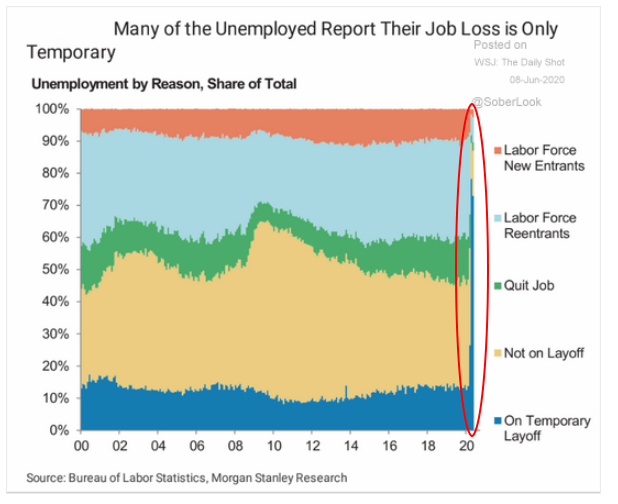

Fireside Charts: Reexamining the Jobs Report, Reopening Trends, and Risky Investments

June 10, 2020Economists (and the markets) were riding high off of Friday's shining beacon of a jobs report, but some of that shine has rubbed off as analysts dig deeper into the numbers and reveal ...

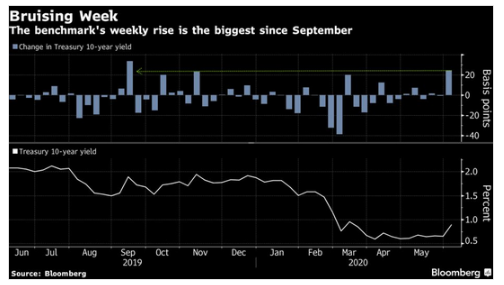

Fireside Charts: May Employment Gains, Optimistic Equities, and Rising Interest Rates

June 8, 2020Were you prepared for Friday's shocker of a job's report? It's been a while since we've seen some truly good news on employment, so we won't blame you if you had to reread the headline ...

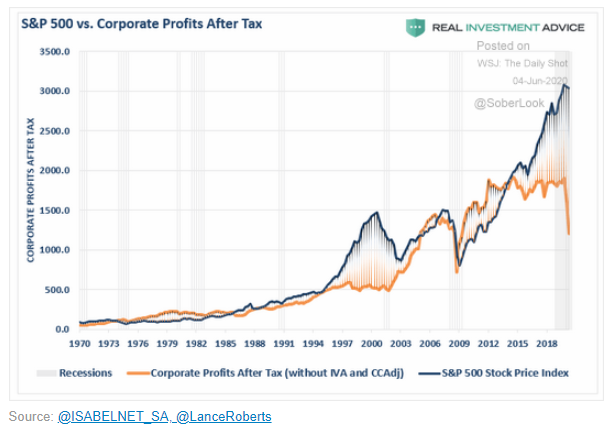

Fireside Charts: Overvalued Equities, Dismal Bond Yields, and a Crude Oil Check in

June 5, 2020While growth in corporate profits and earnings have stalled in the past few years, equity gains have continued on largely unimpeded, even through the COVID-19 crisis. What will it take ...

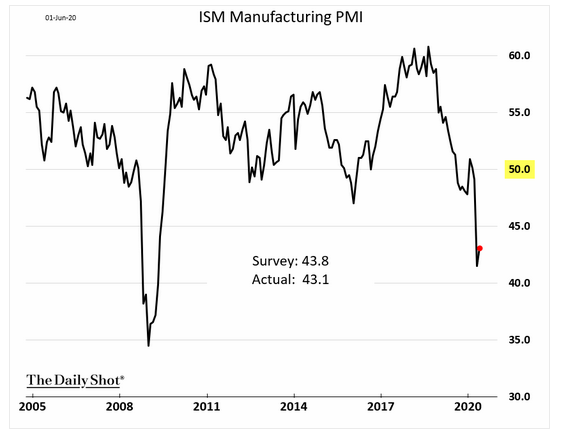

Fireside Charts: Manufacturing Momentum, Growing Debt Levels, and a COVID-19 Check In

June 3, 2020The ISM Manufacturing PMI report showed a modest improvement last month, narrowly beating analyst expectations and (hopefully) establishing some upward momentum. The sector has ...

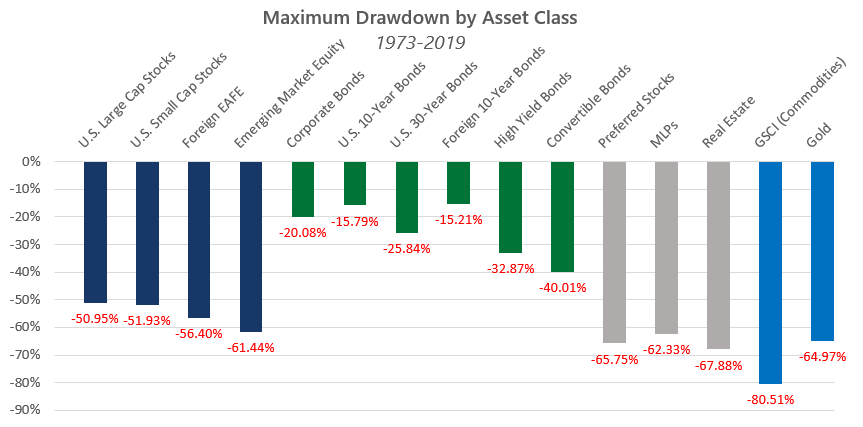

The Anatomy of a Bear Market

June 2, 2020Updated: 6/25/20 What does a typical bear market look like? How long do they last? When are the majority of the losses incurred? Most investors believe that the losses occur fairly evenly throughout a bear. Based on the past, with one and now possibly two notable exceptions, nothing could be further from the truth. In another piece we wrote about bear markets, Tactical to ...

Fireside Charts: Recovery Continues for Equities & Regional PMIs, And Who's Buying All That Government Debt?

June 1, 2020Five months in to an unprecedented year for the markets and U.S. equities have staged a furious rebound from their March troughs. Large caps are still leading the charge with the ...

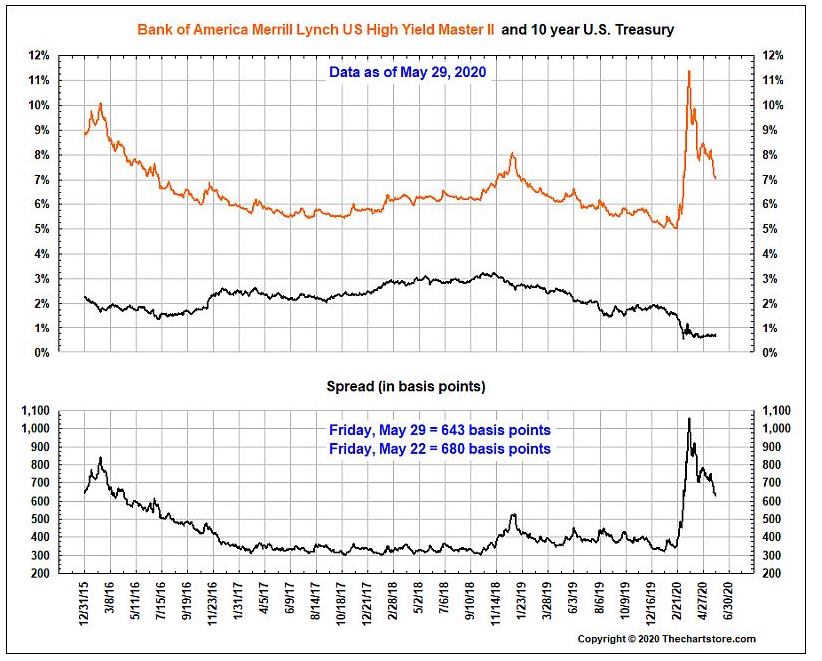

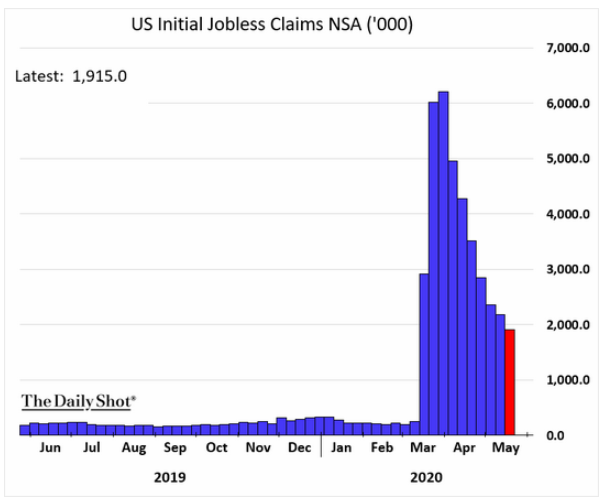

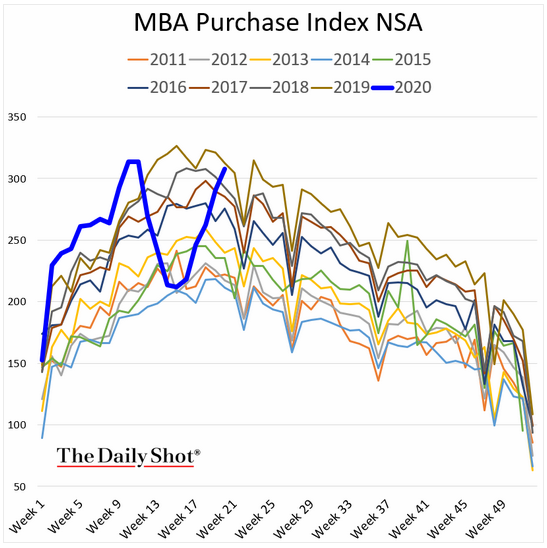

Fireside Charts: Unemployment Trends as States Reopen and Emerging Risks to Banks in the Coronavirus Era

May 29, 2020Nearly two million more Americans found themselves out of a job and applying for unemployment last week in the coronavirus-era trend that just won't quit (no pun intended). Continuing ...

Fireside Charts: Reopenings Spark Hope in the Markets, Corporate Debt Looms, and Conflict with China Reignites

May 27, 2020New York Governor Andrew Cuomo rang the bell to mark the reopening of the NYSE yesterday and the markets were quickly off to the races; the S&P 500® Index even briefly ...

Using Total Return to Meet Your Clients' Withdrawal Needs

May 21, 2020We originally posted this piece back in 2016 when the 10-year U.S. Treasury (UST) yield was ~1.9%. At that time, most were predicting a rise in interest rates and it would have been hard to imagine that four years later, the 10-year UST would be ~0.65%—especially given where interest rates had been for the preceding decades. Now, the Total Return concept is even more relevant today with interest rates at record lows and no one knows how long they will remain at this level, or where they may go from here. Read on as BCM Portfolio ...

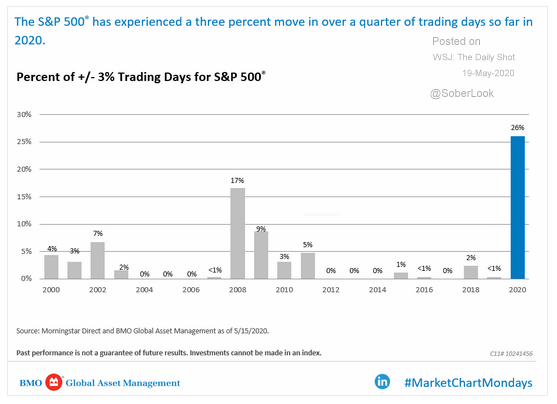

Fireside Charts: P/E Ratios Reach New Highs and Emerging Markets May Present Opportunities

May 20, 2020While we've seen a partial recovery in the equity markets, volatility remains with over a quarter of the trading days so far in 2020 swinging 3% or more. That is well above levels we ...