David M. Haviland

Dave is the Portfolio Manager of Beaumont Capital Management’s (BCM) Investment Strategies as well as a Managing Partner of BCM. He chairs the BCM Investment Committee and serves on the Beaumont Financial Partners (BFP) Asset Allocation and Investment Committees. His overall responsibilities include portfolio management, product creation, and ongoing business development.

With three decades of experience, Dave has worked in the financial industry since 1986 and has spent most of his career as an investment advisor. His advisory background has provided him with a unique perspective on managing the BCM Strategies. In 1993, Dave joined his father at H & Co. Financial Services and in October 2000, under his management, Dave merged H & Co. into Beaumont Financial partners (BFP). In 2009, Dave created the BCM division and has been the steward of BCM’s rapid yet purposeful growth.

Outside of the office, Dave has always been active in his community. He has served as Treasurer for several organizations, volunteered six years on the Dover School Committee, including multiple chairmanships, and currently serves as Dover’s Assistant Town Moderator. Dave enjoyed coaching his three boys in just about every sport; he and his wife Kate, along with their sons, are active trap and skeet enthusiasts and registered Therapy Dog handlers. Dave is a graduate of Deerfield Academy and an honors graduate of the University of Vermont.

Dave is supported by our team of research analysts who also serve on the Beaumont Investment Committees. The team employs a discretionary and quantitative investment process to provide upside participation while minimizing losses.

Recent Posts

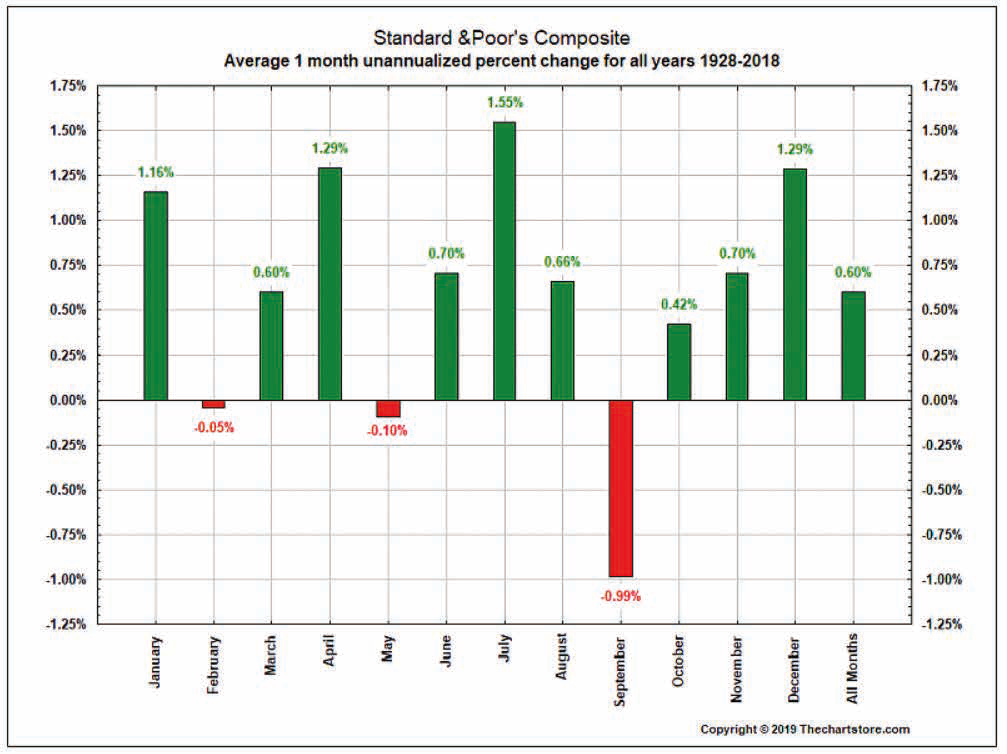

Debunking Some Bunk: Is September Really That Bad a Month?

September 10, 2019Sometimes our industry grabs on to a concept and cannot let it go. Is September the worst month from a performance standpoint? Does it always/mostly go down? Should one avoid the markets in September? Let’s take a quick look.

Finding Total Return in an Ultra-low Interest Rate Environment

September 5, 2019Your clients need to withdraw 4-5% a year, but interest rates are setting record lows. Here’s what you can do to help get them there.

Financial Literacy Month Glossary of Financial Terms: Educate and Empower

April 1, 2019Today is April 1, which marks the beginning of Financial Literacy Month!

The Stock Markets are Ripping Up. The Economy is Slowing. What Could Ultimately Be Wrong?

March 21, 2019The 2019 recovery of U.S. and international equity markets continues to claw back at the losses from late ...

Buying the Dips: When Does this Approach Run the Most Risk?

March 14, 2019Updated: Feb 19, 2020 About a year ago now, Fidelity, in their 1Q19 Market Update,suggested that the U.S. wass following many other

Changes to the Aggregate Bond Index that Advisors Should Know About: Part Two

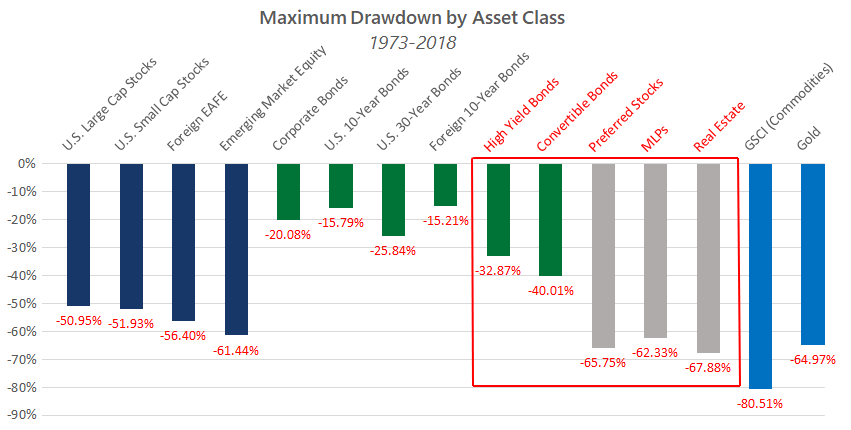

March 5, 2019Last week, we shared some facts about the Bloomberg Barclays Aggregate Bond Index (BBAB). (Missed it? Click here). Outside of the BBAB, there are a few more items that you may want to know about in the corporate bond landscape that may also surprise you and your clients.

Changes to the Aggregate Bond Index that Advisors Should Know About: Part One

February 28, 2019In 2018, the Bloomberg Barclays Aggregate Bond Index (BBAB) eked out a whopping 0.01% return and thus preserved a rather remarkable streak of only having one negative year since 1999. What’s new in the evolving construct of the BBAB index, and do you know the risks that are creeping into the bond markets?

An Open Letter to Jerome Powell

February 21, 2019Dear Jerome Powell, I write this letter with the utmost gratitude and respect. You see, unlike your predecessors, this time you and your Committee acted quickly, decisively and appropriately to a rapidly evolving political and macro-economic world. It is hard to contemplate what Congress has charged the Federal Open Market Committee (FOMC), and you, to do.

BCM 4Q 18 Market Commentary

January 17, 2019During the holiday-shortened last week of 2018, the S&P 500 Index gained ~6.7%. Normally such returns would be a cause for celebration, but this quarter it only lessened the pain. The S&P 500 ended December down ~8.8% bringing the fourth quarter’s return to -13.8%. Volatility is back with a vengeance as the market is rising and falling 2, 3, and even 4% at a time. So, what is going on?

It's Time to Talk About the R-Word

December 14, 2018As we frequently like to point out, no one knows what will happen to the markets or the economy over the short term. Not tomorrow, next week, next quarter