It's a big day for the markets with Q1 GDP data, an FOMC meeting, and earnings reports from industry leaders Microsoft and Facebook. Amid a 4.8% contraction in GDP—the sharpest since the financial crisis—the S&P 500® Index forward P/E ratio shows that stocks remain expensive, meaning that demand has remained high despite the nosedive in earnings per share (EPS) projections. The S&P 500's weathered the coronavirus crisis better than many indices, but how much of that is down to the $4 trillion behemoth of FAANG + Microsoft, and are we putting too many eggs in that basket? Meanwhile, as banks and investors alike pile into traditional "safe havens" like money markets and treasuries, it's worth noting that credit related sectors took a significant (re: double digit) blow in Q1. And will the explosion of central bank easing and government stimulus be enough to prop up the meat-processing industry? Finally, as various nations and U.S. states begin to emerge from lockdown, where does global opinion stand on re-opening the economy?

1. Markets are famous for climbing a wall of worry. Have the bulls gone a bit too far, too fast? Earnings season isn't even half over...

Source: WSJ Daily Shot, from 4/27/20

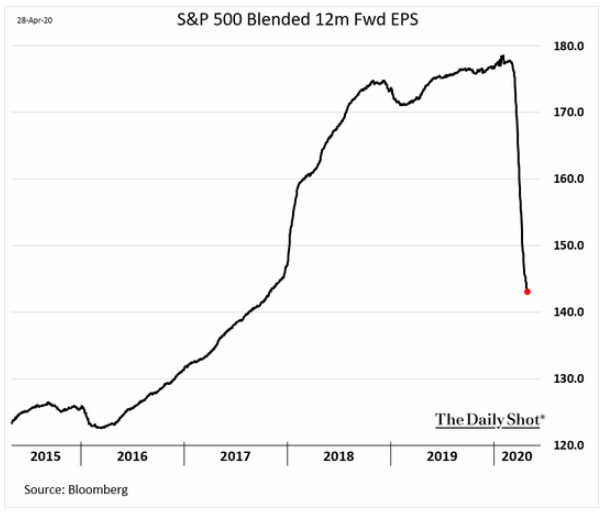

2. As earnings drop, based on the recent rally, it reminds us that the markets are forward looking mechanism...

Source: WSJ Daily Shot, from 4/29/20

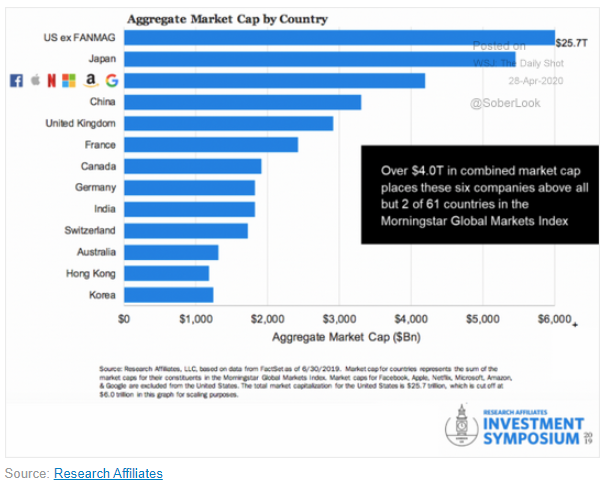

3. When is too big too big? FAANG + Microsoft now have a $4 trillion aggregate value, larger than all but two countries' stock market aggregate values...

Source: Research Affiliates, as of 6/30/19

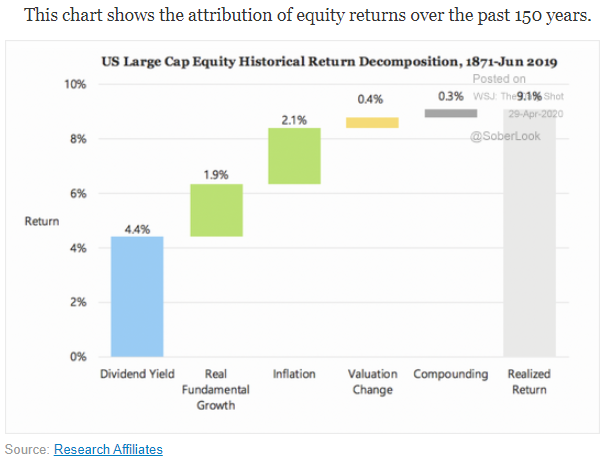

4. Much has changed in the world in the last 150 years...

Source: WSJ Daily Shot, from 4/29/20

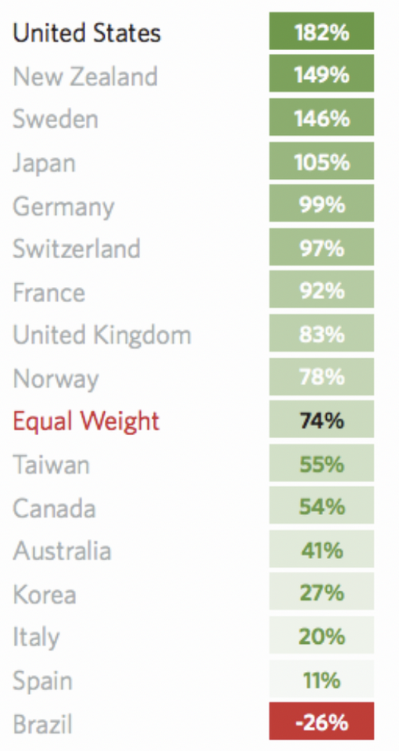

5. Speaking of trends...here are some equity returns over the past decade.

Source: WSJ Daily Shot, from 4/29/20

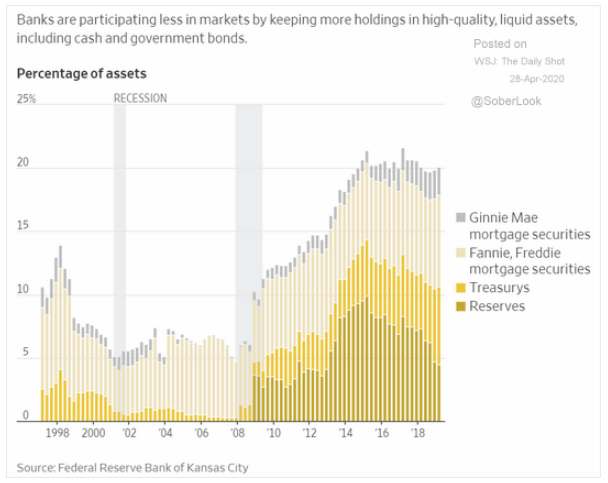

6. With rates so low, are these assets still considered "safe"? Their returns are certainly going to be paltry as ~93% of a bonds return is driven by the coupon...

Source: Wall Street Journal, from 4/24/20

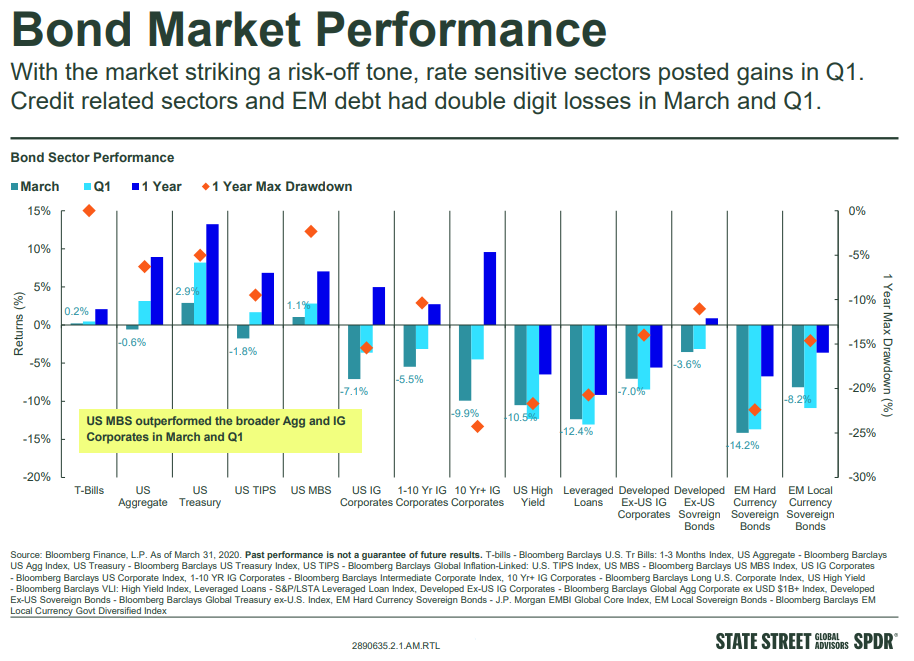

7. Many do not realize that bonds had losses in March as well...

Source: SSgA, as of 3/31/20

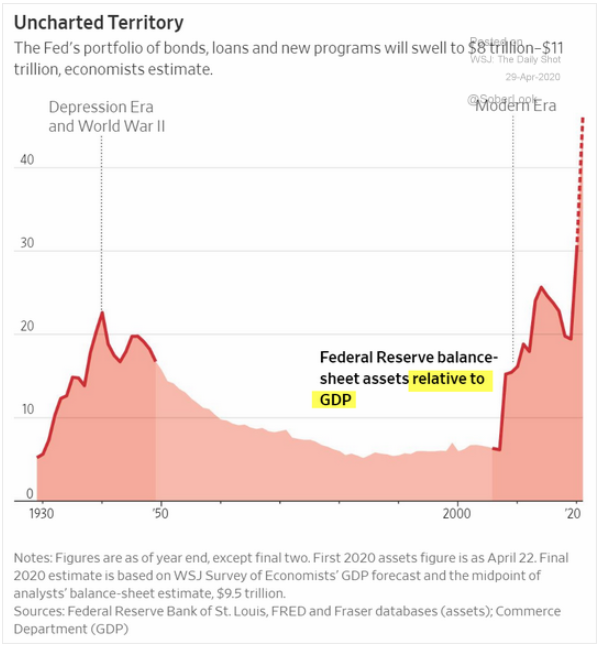

8. What does this mean for the future?

Source: WSJ Daily Shot, as of 4/22/20

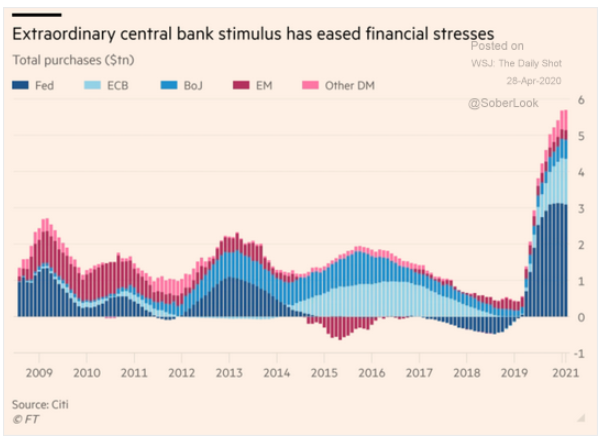

9. Central Bank bond purchases (QE) have already dwarfed the post Great Recession levels...

Source: WSJ Daily Shot, from 4/28/20

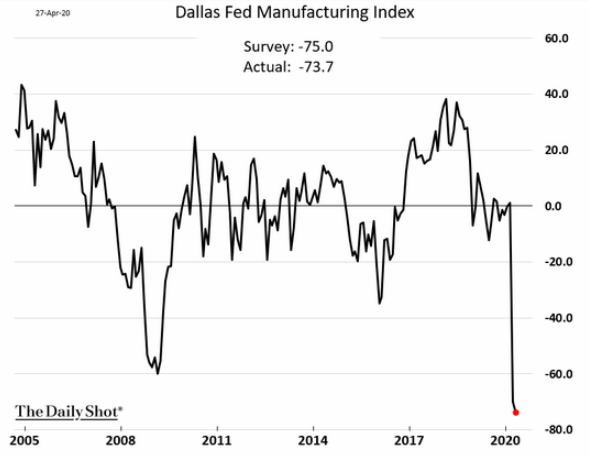

10. The Pandemic plus the oil feud has caused the Texas area's manufacturing to be hit harder than most...

Source: WSJ Daily Shot, from 4/29/20

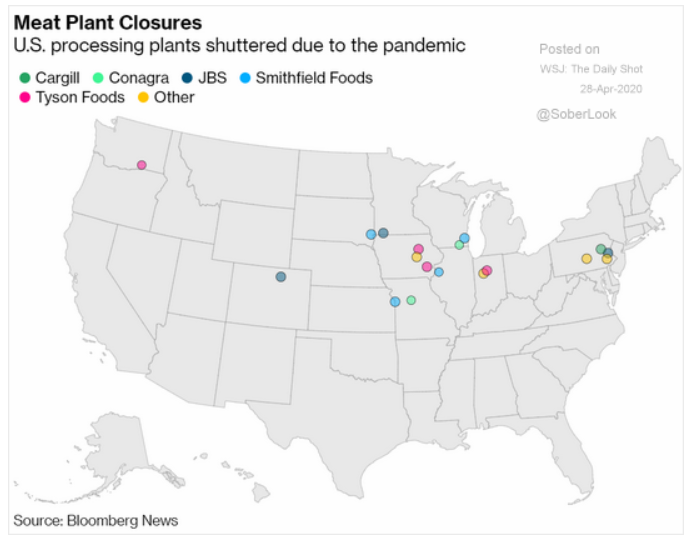

11. Isn't it time we protected the folks who create our food supply?

Source: Bloomberg, from 4/27/20 & Reuters, from 4/27/2020

12. Are small caps finally waking up?

Source: WSJ Daily Shot, from 4/29/20

13. Talk about a mega-cycle...

Source: WSJ Daily Shot, from 4/29/20

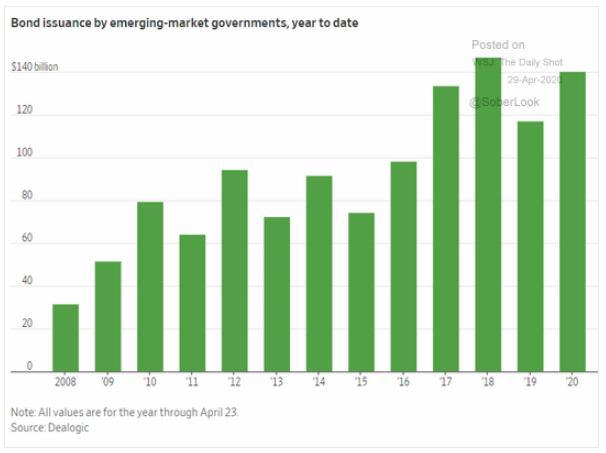

14. Unlike the developed world, EM needs foreign capital to help fund their economies. Capital has been fleeing, forcing debt issuance. Note 2020 is through April 23rd!

Source: Dealogic, as of 4/23/20

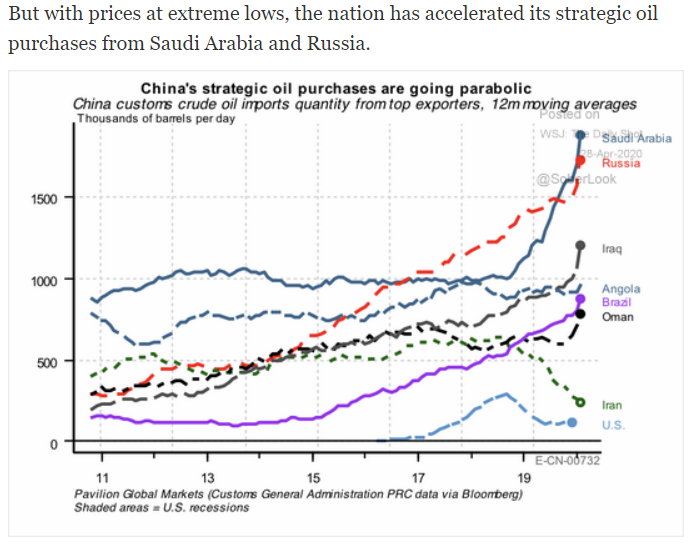

15. So much for the trade deal with China...the opportunity to buy U.S. oil is squandered on Saudi and Russian purchases...

Source: WSJ Daily Shot, from 4/28/20

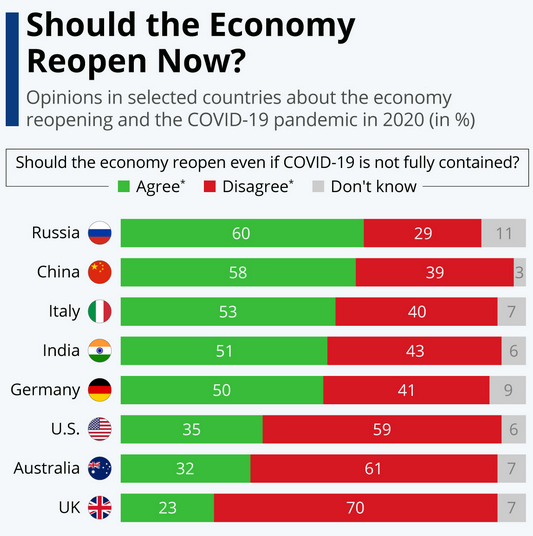

16. As we pointed out in our quarterly calls, if we open too early...

Source: WSJ Daily Shot, from 4/29/20

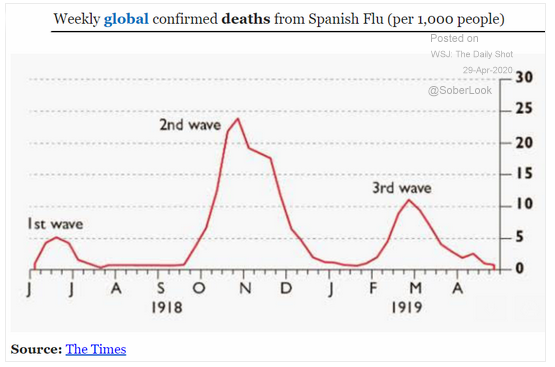

17. ...Will we be doomed to repeat the results of other historical coronavirus pandemics? Here is the flu 1918-19...

Source: WSJ Daily Shot, from 4/29/20

High dividend ETFs/funds are popular among investors seeking relatively safe and stable yield, but could a high dividend yield actually indicate that a company's in trouble? It's possible—just ask 2007! If you haven't already, read "A Caution from 2007: Beware of the Dividend in Your High Dividend ETFs & Funds" by BCM Portfolio Manager Dave Haviland to learn more.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.