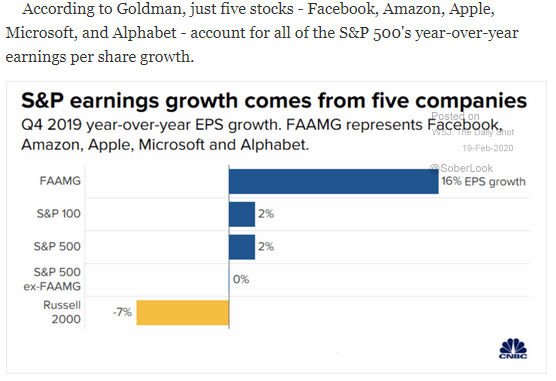

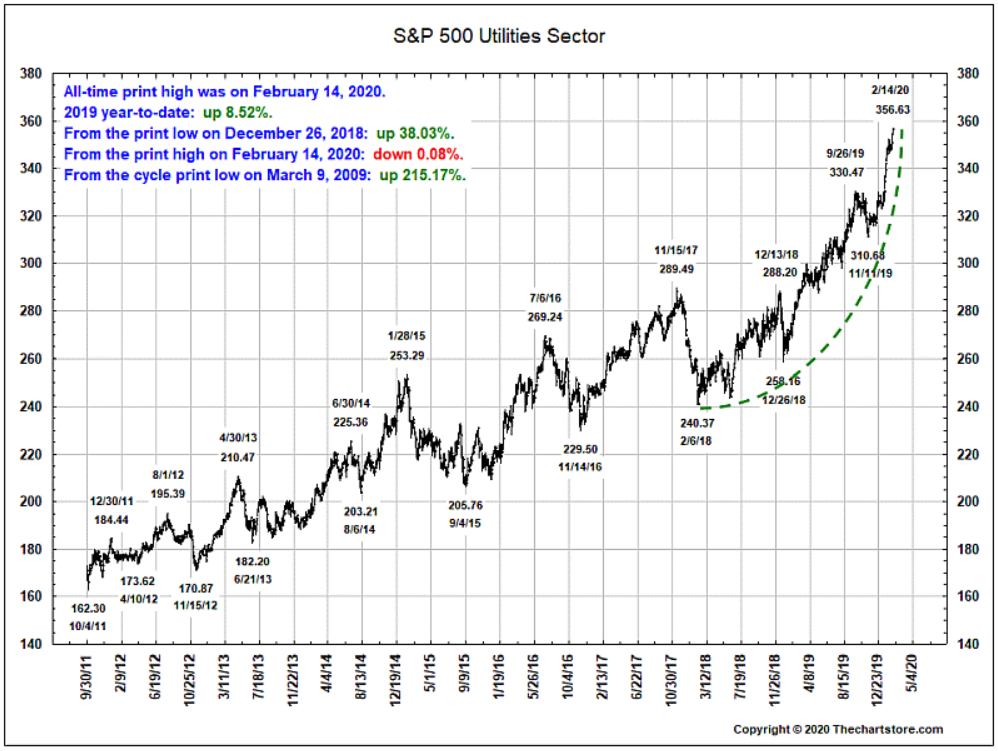

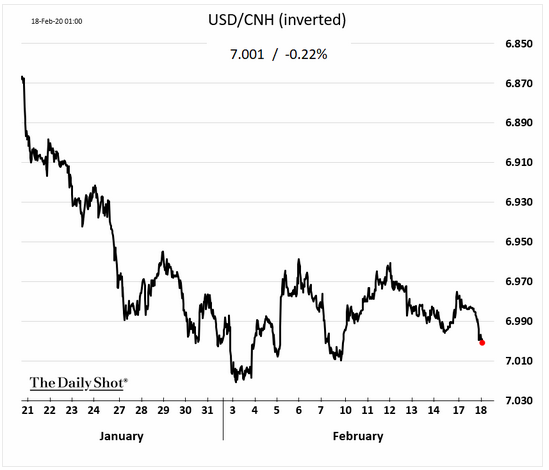

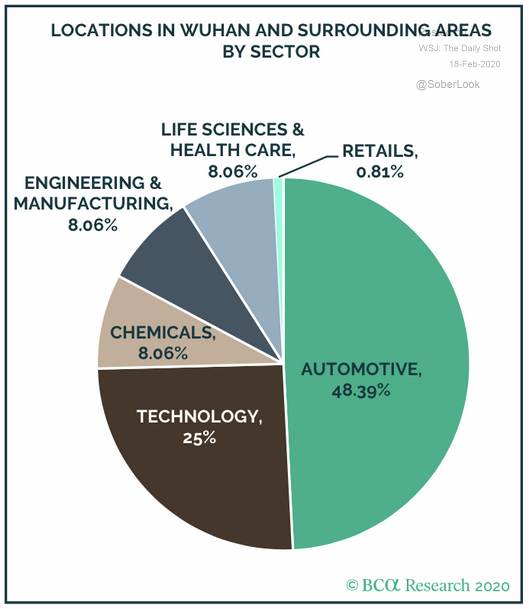

The S&P 500 had a record year in 2019 and may still be hovering around all-time highs, but it looks like (when it comes to 4Q19 earnings per share growth, at least) credit is owed exclusively to just five companies... and the names will likely come as no surprise. Value hasn't been this concentrated among just five stocks since the tech bubble; are we in danger of history repeating itself? Some investors appear to believe so, as evident by the typically defensive utilities sector hitting an all-time high on Friday. It's perhaps unsurprising investors are seeking safety as fallout from the coronavirus continues to spread. While Chinese factories—including Toyota, Airbus, and GM, among others—have gradually begun to reopen, Apple (one of those main drivers of S&P EPS growth mentioned above) dealt a blow to sentiment this week with a statement saying they do not expect to hit revenue guidance for Q1 due to the manufacturing disruption. Auto and tech manufacturers have a significant presence in Wuhan... should we brace for similar statements from other industry leaders? Finally, while things look to be cruising along in the high yield market, treasuries are painting a less rosy picture and look to be signaling that a more sustained slowdown may be on the horizon.

1. Is this healthy?

Source: Goldman Sachs Global Investment Research & Fact Set, as of 2/13/20

2. A parabola in the most unlikely sectors:

Source: The Chart Store, as of 2/14/20

3. Apple and HSBC both issued revenue and profit warnings due to the coronavirus. It is almost certain the world's economy and trade will be negatively impacted. The questions are for "How long?" and "How bad?"

Source: WSJ Daily Shot, from 2/18/20

4. Which industries are concentrated in virus' epicenter?

Source: WSJ Daily Shot, from 2/18/20

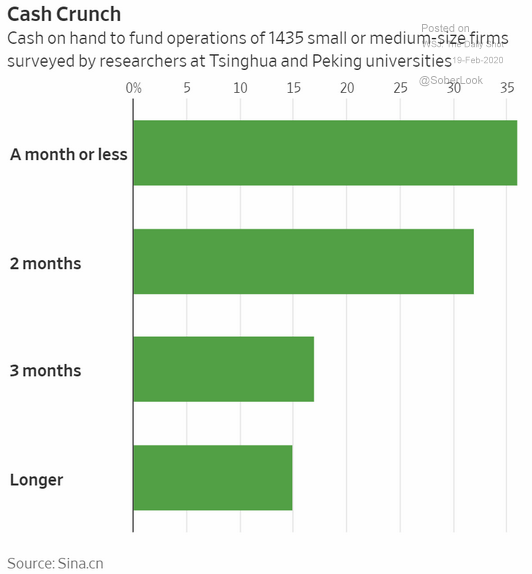

5. While the coronavirus may be on the way to being contained, the issue for many smaller firms in China is time... shut factories produce no revenue yet expenses continue...

Source: WSJ Daily Shot, from 2/19/20

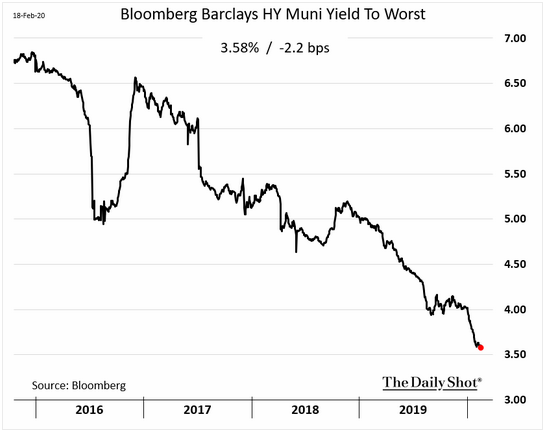

6. While high yield bonds are signaling an "all clear"...

Source: WSJ Daily Shot, from 2/18/20

7. ...Treasuries are showing something quite different. The 30-year yield is back below 2%!

Source: WSJ Daily Shot, from 2/18/20

Are we nearing the end of the economic cycle? According to global outlook data, the U.S. is following several other global leaders into the late stage of the business cycle. Should this make us change our investment behavior? Is “buying the dips” the correct approach? Read more in “Buying the Dips: When Does this Approach Run the Most Risk?" by BCM portfolio manager and managing partner Dave Haviland.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.