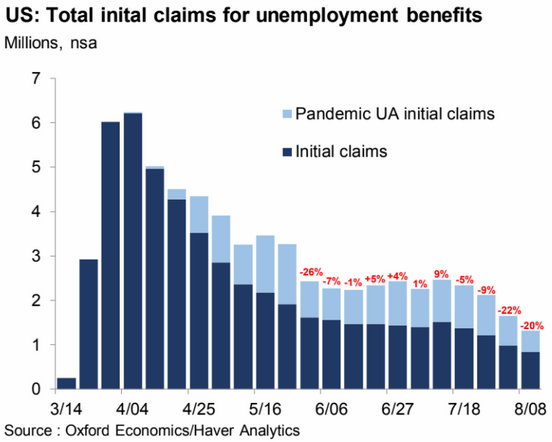

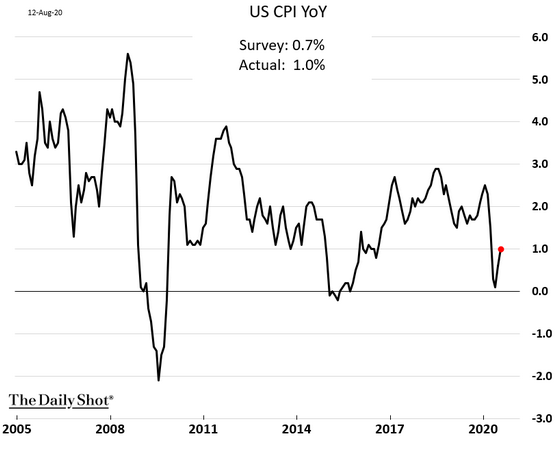

While the U. S. unemployment situation is still dire, we hit a milestone this week: for the first time since mid-March, first-time claims for state unemployment insurance fell below one million. U.S. consumer prices have risen more than projected though as states continue to ease lockdown restrictions, and it has some concerned about inflation... and what that could mean for a still struggling economy. Economists will likely be keeping an eye on oil for more inflation indicators as it hovers close to its 200-day moving average—could it be poised for a breakout? Meanwhile, as bond yields continue to dwindle and corporate bankruptcies hit a 10-year high, investors will be pushed to take on additional risk to meet their return objectives. With equity risk still elevated, do you have strategies in place that are designed to pursue growth while offering a degree of downside protection?

1. May this trend continue....

Source: WSJ Daily Shot, from 8/14/20

2. With the Fed targeting ~2% inflation rate, the rebound to just 1% has some investors spooked about future inflation...

Source: WSJ Daily Shot, from 8/13/20

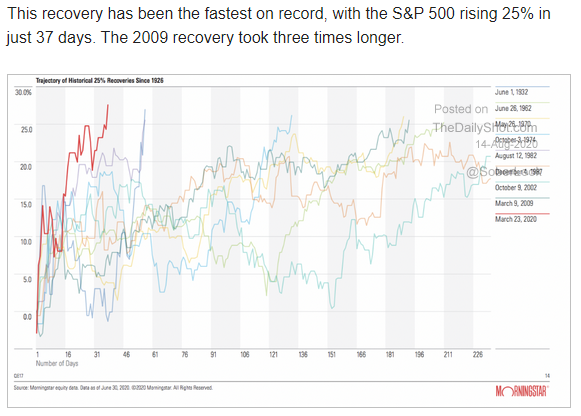

3. The Covid-induced bear and recovery has been unprecedented... almost twice as fast as the next closest!

Source: Morningstar equity data, as of 6/30/20

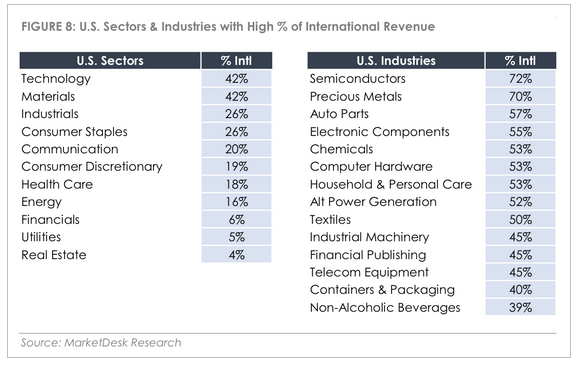

4. A great recap of globalization by sector....

Source: WSJ Daily Shot, from 8/2/20

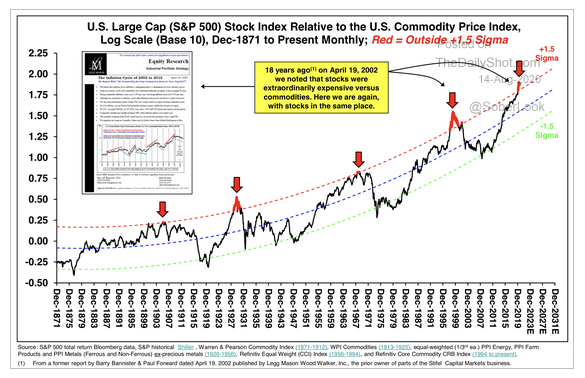

5. With only ~1/3 of commodities showing a year-over year gain, will the trend versus stocks begin to flip if the USD continues its downtrend?

Source: WSJ Daily Shot, from 8/14/20

6. Energy prices have a massive impact on inflation. Will oil break out about its 200 day moving average?

Source: WSJ Daily Shot, from 8/13/20

7. Gold looks like it got ahead of itself and has corrected to the trend line. The future will largely depend on the direction of the USD and U.S. interest rates...

Source: WSJ Daily Shot, from 8/11/20

8. Here are the markets' current expectations for 5 years out...

Source: WSJ Daily Shot, from 8/13/20

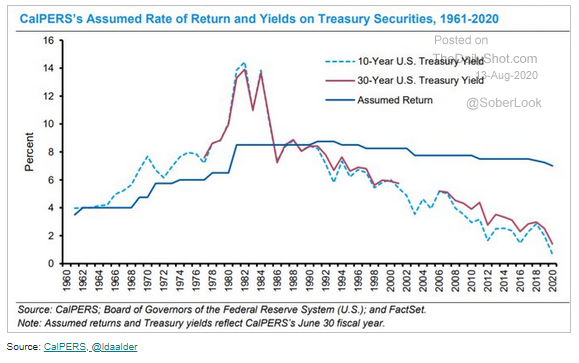

9. A classic example of flawed capital market assumptions...going forward, either returns expectations must be lowered or a lot more risk must be taken to try to reach these targets.

Source: WSJ Daily Shot, from 8/13/20

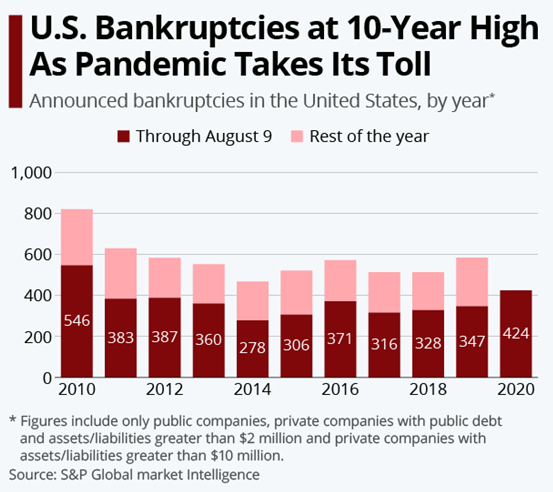

10. Junk bond owners beware!

Source: WSJ Daily Shot, from 8/14/20

11. More evidence that high yield bonds may be in for a rough run...

Source: WSJ Daily Shot, from 8/14/20

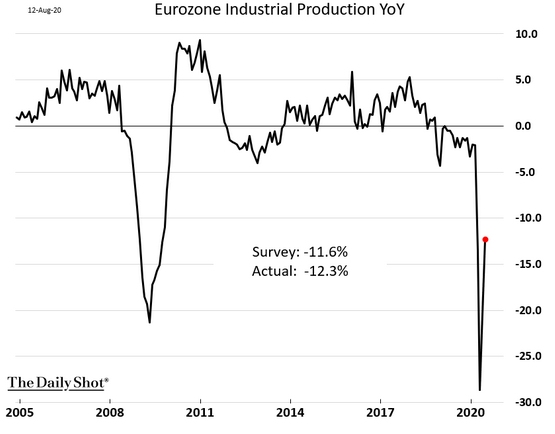

12. While the rebound was welcome, European industry has a long way to go to full recovery...

Source: WSJ Daily Shot, from 8/13/20

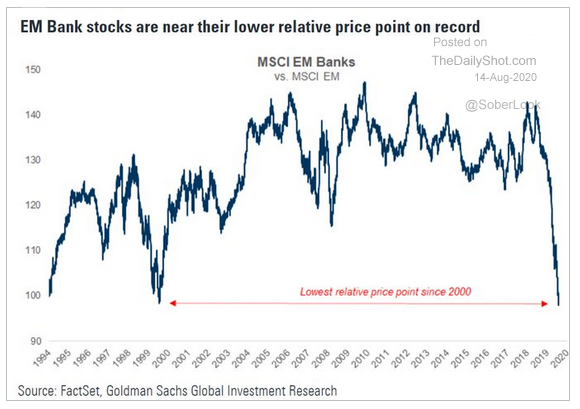

13. About 1/3 of EM state owned enterprises are banks. State-owned enterprises are often run for the benefit of the country, not shareholders...

Source: WSJ Daily Shot, from 8/14/20

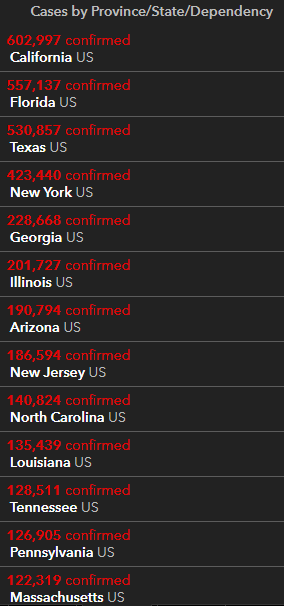

14. According to JHU CSSE, here are the highest state by state Covid-19 confirmed infections....

Source: JHU CSSE, from 8/14/20

15. According to coinnews.net, it cost 2 cents to make a penny. Would this knowledge change respondent's answers?

Source: WSJ Daily Shot, from 8/14/20

Headlines move markets, and nothing makes headlines like a contentious presidential election…but is the effect enough to write home about? For a look at how markets have historically performed during election years—and our thoughts on what investors should be looking out for—read "How Should Investors Think About the Upcoming Election’s Impact on the Stock Market?" by BCM Portfolio Manager Brendan Ryan.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.