BCM 2Q20 Market Commentary: The Best of Times and The Worst of Times...

July 9, 2020“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.” Charles Dickens, in A Tale of Two Cities, set out to describe the necessity of compassion and the possibility of redemption during the French Revolution. Based on how 2020 has unfolded so far, we too are going to need all the compassion ...

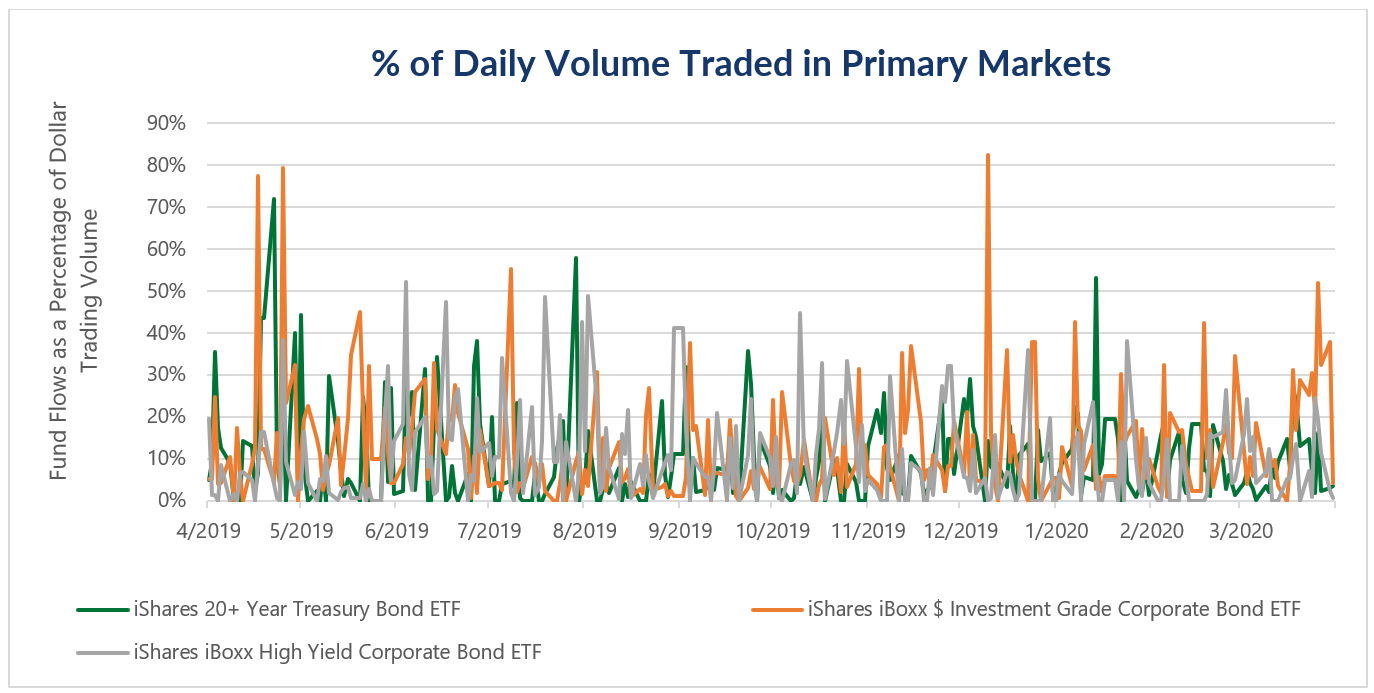

Bond ETF’s Price Divergence From NAV: How Do We Tell Which Was “Right”?

April 30, 2020“What happened to fixed income ETFs in the March sell-off?" So far, we’ve kept quiet on the subject. Not due to a lack of opinions, but because we felt we didn’t have much to add to the discussion. Our many fund sponsor and trading partners (SSGA, iShares, Invesco, and Jane Street to name a few) have done a fantastic job of providing detailed analyses on the subject. Anything we could have produced over the past month would have been nothing more than a regurgitation of work produced by others. So, what’s changed? Why have we decided, after the fact, to throw our hat ...

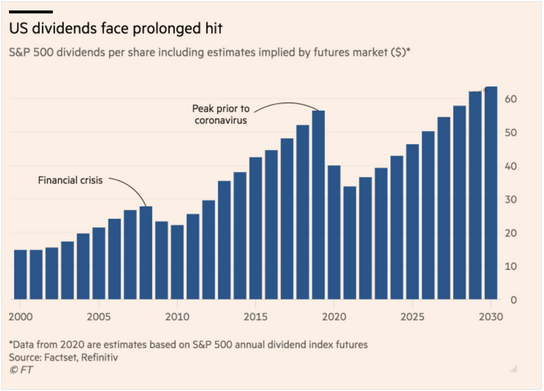

A Caution From 2007: Beware of the Dividend in Your High Dividend ETFs & Funds

April 23, 2020Remember this? It’s late in 2007 and the banks have already started their downward spiral. As their prices fell, their dividend yields rose. Most “high yielding,” “high dividend” or “dividend achiever” type ETFs/funds rebalance quarterly, so at year end, what did they do? They loaded up on bank stocks.

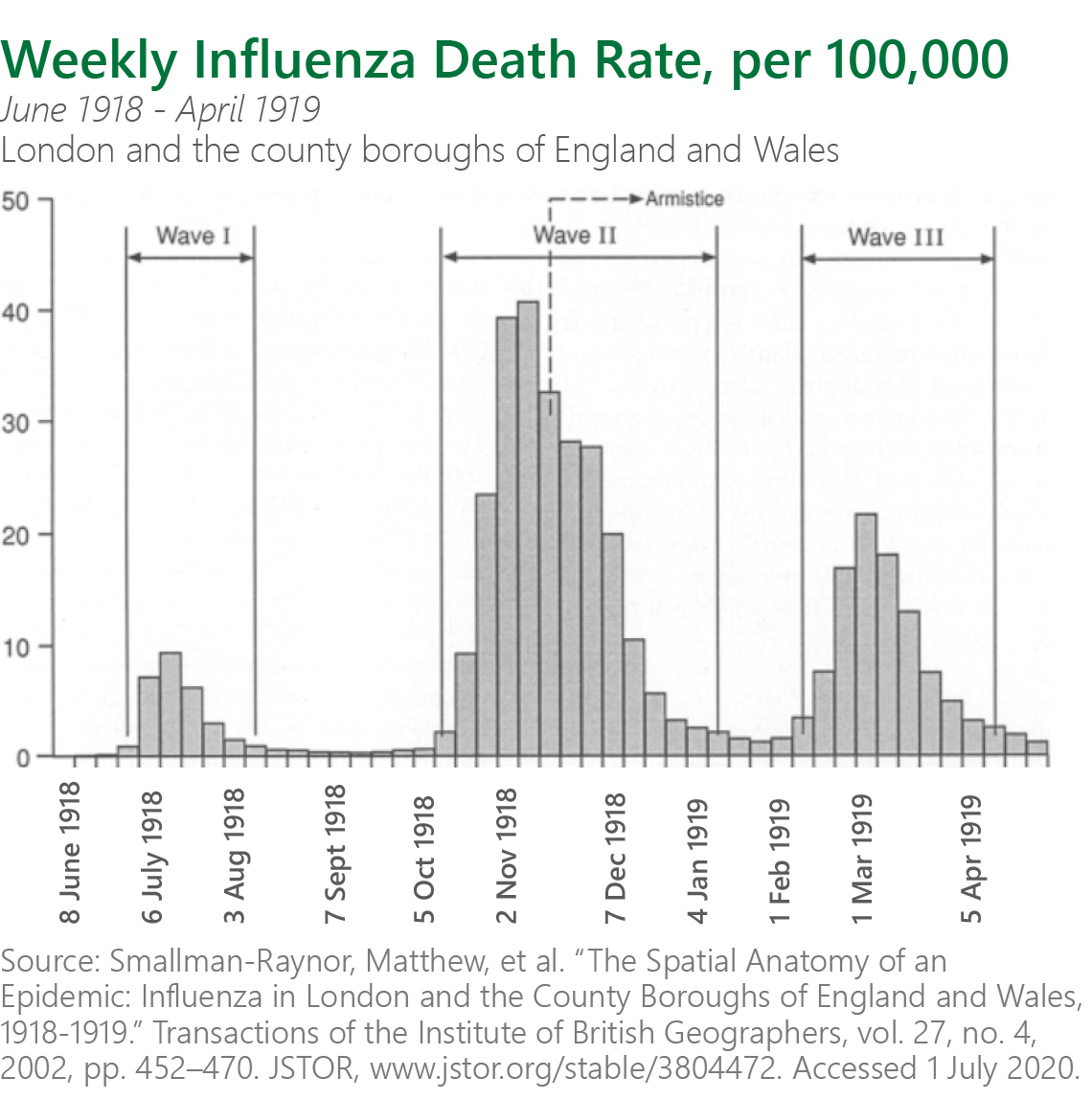

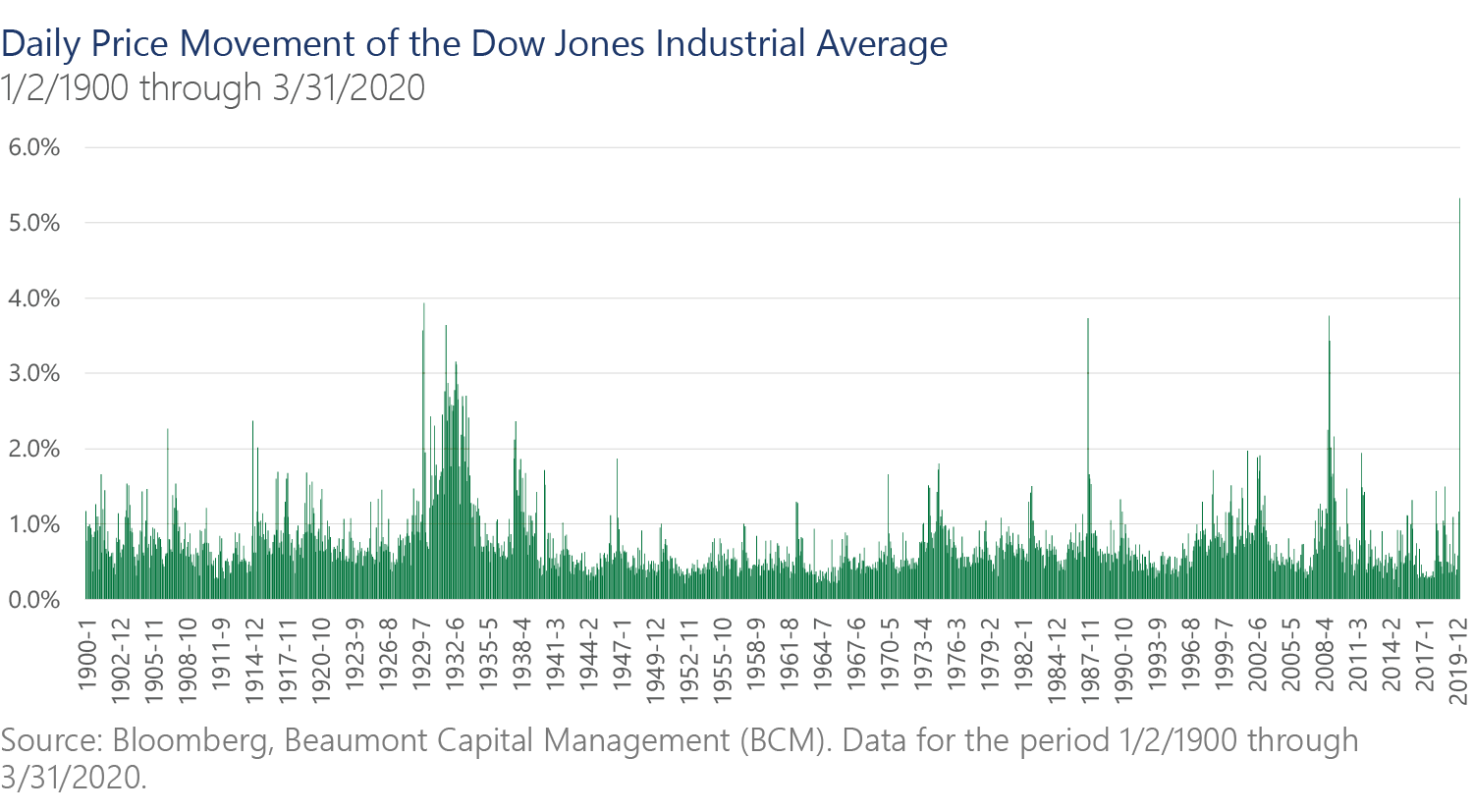

BCM 1Q20 Market Commentary: To V or Not to V, That Is the Question…

April 7, 2020With apologies to Mr. Shakespeare... The Covid-19 pandemic has set upon the globe with lightning speed and is unlikely to leave us anytime soon. First and foremost, we hope that you, your family and loved ones are well. While the level of disruption that the virus has caused to our daily lives is unprecedented, we wish to offer hope with a healthy dose of realism.

Mutual Funds in Taxable Accounts: Despite Losses, You May Incur Sizable Capital Gains Tax

April 2, 2020As investors and advisors alike look to realign/re-balance their portfolios this year, we wanted to provide a reminder about how mutual funds are taxed. Like any investment, if you buy a mutual fund, own it for more than one year, and sell it at a profit, you must pay federal (and for most states) capital gains tax on your gain. If you own the position for less than one year, you will have to pay ordinary income tax on your gain. Yet many do not realize that if you keep owning a mutual fund (you don’t sell it), there may be short- and long-term capital ...

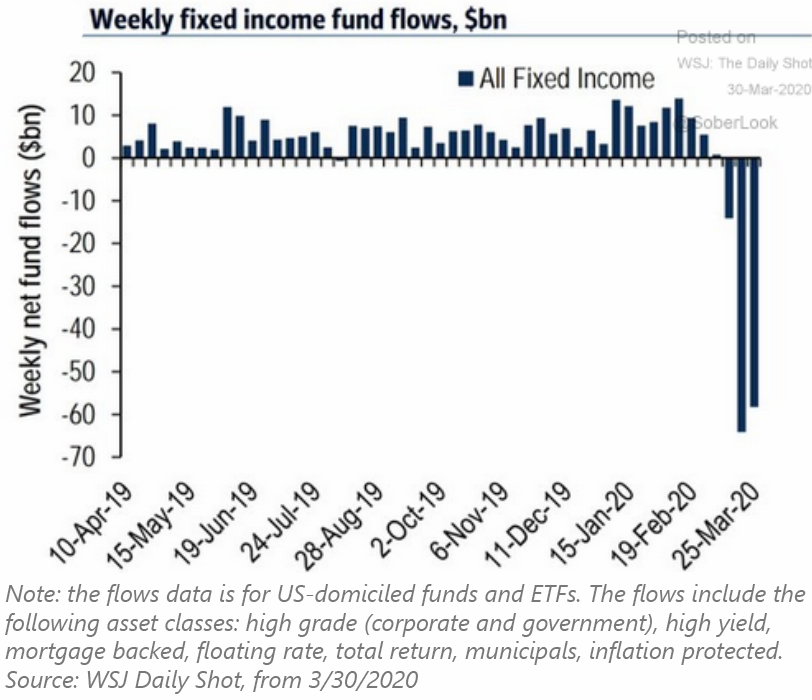

A Word of Caution on Fixed Income in the Current Market Environment

March 26, 2020Investors of balanced strategic portfolios as well as effective tactical portfolios are now well aware of the benefits of reduced risk during times of market duress. While volatile markets may encourage investors to seek the historical “safe havens” of fixed income and lower risk investments, an unfortunately timed rebalance or re-allocation towards fixed income can be particularly risky in today’s environment.

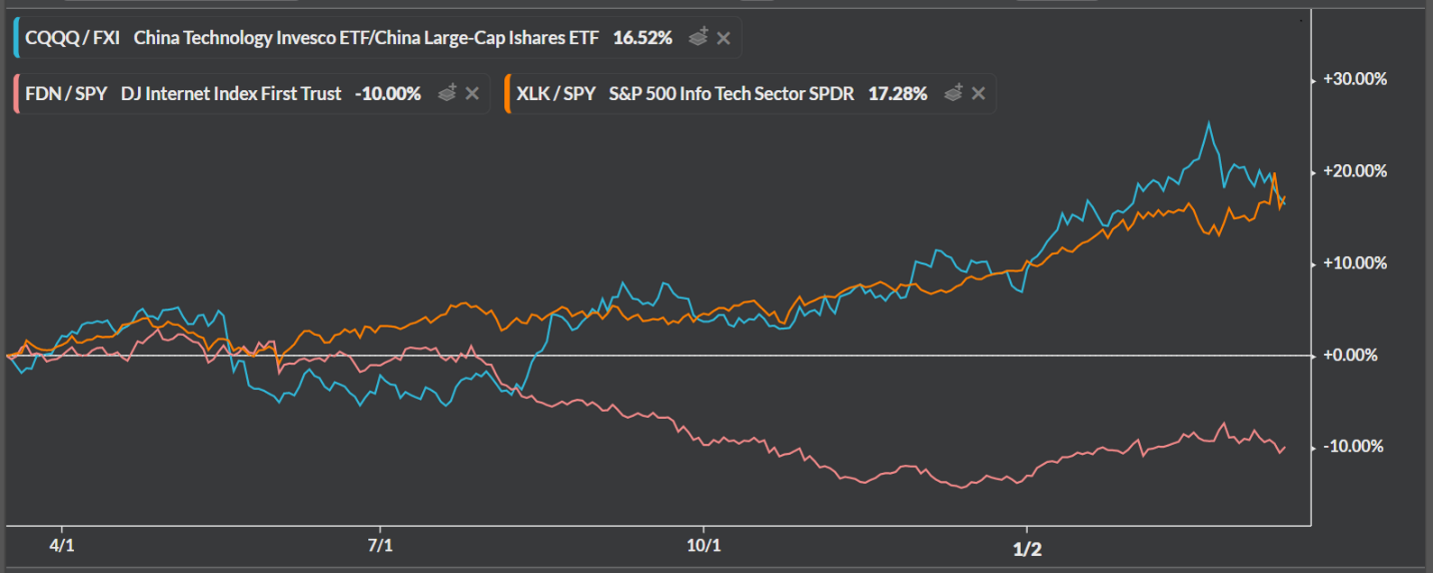

Technology Sector in the “Work from Home” Economy

March 17, 2020Although none of our investment systems directly incorporate fundamental data, we enjoy contemplating the fundamental narratives reflected in the price trends our systems ultimately find attractive. Our systems are currently quite leery of equity or other risk assets, as we now sit firmly in a bear market induced by the widespread economic halt caused by COVID-19. However, our Decathlon system continues to favor technology-sector equities more than its other investment opportunities. In addition, our Weekly Sector Rotation strategies have held on to the technology sector, due to its ...

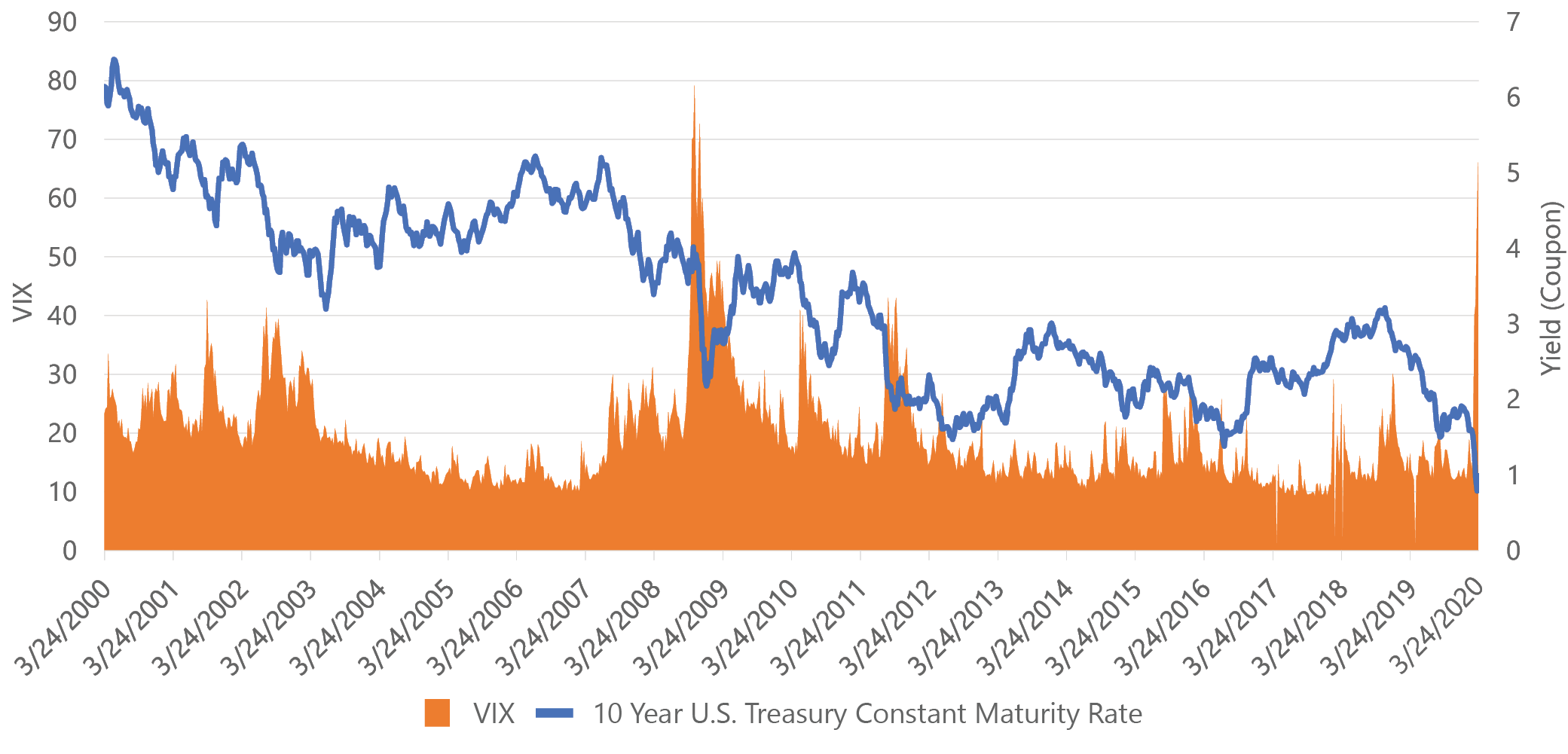

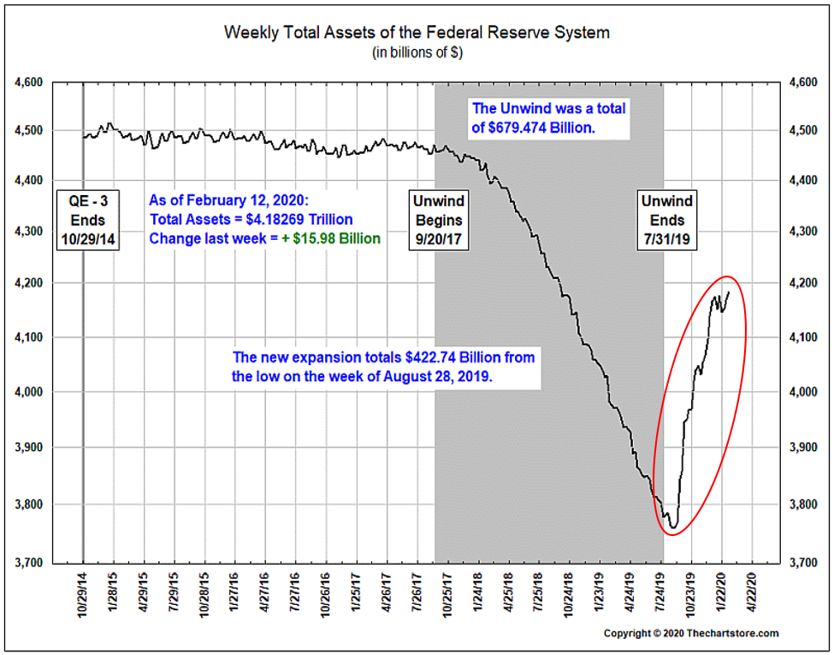

Recent Repo Market Fiasco and Intervention

March 3, 2020Recently a reader asked us to explain “the recent Repo Market Fiasco and the Fed’s intervention,” as well as the consequences and outcomes. For those of you who regularly read our blog, we first included a chart on this subject on September 23, 2019. The answer is fairly technical, but let’s focus on some charts to show the enormity of the issue first.

From the Desk of the PM - Update on Market Selloff and and Coronavirus Fears

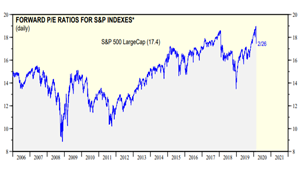

February 27, 2020With the sudden drop in the global equity markets, we thought it might be helpful to remind everyone about where we have been, where we are now, and share some helpful source information. Before we discuss the virus, let’s go back and remind everyone that U.S. large cap stocks, after demonstrating a decade of leadership, may have gotten ahead of themselves from a valuation standpoint. As the chart below from Ed Yardeni Research shows, the forward P/E of the S&P 500 reached 19X—which is a level not seen since the Dot.com bubble in the late 1990’s—and, depending on ...

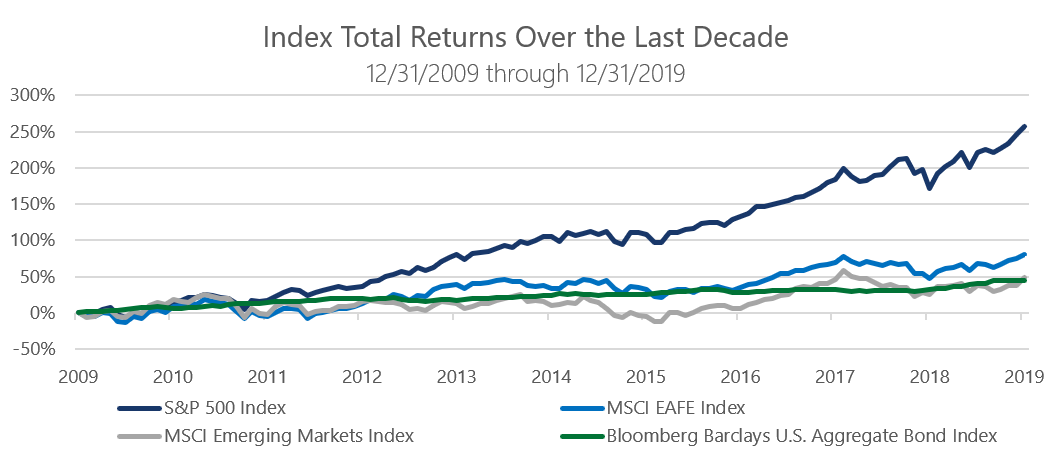

BCM 4Q19 Market Commentary: Will the Next Decade Look Anything Like the Last Two?

January 14, 2020The fourth quarter of 2019 brought the decade to a close in a manner consistent with U.S. investors’ experience during the past ten years. Calming trade tensions propelled the S&P 500 index to a 9.07% total return and 22 new all-time closing highs. Trade tension between the U.S. and China has been one of the largest macroeconomic risk factors hanging over the global economy for the better part of the past two years. Therefore, it’s no surprise that the global equity markets ...