Fireside Charts: Resistance Levels, the Calming Bond Markets, and Struggling Small Businesses

March 23, 2020As stocks come off their worst week since 2008, Washington's failure to produce a stimulus package and the spread of increasingly strict containment measures are putting increasing ...

Special Update From BCM Portfolio Manager: Coronavirus and Current Market Conditions

March 20, 2020The emergence of COVID-19 and its rapid spread have sparked an exceptional market meltdown and a fundamental restructuring of our daily lives. In this uncertain time, we wanted to ...

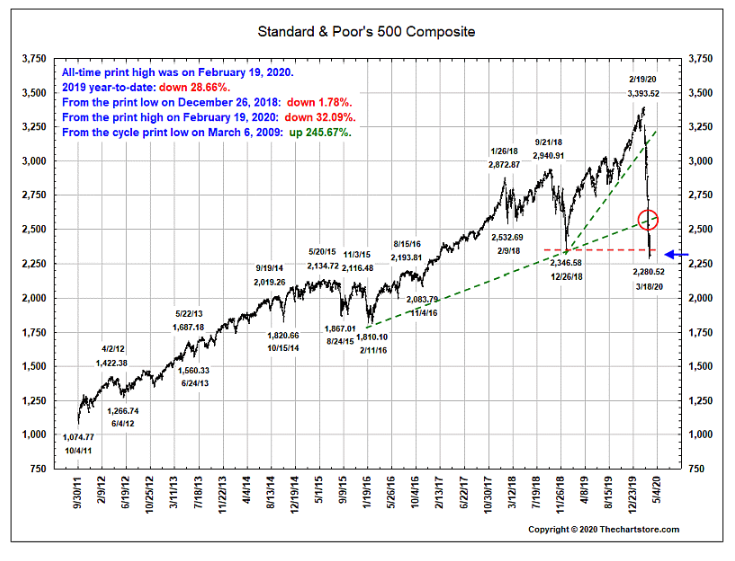

Fireside Charts: 1+ Years of Gains Erased, Jobless Claims Surge, Yield Curves Normalize

March 20, 2020Stocks may have had a relatively stable day yesterday (by recent standards, anyway...) but a look back at history shows that we've so far only wiped out 1.3 years of gains, and—coming ...

Fireside Charts: VIX Hits Record High, Easing Accelerates, and the Oil Price War Continues

March 18, 2020Market swings are still coming at a breakneck pace as investor fear drives the VIX to record highs. Markets were slightly higher yesterday on the hopes of additional stimulus as the ...

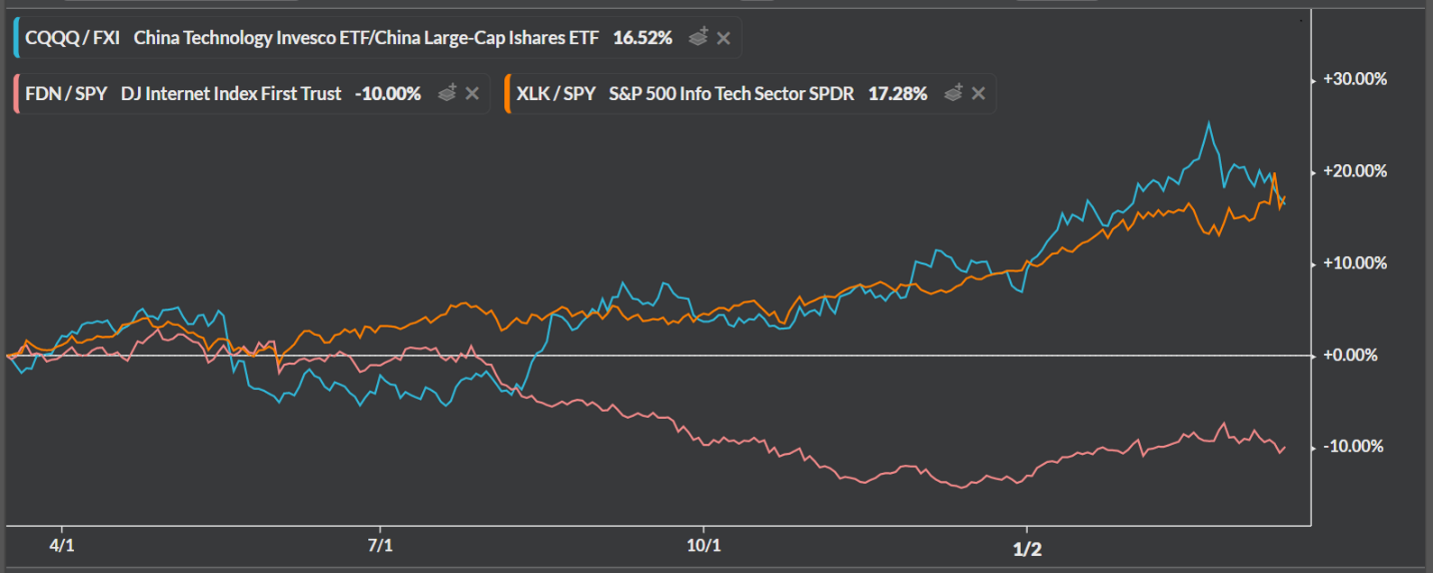

Technology Sector in the “Work from Home” Economy

March 17, 2020Although none of our investment systems directly incorporate fundamental data, we enjoy contemplating the fundamental narratives reflected in the price trends our systems ultimately find attractive. Our systems are currently quite leery of equity or other risk assets, as we now sit firmly in a bear market induced by the widespread economic halt caused by COVID-19. However, our Decathlon system continues to favor technology-sector equities more than its other investment opportunities. In addition, our Weekly Sector Rotation strategies have held on to the technology sector, due to its ...

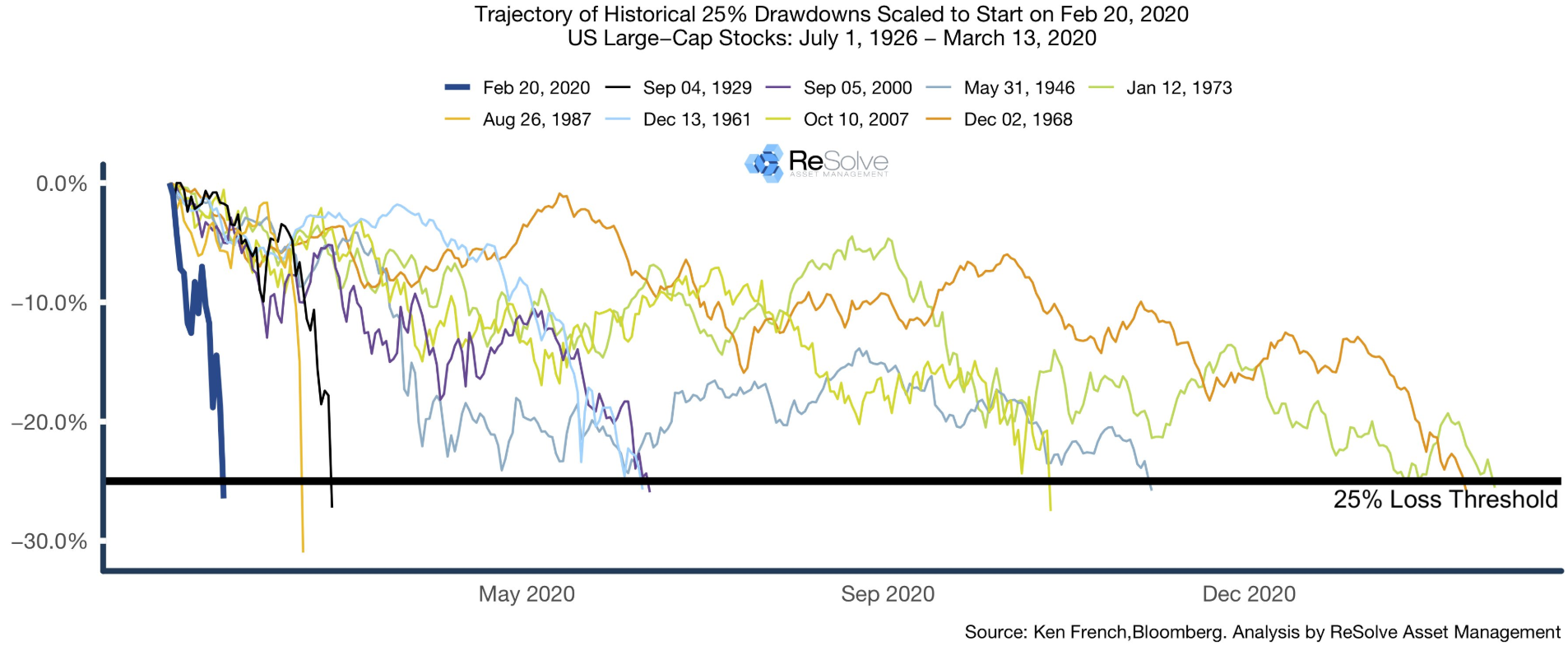

Fireside Charts: Fastest 25% Drawdown in a Century, More Fed Intervention, and Record Volatility

March 16, 2020It's been what feels like a lightning-fast switch from the economy enjoying its longest and slowest period of growth to setting new types ...

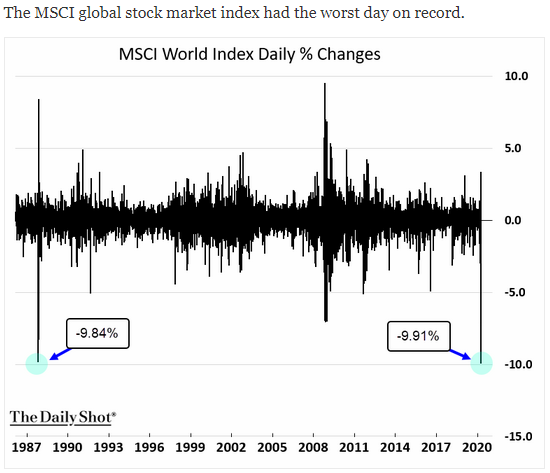

Fireside Charts: Lions and Tigers and... You Know the Rest

March 13, 2020And the hits just keep on coming... The Dow saw its worst single-day loss since the 1987 rash yesterday, the circuit breaker kicked in again, the MSCI world Index saw it's ...

Fireside Charts: Volatility Surges (Again), the Oil Price War, and Recession Indicators Are on the Rise

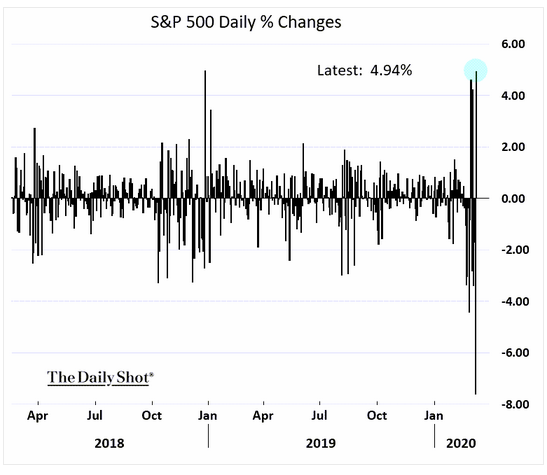

March 11, 2020While we've seen some recovery since Monday's massive day-long rout, it's been anything but smooth sailing in the markets this week. Volatility has surged—with the S&P 500 ...

Fireside Charts: Volatility Continues, Energy Market Spirals on Production Conflict, and Bonds Sound More Warnings

March 9, 2020To many people's shock, stocks ended last week slightly higher, likely thanks in part to Friday's strong jobs report. The ...

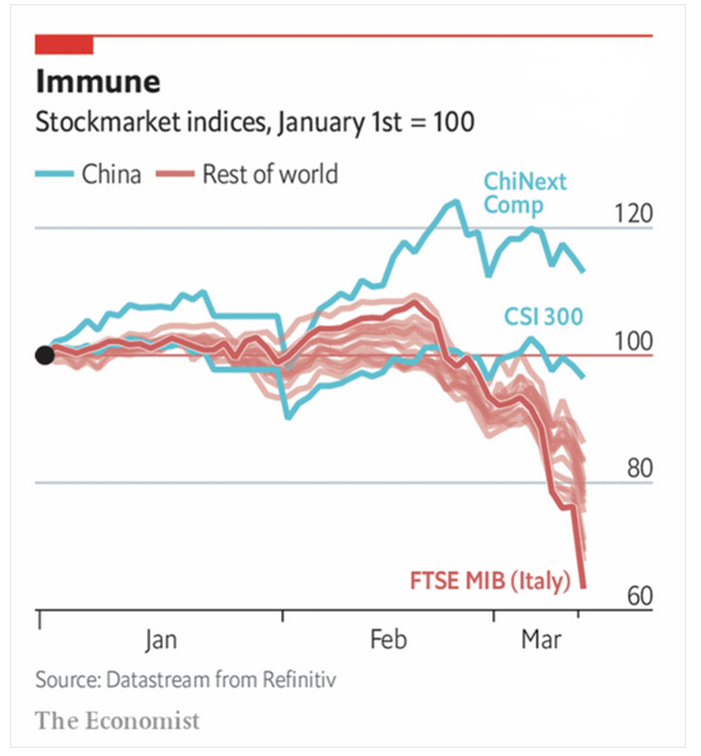

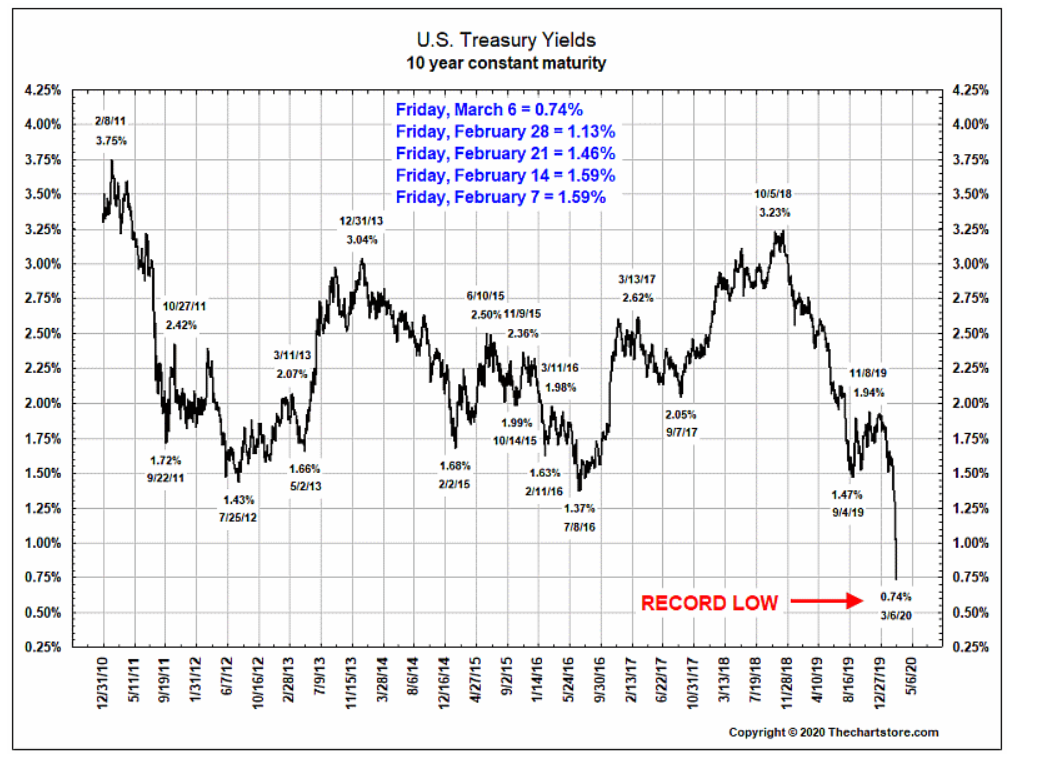

Fireside Charts: 30-Year Fixed Rate Lowest on Record, Energy Market in Flux, Shenzhen Index Recoups Losses

March 6, 2020This week's emergency interest rate cut brought mortgage rates even lower—the average 30-year fixed rate dropped to 3.29%, its lowest level on record—in a potential boon to U.S. ...