Fireside Charts: A Bear Market Bounce, Stalled Dividends & Buybacks, and Unemployment

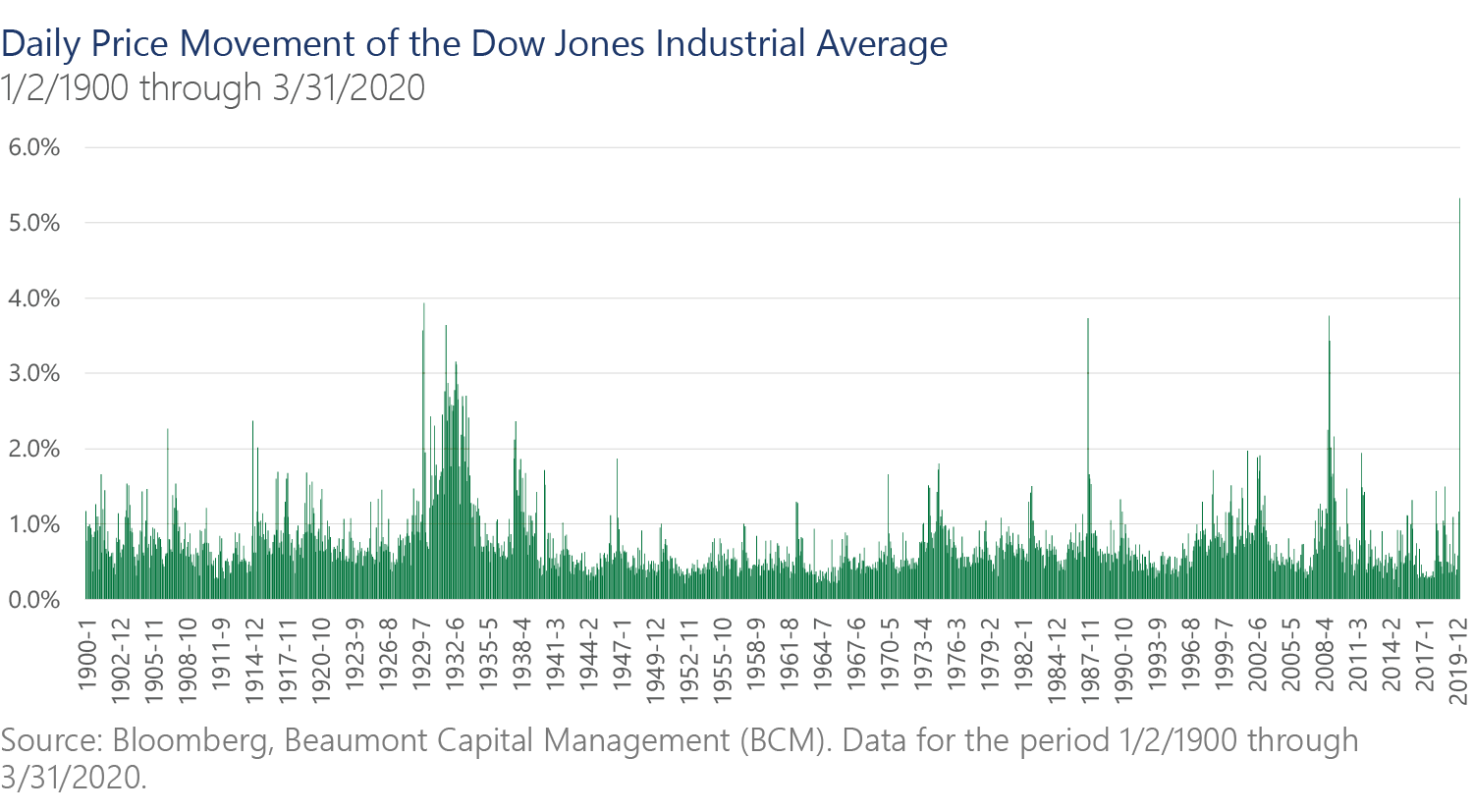

April 8, 2020Stocks soared Monday on hopes that COVID-19 had reached its peak in epicenters like New York and Italy, but such rallies aren't uncommon in bear markets, and the euphoria was short ...

BCM 1Q20 Market Commentary: To V or Not to V, That Is the Question…

April 7, 2020With apologies to Mr. Shakespeare... The Covid-19 pandemic has set upon the globe with lightning speed and is unlikely to leave us anytime soon. First and foremost, we hope that you, your family and loved ones are well. While the level of disruption that the virus has caused to our daily lives is unprecedented, we wish to offer hope with a healthy dose of realism.

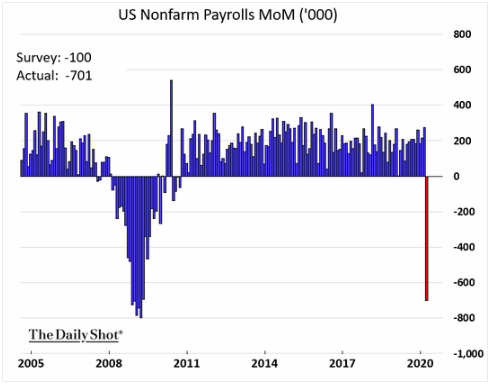

Fireside Charts: The Changing Employment Landscape, Debt Downgrades, and Slashed Dividends

April 6, 2020The U.S. lost about 700,000 jobs in March—7x the expected figure and a grim way to cap off the first quarter. Still, given the staggering number of unemployment claims continuing to ...

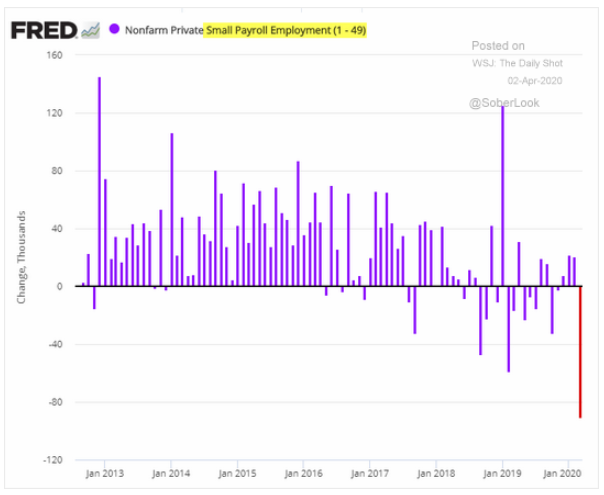

Fireside Charts: Unprecedented Unemployment, Reshaped Industries, and a Look Ahead at EPS

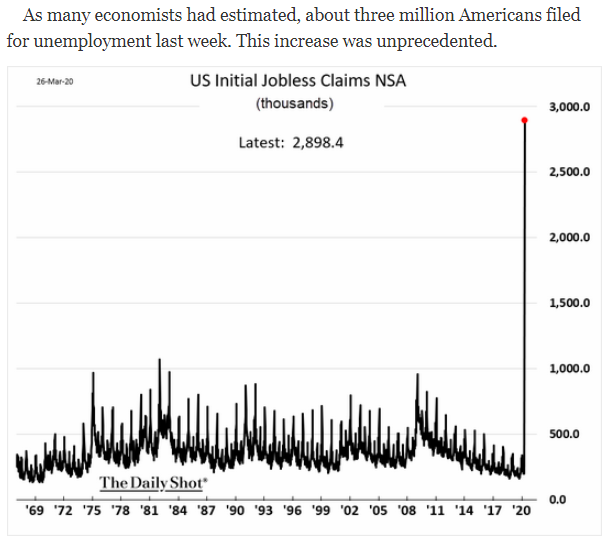

April 3, 2020An unprecedented wave of unemployment is crossing the U.S. and small businesses are being hit particularly hard. Plummeting retail and restaurant activity have driven the industries to ...

Mutual Funds in Taxable Accounts: Despite Losses, You May Incur Sizable Capital Gains Tax

April 2, 2020As investors and advisors alike look to realign/re-balance their portfolios this year, we wanted to provide a reminder about how mutual funds are taxed. Like any investment, if you buy a mutual fund, own it for more than one year, and sell it at a profit, you must pay federal (and for most states) capital gains tax on your gain. If you own the position for less than one year, you will have to pay ordinary income tax on your gain. Yet many do not realize that if you keep owning a mutual fund (you don’t sell it), there may be short- and long-term capital ...

Fireside Charts: Evaluating the Rebound, 1929 Comparisons, and a Look at Manufacturing

April 1, 2020And that's a wrap on Q1. As we close out a quarter for the history books, let's hope there are better days ahead in Q2. The recent equity rebound may have convinced some optimists out ...

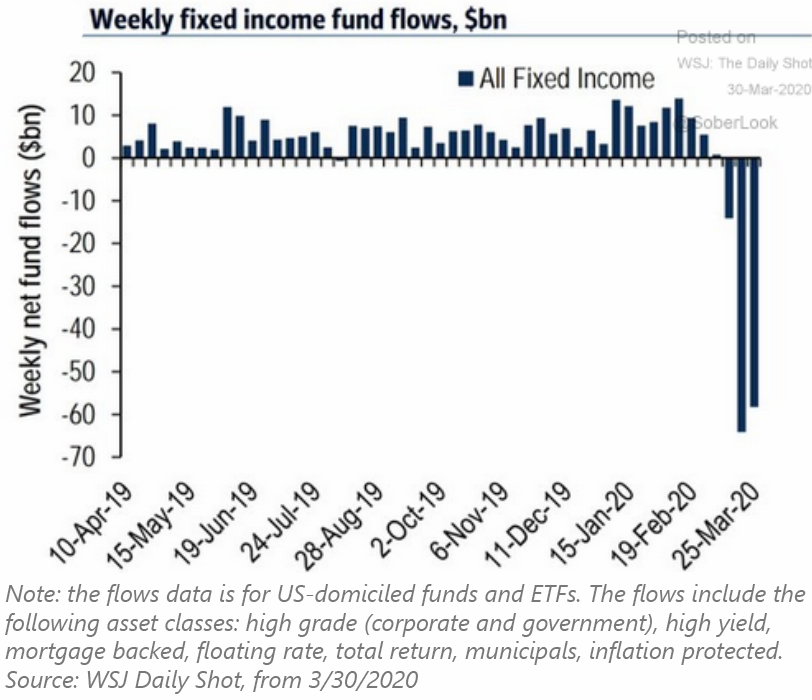

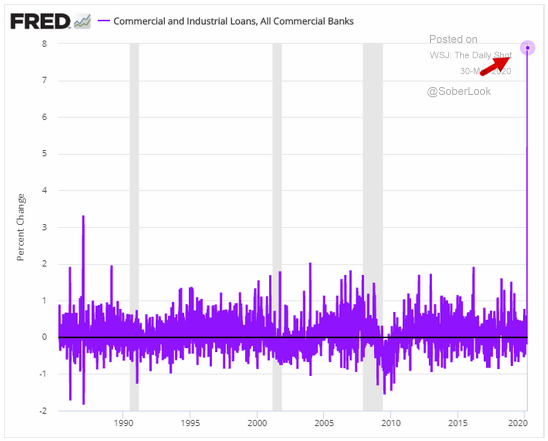

Fireside Charts: Mounting Corporate Debt, Effects of New QE Measures, and a Currency Check In

March 30, 2020U.S. businesses are scrambling for liquidity in an increasingly arid market. Corporate loan balances have surged by the highest ...

Fireside Charts: Historic Unemployment, Corporate Borrowing Surges, Chinese Economic Output Normalizes

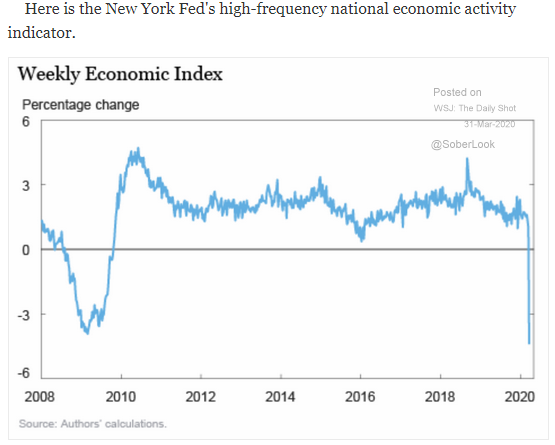

March 27, 2020Unemployment spiked at an unprecedented rate (and to historic levels) this week as layoffs and shutdowns pick up steam across the country. ...

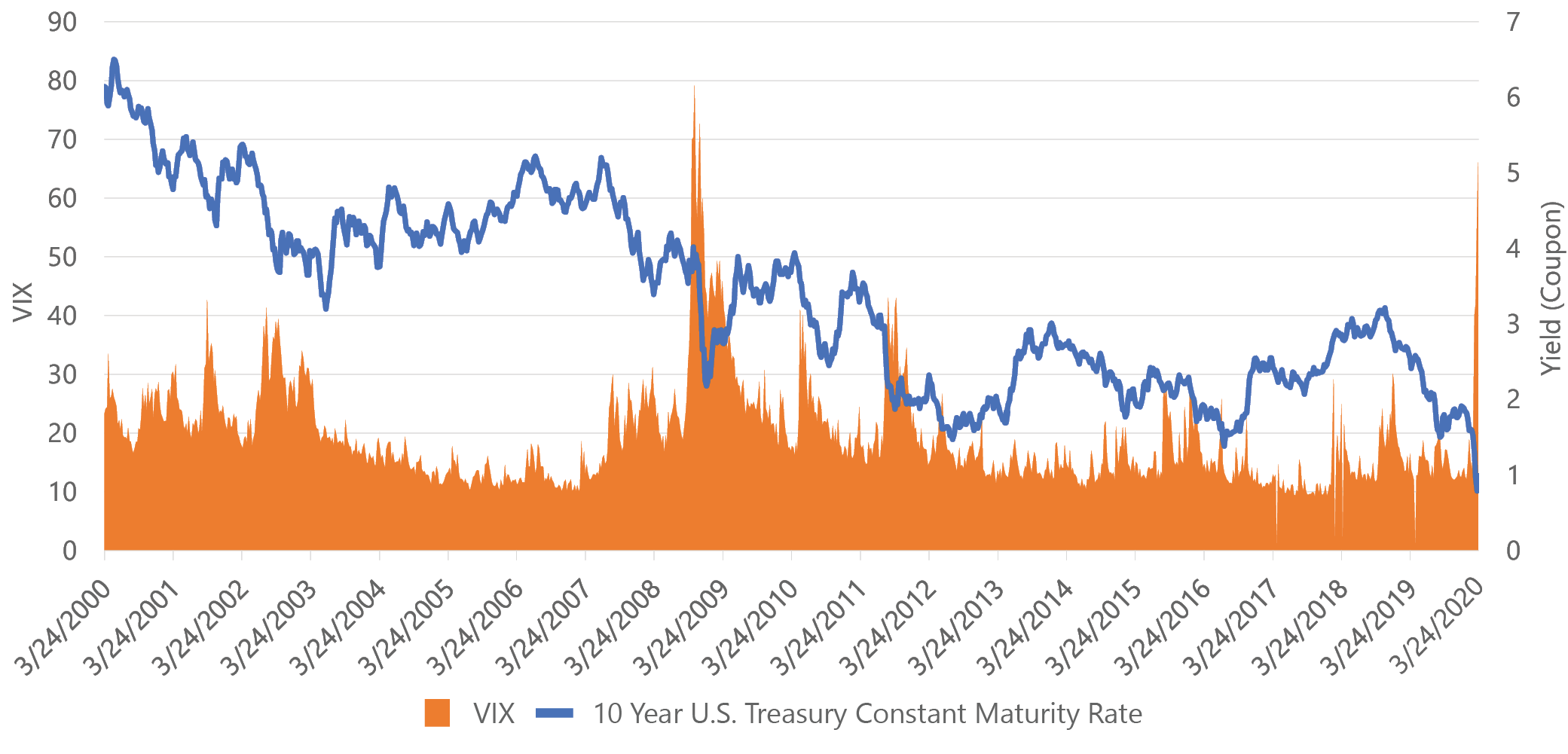

A Word of Caution on Fixed Income in the Current Market Environment

March 26, 2020Investors of balanced strategic portfolios as well as effective tactical portfolios are now well aware of the benefits of reduced risk during times of market duress. While volatile markets may encourage investors to seek the historical “safe havens” of fixed income and lower risk investments, an unfortunately timed rebalance or re-allocation towards fixed income can be particularly risky in today’s environment.

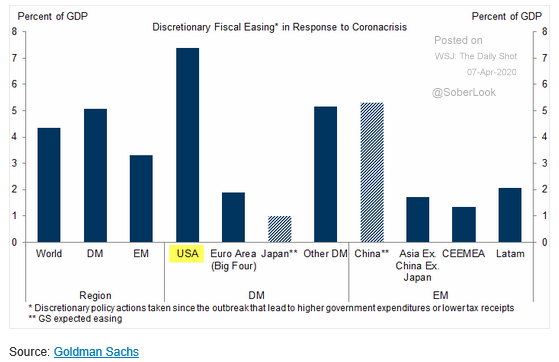

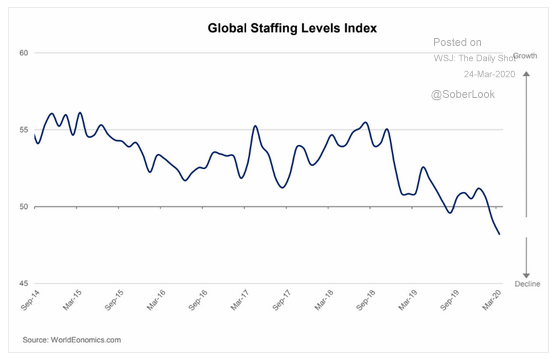

Fireside Charts: Plummeting Employment, Stimulus Packages, and China's Budding Recovery

March 26, 2020There’s been a lot of talk about recession lately, and the sharp drop in global staffing will certainly factor into the equation. Given the speed with which this has all unfolded ...