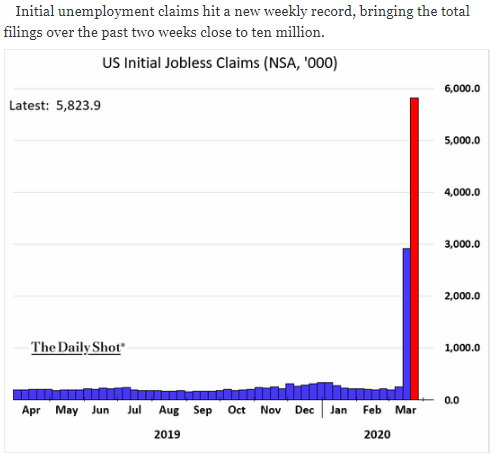

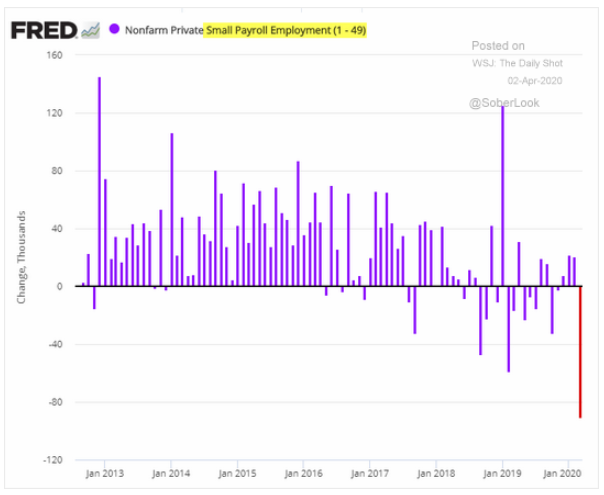

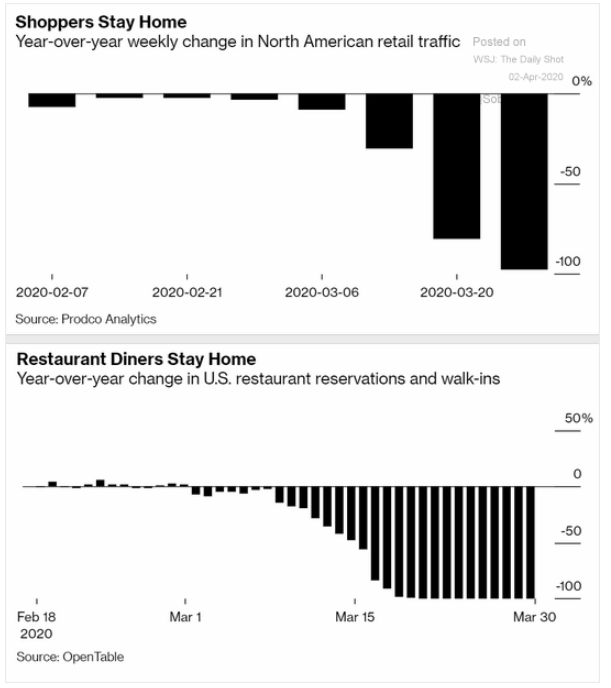

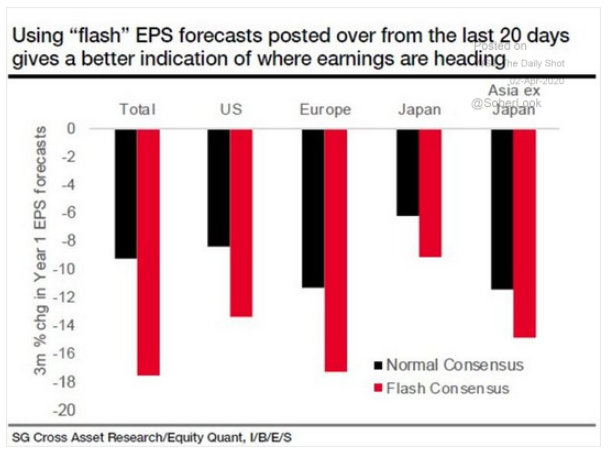

An unprecedented wave of unemployment is crossing the U.S. and small businesses are being hit particularly hard. Plummeting retail and restaurant activity have driven the industries to a grinding halt; both have seen a nearly 100% year-over-year drop in traffic unfold in less than a month. How will such a dramatic (and swift) change reshape our economy going forward? Unsurprisingly, EPS forecasts are grim. Like the U.S., EU governments are struggling to battle the slowdown and have issued massive stimulus packages—Germany's clocks in at 35% of their GDP! Will it be enough to carry people through until the crisis has passed? A lower household debt ratio might help, in good news for developed-market households—but what about the EM sphere?

1. These numbers are likely underreported as many states' unemployment offices are overwhelmed.

Source: WSJ Daily Shot, from 4/3/20

2. As expected, small businesses with low cash reserves are being forced to lay-off employees.

Source: WSJ Daily Shot, from 4/1/20

3. Certain segments of the economy have virtually ceased to exist:

Source: Bloomberg, from 3/31/20

4. This is the ultimate concern for the markets...

Source: WSJ Daily Shot, from 4/3/20

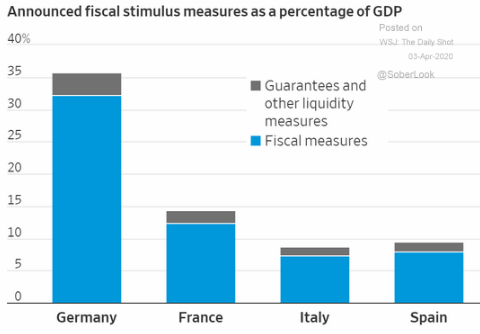

5. European Governments are joining the U.S. in implementing massive stimulus packages.

Source: Pictet Wealth Management, as of 3/26/20

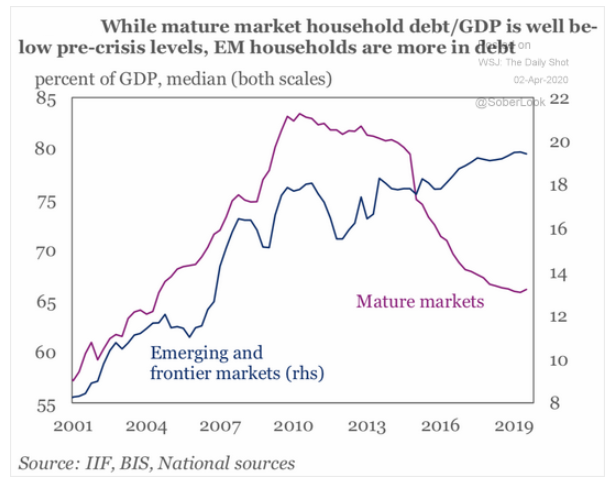

6. While consumers in developed markets used the economic expansion to reduce their debt by ~1/3, EM consumers have done the opposite...

Source: WSJ Daily Shot, from 4/2/20

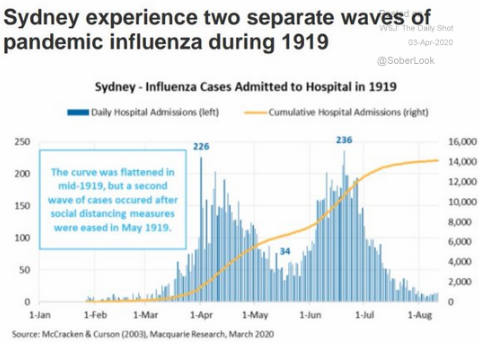

7. This is most important...we must keep the social distancing in place until COVID-19 is truly under control. If we don't, we'll likely get a second wave and have to start all over again!

Source: WSJ Daily Shot, from 4/3/20

In the spirit of Financial Literacy month, we will be sharing educational content throughout the month that we hope will be a helpful resource during such an uncertain time. Let's kick it off with a look at mutual funds:

Did you know that by simply owning a mutual fund in a taxable account, you might inadvertently be made to pay tax on the gains of holdings of previous shareholders, even if you suffered a loss yourself? In the current market environment, mutual funds are being forced to sell shares of their securities to meet redemption requests, so what could your tax liability look like in 2020 despite the massive losses you may incur? For a reminder on mutual funds and how they're taxed, read "Mutual Funds in Taxable Accounts: Despite Losses, You May Incur a Sizable Capital Gains Tax" by BCM Portfolio Manager and Managing Partner, Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.