We originally posted this piece back in 2016 when the 10-year U.S. Treasury (UST) yield was ~1.9%. At that time, most were predicting a rise in interest rates and it would have been hard to imagine that four years later, the 10-year UST would be ~0.65%—especially given where interest rates had been for the preceding decades. Now, the Total Return concept is even more relevant today with interest rates at record lows and no one knows how long they will remain at this level, or where they may go from here. Read on as BCM Portfolio Manager, Dave Haviland, describes the Total Return concept from his own experience as a financial advisor.

Your clients need to withdraw 4-5% a year, but interest rates are at record lows. Here’s what you can do to help get them there.

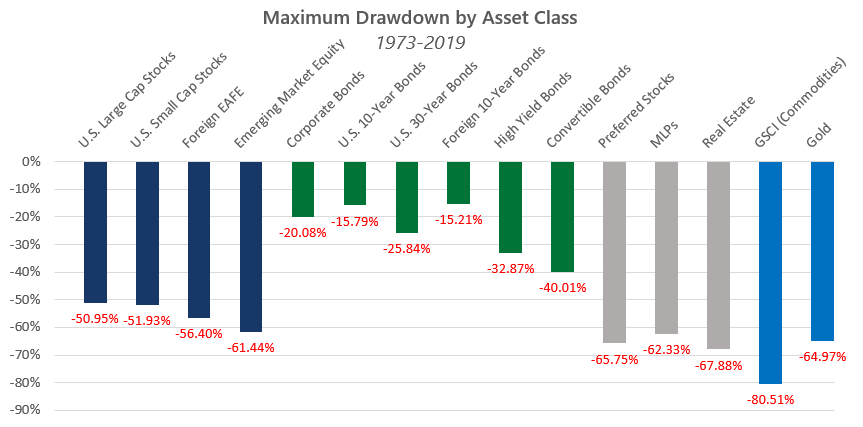

For decades most financial plans were created with withdrawal rates of 4 to 5% to meet clients’ living needs. Yet today, the 10-year U.S. Treasury yield is hovering around 0.65% and even the 30-year has a ~1.0% yield. Worse yet, yields on equities have also trended lower with the dividend yield of the S&P 500® Index sitting at ~2.1%. Today, trillions of international bonds and even some U.S. bonds have negative yields! One can stretch for yield in relatively less liquid, riskier income-producing asset classes, but investors are wary of risk in this unprecedented market environment and, as the chart below shows, this may not work out so well for retirees or the rest of the boomers nearing retirement in a bear market. Clients don’t want extra risk; they just want to live off their portfolio and avoid losing a significant portion of their assets along the way. So, what can an advisor do?

Source: Global Asset Allocation (Chapter 3) via mebfaber.com, Meb Faber, March 6, 2015. Bloomberg for the period 1973-2019. The data shown for Convertible Bonds, Preferred stock, High Yield Bonds and MLPs is sourced by Bloomberg. They use the same end date as the rest of the asset classes (12/31/19) but have different start dates due to the fact the indices for these asset classes did not exist in 1973. Convertible bonds is for the time period starting on 6/17/1986, Preferred stock data starts 9/9/2003 and the MLP data begins 12/21/1995. The returns shown are “Nominal Returns” for the time period specified. For more information on what each asset class performance is represented by, please reference the disclosure pages. “EAFE” represents the regions of Europe, Australasia and Far East. Past performance is no guarantee of future results. An investment cannot be made directly in an index. Refer to the disclosure page for additional, important information.

My father started financial planning in 1981. When I joined him in the early 1990’s, he taught me an important concept: Use Total Return when yield alone does not meet a client’s living needs. The Total Return concept is simple: Instead of relying on dividends and interest alone, include a portion of the capital gains to meet client needs. Let’s look at a hypothetical example:

As you can see, this method can generate the money needed to meet the desired withdrawal rate. Then, the remainder of any capital gains remains in the portfolio to provide growth and/or to keep up with inflation.

As you can see, this method can generate the money needed to meet the desired withdrawal rate. Then, the remainder of any capital gains remains in the portfolio to provide growth and/or to keep up with inflation.

On a practical basis, in a separate cash flow account, we kept 1-3 years of income needs in one-, two- and three-year treasuries. This way, when markets faltered, we would not have to take from the investment portfolio at market lows, exacerbating the losses. Dividend, interest and gains remained in the investment account. Provided markets were not faltering though, once a year a withdrawal for the full amount was transferred to the income account and a new 3-year Treasury was purchased to refill the reserve. The matured Treasury in the cash flow account was used to meet client needs for the year with a periodic distribution.

If the accounts are set up to automatically distribute, all the advisor needs to do is make sure there is $20,000 of cash raised in the investment account a few days before the transfer to the cash flow account.

On a separate note, the cash flow account can also be a “holding tank” for any low-cost basis positions that need to be liquidated over time. Once sold, these proceeds can be added to the investment portfolio, but I digress.

The simple total return concept and process allows you to work with clients to help meet their withdrawal needs despite the ultra-low interest rates of today's unprecedented market environment. If you would like to learn how we seek total return, please click here.

Contact Us:

(844) 401-7699

Sources & Disclosures:

Copyright © 2020 Beaumont Capital Management (BCM). All rights reserved.

As with all investments, there are associated inherent risks including loss of principal. Fixed Income investments are subject to inflationary, credit, market and interest rate risks.

Asset class performance is represented by the following: U.S. Large Cap –S&P 500; U.S. Small Cap –French FamaSmall Cap; Foreign Developed –MSCI EAFE; Foreign Emerging –MSCI EEM; Corporate Bonds –Dow Jones Corporate; T-Bills –U.S. Bills; 10 Year Bonds –U.S. 10-year bonds; 30Year Bonds –U.S. 30-year bonds; 10 Year Foreign Bonds –Foreign 10-year bonds; High Yield –iBoxxLiquid High Yield; Convertible Bonds -Vanguard Convertible Securities Fund; Preferred Stocks –S&P Preferred Stock; MLPs –AlerianMLP; REITs –NAREIT; Commodities –GSCI; Gold –GFD.

This material is for informational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument, nor should it be construed as financial or investment advice. The views and opinions expressed throughout this piece are those of our Portfolio Manager at the time of publication. The opinions or outlooks may change over time with changing market conditions or other relevant variables.

Beaumont Capital Management LLC. 75 2nd Avenue, Suite 700, Needham, MA 024949, (844) 401-7699.