The S&P 500 has surged over 20% and set 16+ record closes this year, but small-cap stocks have failed to follow the same pattern, and appear to be bearing the brunt of rising political, trade, and economic uncertainty. Will they continue to linger under 1600.00? The U.S. farmer is shouldering the same burden, as farm debt is projected to reach record highs this year following a 24% YoY September surge in bankruptcies. And leading economies may be reacting to the same trends, as investment indicators have established some downward momentum this year and economic sentiment appears shaky. Finally, could an opportunity be presenting itself in the Asian Pacific? Stay tuned for more, as political and U.S./China headlines are sure to be plentiful this week...

1. While U.S. large caps continue on cruise control, small caps have yet to break through resistance, let alone reach new highs...

Source: Yahoo Finance, as of 11/12/19

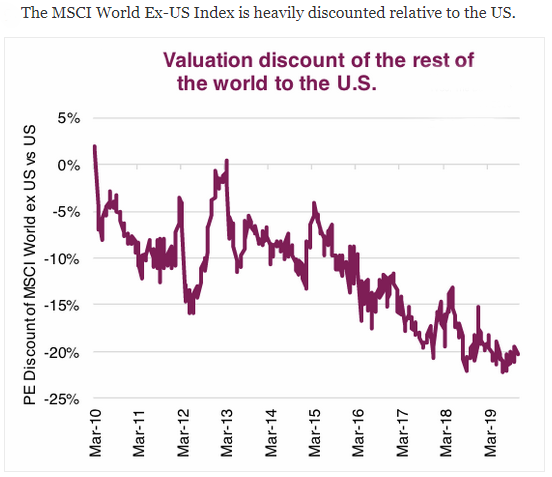

2. Small caps are not the only under-valued market:

Source: Market Ethos, from 11/12/19

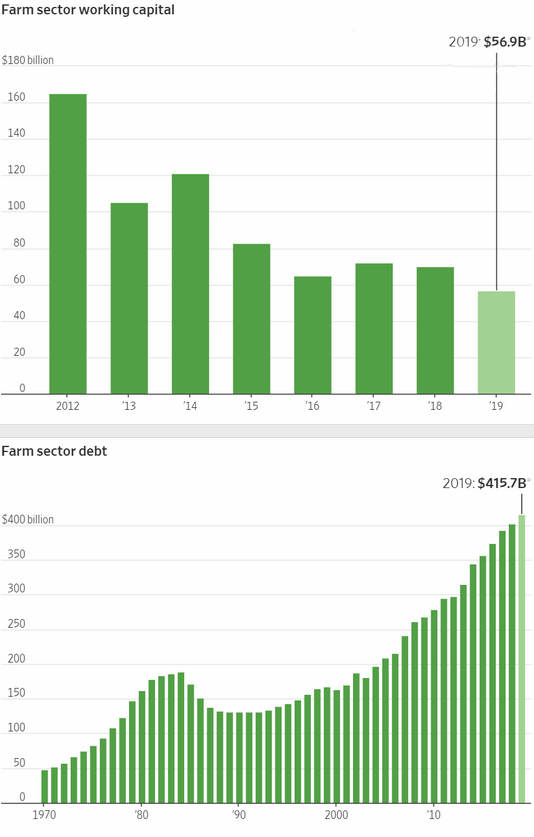

3. The U.S. farmer continues to shoulder much of the trade war burden...

Source: The Wall Street Journal, from 11/10/19

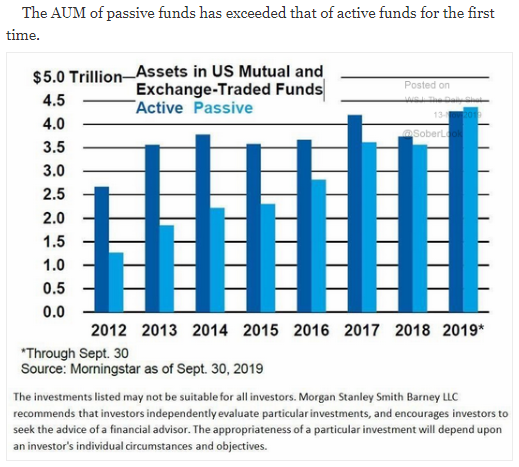

4. Investor behavior and markets in general tend to move towards extremes. Passive investing has surged in recent years, largely thanks to low fees. But we're currently in the longest economic expansion in history, and what goes up must come down...

Source: Morgan Stanley Research, as of 9/30/19

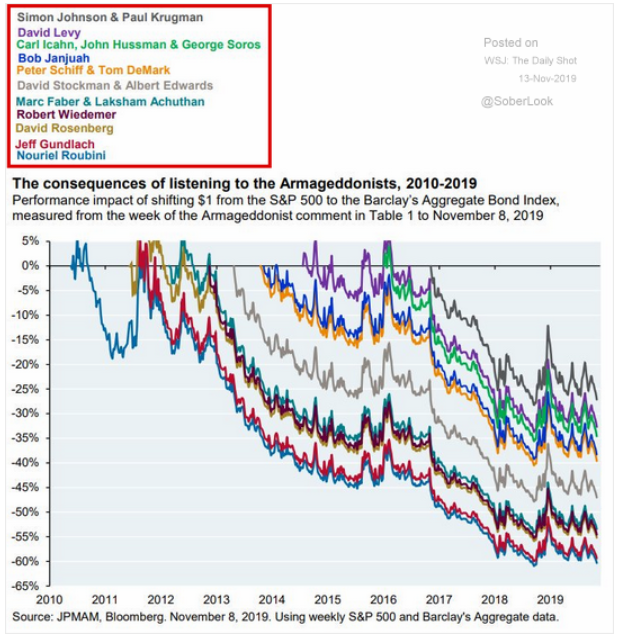

5. Another example of extremes. Fear and emotional decision making can have their own consequences... Shouldn't investors strive for balance?

Source: JP Morgan Asset Management & Bloomberg, as of 11/8/19

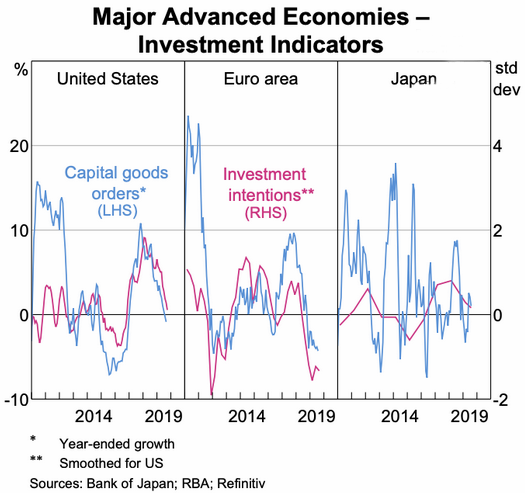

6. Not a healthy picture...

Source: Reserve Bank of Australia, from 11/12/19

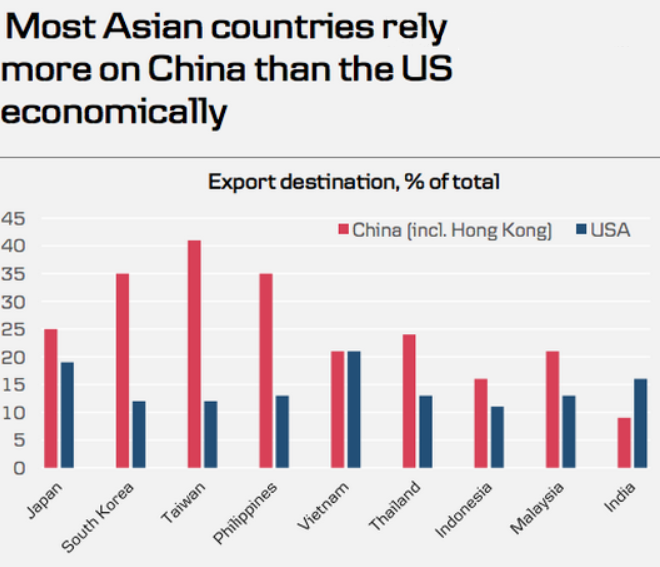

7. Why a Pan-Pacific trade agreement could help the U.S.

Source: Danske Bank, from 11/13/19

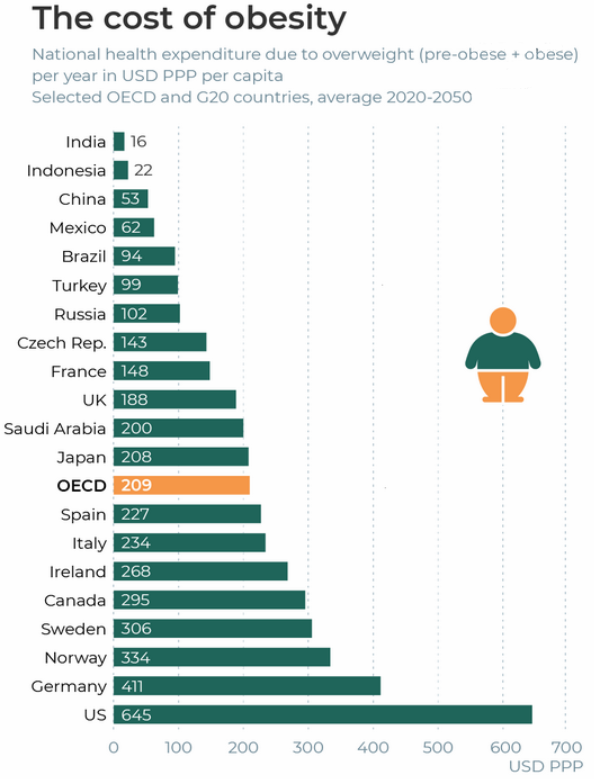

8. The reason why high fructose corn syrup should be illegal!

Source: OECD, from 10/10/19

We said it above and we'll say it again: investing often comes down to striking a balance. Blindly following an index into a bear market is risky, but no one wants to be afraid of their own shadow. Check out our piece "Tactical to Practical: Understanding the Importance of Types of Market Declines" (and how to navigate them) for BCM Portfolio Manager & Managing Partner Dave Haviland's perspective.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.