There’s been a lot of talk about recession lately, and the sharp drop in global staffing will certainly factor into the equation. Given the speed with which this has all unfolded though, could the recovery be just as speedy? The Fed's doing its best to ensure just that and released a sweeping plan to prop up the economy that includes unlimited asset purchases (re: QE) and various additional liquidity provisions. And they're not alone in pursuing stimulative measures; this morning the White House and Senate reached a deal on an historic $2 trillion stimulus package that majority leader McConnell called "a war-time level of investment for our nation." Given how tight cash flow is for small businesses—and how much of the population they employ—let's hope the packages perform as designed. And while the situation is likely to get worse before it gets better, we're taking hope from signs that 1) thus far, U.S. manufacturing hasn't been hit quite as hard as feared, and 2) as Chinese lockdowns begin to lift, economic activity looks to be slowly coming back to life. Is it possible that, should we follow strict containment measures, the U.S. isn't too far behind?

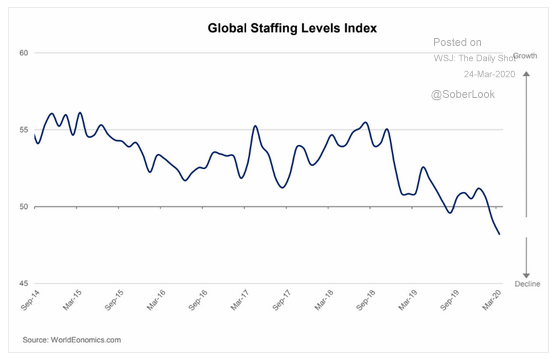

1. Global employment numbers are plummeting. If this trend continues, the Fed’s Sahm rule may soon indicate we’ve entered recession. Given the speed at which things are developing though, by the time the numbers are reported, we may be on the road toward recovery!

Source: WSJ Daily Shot, from 3/24/20

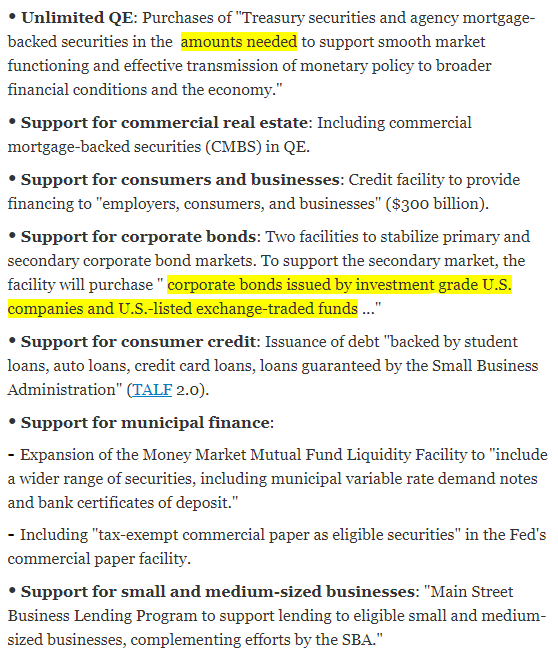

2. Once again the Fed has moved quickly and decisively...

Source: WSJ Daily Shot, from 3/20/20

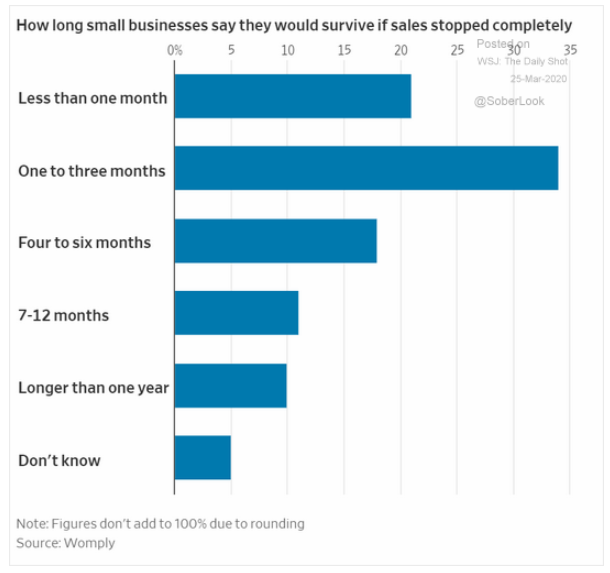

3. In addition to all that the Fed and other central banks have done, now we get a $2 trillion stimulus package that should help cushion the blow...

Source: WSJ Daily Shot, from 3/23/20

4. It is important to note that the speed of this drawdown took 25 trading days (so far); this is ~1/2 the time of 1987 bear and 1987 lost 23% in one day!

Source: WSJ Daily Shot, from 3/24/20

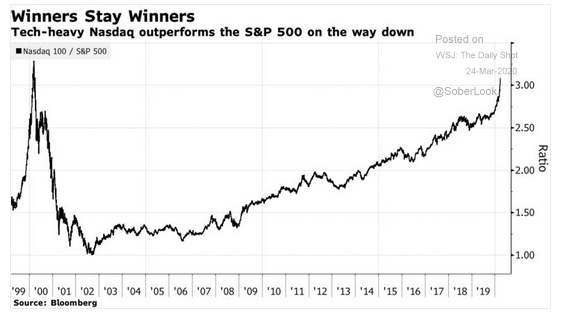

5. More evidence that tech is still the relative winner as it has outperformed on the way up and down...

Source: WSJ Daily Shot, from 3/24/20

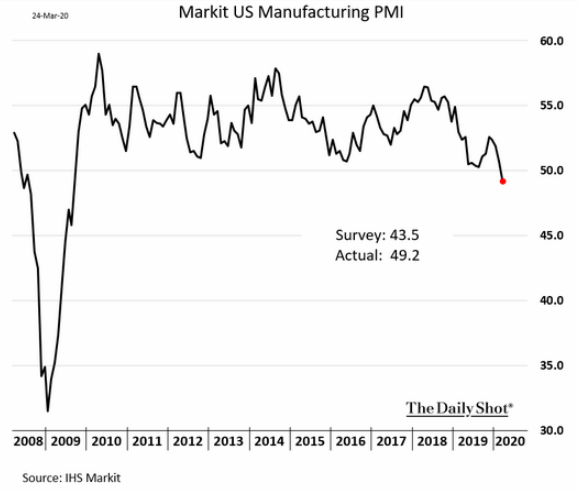

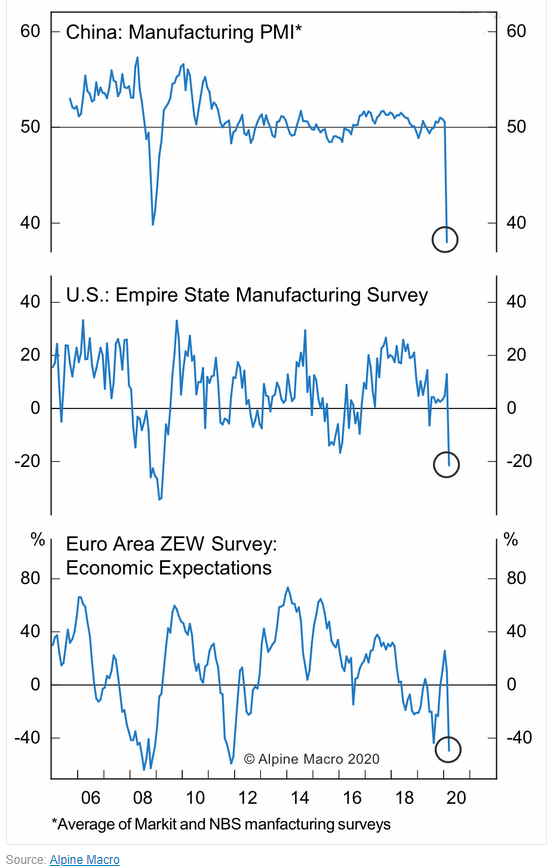

6. The news is similar in the U.S., Japan and Europe...manufacturing is down but not as much as originally feared. It will likely get worse for a month or two before the recovery starts.

Source: WSJ Daily Shot, from 3/25/20

7. No sugar coating: this is a global economic shutdown that is more likely to be short and brutal than long and drawn out. But no one knows the future...

Source: WSJ Daily Shot, from 3/25/20

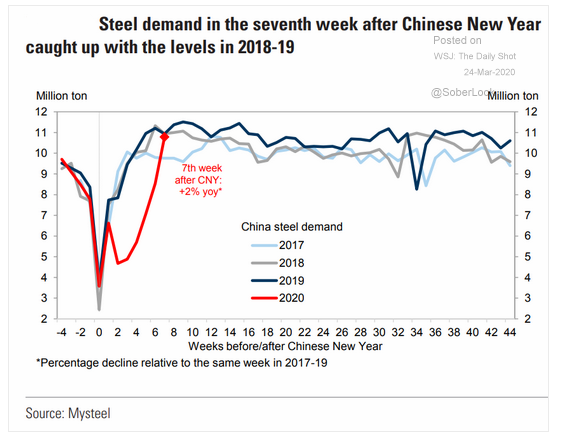

8. There is more and more evidence that China is already going back to work!

Source: WSJ Daily Shot, from 3/24/20

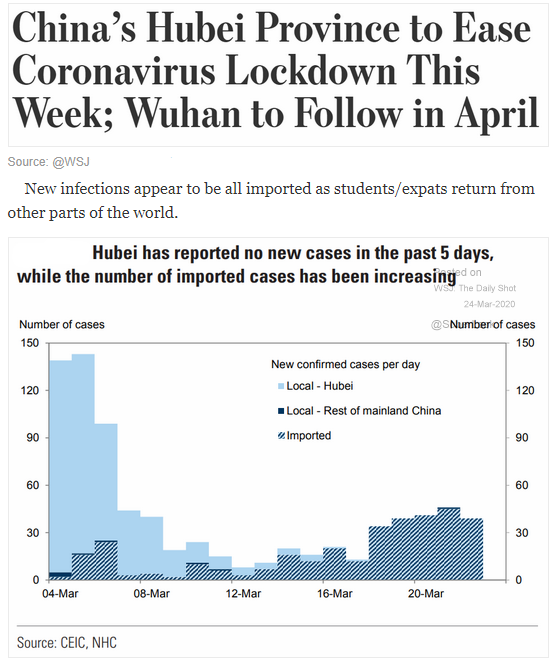

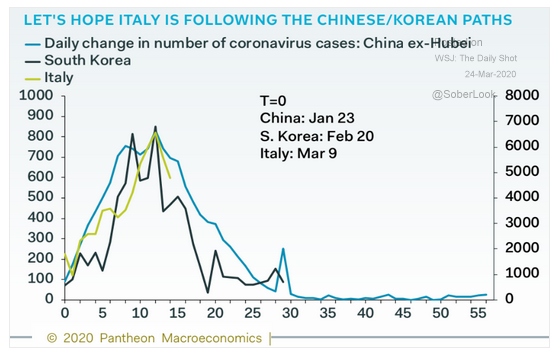

9. This is important: including the discovery and “what are we dealing with” period, the whole event looks to be about three months in China. There is the risk of follow-up outbreaks, but the Chinese and Koreans have shown that with massive testing and containment, the spread can be mitigated. As Americans, let’s be super-vigilant, beat this thing, and move on in even less time!

Source: WSJ Daily Shot, from 3/24/20

10. Other countries must do the same...

Source: WSJ Daily Shot, from 3/24/20

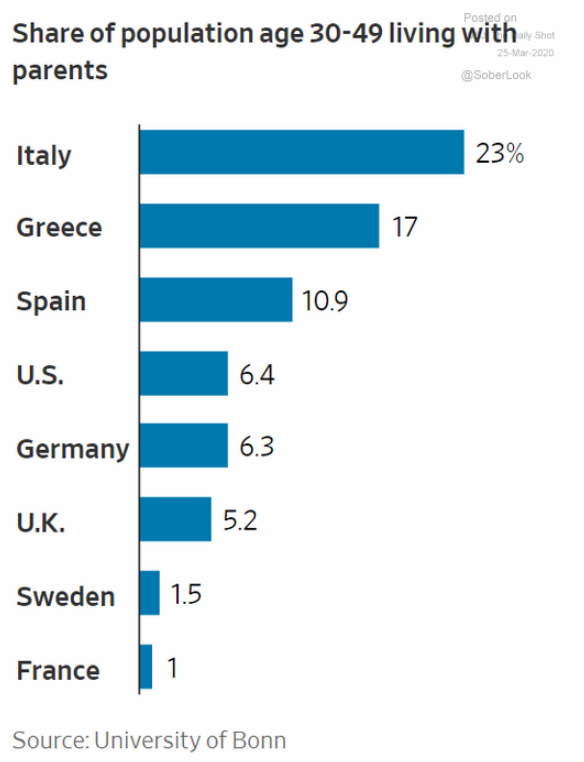

11. In addition to a significantly older population, Italy's social norms (double kiss at greetings) and the information below may well explain the surge in Covid-19 cases.

Source: WSJ Daily Shot, from 3/25/20

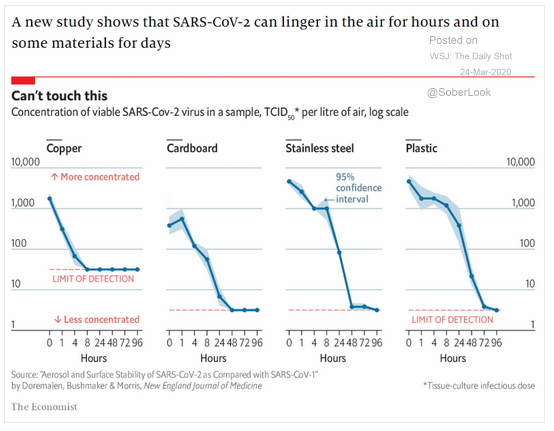

12. Why we need to stay 6 feet apart and wash hands all day long. If you touch a surface, including food delivery bags, wash your hands after plating but before you eat.

Source: WSJ Daily Shot, from 3/24/20

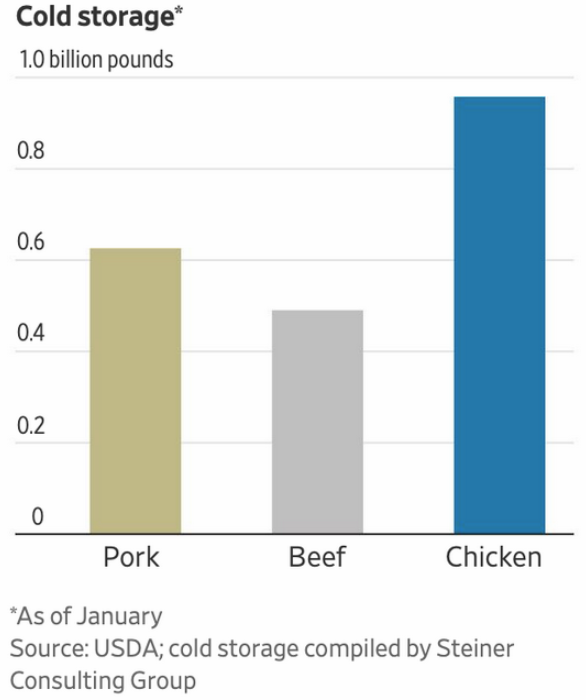

13. Despite some shelves/items running low due to temporary demand (mini-panic if you were behind on groceries), there is plenty of food in our system.

Source: WSJ Daily Shot, from 3/25/20

There are a lot of conflicting views out there on how, but one thing's for sure: COVID-19 is reshaping the markets and our economy. For BCM's analysis of the situation, click below to watch a short video by Portfolio Manager and Managing Partner, Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.