Fireside Charts: GDP, Earnings, Jobs, and Other Measures Exceeding Expectations

November 1, 2019Happy Friday, Fireside Charts readers! We hope you all had a happy and safe Halloween, with plenty of candy to show for your trick-or-treating efforts. Now let's shake off the sugar comas and take a look at the data: Wednesday's rate cut wasn't much of a surprise, so most of the chatter around the announcement has focused on the implication that the committee may be eyeing the pause button... and market expectations for a fourth cut this year adjusted accordingly. Could the surprise out-performance from GDP (0.3% above expectations) and today's

Fireside Charts: 73% of Companies Beat Earnings Estimates, Small Business Job Growth Disappoints, and China Crude Imports Outpace Demand

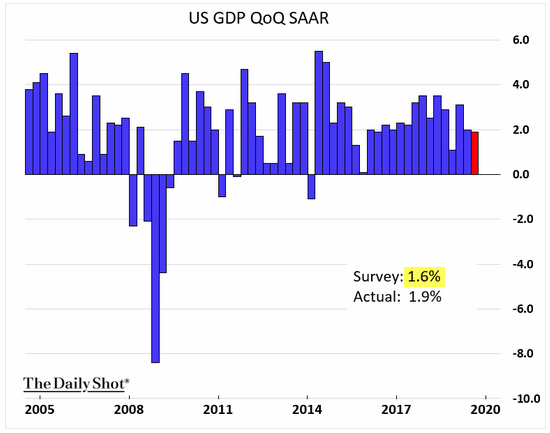

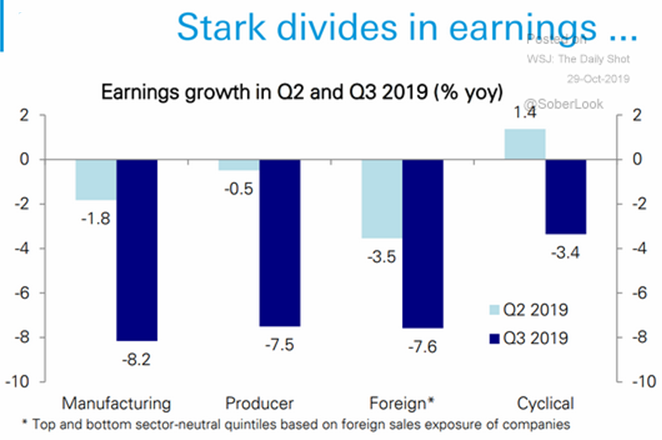

October 30, 2019It's Fed day! Whether the third consecutive interest rate cut happens this afternoon or not, the announcement will likely be sharing column inches with today's other big release: Q3 GDP growth. 1.9% ain't too shabby! Check back in on Friday for more post-game analysis. In the meantime... 73% of companies came in above earnings estimates this quarter (the highest percentage since 2006), but this rising tide didn't lift all boats—many regions of the economy suffered ...

Fireside Charts: U.S. Deficit Soars 26% to 7-year High, Fed Expansion Tops $199 Billion, and USD Reverses Negative Trend

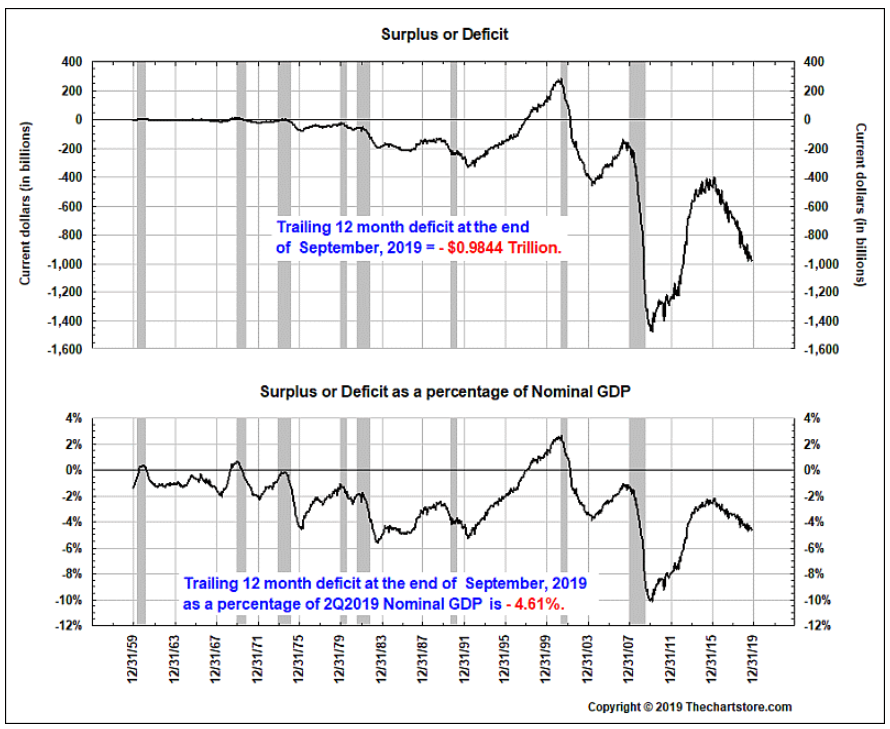

October 28, 2019Warning: the latest federal deficit figure may leave you with sticker shock. The deficit surged 26% in fiscal 2019 to hit $984 billion, the highest point since we topped $1 trillion in 2012. This figure, in addition to the earnings that continue to roll in (heavyweights reporting this week include Alphabet, Facebook and Apple), will likely be a topic of conversation when the Fed kicks off their October meeting tomorrow. Analysts appear confident ...

Fireside Charts: CLO Market Continues to Climb, and U.S. Sees Modest Manufacturing Recovery Despite Global Slowdown

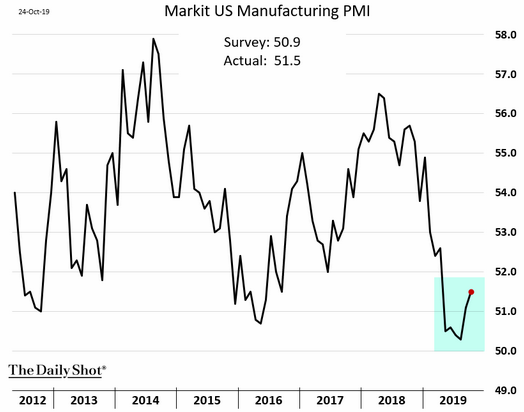

October 25, 2019Earnings news remains mixed as we head into the weekend, with S&P profits dropping only ~1.2% so far—significantly less than the projected 4%+—and economic behemoth Amazon suffering a ~7% after-hours loss after posting its first quarterly profit decline in over two years. Investors remain hungry for returns though (and apparently willing to gamble on riskier assets), which could explain why the risky CLO market has more than doubled in the past decade to top $660 billion. ...

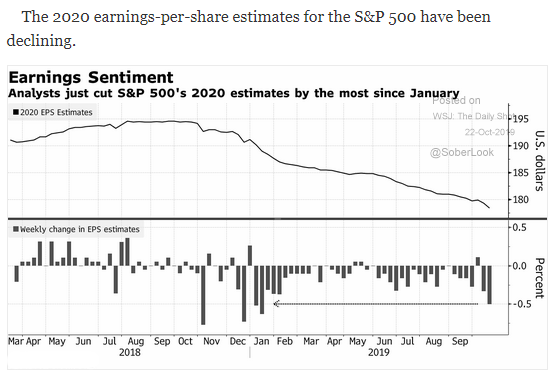

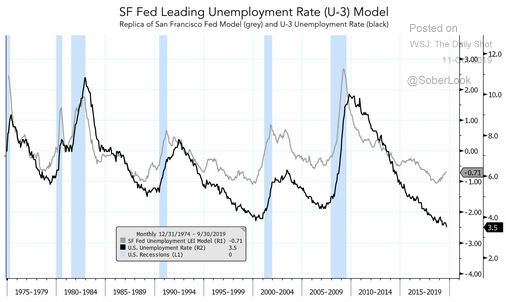

Fireside Charts: 2020 Earnings Estimates Suffer Sharpest Drop Since January, Positive News for the Housing Market, and Has U.S. Unemployment Bottomed?

October 23, 2019Today's another jam-packed day for earnings in a season that's been largely mixed so far; headline names include Microsoft, Ford, Boeing, and Catepillar, among many others. We're keeping our fingers crossed for good news, as the analyst outlook for 2020 seems to be increasingly weak; last week saw the steepest downward revision in nearly a year. The housing market is enjoying a boost from the recent rate cuts and record low unemployment, but while analysts are confident another cut is on the way, we're seeing early signs that unemployment ...

Fireside Charts: S&P 500 Remains Little-Changed Since Spring, Buying Climate Index Hits Record High, and China Yields Look Poised to Turn Negative

October 21, 2019Earnings season continues as about a quarter of S&P 500 companies will report Q3 financials this week; we'll keep it light on charts today as we wait on pins and needles. S&P readings haven't broken out (one way or the other) more than ~300 points since early spring—could any surprise readings this week push the index outside of that established range? And while September's ...

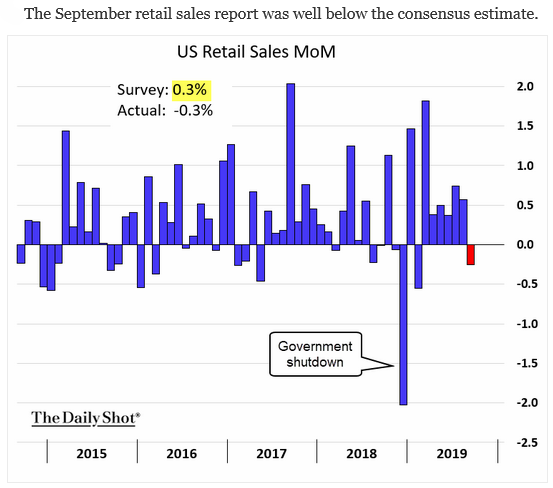

Fireside Charts: Soft Retail Sales Spark Concern About the U.S. Consumer, and Has the End Come For the 60/40 Portfolio?

October 18, 2019U.S. retail sales dropped unexpectedly in September for the first time in seven months in what many analysts consider an early sign that the global manufacturing slowdown and trade war anxiety are finally starting to weigh on consumers (re: the driving force behind ~70% of the U.S. economy). Is this a blip—especially given that numbers are still up YoY, unlike Industrial Production—or the onset of a new pattern? Treasury yields dipped slightly following the soft retail numbers, but seem to have stabilized, and yields are starting to rise ...

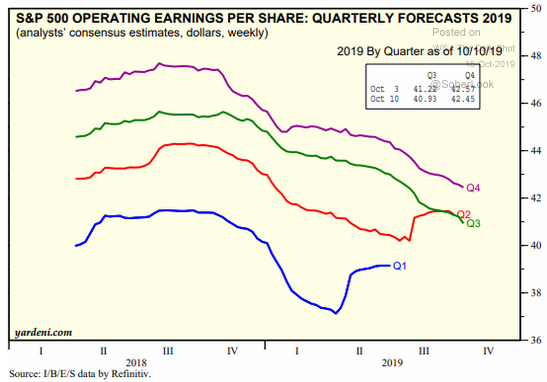

Fireside Charts: Earnings Have Sparked a Rally; Is it Sustainable? And China Might be Winning the Trade War

October 16, 2019Earnings season kicked off in bullish style yesterday—with nine of the 11 reporting S&P companies either meeting or exceeding expectations—and sparked a market rally. While this eased many's anxieties over market impact of the trade war, our optimism is more cautious as we remember how late-year estimates are often anchored low, and observe that much of the rally is attributable to only a few linchpin companies. Could that be thanks in part to the enduring trend of dividends and buybacks tying up (and exceeding!) cash flow? These ...

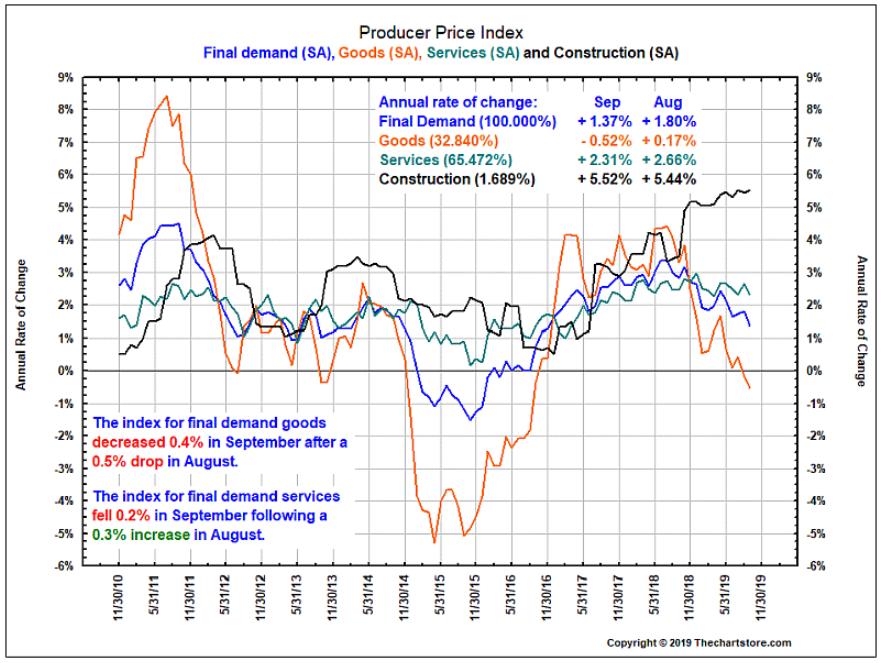

Fireside Charts: U.S. PPI Drops in September, Fed Intervention Kicks into High Gear, and LEI Index Sparks Some Hope

October 14, 2019Happy Monday Fireside Charts readers! Today may be a holiday, but that doesn't mean it'll be a leisurely week in the markets as earnings season kicks off tomorrow! Banks are up first and we'll be keeping an eye on how they performed in this historically low interest rate environment. Producer price inflation appears weak in the U.S.—despite a strong showing from the construction sphere—as PPI for final demand goods has dropped nearly a full percentage point since July, and a 0.2% drop in PPI for final demand services has nearly erased its ...

Fireside Charts: Manufacturing Weakness Weighing Down U.S., Britain and Germany (but Not China) as Trade Negotiations Resume in D.C.

October 11, 2019Unemployment is rising in San Francisco despite the low national rate and we're seeing a growing divergence between high yield and investment grade bond performance—both phenomena the Fed should keep its eye on—but the big news today is President Trump's 2:45 pm meeting with China's Vice Premier Liu He on trade. Hopes appear high for progress, or at least a tentative truce, as Trump says the first round of meetings yesterday went "very well" and reports came out of a potential