VIDEO: BCM's 2Q20 Quarterly Market Update Call with the PM

July 23, 2020We've come a long way since the onset of the Covid-19 crisis and resultant market meltdown in Q1—the S&P 500® Index has erased its losses for the year and the Nasdaq has ...

Watch: How to Invest Opportunistically and Defensively in a New Investment Paradigm

July 16, 2020In this record-low interest rate environment, advisors will need to adapt—stepping beyond traditional asset allocation and the 60/40 ...

VIDEO: BCM's 1Q20 Quarterly Market Update Call with the PM

April 16, 2020A few weeks ago we provided a Special Update from BCM's Managing Partner and Portfolio Manager, Dave Haviland. At that time ...

Special Update From BCM Portfolio Manager: Coronavirus and Current Market Conditions

March 20, 2020The emergence of COVID-19 and its rapid spread have sparked an exceptional market meltdown and a fundamental restructuring of our daily lives. In this uncertain time, we wanted to ...

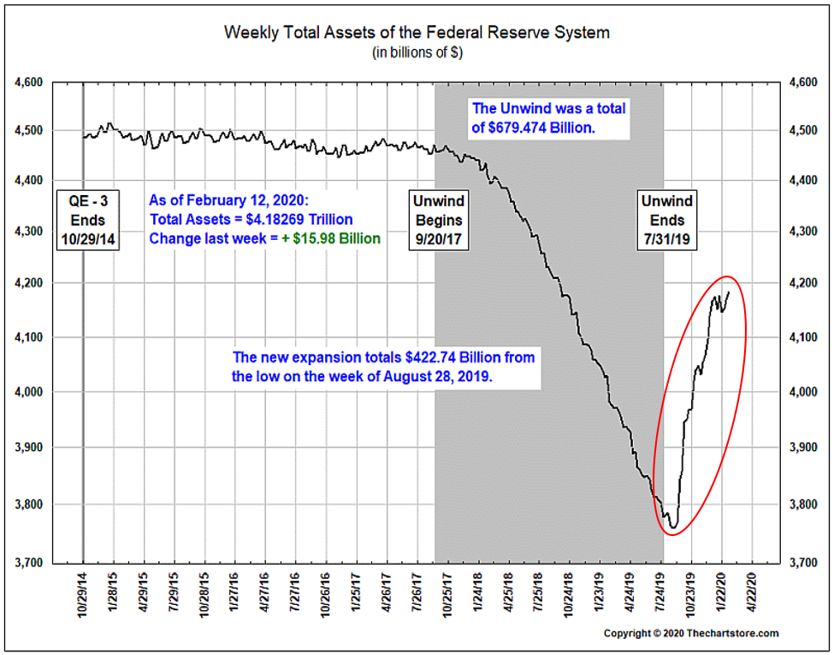

Recent Repo Market Fiasco and Intervention

March 3, 2020Recently a reader asked us to explain “the recent Repo Market Fiasco and the Fed’s intervention,” as well as the consequences and outcomes. For those of you who regularly read our blog, we first included a chart on this subject on September 23, 2019. The answer is fairly technical, but let’s focus on some charts to show the enormity of the issue first.

From the Desk of the PM - Update on Market Selloff and and Coronavirus Fears

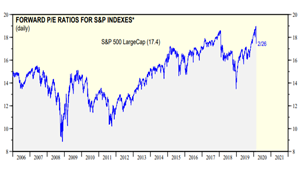

February 27, 2020With the sudden drop in the global equity markets, we thought it might be helpful to remind everyone about where we have been, where we are now, and share some helpful source information. Before we discuss the virus, let’s go back and remind everyone that U.S. large cap stocks, after demonstrating a decade of leadership, may have gotten ahead of themselves from a valuation standpoint. As the chart below from Ed Yardeni Research shows, the forward P/E of the S&P 500 reached 19X—which is a level not seen since the Dot.com bubble in the late 1990’s—and, depending on ...

It's Time to Talk About the R-Word

December 14, 2018As we frequently like to point out, no one knows what will happen to the markets or the economy over the short term. Not tomorrow, next week, next quarter

Anatomy of a Bear Market

December 6, 2018Updated: May 4, 2020 What does a typical Bear market look like? How long do they last? When are the majority of the losses incurred? Most investors believe that the losses occur fairly evenly throughout the Bear. Based on the past, with one notable exception, nothing could be further from the truth.

From the Desk of the PM

October 29, 2018It looks like some of the issues we have been concerned about, namely rising interest rates and the trade war, have finally caught up to us. In addition, there have been some high profile missed earnings, bombs being mailed to prominent figures, BREXIT, and Italy’s budget crisis. Discourse at home and abroad is not helping. The result has been that October has been difficult to endure.

From the Desk of the PM - Update on Current Market Conditions

October 11, 2018Yesterday saw the major U.S. stock bourses suffer the worst losses since February. Today, they followed suit. While it may be hard to ignore the financial press’s headlines, we would like to remind everyone of a few pieces of information that should allow most angst to subside.