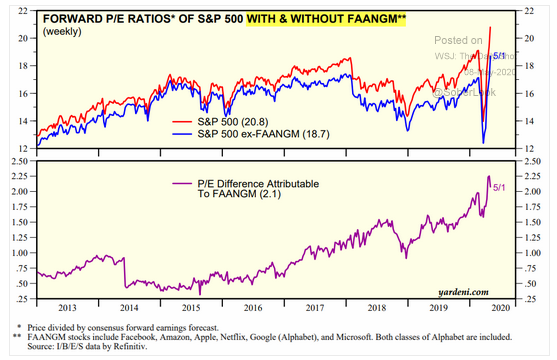

It's jobs report day and we hate to break it to you, but the situation is... grim. The U.S. Bureau of Labor Statistics released its monthly Employment Situation Summary this morning and highlights include 20.5 million jobs lost in April, the highest unemployment rate since the Great Depression (14.7%), and a "real" unemployment rate (which includes the underemployed and workers not actively seeking jobs) of 22.8%. New applications for unemployment benefits are trending downward, but could that trend reverse as depressed activity forces small businesses to burn through their cash reserves? Equities don't seem too perturbed by the news though, and the market recovery rages on. The Nasdaq has even inched into positive territory for the year! Markets, as always, are a forward looking mechanism; could this indicate that investors are feeling bullish on a late-2020 economic recovery? The S&P 500® Index looks likely to remain expensive over the coming months—with analysts pegging the forward P/E ratio at ~21%—but we're taking the number with a grain of salt given how many companies have pulled their earnings guidance, and eyeing how much of that number is attributable to just six companies. Fund flow trends, the trade war, and the reopening of the economy have also offered some food for thought heading into the weekend.

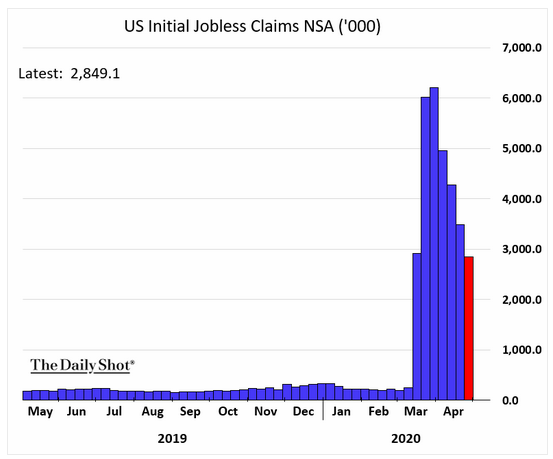

1. Optically, it looks like this is improving, but try telling that to the ~25 million Americans who are out of work...

Source: WSJ Daily Shot, from 5/8/20

2. Below is a categorical summary of all the recent unemployment claims. Literally all job growth since the last recession has been erased. This excludes yesterday's unemployment report.

Source: ADP, from 5/6/20

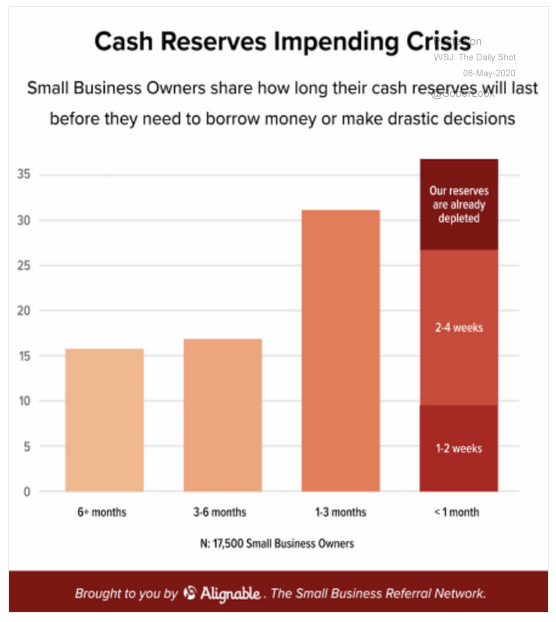

3. Unfortunately, unemployment is most likely to get worse as the cash runs out for employers...

Source: WSJ Daily Shot, from 5/8/20

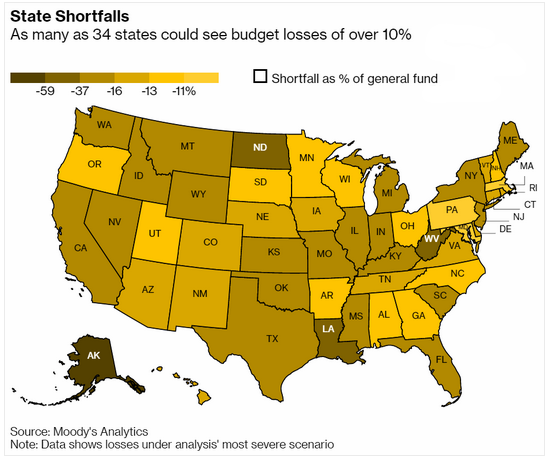

4. This does not include cities, towns and counties...

Source: Bloomberg, from 5/7/20

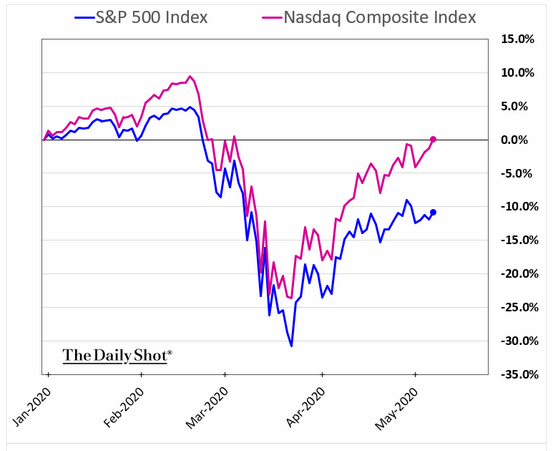

5. The tech-heavy Nasdaq is flat for the year. Investors are treating this like nothing ever happened...

Source: WSJ Daily Shot, from 5/8/20

6. Is a forward P/E of ~21% sustainable? The problem is that the constituents of the denominator are truly unknown, especially with earnings guidance pulled by most companies in the S&P 500...!

Source: WSJ Daily Shot, from 5/8/20

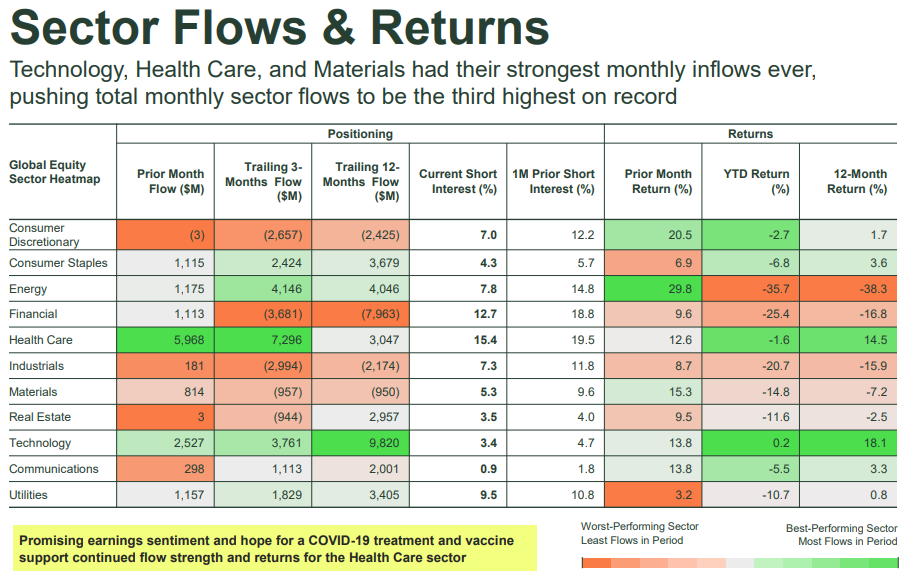

7. Technology and healthcare continue to lead in fund flows and returns.

Source: SSgA & Bloomberg Finance, as of 4/30/20

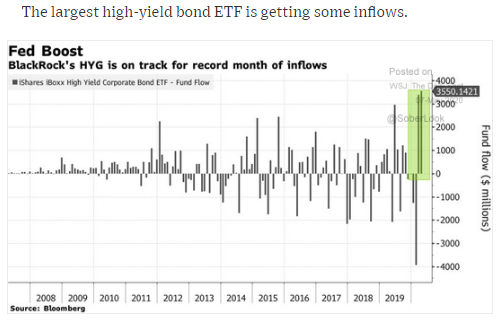

8. Will investors' need for income drive them to take on too much risk? Bankruptcies are bound to rise as will bond default rates...

Source: WSJ Daily Shot, from 5/7/20

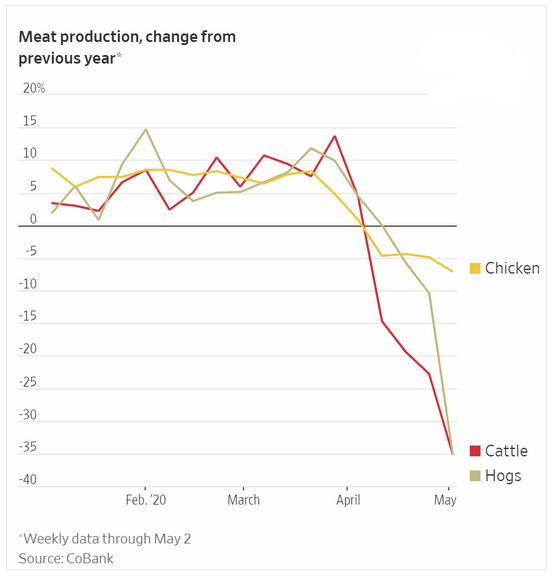

9. Lesson learned: We need to protect our food supply workers as carefully as the medical community...

Source: CoBank, as of 5/2/20

10. Perhaps a temporary suspension of all tariffs would spur some economic activity...

Source: WSJ Daily Shot, from 5/7/20

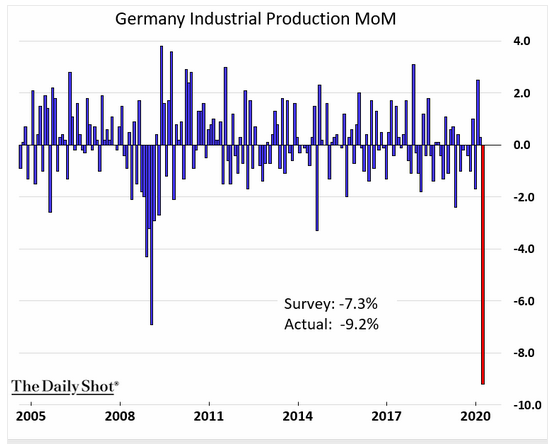

11. We know March numbers are horrible across the globe. Will we see improvement in April and May?

Source: WSJ Daily Shot, from 5/8/20

12. Is this a forecast of how the election will shake out?

Source: Bloomberg, as of 5/5/20

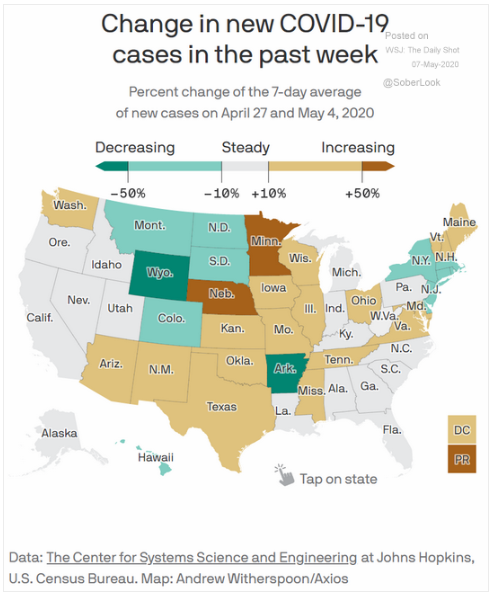

13. Many states are starting to reopen even as their COVID-19 infections are on the rise.

Source: WSJ Daily Shot, from 5/7/20

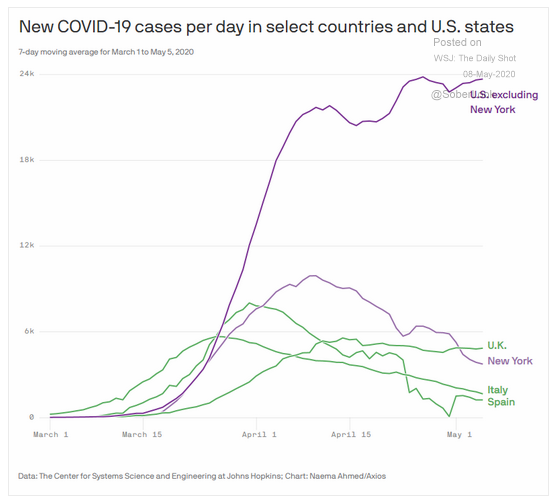

14. While known hot spots are trending down, new flare-ups across the country are keeping infections on the rise...

Source: WSJ Daily Shot, from 5/8/20

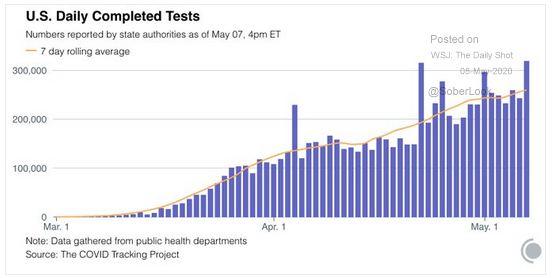

15. This trend will help us manage and defeat COVID-19.

Source: WSJ Daily Shot, from 5/8/20

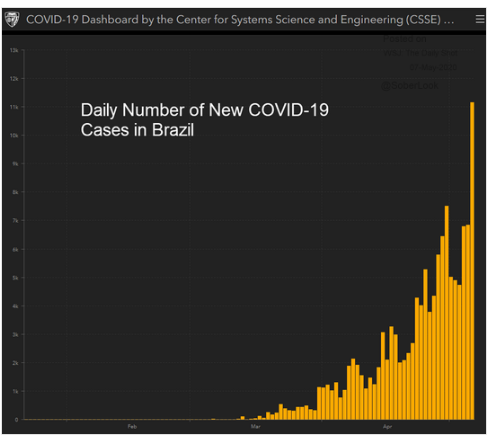

16. Leadership in Brazil has downplayed the virus with a "just a flu" attitude. Now they are paying the price...

Source: WSJ Daily Shot, from 5/7/20

17. Are your pets missing their alone time?

Source: Dilbert, from 4/21/20

If there was ever a time to be keeping a close eye on the markets and economy, this is it. Trends can change on a dime (just ask equities in March) and with news pouring in so fast, it can be difficult to keep up. So let us do it for you! Subscribe to the BCM blog to receive data and insights from our PM team delivered straight to your inbox.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.