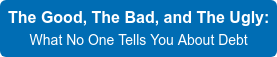

U.S. retail sales surprised to the downside in November, growing by only 0.2% and indicating a slow start to the holiday season. Could this spell trouble when consumer spending accounts for over 70% of GDP growth? And while the S&P 500 went on a record-setting spree in 2019 and seems determined to close out the decade on a high, the Communications Services and Energy sectors haven't quite followed suit. They've both enjoyed gains year-to-date but it's been years since they've done any record setting of their own. Meanwhile, the CBOE SKEW index continues to climb this week as investors look to be growing nervous about tail risk and outlier returns. Will you have downside protection in place when a left-tail event hits?

1. Has the U.S. economy become too dependent on the consumer?

Source: Oxford Economics & Haver Analytics, from 12/16/19

2. While the S&P 500 marches on to seemingly endless new highs, several sectors are not participating:

Source: The Chart Store, from 12/15/19

3. The energy sector has not hit a new high in ~6.5 years!

Source: The Chart Store, from 12/15/19

4. Similar to the transports...

Source: The Chart Store, from 12/15/19

5. Mid-caps are getting close...

Source: The Chart Store, from 12/15/19

6. Yet Small Caps still have some work to do to catch up...

Source: The Chart Store, from 12/15/19

7. The SKEW Index is elevated indicating a tail event is more likely...

Source: WSJ Daily Shot, from 12/16/19

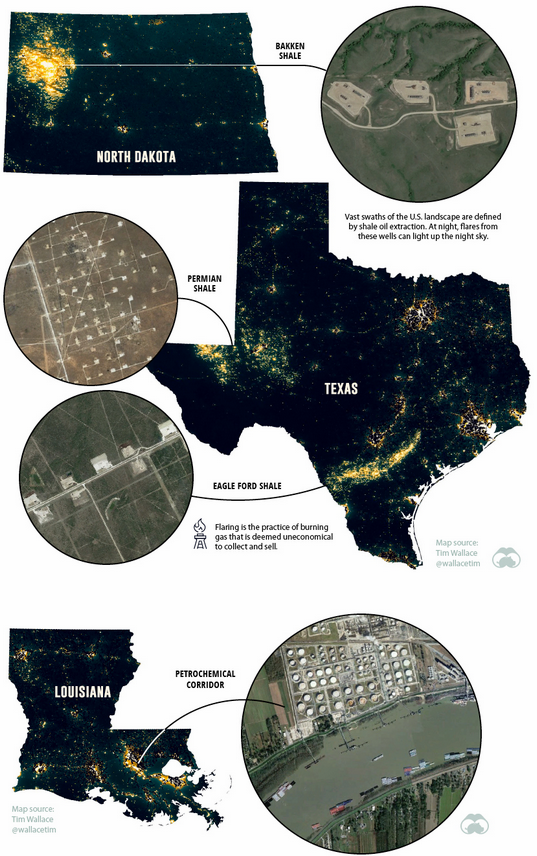

8. What causes the most light pollution at night? Put another way, what are the bright spots?

Source: WSJ Daily Shot, from 12/16/19

9. Cities? Nope! It is the flaring off of excess gas in the shale oil fields:

Source: WSJ Daily Shot, from 12/16/19

10. You are not alone!

Source: Statista, from 12/11/19

With so much pressure around the holidays, many are either bound to overspend or have already. According to the chart above, 40% of Americans expect to go into debt this holiday season, and 30% are still battling debt from the 2018 holidays! For a primer for the types of debt and their effects on your wallet, check out our piece "The Good, the Bad, and The Ugly: What No One Tells You About Debt" by BCM Portfolio Manager and Managing Partner, Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.