BCM 3Q19 Market Commentary: Blinking Yellow Lights

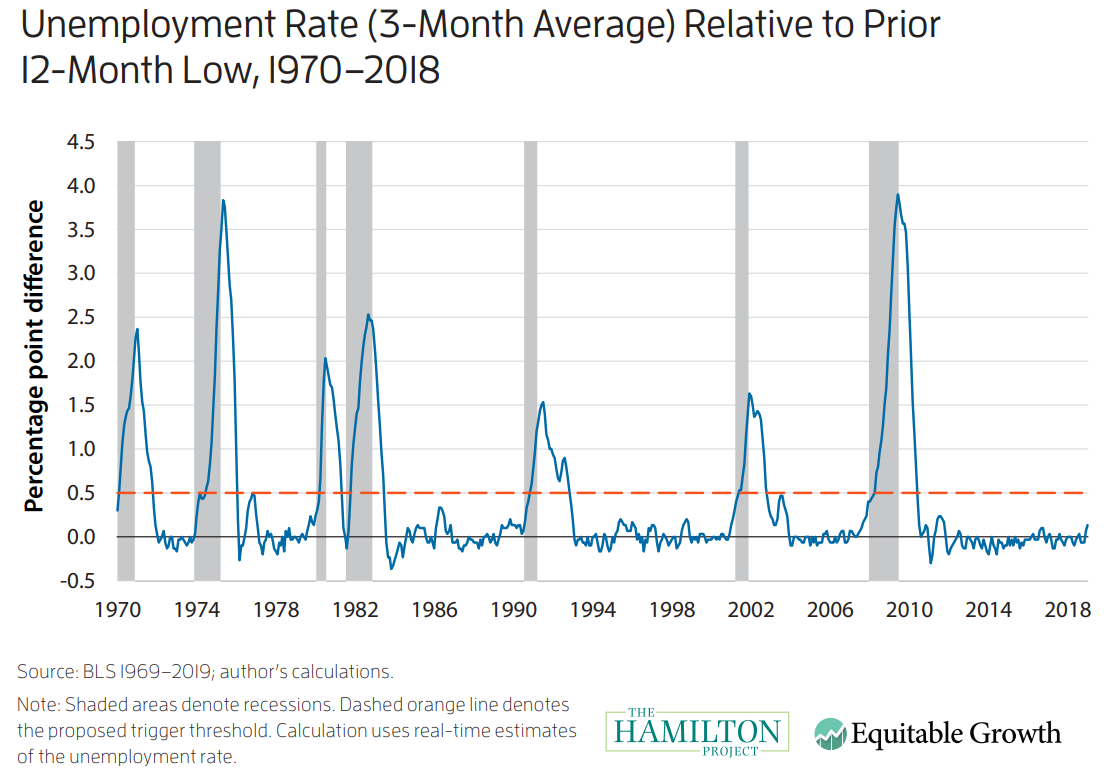

October 9, 2019The Inverted Yield Curve and Other Recession Indicators The third quarter of 2019 was full of noise and lacking substance. There was a terrorist attack on oil facilities in Saudi Arabia, which affected the price of oil for about two weeks, and now oil is right back where it started. The U.S. dollar continued to grind higher and has now ...

BCM 2Q19 Mid-Year Review: Odd, Odds, and Tods

July 11, 2019Which index has realized the highest 1-year return through June 30th, 2019? S&P 500® Index MSCI Emerging Markets Index Russell 2000 Index (Small Cap) Bloomberg Barclays U.S. Long Treasury Index

BCM 1Q 19 Market Commentary

April 12, 2019At the end of 2018, interest rates were heading higher due to a hawkish Federal Reserve (FED); both global trade and manufacturing were slowing as the trade war raged on; and earnings expectations were being revised down. This led investors to conclude that the economy was slowing both abroad and here at home. Due to all of this, global equities, represented by the MSCI ACWI Index, suffered their eighth worst¹ quarterly loss in 30 years.

From the Desk of the PM - Update on Current Market Conditions

October 11, 2018Yesterday saw the major U.S. stock bourses suffer the worst losses since February. Today, they followed suit. While it may be hard to ignore the financial press’s headlines, we would like to remind everyone of a few pieces of information that should allow most angst to subside.

Are you wearing rose colored glasses? Take them off and you might see Bifurcated Markets, Tariffs, and Tempered Earnings Expectations

October 9, 2018“These rose colored glasses That I'm looking through Show only the beauty 'Cause they hide all the truth” -John W Conlee