"FOMO" or "Oh, No!": Balancing Risk and Capital Gains

March 29, 2018Can you be honest with yourself? Seriously…completely honest? OK, then please answer this question: When was the last time you reviewed your portfolios and rebalanced them back to the asset allocation outlined in your financial plan? As the chart below illustrates, we have been enjoying a nine-year bull market, currently the second longest in history, which may continue to run for a long time. Or not. No one, including us, has any idea what the next week, month or year will bring. Looking at the chart, what does your gut tell you will happen next?

Tactical to Practical: Understanding the Importance of Types of Market Declines

March 22, 2018Updated: May 4, 2020 Most investment professionals would agree that stock market price movement in the 0-5% range is just ordinary market movement or statistical “noise”. After this, there are three types of market declines that are simply distinguished by the size of the declines: A Pullback is defined as a 5-10% drop, a Correction is a 10-20% decline and a Bear Market is a 20+% decrease in market price. The first should ...

Trend Following: An Alternative to Buy and Hold

March 13, 2018Trend following can be a good alternative to the “Buy and Hold” phenomenon that is currently being shown to investors. Many in the financial services industry will tell you that over the long term, Buy and Hold investing will provide you with index-like returns and can beat most active managers. Their philosophy is essentially that there are three steps you should take as an investor: 1) build an asset allocation to manage your risk, meaning deciding what percent to put into the growth portion of your portfolio like stocks or stock funds, and what percent to put into the more stable piece of ...

How to Select and Evaluate an Investment Manager

March 8, 2018Like clients, every advisor has a different level of knowledge of the due diligence process. Often times advisors rely heavily on the due diligence efforts of a third-party such as their broker-dealer or Turnkey Asset Management Platform (TAMP). Regardless of your situation, we hope that the process outlined below gives a solid baseline process for manager evaluation. Hopefully it will help you gain comfort with your investment selections, help demonstrate the value you’re providing your clients, and fulfill many of your fiduciary duties as an ...

10 Reasons to Change Your Practice to Grow Your Revenue

February 15, 2018Every investment advisor has to make a choice when running a financial advisory practice: Do I manage my client’s investment portfolios myself or do I hire someone to do it for me? Almost every broker-dealer we work with has asked us to address this topic due to rising compliance concerns, but I’ve chosen to do it for a different reason: you the advisor.

From the Desk of the PM

February 9, 2018The following memo was sent on Friday evening, February 9th at the end of last week's market action and volatility to BCM's current clients.

Is Your Investment Manager Only Doing Half the Job?

February 8, 2018Do you own or use mutual funds, passive ETFs or strategic SMA managers?

From the Desk of the PM

February 5, 2018The following memo was sent on Monday evening, February 5th at the start of this week's market action and volatility to BCM's current clients.

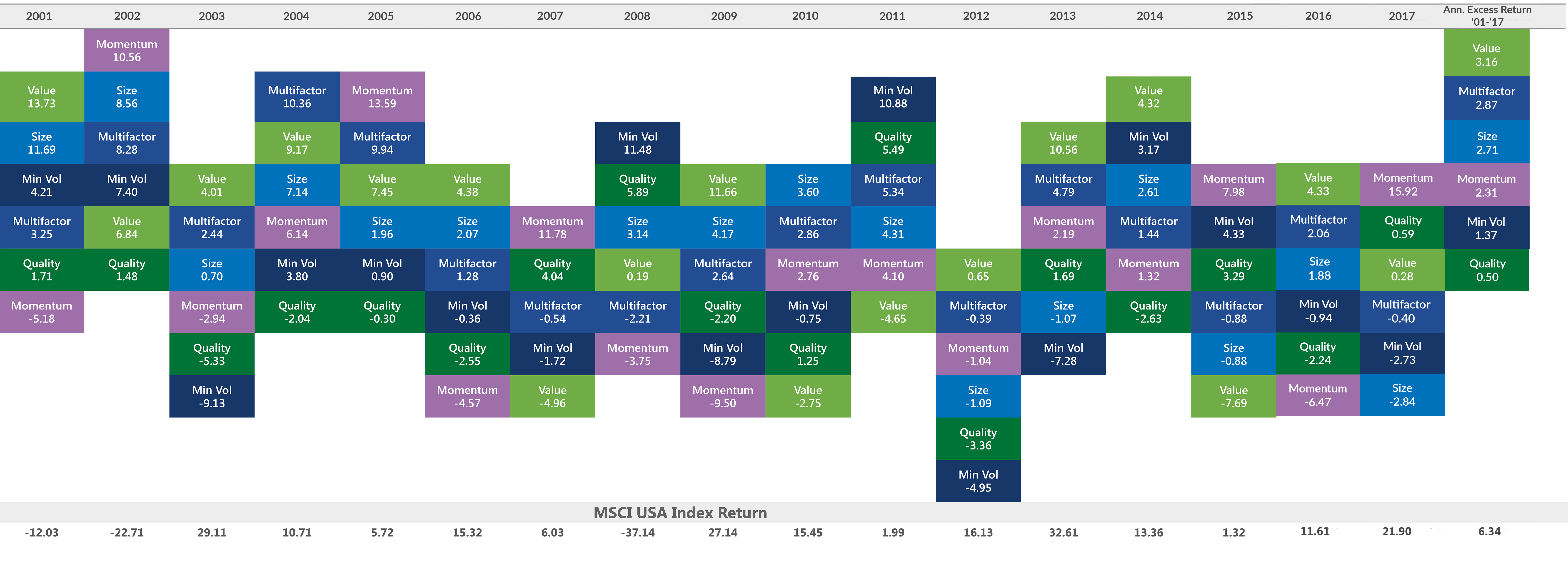

Factor Investing: Smart Beta Pursuing Alpha

September 28, 2016In the spectrum of investing from passive (index based) to active management there are no shortage of considerations. Passive tends to be cheaper and should deliver returns very close to the index it tracks, which is great in up markets, less so in down markets. Active tends to be more expensive and relies on the skill of the portfolio manager(s) to deliver desirable results. Factor investing is a blended approach which may be best characterized by the popularly used phrase ‘smart beta’.