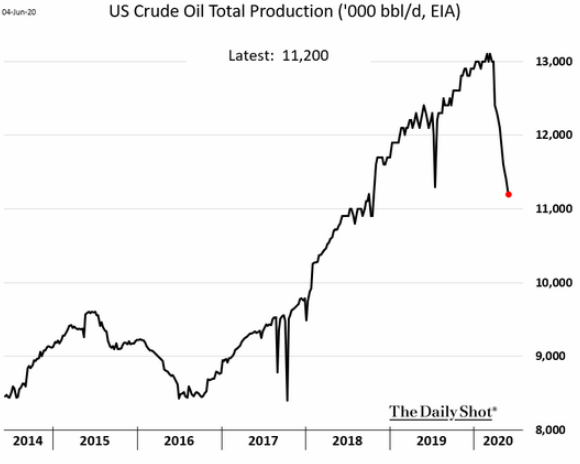

While growth in corporate profits and earnings have stalled in the past few years, equity gains have continued on largely unimpeded, even through the COVID-19 crisis. What will it take to bring prices back to earth and moderate the overvaluation? And bargain hunters may prefer to eschew expensive equities, but is the bond market a decent alternative when a high-yield savings account offers a higher return than 90% of global government bonds? Oil production has plummeted nearly 14% year-over-year and prices have just begun to stabilize following the price war this spring, reaching a three-month high ahead of this weekend's OPEC meeting. Are more production cuts in store? Meanwhile, if you were surprised by the price of rice during your quarantine dry-goods shop, you aren't alone. Prices have risen nearly 70% this year, with much of the spike occurring after social distancing recommendations went into effect. But did restrictions lift too soon in the U.S.?

1. How will earnings and price re-converge this time...and when?

Source: WSJ Daily Shot, from 6/4/20

2. ~20% of all government bonds still have negative yields and ~90% have yields below 1%.

Source: WSJ Daily Shot, from 6/4/20

3. The spikes down in 2017 and 2019 were due to gulf hurricanes. Will the ~14% decline in U.S. production have a similar snap back if prices continue to recover?

Source: WSJ Daily Shot, from 6/4/20

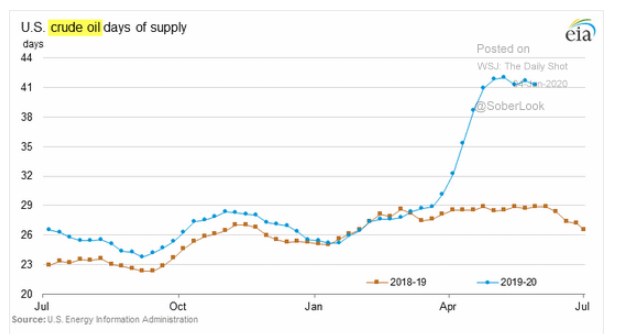

4. We will have to use up the floating and land-based storage first...

Source: WSJ Daily Shot, from 6/4/20

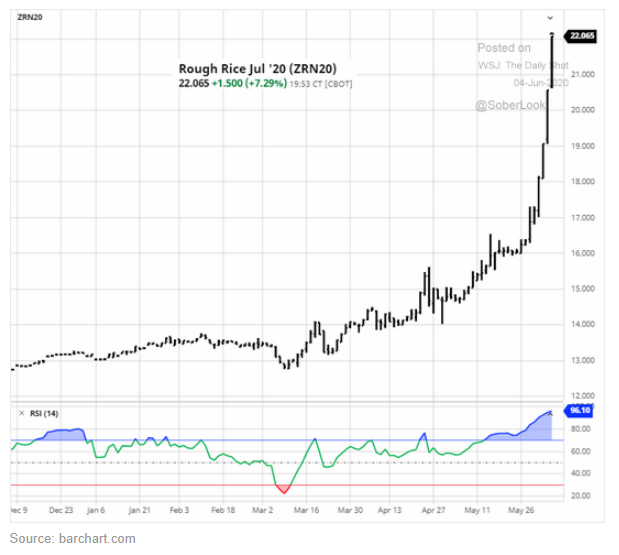

5. A small crop last year, low plantings this year and increased consumer demand has rice prices increasing almost 70% this year...

Source: WSJ Daily Shot, from 6/4/20

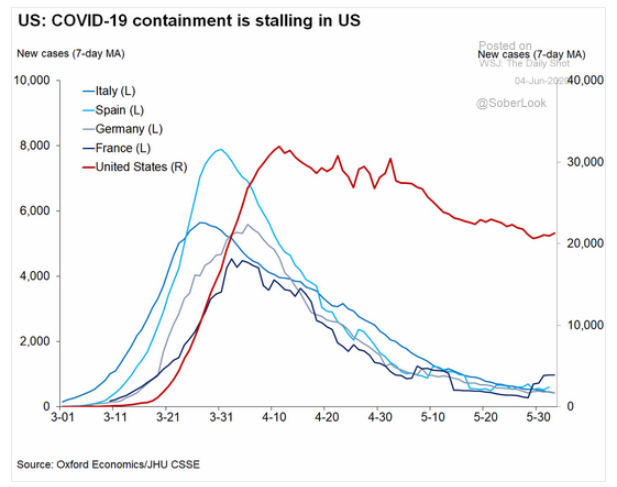

6. Are we re-opening too soon? It may depend on which state you live in...

Source: WSJ Daily Shot, from 6/4/20

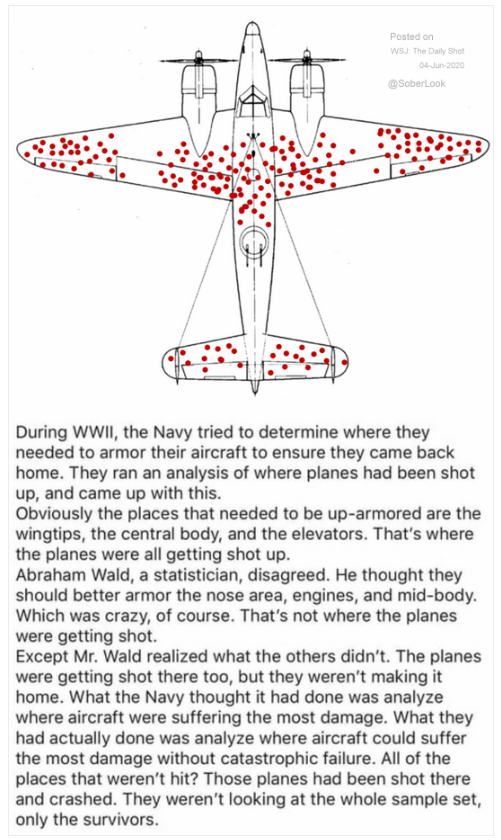

7. A fascinating study on how bias can effect analysis. This is why we try to remove bias from our rules-based systems!

Source: WSJ Daily Shot, from 6/4/20

The trajectory of a bear market isn't straight down, and rallies don't necessarily mean a bear has come to a close. Is it possible that's what we're seeing in the equity markets right now? Read “The Anatomy of a Bear Market” by BCM Portfolio Manager Dave Haviland to see how past bear markets have played out and why this one may just be getting started.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.