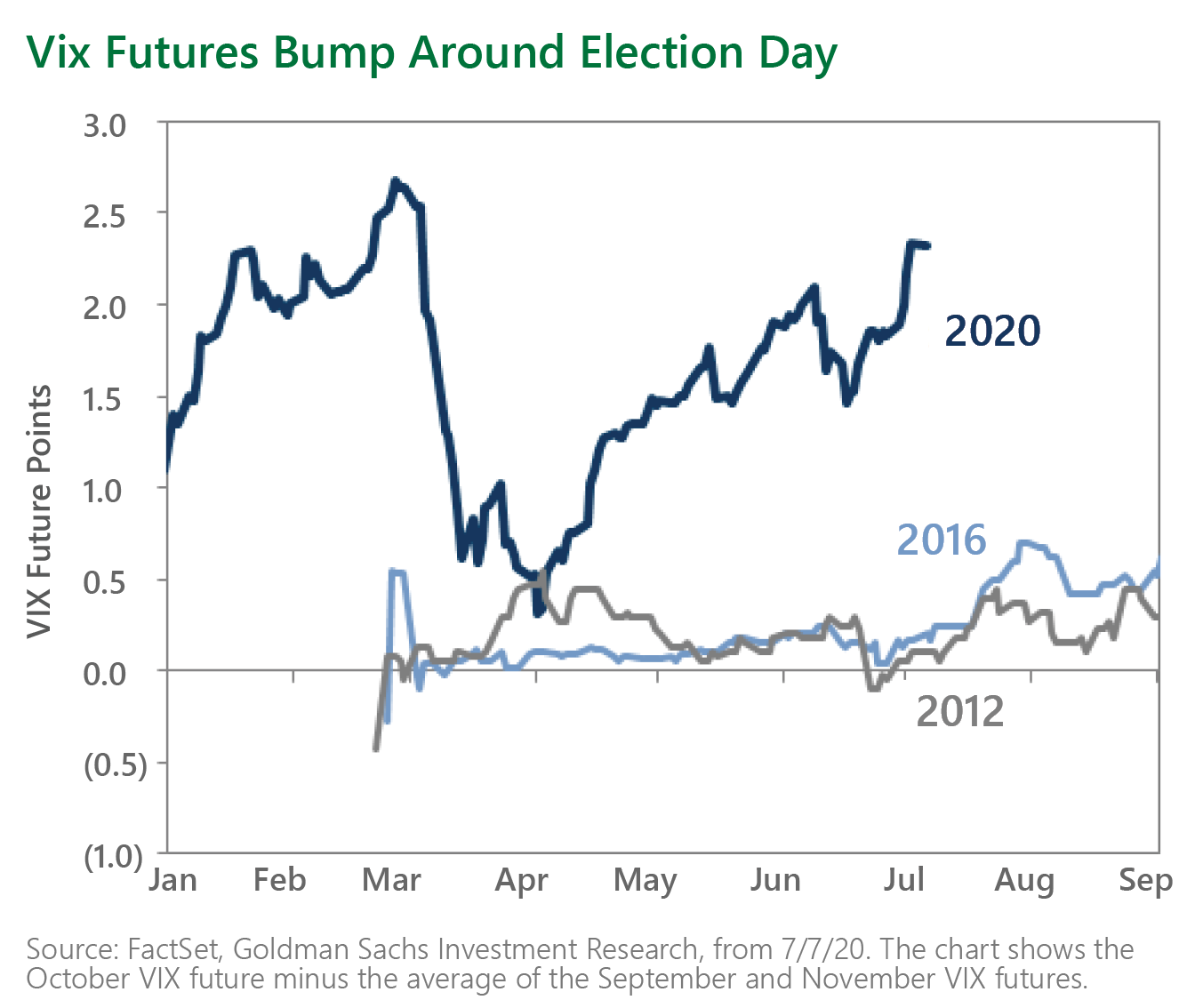

How Should Investors Think About the Upcoming Election’s Impact on the Stock Market?

August 11, 2020The top question we are being asked from advisors right now: “is there data that can help me anticipate stock market returns in an election year?” While we have outlined some key data worth examining, our takeaway is we would caution against making any significant investment decisions based on these trends.

The Anatomy of a Bear Market

June 2, 2020Updated: 6/25/20 What does a typical bear market look like? How long do they last? When are the majority of the losses incurred? Most investors believe that the losses occur fairly evenly throughout a bear. Based on the past, with one and now possibly two notable exceptions, nothing could be further from the truth. In another piece we wrote about bear markets, Tactical to ...

Using Total Return to Meet Your Clients' Withdrawal Needs

May 21, 2020We originally posted this piece back in 2016 when the 10-year U.S. Treasury (UST) yield was ~1.9%. At that time, most were predicting a rise in interest rates and it would have been hard to imagine that four years later, the 10-year UST would be ~0.65%—especially given where interest rates had been for the preceding decades. Now, the Total Return concept is even more relevant today with interest rates at record lows and no one knows how long they will remain at this level, or where they may go from here. Read on as BCM Portfolio ...

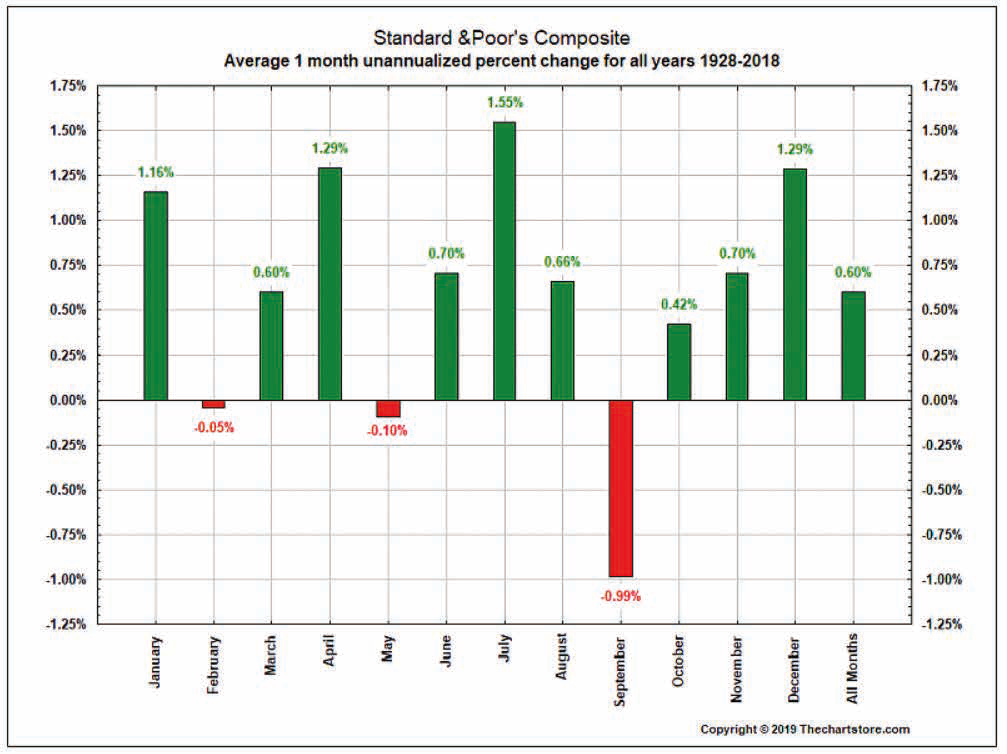

Debunking Some Bunk: Is September Really That Bad a Month?

September 10, 2019Sometimes our industry grabs on to a concept and cannot let it go. Is September the worst month from a performance standpoint? Does it always/mostly go down? Should one avoid the markets in September? Let’s take a quick look.

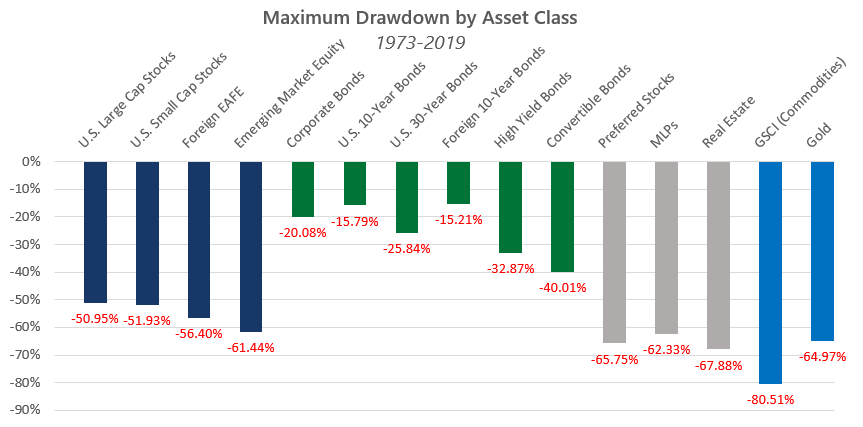

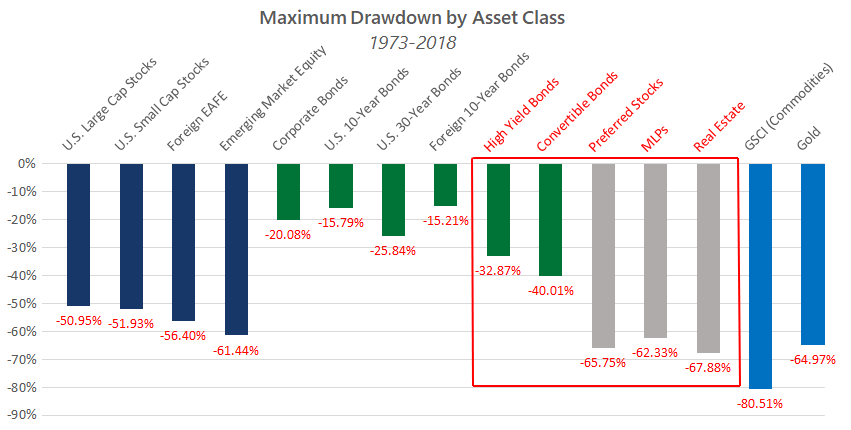

Finding Total Return in an Ultra-low Interest Rate Environment

September 5, 2019Your clients need to withdraw 4-5% a year, but interest rates are setting record lows. Here’s what you can do to help get them there.

It's Time to Talk About the R-Word

December 14, 2018As we frequently like to point out, no one knows what will happen to the markets or the economy over the short term. Not tomorrow, next week, next quarter

Anatomy of a Bear Market

December 6, 2018Updated: May 4, 2020 What does a typical Bear market look like? How long do they last? When are the majority of the losses incurred? Most investors believe that the losses occur fairly evenly throughout the Bear. Based on the past, with one notable exception, nothing could be further from the truth.

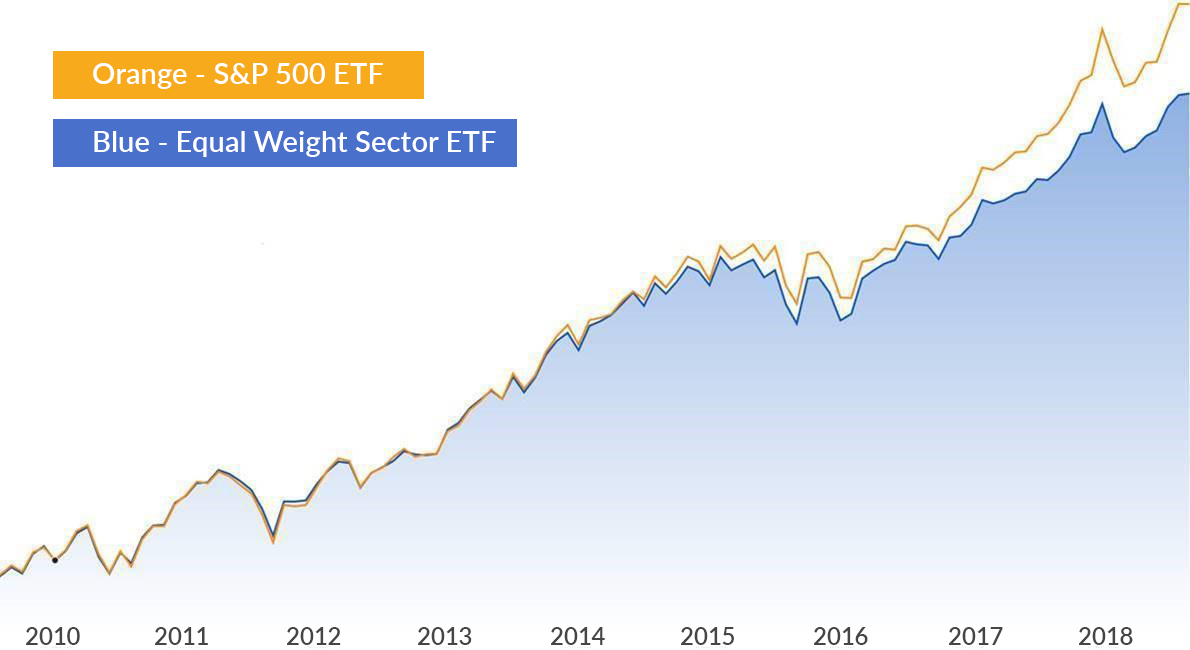

Why the Upcoming GICS Sector Shakeup Matters

September 27, 2018Tomorrow, September 28th, the S&P is making some big changes to the sectors of the S&P 500® Index. These changes will have an impact on the overall market and will also impact how Beaumont Capital Management (BCM) strategies will track the overall market.

A Final Call Before the Fall

September 20, 2018We have enjoyed the current bull market which recently surpassed the 1990-2000 technology-led bull as the longest bull ever.

Excuse the rant…this isn’t about politics, it's about economics.

September 10, 2018Editor's Note: The views and opinions expressed herein are those of the writer and may not be the opinions of Beaumont Capital Management (BCM).