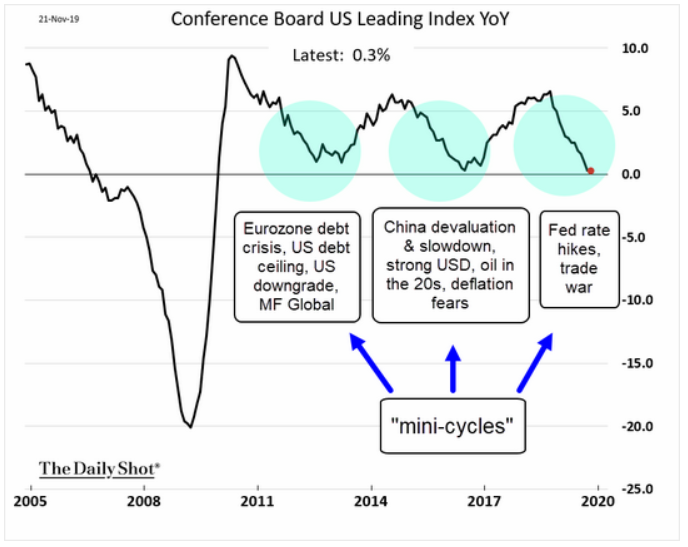

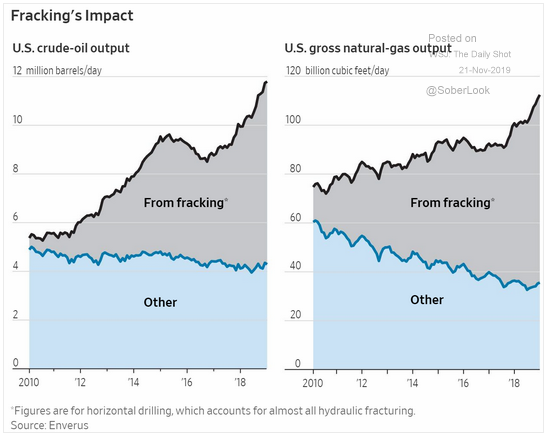

The U.S. Leading Economic Index dropped for the third straight month in October, driven largely by investor uncertainty around the trade war, but a long-term view makes us wonder: are occasional hits to economic sentiment—and the "mini-cycles" they spur—a key to understanding how the current expansion has become the longest on record? Stay tuned as we keep our eyes trained to see if we're on the edge of another rebound or already in the midst of a more sustained downturn. In the meantime, we're seeing some mixed signals from the Philly Fed on manufacturing, and more evidence is piling up that hedge funds maybe aren't all that they're cracked up to be. And the state of American farming might not be either—just how much has the government intervened over the past decade? Finally, we mentioned a few weeks ago that the U.S. is on track to become a net energy exporter in 2020—is the rising popularly of a controversial process to thank?

1. This chart would indicate we're at a demarcation line between a mini-cycle rebound or something worse...

Source: WSJ Daily Shot, from of 11/21/19

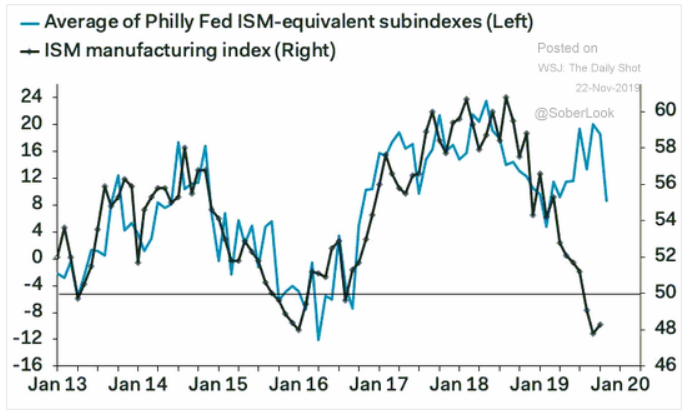

2. A split decision out of the Philly Fed: The headline was better but the sub-indices were decidedly worse...

Source: WSJ Daily Shot, from of 11/22/19

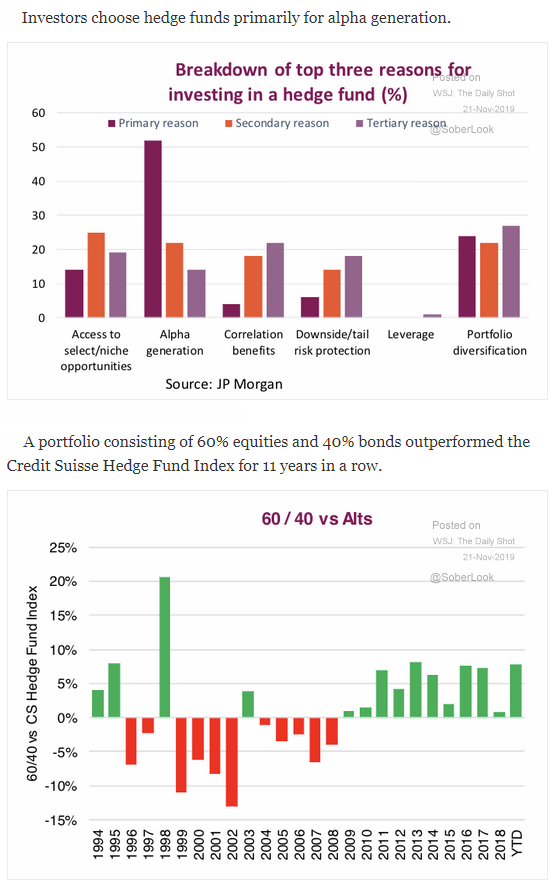

3. When desire and results do not match:

Source: Market Ethos, from of 11/21/19

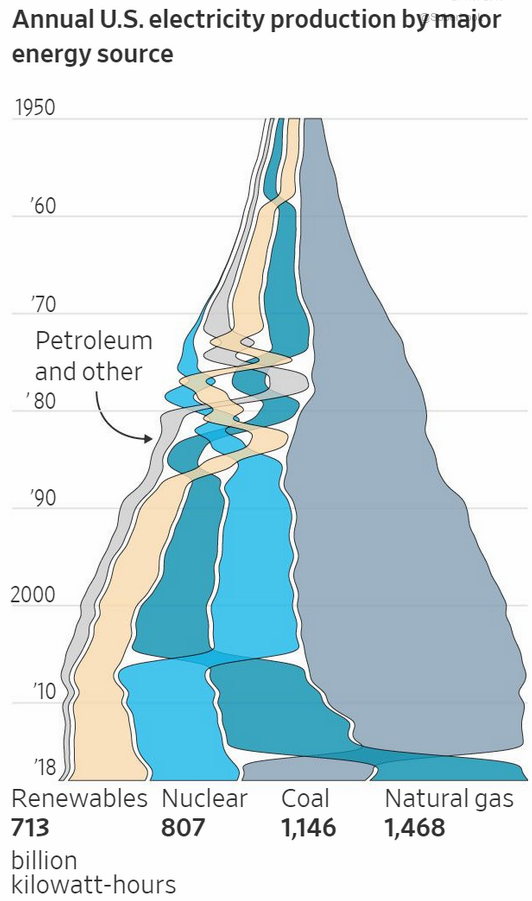

4. We understand fracking is controversial, but it is allowing the U.S. to become energy independent again...

Source: WSJ Daily Shot, from of 11/21/19

5. Very little U.S. electricity is made from oil...

Source: WSJ Daily Shot, from of 11/21/19

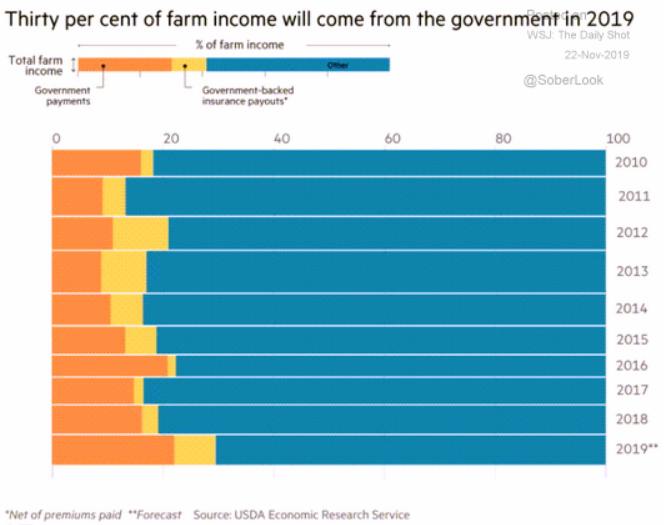

6. The U.S. may be the largest food exporter, but this figure seems out of whack; ~33% of farm income is from the government?

Source: Financial Times, from 11/22/19

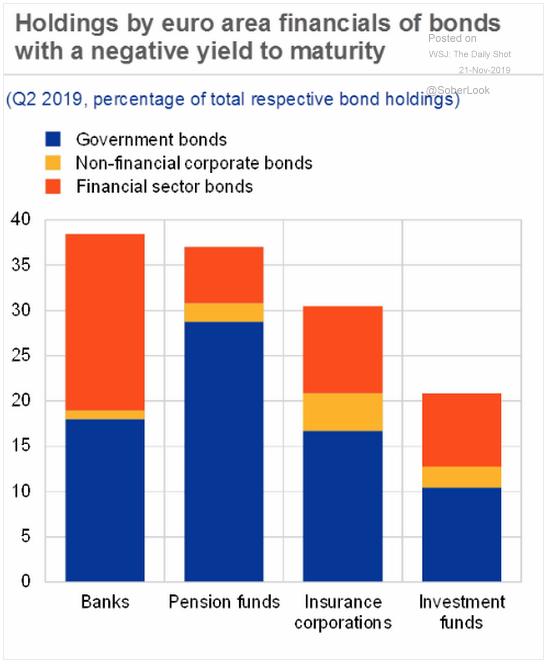

7. This is crazy! If a bank has an asset with a negative yield, does that make it a liability of sorts?

Source: ECB, from 11/21/19

8. May the trend continue!

Source: Alpine Macro, from 11/22/19

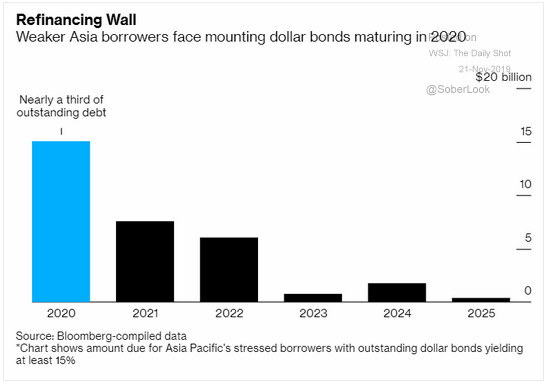

9. "Hello, Houston! Do we have a problem?"

Source: WSJ Daily Shot, from of 11/21/19

Do you use factors in your portfolios? Factor-based investing is one of the fastest growing investment strategies, and has been gaining even more traction this year as investors seek to manage uncertainties around trade tensions and Federal Reserve policy moves. For a primer (or refresher) on how to get the most out of factor investing, read our piece Factor Investing in the 2019 Landscape.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are a recommendation to take any action. Individual securities mentioned may be held in client accounts.