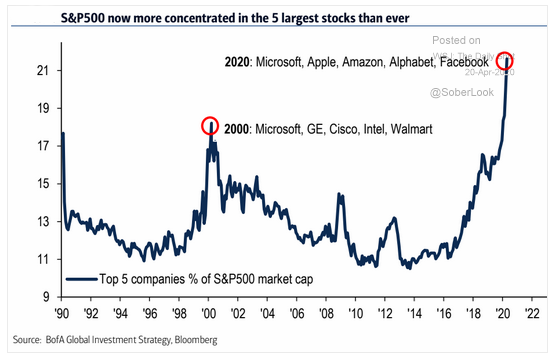

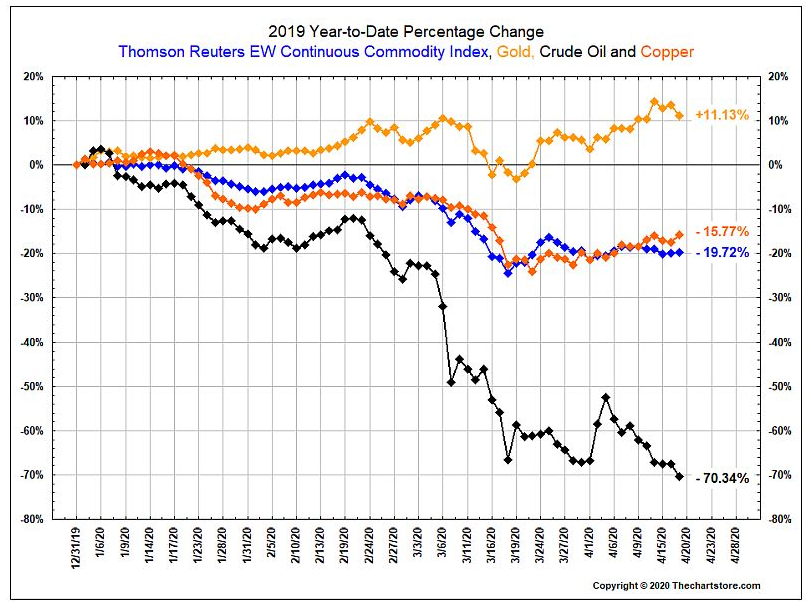

In unsurprising news to anyone who's been keeping an eye on their screen time reports lately, tech companies like Facebook and Amazon are riding a wave of increased traffic in the #socialdistancing era. And as demand falters in other sectors, just five of these companies have cornered over 21% of the S&P 500 Index's market-cap, flashing reminders of the ultra-concentrated days of '99-'00. Is such massive concentration sustainable? In another blast from the past, crude oil has plunged over 70% year-to-date, hitting its lowest levels since 1999 as supply continues to run circles around demand. But weren't energy stocks up big on Friday? Talk about mixed signals... Meanwhile, bond market spreads are returning to (somewhat) normal territory, but the high-yield gap shows investors remain nervous about the growing risk of defaults and bankruptcies. U.S. lawmakers are reportedly nearing an agreement to reload the Paycheck Protection Program's piggy bank though, in what will hopefully help companies buffer losses and stave off chapter 11 filings.

1. And the big get bigger...

Source: WSJ Daily Shot, from 4/20/20

2. This morning oil is down an additional 20% as producers are running out of places to store it!

Source: The Chart Store, as of 4/17/20

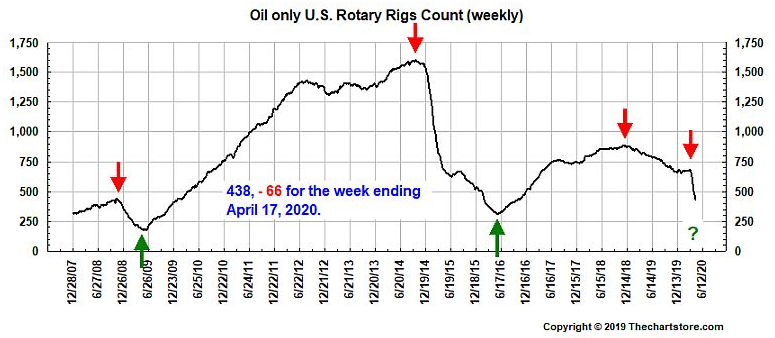

3. Rig counts are dropping commensurately as at~ $15/barrel, much of the U.S. production price is ~1/3 production costs.

Source: The Chart Store, as of 4/17/20

4. On Friday, as the price of oil plummeted, energy stocks were way up. With oil down another 20% this morning, somebody's wrong...

Source: WSJ Daily Shot, from 4/20/20

5. The Fed's swift actions have helped bring the bond markets back under control, but more work may be needed...

Source: The Chart Store, as of 4/17/20

6. Junk bond spreads, while gaining about 1/2 back, are still pretty wide as they reflect a greater risk of defaults and bankruptcy...

Source: The Chart Store, as of 4/17/20

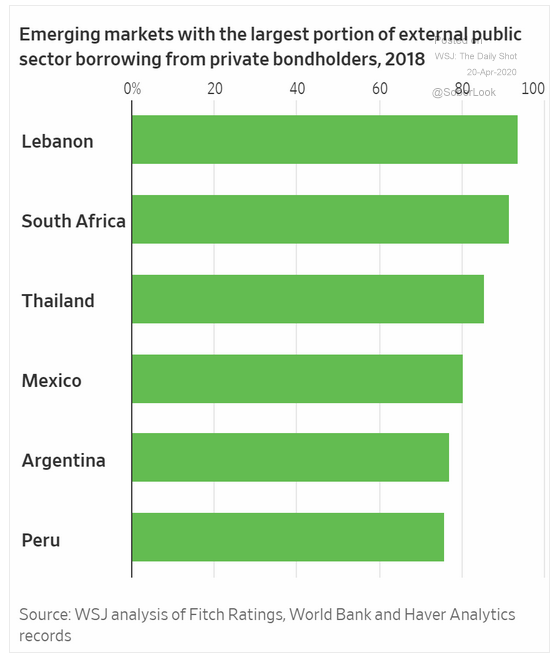

7. These countries are going to struggle to repay their debt, much of which is denominated in USD...

Source: WSJ Daily Shot, 4/20/20

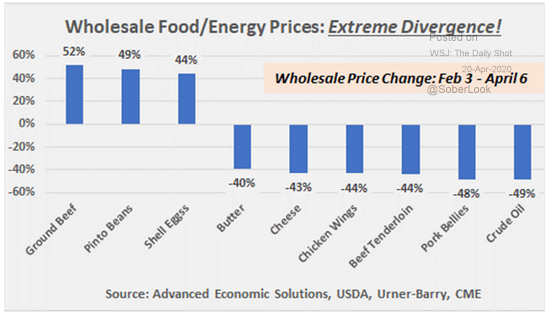

8. With restaurants closed or take-out only, Covid-19 has changed what we eat...

Source: WSJ Daily Shot, from 4/20/20

Data is key, but context is everything. For a review of first quarter events and what you should be keeping an eye on going forward, watch our quick 1Q20 video market commentary by BCM Portfolio Manager, Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.