Diversification has long been touted as a cornerstone of successful long-term investing, but do you know just how in-sync U.S. and international equities have become in the past 20 years? Here's a hint: if it was a letter grade, we wouldn't "B" dissatisfied. We are a little dissatisfied with how U.S. dividends stack up against those in international and emerging markets though. And are junk bond ETFs the next "big short?" Some investors seem to think so, but such heavy shorting has us wondering about the quality of the funds' holdings... and concerned about the retail investor when a downturn finally comes and they're faced with illiquidity. These junk bond ETFs might not be alone in their quality woes, as it appears credit quality has been deteriorating across the board for over a decade now. Are your clients aware (and prepared)?

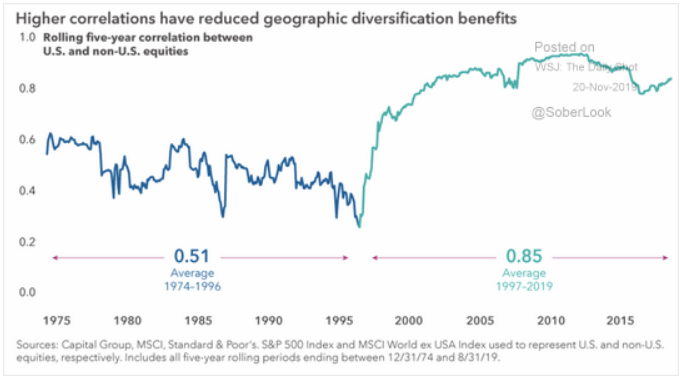

1. Does this lend credence to the notion of diversification is actually "deworsification?" Int'l stock performance has lagged badly for years, yet if the markets correct, int'l stocks have a 80%+ correlation to U.S. stocks...

Source: Capital Group, as of 8/31/19

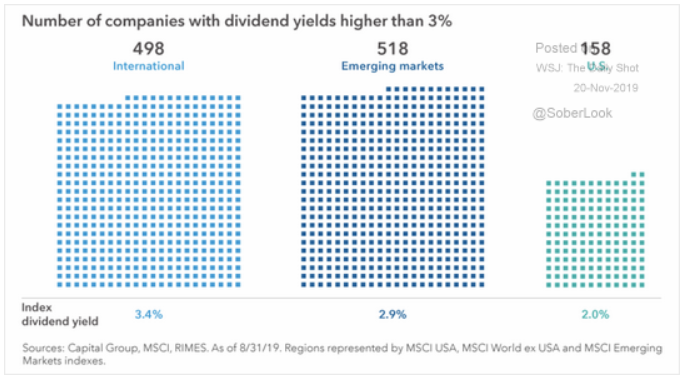

2. While U.S. interest rates are higher than most countries, the opposite is true for dividends...

Source: Capital Group, as of 8/31/19

3. What happens when the music stops?

Source: Financial Times, from of 11/18/19

4. Last week we outlined the risk of extended duration in the Bloomberg-Barclays Aggregate Bond Index (BBAB). This chart shows how the bond market in general, and thus the BBAB, also have deteriorating underlying credits...

Source: Moody's Analytics, from 11/19/19

5. A worry for the future: will these become taxable?

Source: WSJ Daily Shot, from 11/19/19

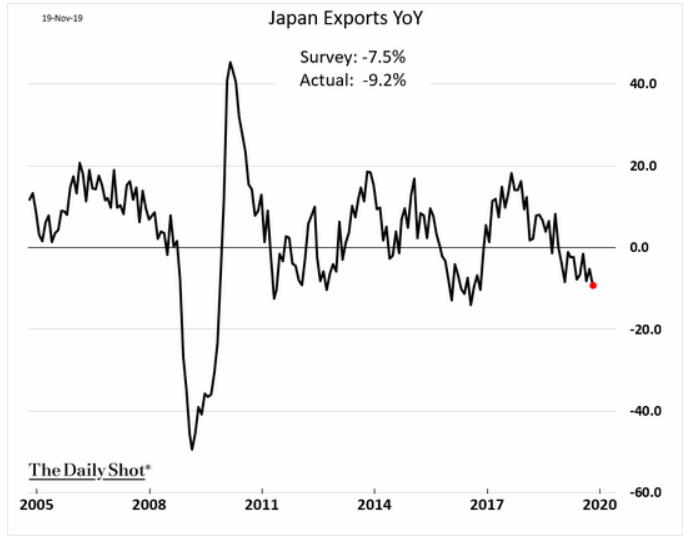

6. The trade war is having a nasty effect on a "non-combatant" Japan, the world's third largest economy.

Source: WSJ Daily Shot, from 11/20/19

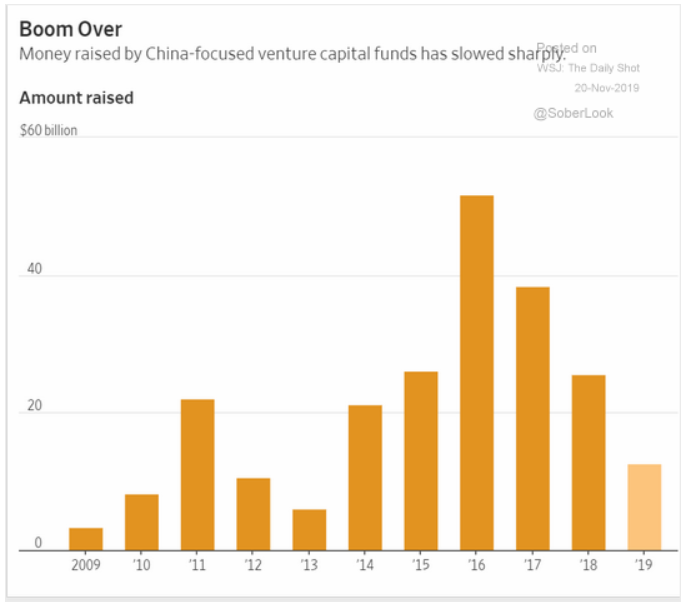

7. Another likely trade war casualty...

Source: WSJ Daily Shot, from 11/20/19

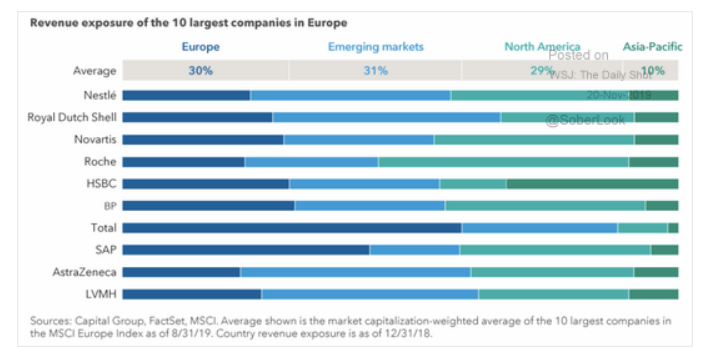

8. We live in a global economy. It is not just the U.S.; here are Europe's 10 largest company revenues:

Source: Capital Group, as of 8/31/19

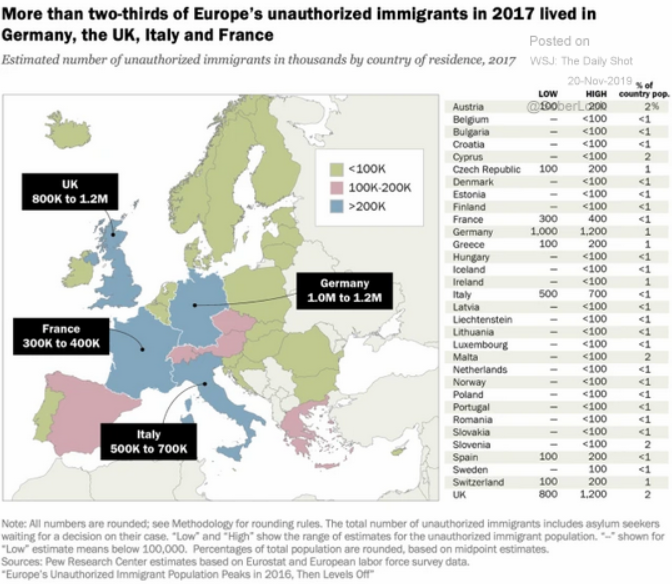

9. This is one of the main drivers of BREXIT...

Source: Pew Research Center, from 11/20/19

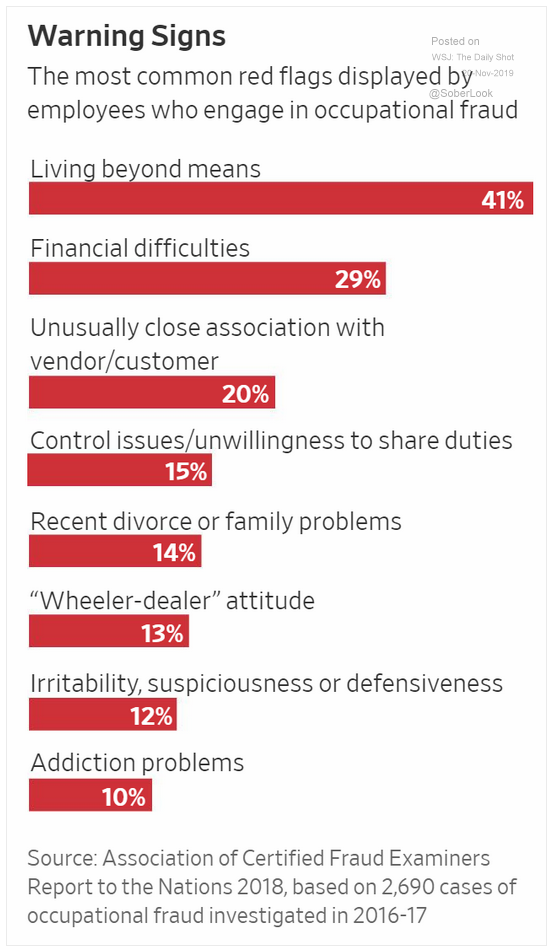

10. If you run a business...

Source: WSJ Daily Shot, from 11/20/19

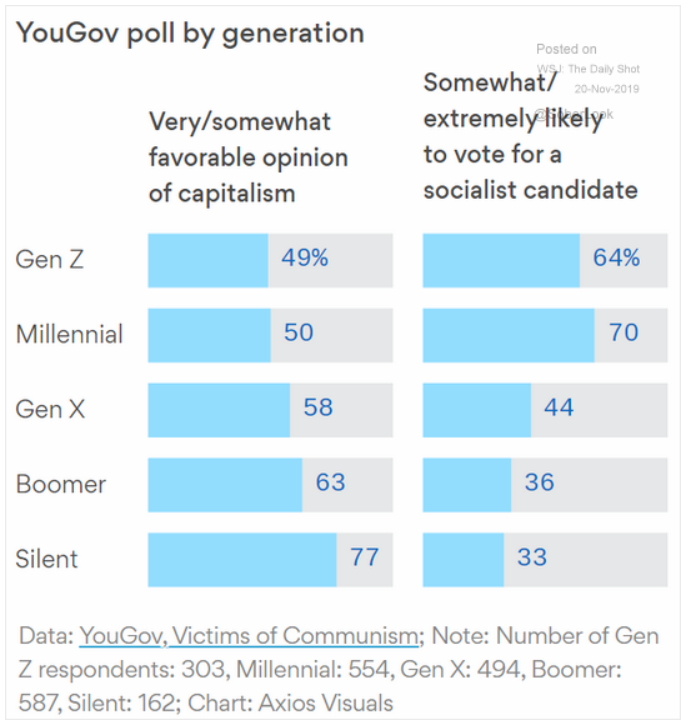

11. Is this because the younger generations are too young to remember?

Source: Axios, from 11/20/19

Investors, like markets, are sensitive to headlines and an uncertain political climate—neither of which have been in short supply in 2019. Do you have a friend or colleague who could benefit from an easy way to keep up with market surprises, emerging trends, and the BCM investment team's analysis? Click below to forward them the link to the BCM blog!

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.