Using Total Return to Meet Your Clients' Withdrawal Needs

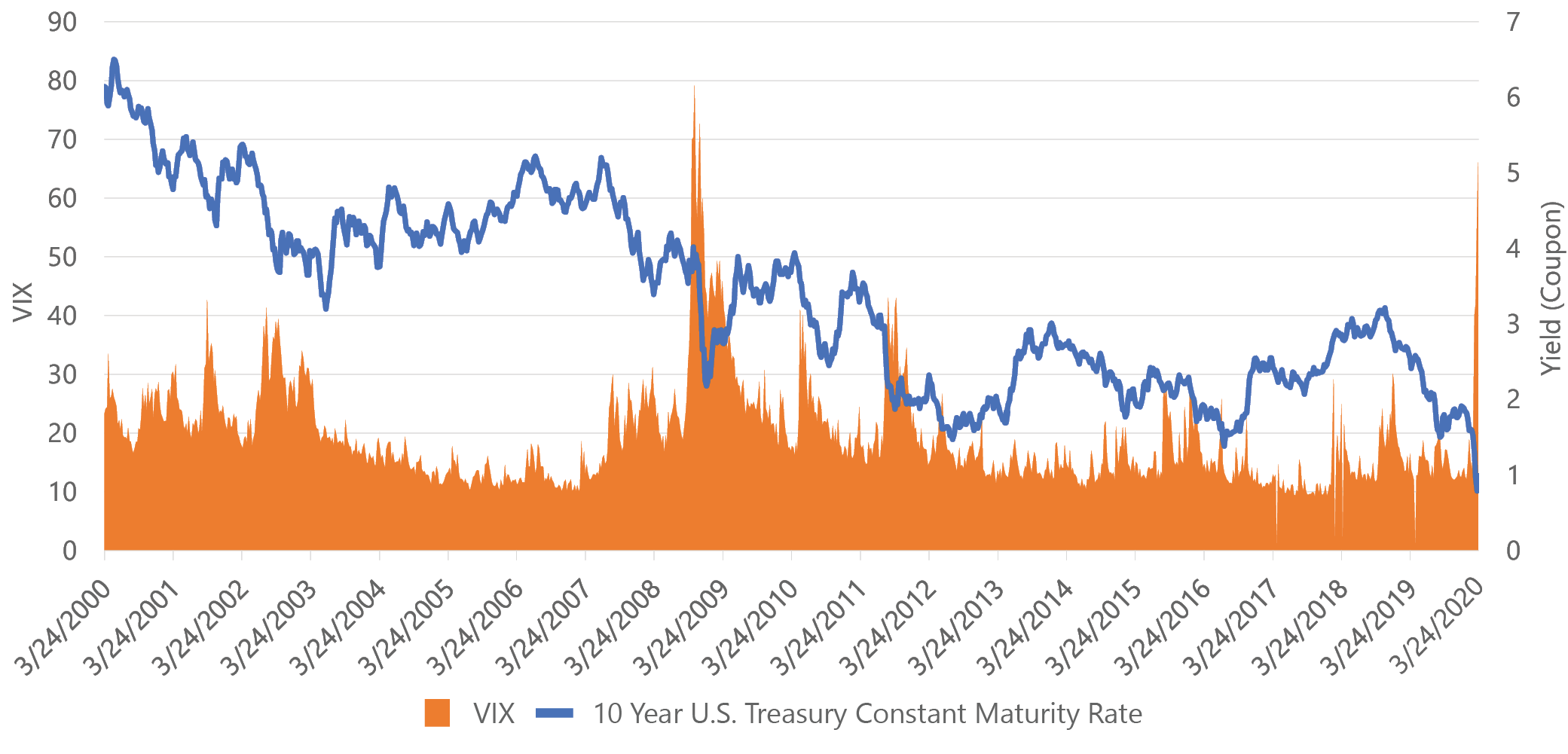

May 21, 2020We originally posted this piece back in 2016 when the 10-year U.S. Treasury (UST) yield was ~1.9%. At that time, most were predicting a rise in interest rates and it would have been hard to imagine that four years later, the 10-year UST would be ~0.65%—especially given where interest rates had been for the preceding decades. Now, the Total Return concept is even more relevant today with interest rates at record lows and no one knows how long they will remain at this level, or where they may go from here. Read on as BCM Portfolio ...

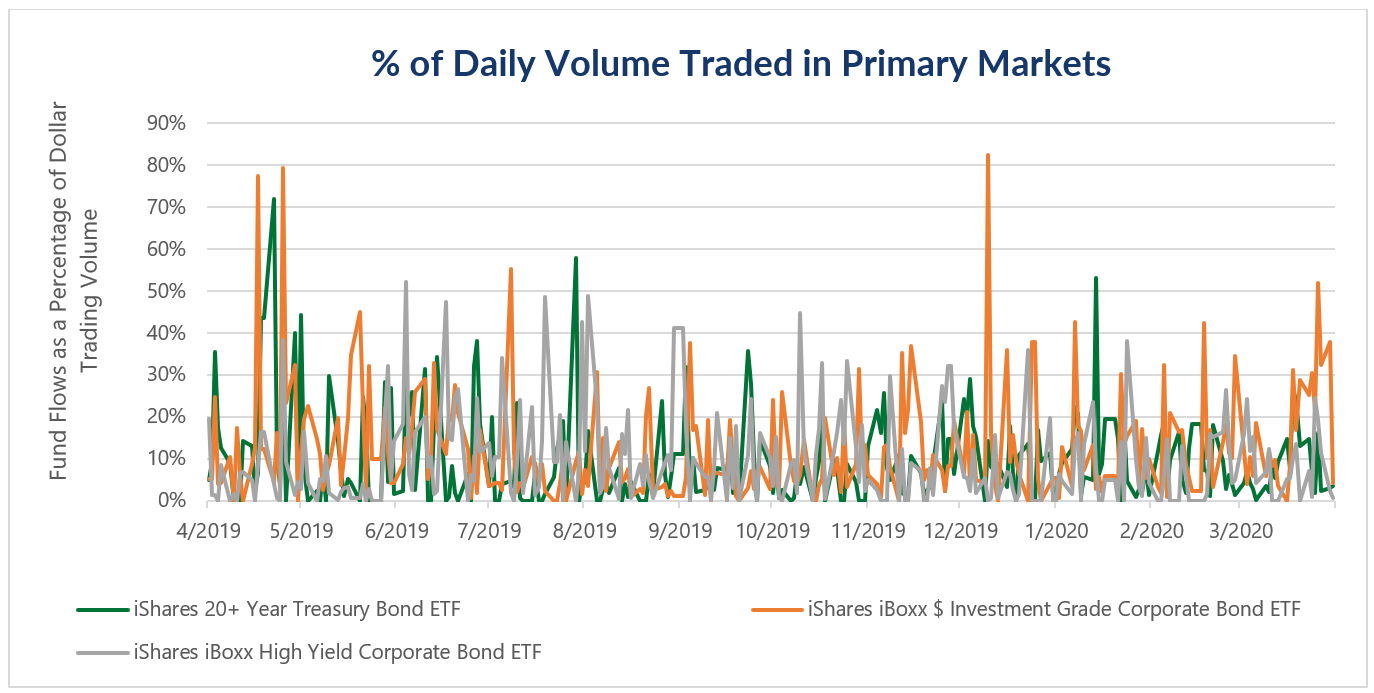

Bond ETF’s Price Divergence From NAV: How Do We Tell Which Was “Right”?

April 30, 2020“What happened to fixed income ETFs in the March sell-off?" So far, we’ve kept quiet on the subject. Not due to a lack of opinions, but because we felt we didn’t have much to add to the discussion. Our many fund sponsor and trading partners (SSGA, iShares, Invesco, and Jane Street to name a few) have done a fantastic job of providing detailed analyses on the subject. Anything we could have produced over the past month would have been nothing more than a regurgitation of work produced by others. So, what’s changed? Why have we decided, after the fact, to throw our hat ...

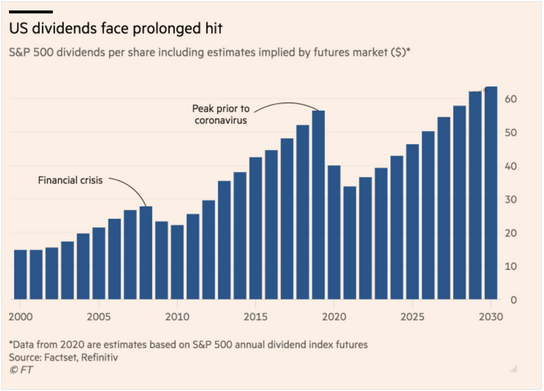

A Caution From 2007: Beware of the Dividend in Your High Dividend ETFs & Funds

April 23, 2020Remember this? It’s late in 2007 and the banks have already started their downward spiral. As their prices fell, their dividend yields rose. Most “high yielding,” “high dividend” or “dividend achiever” type ETFs/funds rebalance quarterly, so at year end, what did they do? They loaded up on bank stocks.

Mutual Funds in Taxable Accounts: Despite Losses, You May Incur Sizable Capital Gains Tax

April 2, 2020As investors and advisors alike look to realign/re-balance their portfolios this year, we wanted to provide a reminder about how mutual funds are taxed. Like any investment, if you buy a mutual fund, own it for more than one year, and sell it at a profit, you must pay federal (and for most states) capital gains tax on your gain. If you own the position for less than one year, you will have to pay ordinary income tax on your gain. Yet many do not realize that if you keep owning a mutual fund (you don’t sell it), there may be short- and long-term capital ...

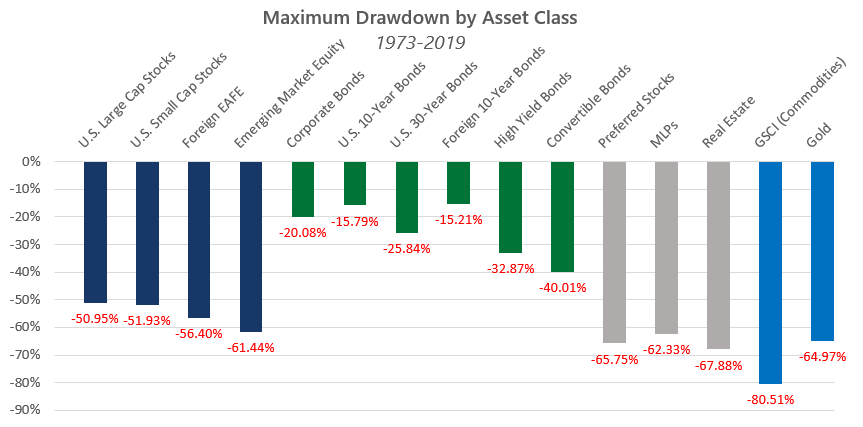

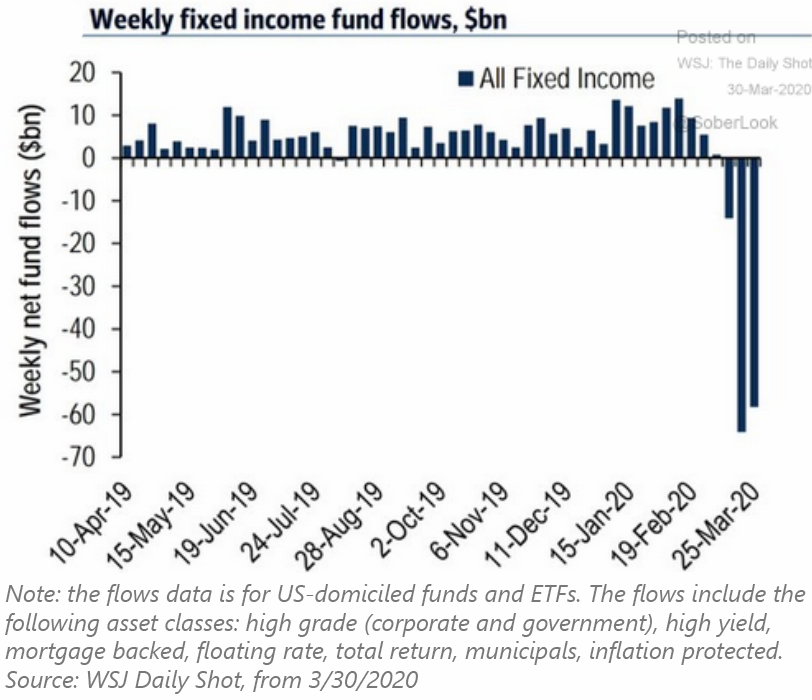

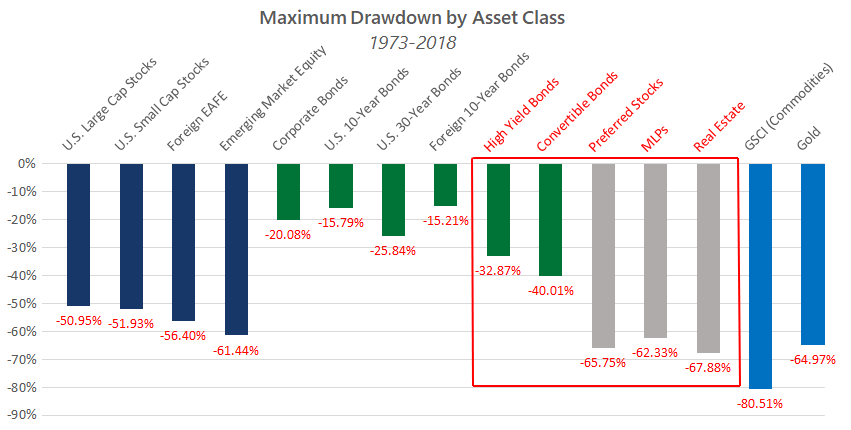

A Word of Caution on Fixed Income in the Current Market Environment

March 26, 2020Investors of balanced strategic portfolios as well as effective tactical portfolios are now well aware of the benefits of reduced risk during times of market duress. While volatile markets may encourage investors to seek the historical “safe havens” of fixed income and lower risk investments, an unfortunately timed rebalance or re-allocation towards fixed income can be particularly risky in today’s environment.

Finding Total Return in an Ultra-low Interest Rate Environment

September 5, 2019Your clients need to withdraw 4-5% a year, but interest rates are setting record lows. Here’s what you can do to help get them there.

Are you wearing rose colored glasses? Take them off and you might see Bifurcated Markets, Tariffs, and Tempered Earnings Expectations

October 9, 2018“These rose colored glasses That I'm looking through Show only the beauty 'Cause they hide all the truth” -John W Conlee

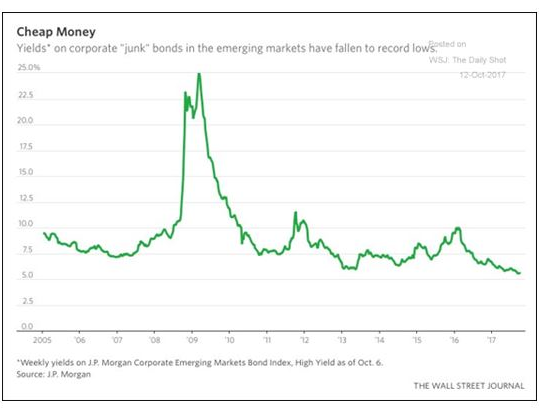

More on Bonds This Week: Emerging Markets and High Yield

October 13, 2017We recently shared several charts showing that U.S. High Yield bond yields are at the low end of their historical range and thus their prices are at the top of their historical range. Yes, both can stay at current levels for extended periods…or not. Similarly, the Emerging Market bond trade seems long in the tooth. For those who want it all, here is a chart of Emerging Market high yield bonds. They too share extremely low yields based on historical ranges. Looking at this chart, is it more likely that these yields will fall further or that they will rise?

Tactical Management and How It Differs from from Active

April 27, 2017Active vs. Passive Management Active management can be thought of as any strategy that uses human discretion to decide what the portfolio should own. The manager(s) generally employs some combination of fundamental, quantitative, or technical research in ...

Part 4: Back to the Future: Fed Normalization and What it Means for You

April 11, 2017On March 17th, we wrote about the size and makeup of the Fed’s balance sheet and our concern if it were to unwind. Little did we know the latest Federal Reserve meeting minutes would disclose the new desire by the Fed governors to shrink their balance sheet.